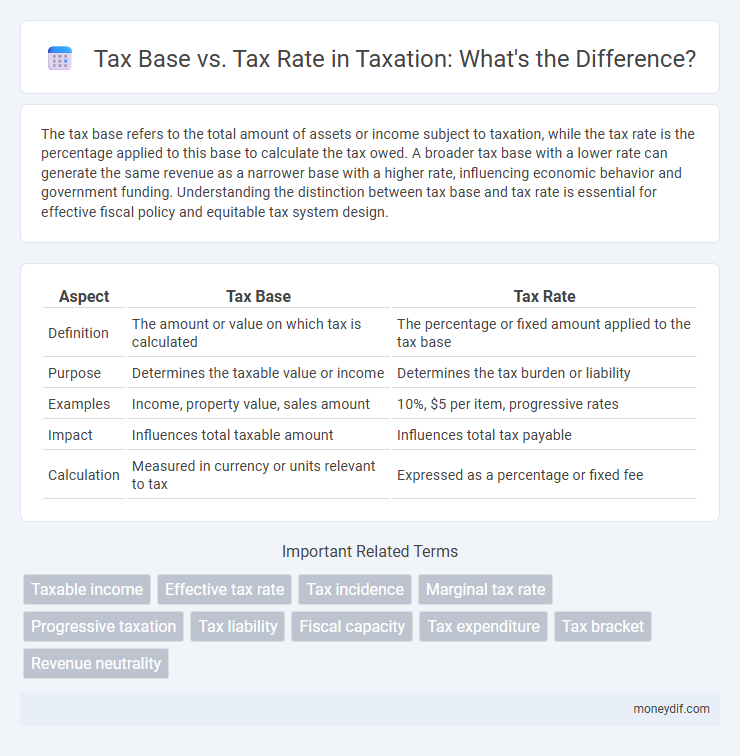

The tax base refers to the total amount of assets or income subject to taxation, while the tax rate is the percentage applied to this base to calculate the tax owed. A broader tax base with a lower rate can generate the same revenue as a narrower base with a higher rate, influencing economic behavior and government funding. Understanding the distinction between tax base and tax rate is essential for effective fiscal policy and equitable tax system design.

Table of Comparison

| Aspect | Tax Base | Tax Rate |

|---|---|---|

| Definition | The amount or value on which tax is calculated | The percentage or fixed amount applied to the tax base |

| Purpose | Determines the taxable value or income | Determines the tax burden or liability |

| Examples | Income, property value, sales amount | 10%, $5 per item, progressive rates |

| Impact | Influences total taxable amount | Influences total tax payable |

| Calculation | Measured in currency or units relevant to tax | Expressed as a percentage or fixed fee |

Understanding the Tax Base: Definition and Importance

The tax base refers to the total value of assets, income, or economic activity subject to taxation, forming the foundation for calculating tax liabilities. Understanding the tax base is crucial for both policymakers and taxpayers as it directly influences government revenue and determines the fairness and efficiency of a tax system. A well-defined tax base ensures accurate tax rate application, prevents loopholes, and promotes equitable tax distribution across different economic sectors.

What is a Tax Rate? Meaning and Calculation

A tax rate is the percentage at which an individual or corporation is taxed on their taxable income or value of goods and services. It determines the amount of tax owed by multiplying the tax base, which is the assessed value subject to taxation, by this percentage. Calculating the tax rate requires understanding the policy set by tax authorities, which can vary from flat rates to progressive brackets depending on the tax system.

Key Differences Between Tax Base and Tax Rate

The tax base refers to the total amount of assets, income, or property subject to taxation, serving as the foundation for calculating tax liabilities. The tax rate is the percentage applied to the tax base to determine the actual tax owed by an individual or entity. Key differences include that the tax base quantifies what is taxed, while the tax rate defines the proportion of that base to be paid as tax.

How Tax Base Influences Government Revenue

The tax base, representing the total value of assets or income subject to taxation, directly influences government revenue by determining the scale of taxable economic activity. A broader tax base allows for increased government revenue without raising tax rates, enabling more stable and sustainable public funding. Changes in the tax base, due to economic growth or policy adjustments, significantly impact overall tax collection and fiscal capacity.

