Nonrefundable tax credits reduce your tax liability but cannot result in a refund if the credit exceeds the amount owed, meaning any excess credit is forfeited. Refundable tax credits, on the other hand, allow taxpayers to receive the difference as a refund if the credit amount is greater than their tax liability. Understanding the distinction between these credits is essential for maximizing tax benefits and planning your tax payments effectively.

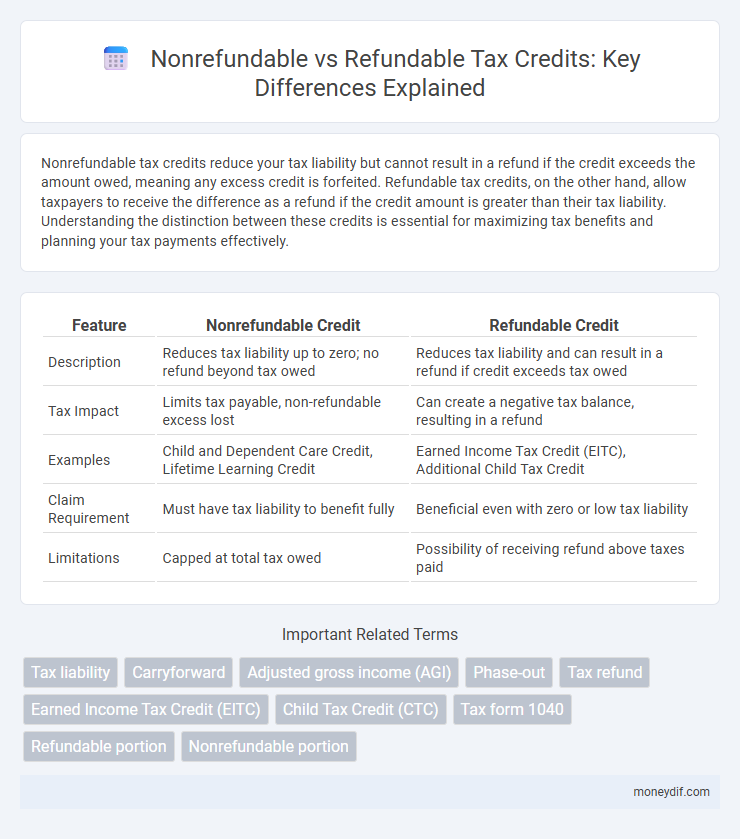

Table of Comparison

| Feature | Nonrefundable Credit | Refundable Credit |

|---|---|---|

| Description | Reduces tax liability up to zero; no refund beyond tax owed | Reduces tax liability and can result in a refund if credit exceeds tax owed |

| Tax Impact | Limits tax payable, non-refundable excess lost | Can create a negative tax balance, resulting in a refund |

| Examples | Child and Dependent Care Credit, Lifetime Learning Credit | Earned Income Tax Credit (EITC), Additional Child Tax Credit |

| Claim Requirement | Must have tax liability to benefit fully | Beneficial even with zero or low tax liability |

| Limitations | Capped at total tax owed | Possibility of receiving refund above taxes paid |

Understanding Tax Credits: Nonrefundable vs Refundable

Nonrefundable tax credits reduce your tax liability up to zero but do not generate a refund if the credit exceeds your tax owed, making them beneficial for minimizing taxes without receiving extra money. Refundable tax credits can decrease your tax bill beyond zero, resulting in a refund if the credit amount surpasses your tax liability, providing direct financial benefits even for taxpayers with little or no tax owed. Common examples include the Child Tax Credit as partially refundable and the Earned Income Tax Credit as fully refundable, illustrating the impact on refunds and tax planning.

What Are Nonrefundable Tax Credits?

Nonrefundable tax credits reduce the amount of tax owed but cannot result in a refund if the credit exceeds the tax liability. Examples include the Child and Dependent Care Credit and the Lifetime Learning Credit, which lower tax bills without generating a refund. Taxpayers must have a tax liability to benefit from nonrefundable credits, making them distinct from refundable credits that can produce refunds beyond taxes owed.

Key Features of Refundable Tax Credits

Refundable tax credits allow taxpayers to receive a refund even if their tax liability is zero, providing a direct financial benefit beyond reducing taxes owed. These credits enhance cash flow by issuing payments when the credit exceeds the total tax due, unlike nonrefundable credits, which only reduce tax liability to zero without generating a refund. Key examples include the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC), which target low- and moderate-income families to increase disposable income and reduce poverty.

Major Differences Between Nonrefundable and Refundable Credits

Nonrefundable tax credits can reduce your tax liability to zero but cannot result in a refund, meaning any excess credit is lost. Refundable tax credits allow taxpayers to receive a refund if the credit exceeds their total tax liability, providing a potential cash benefit beyond zero tax owed. Key examples include the Child Tax Credit, which is partially refundable, and the Earned Income Tax Credit, which is fully refundable, illustrating their distinct impacts on tax outcomes.

Eligibility Requirements for Each Credit Type

Nonrefundable tax credits require taxpayers to have a tax liability against which the credit can be applied, meaning eligibility often depends on income limits and filing status that determine tax owed. Refundable tax credits allow eligible individuals to receive a refund even if their tax liability is zero, with eligibility criteria including income thresholds, qualifying children, or specific life circumstances such as education or earned income. Both credit types have distinct rules governed by the IRS, requiring careful review of taxpayer income, dependents, and filing status to maximize tax benefits.

