VAT and GST are both consumption taxes imposed on goods and services, but VAT is typically a multi-stage tax applied at each point in the supply chain while GST is often implemented as a single-stage tax at the final point of sale. VAT allows businesses to claim credits for tax paid on inputs, reducing the cascading effect of taxes, whereas GST aims to simplify tax collection by integrating various indirect taxes into one system. Understanding the differences between VAT and GST is crucial for businesses to ensure compliance and optimize tax liabilities effectively.

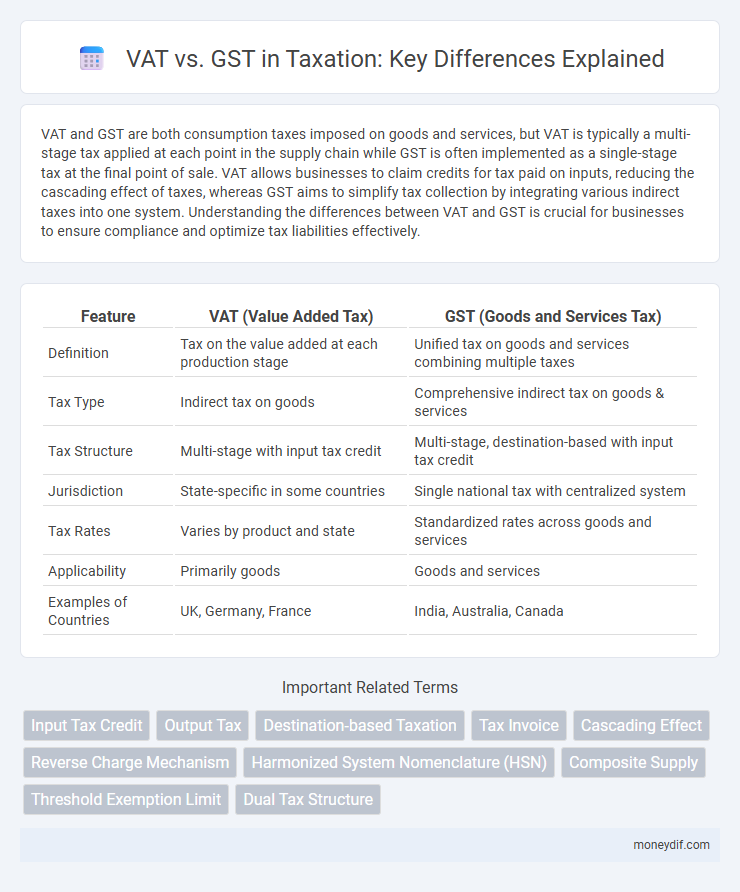

Table of Comparison

| Feature | VAT (Value Added Tax) | GST (Goods and Services Tax) |

|---|---|---|

| Definition | Tax on the value added at each production stage | Unified tax on goods and services combining multiple taxes |

| Tax Type | Indirect tax on goods | Comprehensive indirect tax on goods & services |

| Tax Structure | Multi-stage with input tax credit | Multi-stage, destination-based with input tax credit |

| Jurisdiction | State-specific in some countries | Single national tax with centralized system |

| Tax Rates | Varies by product and state | Standardized rates across goods and services |

| Applicability | Primarily goods | Goods and services |

| Examples of Countries | UK, Germany, France | India, Australia, Canada |

Understanding VAT and GST: A Comprehensive Comparison

VAT (Value Added Tax) and GST (Goods and Services Tax) are indirect taxes applied at different stages of the supply chain, with VAT levied on the value added at each production stage and GST implemented as a single tax on the supply of goods and services to avoid cascading taxes. VAT is commonly used in the European Union and many other countries, while GST is prevalent in countries like India, Canada, and Australia, designed to unify multiple taxes under one regime. Both VAT and GST aim to increase tax efficiency, reduce evasion, and enhance compliance, but their structures and mechanisms vary based on regional tax policies and economic frameworks.