The Role of Tax Rate in Economic Policy

The tax rate directly influences government revenue and economic behavior by determining the proportion of income or profits taxed. Adjusting tax rates strategically can stimulate investment, consumption, or savings, shaping overall economic growth. Policymakers balance tax rates to optimize revenue without discouraging economic activity or creating excessive tax burdens.

Examples of Tax Base in Practice

Tax base refers to the total amount of assets, income, or transactions subject to taxation, such as property values in real estate tax or wages in income tax. For instance, sales tax is calculated on the tax base of total retail sales within a jurisdiction, while corporate tax uses net profits as its base. Understanding variations in tax bases helps businesses and individuals anticipate their tax liabilities across different taxation systems.

Factors Affecting the Tax Base

The tax base is influenced by factors such as income levels, consumption patterns, and property values, which determine the total amount subject to taxation. Economic conditions, demographic changes, and regulatory policies also impact the size and stability of the tax base. Variations in tax compliance and avoidance behaviors can significantly alter the effective tax base available to governments.

Effects of Changing Tax Rates on Compliance

Increasing tax rates often lead to reduced compliance as taxpayers may seek more aggressive tax avoidance strategies to minimize their liabilities. Higher rates can incentivize underreporting of income or engaging in informal economic activities to evade taxes. Conversely, moderate tax rates tend to improve compliance by reducing the perceived cost of taxation and encouraging voluntary reporting.

Tax Base Broadening vs. Tax Rate Increase: Pros and Cons

Expanding the tax base involves increasing the number of taxable entities or income sources, which can lead to a more stable and equitable revenue stream without raising individual tax rates. Increasing the tax rate directly hikes the percentage of tax applied, potentially generating more revenue quickly but risking reduced economic activity and tax compliance. Broadened tax bases often minimize economic distortions, while higher rates may deter investment and labor participation.

Optimizing Tax Systems: Balancing Tax Base and Tax Rate

Optimizing tax systems requires a strategic balance between the tax base and the tax rate to ensure sustainable revenue without discouraging economic growth. Expanding the tax base by broadening the range of taxable income or transactions can allow for lower tax rates, minimizing distortions in taxpayer behavior. Policymakers must analyze economic activity, compliance costs, and administrative efficiency to design tax structures that maximize revenue while promoting fairness and investment incentives.

Important Terms

Taxable income

Taxable income determines the tax base, which, when multiplied by the applicable tax rate, calculates the total tax liability.

Effective tax rate

The effective tax rate measures the actual percentage of income paid in taxes, influenced by both the tax base size and the statutory tax rate applied.

Tax incidence

Tax incidence depends on the elasticity of the tax base and the tax rate, where a more inelastic tax base causes a greater burden on consumers despite higher tax rates.

Marginal tax rate

The marginal tax rate represents the percentage of tax applied to the next dollar of taxable income, directly influencing taxpayers' incentives and behavior within the tax base. Changes in the tax base, such as income brackets or deductions, interact dynamically with varying marginal tax rates to determine overall tax liability and economic efficiency.

Progressive taxation

Progressive taxation increases the tax rate as the tax base (income or wealth) rises, ensuring higher earners contribute a larger percentage of their earnings.

Tax liability

Tax liability is calculated by multiplying the tax base, which represents the amount subject to taxation, by the tax rate applicable to that base.

Fiscal capacity

Fiscal capacity measures a government's ability to generate revenue based on the tax base size and the effective tax rate applied to it.

Tax expenditure

Tax expenditure reduces the effective tax base by providing deductions or exemptions, thereby lowering the overall tax liability despite unchanged tax rates.

Tax bracket

Tax brackets determine the tax base segments to which progressive tax rates apply, influencing the overall tax liability based on income levels.

Revenue neutrality

Revenue neutrality occurs when changes in tax rates are offset by adjustments in the tax base, ensuring overall tax revenue remains constant.

Tax base vs tax rate Infographic

moneydif.com

moneydif.com