Apportionment in taxation involves dividing income or expenses among multiple jurisdictions based on a specific formula, reflecting factors like property, payroll, or sales to determine taxable income in each area. Allocation refers to assigning particular types of income directly to one jurisdiction without division, typically for income that is clearly sourced or earned in a single location. Understanding the distinction is crucial for accurate tax reporting and compliance across different tax authorities.

Table of Comparison

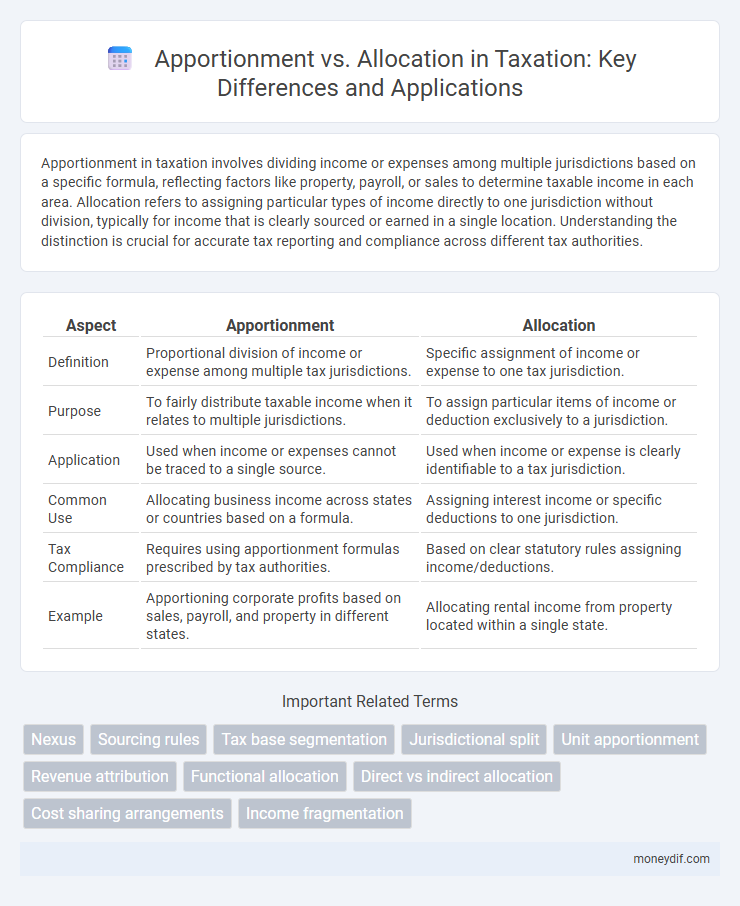

| Aspect | Apportionment | Allocation |

|---|---|---|

| Definition | Proportional division of income or expense among multiple tax jurisdictions. | Specific assignment of income or expense to one tax jurisdiction. |

| Purpose | To fairly distribute taxable income when it relates to multiple jurisdictions. | To assign particular items of income or deduction exclusively to a jurisdiction. |

| Application | Used when income or expenses cannot be traced to a single source. | Used when income or expense is clearly identifiable to a tax jurisdiction. |

| Common Use | Allocating business income across states or countries based on a formula. | Assigning interest income or specific deductions to one jurisdiction. |

| Tax Compliance | Requires using apportionment formulas prescribed by tax authorities. | Based on clear statutory rules assigning income/deductions. |

| Example | Apportioning corporate profits based on sales, payroll, and property in different states. | Allocating rental income from property located within a single state. |

Understanding Apportionment and Allocation in Taxation

Apportionment in taxation refers to the process of dividing income or expenses among multiple jurisdictions based on a specific formula to ensure fair tax distribution, while allocation assigns specific income or expenses directly to a single jurisdiction. Understanding apportionment involves recognizing its role in multi-state tax compliance and formulas like the three-factor method, which considers property, payroll, and sales. Allocation differs by focusing on income sources distinctly tied to one location, impacting tax liabilities by attributing earnings to their precise origin.