Common Examples of Nonrefundable Tax Credits

Common examples of nonrefundable tax credits include the Child and Dependent Care Credit, the Lifetime Learning Credit, and the Elderly and Disabled Tax Credit. These credits reduce taxable income but cannot result in a refund beyond the tax owed. Nonrefundable credits are essential for taxpayers to lower their tax liability without generating a negative tax balance.

Popular Refundable Tax Credits to Know

Popular refundable tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and the American Opportunity Credit, which allow taxpayers to receive a refund even if their tax liability is zero. Nonrefundable credits, such as the Lifetime Learning Credit, can only reduce tax owed to zero without generating a refund. Understanding the difference helps taxpayers maximize benefits and potentially increase their tax refund through credits like the EITC and CTC.

How Nonrefundable Credits Impact Your Tax Liability

Nonrefundable tax credits reduce your tax liability only up to the amount of tax you owe, meaning they cannot generate a refund if the credit exceeds your tax bill. This limitation affects taxpayers with low or no tax liability, as unused credits are either lost or carried forward depending on the specific credit rules. Understanding the distinction between nonrefundable and refundable credits is essential for optimizing tax planning and maximizing potential tax savings.

Maximizing Your Refund with Refundable Credits

Maximizing your refund with refundable credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) can significantly increase your tax return beyond your tax liability. Nonrefundable credits, such as the Lifetime Learning Credit, only reduce your tax owed but cannot generate a refund if they exceed your tax liability. Understanding and strategically applying refundable credits ensures you receive the maximum possible refund, even if your tax liability is zero.

Choosing the Right Tax Credits for Your Situation

Nonrefundable tax credits reduce your tax liability but cannot generate a refund if the credit exceeds the amount owed, making them ideal for taxpayers with sufficient tax liability. Refundable tax credits provide a refund even if your tax liability is zero, offering a financial benefit to low-income earners or those with minimal tax owed. Analyzing your income level and tax liability helps determine whether nonrefundable or refundable credits better maximize your tax benefits.

Important Terms

Tax liability

Tax liability is reduced by nonrefundable credits only up to the amount owed, meaning any excess credit is forfeited, whereas refundable credits can decrease tax liability below zero, resulting in a tax refund to the taxpayer. Examples of nonrefundable credits include the Child and Dependent Care Credit, while the Earned Income Tax Credit represents a common refundable credit.

Carryforward

Carryforward allows unused nonrefundable credits, such as the Lifetime Learning Credit or the Child Tax Credit (when nonrefundable portion applies), to be applied to future tax years, maximizing tax benefit potential. Refundable credits like the Earned Income Tax Credit or the Additional Child Tax Credit provide a tax refund even if the credit exceeds tax liability, making carryforward generally unnecessary.

Adjusted gross income (AGI)

Adjusted Gross Income (AGI) determines eligibility for various tax credits, with nonrefundable credits reducing tax liability only up to the amount owed and refundable credits allowing refunds beyond zero tax owed. Understanding the impact of AGI on phase-out limits is essential for maximizing benefits from both nonrefundable and refundable tax credits.

Phase-out

Phase-out limits restrict the income range in which taxpayers can claim the full amount of nonrefundable credits, causing these credits to be reduced or eliminated as income increases without resulting in a refund. Refundable credits provide tax benefits beyond tax liability and often phase out at higher income thresholds but still offer partial refunds even when tax owed is zero.

Tax refund

Nonrefundable tax credits reduce your tax liability but do not generate a refund if they exceed the amount owed, whereas refundable tax credits can result in a refund even if your tax liability is zero. Understanding the distinction between nonrefundable and refundable credits, such as the Child Tax Credit (refundable) versus the Lifetime Learning Credit (nonrefundable), is crucial for maximizing your tax refund potential.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a refundable credit that helps low to moderate-income working individuals and families reduce their tax burden and potentially receive a refund even if no taxes are owed, contrasting with nonrefundable credits that can only reduce tax liability to zero without generating a refund. This refundability feature makes the EITC a critical tool for poverty alleviation and income support.

Child Tax Credit (CTC)

The Child Tax Credit (CTC) offers a nonrefundable portion that reduces federal income tax liability up to $2,000 per qualifying child, while the refundable portion, known as the Additional Child Tax Credit (ACTC), allows eligible taxpayers to receive up to $1,600 as a refund if the nonrefundable credit exceeds their tax owed. Taxpayers must meet income thresholds and eligibility criteria to maximize both nonrefundable and refundable components of the CTC for substantial tax relief.

Tax form 1040

Tax Form 1040 allows taxpayers to claim both nonrefundable and refundable credits, impacting their overall tax liability differently; nonrefundable credits reduce tax owed up to zero without generating a refund, while refundable credits can create a refund even if the taxpayer has no tax liability. Examples of nonrefundable credits include the Child and Dependent Care Credit, whereas the Earned Income Tax Credit represents a common refundable credit claimed on Form 1040.

Refundable portion

The refundable portion of a credit allows taxpayers to receive a refund if the credit exceeds their tax liability, unlike a nonrefundable credit which can only reduce tax owed to zero without generating a refund. Understanding the difference between refundable and nonrefundable credits is crucial for maximizing tax benefits and accurately calculating potential tax refunds.

Nonrefundable portion

The nonrefundable portion of a tax credit can reduce your tax liability to zero but does not result in a tax refund if the credit exceeds the amount of tax owed, distinguishing it from refundable credits which can generate a refund even when no tax is due. Examples of nonrefundable credits include the Child and Dependent Care Credit, while the Earned Income Tax Credit represents a common refundable credit.

Nonrefundable credit vs Refundable credit Infographic

moneydif.com

moneydif.com