Value-added tax (VAT) and goods and services tax (GST) both serve as consumption taxes applied at different stages of production and distribution, ensuring tax is collected incrementally. VAT is commonly used in European countries and involves taxing the value added at each transaction point, while GST is prevalent in countries like Canada and India, encompassing a broader tax base that integrates multiple indirect taxes into a single system. Both taxes aim to reduce tax evasion and increase transparency but differ in implementation and structure depending on regional tax policies.

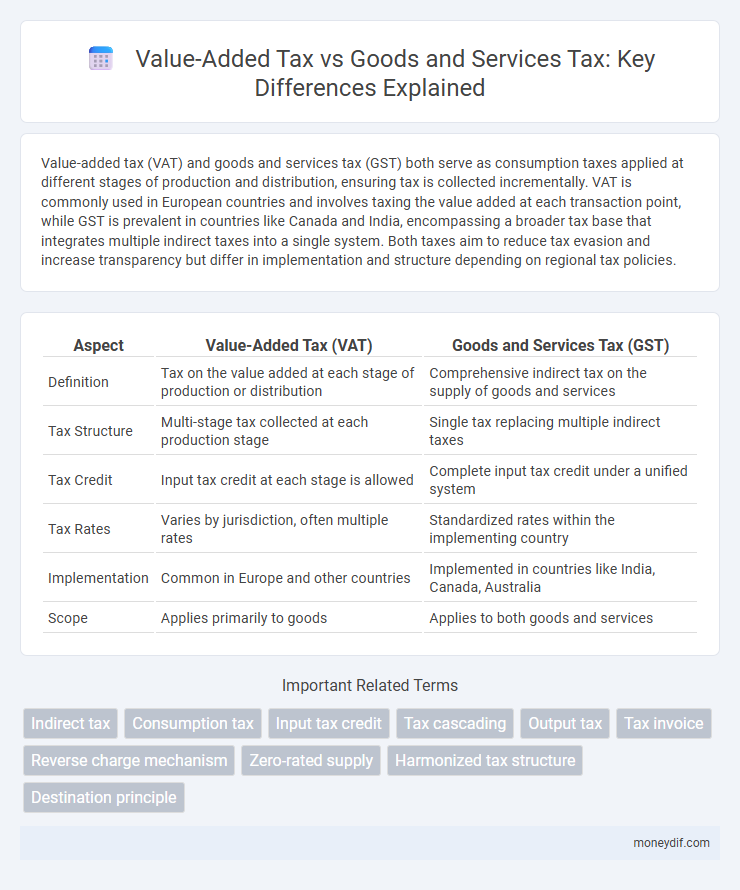

Table of Comparison

| Aspect | Value-Added Tax (VAT) | Goods and Services Tax (GST) |

|---|---|---|

| Definition | Tax on the value added at each stage of production or distribution | Comprehensive indirect tax on the supply of goods and services |

| Tax Structure | Multi-stage tax collected at each production stage | Single tax replacing multiple indirect taxes |

| Tax Credit | Input tax credit at each stage is allowed | Complete input tax credit under a unified system |

| Tax Rates | Varies by jurisdiction, often multiple rates | Standardized rates within the implementing country |

| Implementation | Common in Europe and other countries | Implemented in countries like India, Canada, Australia |

| Scope | Applies primarily to goods | Applies to both goods and services |

Understanding Value-Added Tax (VAT)

Value-Added Tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution of goods and services, typically expressed as a percentage of the sale price. Unlike Goods and Services Tax (GST), which often combines multiple indirect taxes into a single uniform tax, VAT applies separately within specific jurisdictions and can vary by product or region. Understanding VAT requires grasping its mechanism of crediting input tax paid on purchases against output tax collected on sales, ensuring tax is ultimately borne by the final consumer.

Defining Goods and Services Tax (GST)

Goods and Services Tax (GST) is a comprehensive, multi-stage consumption tax levied on the value added at each stage of the supply chain, from production to the final sale to consumers. Unlike Value-Added Tax (VAT), GST integrates various indirect taxes such as excise duty, service tax, and sales tax into a single unified tax system, reducing tax cascading and improving compliance. Implemented in countries like India, Canada, and Australia, GST applies uniformly across goods and services, simplifying the tax structure and enhancing transparency.

Key Differences Between VAT and GST

Value-added tax (VAT) is a multi-stage tax levied at each production stage on the value added, whereas goods and services tax (GST) is a comprehensive indirect tax combining various central and state levies into a single tax system. VAT typically applies only to goods, while GST encompasses both goods and services, unifying them under one tax structure. The input tax credit mechanism under GST is more efficient compared to VAT, reducing the cascading effect and simplifying tax compliance across supply chains.

Global Adoption: VAT vs GST

Value-added tax (VAT) has been widely adopted across Europe, Asia, and Africa, with more than 160 countries implementing this multi-stage tax system on goods and services. Goods and services tax (GST), a comprehensive indirect tax similar to VAT, is predominantly used in countries like India, Australia, and Canada, integrating multiple indirect taxes into a single unified system. The global adoption of VAT and GST reflects a strategic shift toward streamlined taxation frameworks to improve compliance, reduce tax evasion, and enhance government revenue collection.