Key Differences Between Apportionment and Allocation

Apportionment in taxation involves dividing a total tax liability among multiple jurisdictions based on a predetermined formula, often considering factors like property, payroll, and sales within each area. Allocation assigns specific income or expenses directly to a particular jurisdiction, reflecting where the income was earned or the expense was incurred. The key difference lies in apportionment spreading the tax base across locations, while allocation directs specific items to individual tax jurisdictions for precise tax calculation.

Legal Frameworks Governing Apportionment and Allocation

Legal frameworks governing apportionment and allocation in taxation establish consistent rules for distributing income and expenses among jurisdictions, ensuring equitable tax liabilities. Apportionment typically involves formulas based on factors such as property, payroll, and sales within each jurisdiction, while allocation assigns specific types of income or deductions directly to a single jurisdiction. These frameworks are codified in state statutes and intergovernmental agreements, aiming to prevent double taxation and tax avoidance.

Apportionment Methods: Principles and Applications

Apportionment in taxation involves dividing a taxpayer's income among multiple jurisdictions based on specific factors such as property, payroll, and sales, using established methods like the three-factor formula to fairly distribute tax liabilities. Allocation assigns specific income items directly to a single jurisdiction, often for non-business or specialized income sources, simplifying tax reporting for multistate or multinational entities. Understanding the principles behind apportionment methods helps ensure equitable tax distribution and compliance with state tax laws, minimizing disputes and double taxation issues.

Allocation Strategies: Approaches and Examples

Allocation strategies in taxation determine how income, expenses, or credits are assigned to different tax jurisdictions, impacting the overall tax liability of a business. Common approaches include cost allocation, where expenses are distributed based on actual costs incurred in each jurisdiction, and revenue allocation, which assigns income according to where sales or services occur. Examples include the three-factor formula used in U.S. state taxation, which allocates income based on property, payroll, and sales within each state.

Impact on Multistate and International Taxation

Apportionment determines the portion of income taxable by each state based on a formula considering property, payroll, and sales, ensuring fair multistate tax distribution. Allocation assigns specific income types, such as interest or dividends, exclusively to one state, preventing double taxation in international scenarios. Understanding these distinctions is critical for multinational corporations navigating complex tax obligations across jurisdictions.

Challenges in Apportionment and Allocation Processes

Challenges in apportionment and allocation processes in taxation arise from the complexities of accurately assigning income and expenses across multiple jurisdictions, which often lack uniform statutory standards. Variations in state tax laws, inconsistent definitions of taxable income, and the presence of multifaceted business activities complicate the determination of appropriate tax bases. These issues lead to disputes, increased compliance costs, and potential double taxation or tax avoidance risks for multistate businesses.

Case Studies: Apportionment vs Allocation in Practice

Apportionment involves dividing income or expenses among multiple tax jurisdictions based on specific factors such as property, payroll, and sales, while allocation assigns specific income or expense items entirely to one jurisdiction. In practice, cases like *CFA Institute v. Commissioner* highlight disputes where apportionment formulas determined taxable income in multiple states, contrasting with the *National Industries Inc. v. Commissioner* case, emphasizing precise allocation of income from intangible assets. Understanding these distinctions is critical for accurately reporting taxable income and minimizing double taxation risks across jurisdictions.

Compliance and Documentation Requirements

Apportionment requires detailed documentation to accurately split income or expenses among multiple jurisdictions based on specific formulas outlined by tax authorities, ensuring compliance with local tax laws. Allocation involves assigning entire items of income or deduction to a single jurisdiction, demanding thorough records that substantiate the taxpayer's position to satisfy audit scrutiny. Maintaining robust compliance processes and comprehensive documentation is critical to withstand tax authority reviews and avoid penalties.

Future Trends in Apportionment and Allocation for Tax Professionals

Future trends in apportionment and allocation for tax professionals emphasize increased reliance on data analytics and artificial intelligence to enhance accuracy in dividing income among jurisdictions. Tax authorities are advancing rules that incorporate digital economy considerations, resulting in more complex methodologies to fairly allocate taxable income. Understanding these evolving frameworks is essential for tax professionals to ensure compliance and optimize tax planning strategies across multinational operations.