Key Differences Between VAT and GST

VAT (Value-Added Tax) is a multi-stage tax levied on the value added at each production stage, primarily used in European countries, while GST (Goods and Services Tax) is a comprehensive indirect tax combining multiple taxes into a single system, implemented widely in countries like India and Australia. VAT is generally applied only on goods, whereas GST covers both goods and services, enhancing tax efficiency and reducing cascading effects. The administration of GST involves a dual model with Central GST and State GST components, contrasting with VAT's typically single-jurisdiction framework.

How VAT and GST Work: Mechanisms Explained

VAT (Value-Added Tax) and GST (Goods and Services Tax) function by levying taxes on the value added at each stage of production or distribution, ensuring taxation is applied incrementally rather than solely at the final sale. Both systems use input tax credits that allow businesses to deduct the tax paid on purchases from their tax liability on sales, preventing cascading taxes and reducing overall tax burden. VAT is typically used in European countries, while GST is more common in countries like India, Canada, and Australia, with both aiming to create a seamless tax collection mechanism across the supply chain.

Advantages and Disadvantages of VAT vs GST

VAT offers advantages such as a broad tax base and transparency in tax collection but can lead to tax cascading if input credit mechanisms are weak. GST simplifies taxation by merging multiple indirect taxes into a single system, reducing compliance costs and minimizing tax evasion risks, though its multi-rate structure may complicate administration. Both VAT and GST require robust IT infrastructure for effective implementation, with GST generally providing better input tax credit recovery and improved supply chain efficiency.

VAT and GST: Impact on Businesses

VAT and GST are indirect taxes levied on the consumption of goods and services, impacting business cash flow and compliance requirements significantly. VAT requires businesses to collect tax on sales and reclaim it on purchases, affecting pricing strategies and administrative costs. GST's unified tax structure often simplifies compliance but still demands accurate accounting to avoid penalties and maintain smooth business operations.

VAT vs GST: Compliance and Reporting Requirements

VAT and GST require businesses to maintain detailed tax records and submit regular filings to tax authorities, but the specific compliance procedures vary by jurisdiction. VAT systems typically demand tax invoices and input tax credit documentation, while GST frameworks emphasize comprehensive returns that reconcile input and output taxes. Both tax regimes necessitate strict adherence to deadlines and accurate calculation to avoid penalties and ensure proper tax credit claims.

Tax Rates: Comparing VAT and GST Structures

VAT (Value-Added Tax) rates typically vary between 5% and 25% depending on the country, with some regions applying multiple rates for different goods and services, while GST (Goods and Services Tax) usually features a single uniform rate, commonly ranging from 5% to 18%. VAT structures often impose tax at each stage of production and distribution, enabling input tax credit mechanisms, whereas GST consolidates multiple indirect taxes into one, simplifying compliance and reducing tax cascading. Comparing tax rates reveals VAT's complexity with variable rates and exemptions contrasts with GST's streamlined, consistent rate approach aimed at enhancing transparency and ease of administration.

VAT vs GST in Different Countries

VAT (Value Added Tax) and GST (Goods and Services Tax) are both consumption taxes imposed on the value added to goods and services at each stage of production. Countries like the United Kingdom, Germany, and France primarily use VAT systems, characterized by a multi-stage tax collection process with input tax credits. In contrast, countries like India, Australia, and Canada implement GST, which often represents a unified tax system consolidating multiple indirect taxes to streamline compliance and reduce cascading effects.

Challenges in Transitioning from VAT to GST

Transitioning from VAT to GST presents significant challenges including the need to reconfigure accounting systems to accommodate the multi-stage tax structure unique to GST. Businesses often face difficulties in compliance due to differences in tax rates, input tax credit mechanisms, and filing procedures. Moreover, extensive training is required for tax professionals and stakeholders to ensure accurate GST implementation and reporting.

Which is Better for the Economy: VAT or GST?

VAT (Value-Added Tax) and GST (Goods and Services Tax) both streamline tax structures by taxing consumption at multiple stages, but GST's unified framework reduces cascading taxes and improves transparency across supply chains. Economies with GST experience enhanced compliance and broader tax bases due to its integration of central and state levies, unlike the segmented VAT systems that may cause inefficiencies and tax evasion. Empirical studies indicate GST fosters stronger economic growth and investment by minimizing tax distortions and lowering the overall tax burden compared to traditional VAT models.