Tax Structure and Implementation

Value-added tax (VAT) is a multi-stage tax levied on the value added at each production or distribution stage, typically implemented through a credit-invoice system ensuring taxes paid on inputs are deductible. Goods and services tax (GST) consolidates various indirect taxes into a single, comprehensive tax structure covering both goods and services with uniform rates and centralized administration to reduce complexity and tax cascading. VAT often requires separate filings for each stage, whereas GST provides a unified tax return mechanism improving compliance and transparency in tax implementation.

Impact on Businesses: VAT vs GST

Value-added tax (VAT) and goods and services tax (GST) both impact businesses by affecting cash flow, compliance costs, and pricing strategies. VAT typically requires businesses to file periodic returns and maintain detailed records of input and output tax, influencing administrative workload. GST consolidates multiple indirect taxes into a single system, simplifying tax compliance but may require significant initial adaptation for businesses.

Consumer Perspective: VAT vs GST

From a consumer perspective, Value-Added Tax (VAT) is typically charged at each stage of production and distribution, which can lead to a cumulative tax impact but also provides transparency on tax amounts at each transaction level. Goods and Services Tax (GST) simplifies this process by integrating multiple indirect taxes into a single levy, reducing the complexity for consumers when purchasing goods and services. GST often results in a more streamlined billing system with tax rates clearly displayed, enhancing consumer understanding and compliance.

Compliance and Administrative Requirements

Value-added tax (VAT) typically requires businesses to register with tax authorities, maintain detailed transaction records, and file periodic returns, ensuring compliance through systematic invoicing and input tax credit documentation. Goods and Services Tax (GST) often consolidates multiple indirect taxes into a single framework, simplifying compliance by unifying registration, return filing, and payment processes across federal and state levels. Both VAT and GST demand stringent adherence to audit norms and penalty provisions, but GST's integrated structure reduces administrative complexity and enhances transparency for taxpayers.

Revenue Generation for Governments

Value-added tax (VAT) and goods and services tax (GST) serve as vital sources of revenue generation for governments by taxing consumption at multiple stages of production and distribution. VAT typically applies in a multi-stage tax structure with separate state and central components, enhancing compliance and reducing evasion, while GST unifies these taxes into a single, comprehensive levy streamlining administration. Both tax systems contribute significantly to national coffers, funding public services and infrastructure, with GST often increasing revenue efficiency through broader tax base coverage and reduced cascading effects.

Future Trends in Indirect Taxation

Value-added tax (VAT) and goods and services tax (GST) are evolving with a growing emphasis on digital transformation and real-time reporting to enhance compliance and reduce tax evasion. Emerging trends indicate increased adoption of blockchain technology for transparent transaction tracking and artificial intelligence for automated tax assessments. Governments worldwide are shifting towards harmonized indirect tax frameworks to streamline cross-border trade and improve revenue collection efficiency.

Important Terms

Indirect tax

Value-added tax (VAT) is a type of indirect tax levied at each stage of production on the value added, while goods and services tax (GST) is a comprehensive indirect tax that consolidates multiple indirect taxes including VAT, providing a unified tax structure on the supply of goods and services.

Consumption tax

Consumption tax encompasses both value-added tax (VAT) and goods and services tax (GST), which are indirect taxes levied on the consumption of goods and services at different stages of production and distribution.

Input tax credit

Input tax credit allows businesses to deduct the tax paid on purchases from their total VAT or GST liability, enhancing cash flow and reducing tax burden under both Value-added Tax and Goods and Services Tax systems.

Tax cascading

Tax cascading occurs when Value-Added Tax (VAT) is applied multiple times on the same product at different production stages, whereas Goods and Services Tax (GST) eliminates cascading by allowing input tax credits across the supply chain.

Output tax

Output tax refers to the value-added tax (VAT) or goods and services tax (GST) a business charges on its sales of goods and services, which must be collected from customers and remitted to the tax authorities. While both VAT and GST are consumption taxes levied at each stage of the supply chain, VAT is commonly used in Europe with multiple rates and rebate systems, whereas GST is a single-stage tax adopted in countries like Canada and Australia, simplifying compliance by unifying federal and state taxes.

Tax invoice

A tax invoice must clearly specify the applicable rate and amount of Value-Added Tax (VAT) or Goods and Services Tax (GST) to ensure accurate compliance and input tax credit claims.

Reverse charge mechanism

The reverse charge mechanism shifts the liability to pay Value-added Tax (VAT) or Goods and Services Tax (GST) from the supplier to the recipient, ensuring tax compliance in cross-border or specified transactions.

Zero-rated supply

Zero-rated supply under Value-added tax (VAT) and Goods and Services Tax (GST) refers to goods and services taxed at a 0% rate, allowing businesses to claim input tax credits while charging no tax to consumers.

Harmonized tax structure

The harmonized tax structure integrates Value-Added Tax (VAT) and Goods and Services Tax (GST) to streamline indirect taxation by unifying multiple tax rates into a single, comprehensive system enhancing compliance and reducing cascading taxes.

Destination principle

The Destination Principle in taxation mandates that Value-Added Tax (VAT) and Goods and Services Tax (GST) are levied based on the location of consumption rather than the origin of production.

Value-added tax vs goods and services tax Infographic

moneydif.com

moneydif.com