Important Terms

Nexus

Nexus determines the connection required between a taxpayer and a jurisdiction to impose tax, impacting whether income is subject to apportionment or allocation methods. Apportionment divides business income proportionally across multiple states based on factors like property, payroll, and sales, while allocation assigns specific income categories entirely to a single state, both guided by the presence of nexus.

Sourcing rules

Sourcing rules determine the location of income for tax purposes, crucial in distinguishing apportionment, which divides a single income source among multiple jurisdictions, from allocation, which assigns distinct income types to specific jurisdictions. Accurate application of sourcing rules ensures proper tax jurisdiction determination, minimizing double taxation and complying with international tax treaties.

Tax base segmentation

Tax base segmentation involves dividing a taxpayer's income or assets into distinct categories to determine tax liability across different jurisdictions, which is essential in apportionment where the tax base is proportionally distributed based on specific factors like sales, payroll, or property within each jurisdiction. Allocation differs by assigning entire specific income items or assets exclusively to one jurisdiction, impacting how multi-state or multinational entities calculate taxable income and comply with varying tax rules.

Jurisdictional split

Jurisdictional split in taxation refers to how income and expenses are divided among different tax authorities, with apportionment allocating a portion of total income based on a formula considering factors like sales, property, and payroll, while allocation assigns specific income items directly to jurisdictions according to statutory rules. Apportionment is commonly used by states for multistate businesses, whereas allocation addresses income that can be distinctly identified with a particular location or activity.

Unit apportionment

Unit apportionment determines the taxable income portion for a business across multiple jurisdictions by calculating the share of property, payroll, and sales within each state, while apportionment vs allocation distinguishes unit apportionment as the method for dividing income among states versus allocation, which assigns specific income items directly to a single state. Tax authorities use unit apportionment formulas to ensure multi-state businesses pay taxes proportionate to their economic activity in each jurisdiction, contrasting with allocation that isolates particular income types to designated states.

Revenue attribution

Revenue attribution in taxation involves accurately assigning income to specific sources or activities, ensuring compliance with tax regulations. Apportionment divides revenue among multiple jurisdictions based on factors like sales, property, or payroll, while allocation allocates specific income items to a single jurisdiction, optimizing taxable income reporting and minimizing double taxation risks.

Functional allocation

Functional allocation refers to the process of assigning income or expenses to specific functions or activities within a business, which contrasts with apportionment and allocation in taxation where income or expenses are distributed among jurisdictions based on formulas such as sales, property, and payroll factors. Apportionment determines the taxable share of income for each jurisdiction by applying statutory ratios, while allocation assigns particular income items directly to one jurisdiction, optimizing compliance and tax liability management.

Direct vs indirect allocation

Direct allocation assigns specific expenses or incomes straight to a particular tax cost center, ensuring precise tax apportionment based on identifiable tax liabilities. Indirect allocation distributes shared costs or incomes proportionally among multiple tax entities using apportionment methods like the formula-based approach, reflecting fair tax burden division across jurisdictions.

Cost sharing arrangements

Cost sharing arrangements allocate expenses based on each participant's anticipated benefits, while apportionment distributes income or expenses across multiple jurisdictions according to specific tax rules. Accurate apportionment vs allocation ensures compliance with international tax regulations and minimizes risks of double taxation in cross-border transactions.

Income fragmentation

Income fragmentation involves dividing income among multiple entities or jurisdictions to minimize tax liability, a concept critical in apportionment and allocation methods in taxation. Apportionment assigns a portion of total income to a jurisdiction based on a formula considering factors like sales, property, and payroll, while allocation directly assigns specific income types to particular jurisdictions, impacting tax base determination and compliance strategies.

Apportionment vs allocation (in taxation) Infographic

moneydif.com

moneydif.com