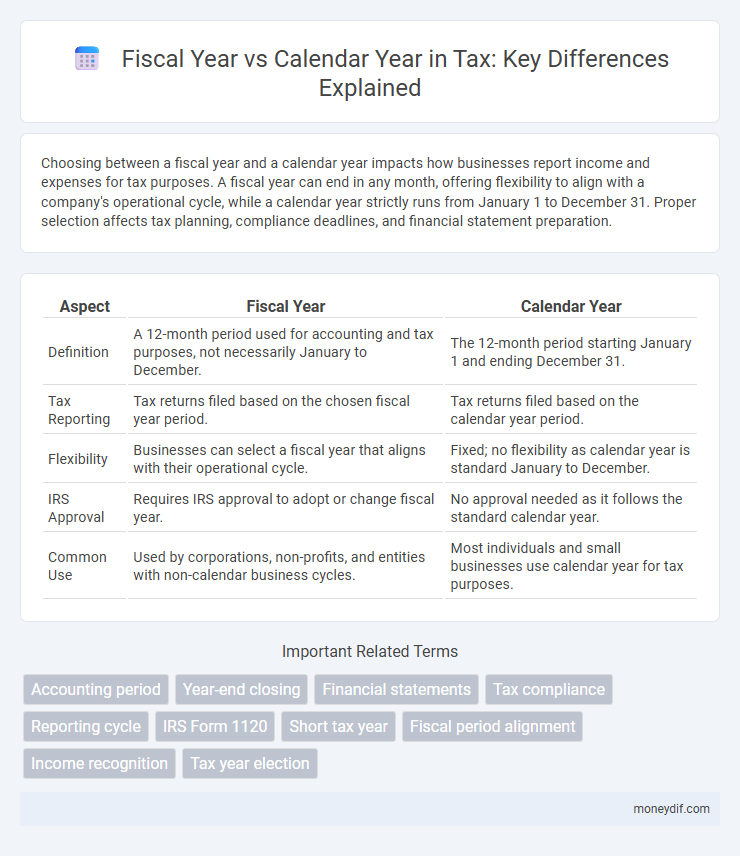

Choosing between a fiscal year and a calendar year impacts how businesses report income and expenses for tax purposes. A fiscal year can end in any month, offering flexibility to align with a company's operational cycle, while a calendar year strictly runs from January 1 to December 31. Proper selection affects tax planning, compliance deadlines, and financial statement preparation.

Table of Comparison

| Aspect | Fiscal Year | Calendar Year |

|---|---|---|

| Definition | A 12-month period used for accounting and tax purposes, not necessarily January to December. | The 12-month period starting January 1 and ending December 31. |

| Tax Reporting | Tax returns filed based on the chosen fiscal year period. | Tax returns filed based on the calendar year period. |

| Flexibility | Businesses can select a fiscal year that aligns with their operational cycle. | Fixed; no flexibility as calendar year is standard January to December. |

| IRS Approval | Requires IRS approval to adopt or change fiscal year. | No approval needed as it follows the standard calendar year. |

| Common Use | Used by corporations, non-profits, and entities with non-calendar business cycles. | Most individuals and small businesses use calendar year for tax purposes. |

Understanding Fiscal Year and Calendar Year

A fiscal year is a 12-month period used by businesses and governments for accounting and tax purposes, which may start and end in any month, unlike the calendar year that runs from January 1 to December 31. Understanding the difference is crucial for filing accurate tax returns, as companies may choose a fiscal year to align financial reporting with operational cycles. The choice between fiscal year and calendar year affects tax deadlines, financial planning, and compliance with regulatory authorities such as the IRS.

Key Differences Between Fiscal Year and Calendar Year

A fiscal year is a 12-month accounting period chosen by a business or government for financial reporting, which may start on any date, while a calendar year runs from January 1 to December 31. Corporations often select a fiscal year that aligns with their business cycles, enabling more accurate tax planning and financial analysis. Tax deadlines, reporting requirements, and deduction timings can vary significantly depending on whether a taxpayer uses a fiscal year or a calendar year for accounting purposes.

Choosing Between Fiscal Year and Calendar Year for Tax Purposes

Choosing between a fiscal year and a calendar year for tax purposes depends on the business's revenue cycle and accounting practices. A fiscal year can end on any day other than December 31, allowing alignment with specific operational cycles, while a calendar year follows January 1 to December 31. The IRS requires most individual taxpayers and some businesses to use the calendar year, but corporations and partnerships may elect a fiscal year if it better matches their financial activities.

Tax Filing Implications of Fiscal Year vs Calendar Year

Choosing a fiscal year instead of a calendar year for tax filing impacts the timing of income recognition, deductions, and tax payments, as fiscal years do not coincide with January 1 to December 31. Businesses using a fiscal year can align tax reporting with their natural business cycles, potentially optimizing tax planning and cash flow. However, IRS approval is required to change or establish a fiscal year, and different tax deadlines and forms may apply compared to calendar year filers.

IRS Guidelines on Fiscal Year and Calendar Year

The IRS allows businesses to choose between a fiscal year and a calendar year for tax reporting, provided they maintain consistent accounting periods. A fiscal year ends on the last day of any month except December, while a calendar year ends on December 31. Taxpayers must obtain IRS approval to change their tax year and comply with specific filing deadlines associated with their chosen accounting period.