Important Terms

Input Tax Credit

Input Tax Credit (ITC) allows businesses to reduce the tax payable on outputs by deducting the tax paid on inputs, differing under VAT and GST frameworks; VAT restricts ITC to within the same state and specific goods, whereas GST enables seamless ITC across states and broadly on goods and services. This system promotes transparency and prevents cascading taxes more effectively under GST by integrating central and state taxes into a single unified tax regime.

Output Tax

Output Tax refers to the tax collected by a business on sales of goods or services, which must be reported and remitted to tax authorities under both VAT (Value-Added Tax) and GST (Goods and Services Tax) systems. While VAT is typically applied at each stage of the supply chain with input tax credit offsetting output tax, GST consolidates multiple indirect taxes into a single system, streamlining compliance and ensuring output tax is uniformly applied across goods and services.

Destination-based Taxation

Destination-based taxation imposes Value Added Tax (VAT) or Goods and Services Tax (GST) based on the location where goods or services are consumed rather than where they are produced, ensuring tax revenue aligns with the market jurisdiction. This system promotes fair competition among domestic and foreign suppliers by standardizing tax rates across states or countries, reducing tax evasion and simplifying compliance for cross-border transactions.

Tax Invoice

A tax invoice is a crucial document for claiming input tax credits, detailing the transaction value and applicable taxes such as VAT (Value Added Tax) or GST (Goods and Services Tax). VAT typically applies in countries with a multi-stage tax system focusing on value addition at each production step, while GST integrates multiple indirect taxes into a single system, commonly used in countries like India, encompassing central and state-level components.

Cascading Effect

The cascading effect occurs when VAT or GST is applied on a product or service without allowing credit for the tax paid on inputs, leading to tax on tax and increasing the overall cost. In VAT systems, this effect is more prevalent due to limited input tax credit claims, whereas GST is designed to eliminate cascading by providing seamless input tax credit across the entire supply chain.

Reverse Charge Mechanism

The Reverse Charge Mechanism (RCM) shifts the liability to pay Value Added Tax (VAT) or Goods and Services Tax (GST) from the supplier to the recipient of goods or services, commonly applied in cross-border transactions or specified categories like imports and unregistered vendors. Under GST, RCM ensures seamless tax compliance and input tax credit availability, contrasting with VAT systems where RCM's implementation varies widely by jurisdiction and is less integrated into the overall tax input output chain.

Harmonized System Nomenclature (HSN)

The Harmonized System Nomenclature (HSN) is a standardized numerical method of classifying traded products used globally to determine customs and tax rates, including Value Added Tax (VAT) and Goods and Services Tax (GST). GST leverages HSN codes to ensure uniform tax slabs across states in countries like India, while VAT systems use HSN codes mainly for categorizing goods to apply appropriate tax percentages within individual states or regions.

Composite Supply

Composite supply under VAT and GST involves a principal supply combined with ancillary supplies forming a single taxable event, with GST clearly defining it as a supply where one component predominates and determines the tax rate. VAT systems may vary in treatment but generally do not recognize composite supply as distinctly as GST, which aims to simplify tax calculation by applying a unified tax rate to the entire composite supply.

Threshold Exemption Limit

The Threshold Exemption Limit distinguishes the minimum turnover at which businesses must register and charge Value Added Tax (VAT) or Goods and Services Tax (GST), varying by country and tax system. While VAT systems often have specific limits based on revenue or sales volume, GST regimes typically set exemption thresholds to reduce compliance burdens on small businesses and encourage formalization.

Dual Tax Structure

Dual Tax Structure refers to the coexistence of two tax systems where Value Added Tax (VAT) is imposed by state governments on the sale of goods, while Goods and Services Tax (GST) integrates both central and state taxes into a single unified framework covering goods and services. This structure aims to streamline tax administration and reduce cascading taxes, enhancing compliance and economic efficiency within federal tax jurisdictions.

VAT vs GST Infographic

moneydif.com

moneydif.com