Impact on Business Financial Reporting

Choosing a fiscal year instead of a calendar year impacts business financial reporting by aligning accounting periods with operational cycles, improving expense matching and revenue recognition accuracy. Businesses with seasonal fluctuations often prefer fiscal years to reflect true performance during peak periods, enhancing stakeholder insights. Tax compliance deadlines and financial statement comparability also vary depending on the chosen year type, influencing audit processes and investor evaluations.

Fiscal Year vs Calendar Year: Pros and Cons

Choosing a fiscal year instead of a calendar year can provide businesses with better alignment to their operational cycles and seasonal revenue fluctuations, potentially optimizing tax planning and cash flow management. However, using a calendar year simplifies compliance and reporting requirements since most tax authorities and financial institutions default to this system, reducing administrative complexity. Companies must weigh the flexibility of a fiscal year against the standardized ease of a calendar year to determine the best fit for their financial reporting and tax strategies.

Changing Your Tax Year: Procedures and Considerations

Changing your tax year requires filing Form 1128 with the IRS to request approval, which involves justifying the need for a fiscal year instead of the default calendar year. Businesses must consider potential tax implications such as short-period returns and potential changes in filing deadlines. Careful planning is essential to align your tax year with your financial reporting needs while ensuring compliance with IRS regulations.

Common Mistakes When Selecting a Tax Year

Choosing a fiscal year instead of a calendar year for tax reporting often leads to common mistakes such as incorrect filing deadlines and mismatched income recognition periods. Many taxpayers mistakenly assume the fiscal year aligns with the calendar year, causing errors in tax calculations and potential penalties. It is crucial to understand IRS rules for tax year selection to avoid compliance issues and optimize tax planning strategies.

Frequently Asked Questions About Fiscal and Calendar Years

A fiscal year is a 12-month period used for accounting and tax purposes that does not necessarily align with the calendar year, which runs from January 1 to December 31. Businesses often adopt fiscal years to match their operational cycles, affecting tax reporting deadlines and financial statements. Common questions include how to select a fiscal year, implications for tax filings, and differences in IRS regulations between fiscal and calendar year taxpayers.

Important Terms

Accounting period

An accounting period defines the specific timeframe for financial reporting, typically aligning with a fiscal year or a calendar year; a fiscal year can start in any month and runs for 12 consecutive months, while a calendar year strictly spans January 1 to December 31. Businesses select fiscal years to match operational cycles or industry practices, optimizing tax planning and financial analysis compared to the standard calendar year approach.

Year-end closing

Year-end closing processes differ significantly between fiscal year and calendar year companies, as fiscal years can end on any date chosen by the organization, often aligning with business cycles, while calendar year companies close books on December 31. Understanding the specific cut-off dates is crucial for accurate financial reporting, tax compliance, and audit preparations, ensuring alignment with respective regulatory standards and internal accounting practices.

Financial statements

Financial statements prepared on a fiscal year basis reflect a company's performance over a 12-month period that may differ from the calendar year, aligning with specific business cycles or regulatory requirements. In contrast, calendar year financial statements cover January 1 to December 31, providing a standardized timeline for comparing financial data across companies and industries.

Tax compliance

Tax compliance requires accurate alignment of reporting periods with either the fiscal year or calendar year, as regulatory authorities mandate specific timelines for filing returns and payments based on these periods. Understanding the differences between fiscal year-end dates and calendar year-end dates is crucial to ensure timely submissions and avoid penalties associated with misaligned tax periods.

Reporting cycle

The reporting cycle for fiscal years varies by organization and often begins on a date other than January 1, aligning financial reporting with specific business operations, unlike the calendar year which strictly spans January 1 to December 31. Fiscal year reporting cycles impact budgeting, taxation, and financial analysis by providing tailored periods that better reflect operational performance rather than the fixed calendar year.

IRS Form 1120

IRS Form 1120 requires corporations to report income on either a fiscal year or calendar year basis, with the fiscal year defined as any 12-month accounting period ending on the last day of any month except December. Choosing a fiscal year different from the calendar year necessitates IRS approval and consistent annual use to ensure accurate tax filing and compliance.

Short tax year

A short tax year occurs when a fiscal year or calendar year is less than 12 months due to a change in accounting periods or business operations. Businesses transitioning from a calendar year to a fiscal year, or vice versa, often file a short tax year return to reflect the shortened reporting period for accurate tax compliance.

Fiscal period alignment

Fiscal period alignment involves synchronizing accounting periods to match either the fiscal year or the calendar year, ensuring consistent financial reporting and comparability. Organizations choosing a fiscal year often align it with business cycles or industry practices, unlike the calendar year which follows January to December, affecting tax filings, budgeting, and performance analysis.

Income recognition

Income recognition depends on whether a business operates on a fiscal year or calendar year, affecting how revenue and expenses are recorded for financial reporting. Companies using a fiscal year may recognize income based on their specific accounting period, which could differ from the standard January to December calendar year, influencing tax obligations and financial analysis outcomes.

Tax year election

Tax year election allows businesses to choose between a fiscal year or calendar year for reporting income and expenses, impacting their tax filing deadlines and financial planning. Selecting a fiscal year, which ends on any date except December 31, can optimize tax strategies by aligning reporting periods with business cycles, while a calendar year ends on December 31 and is the default tax year for most entities.

Fiscal year vs Calendar year Infographic

moneydif.com

moneydif.com