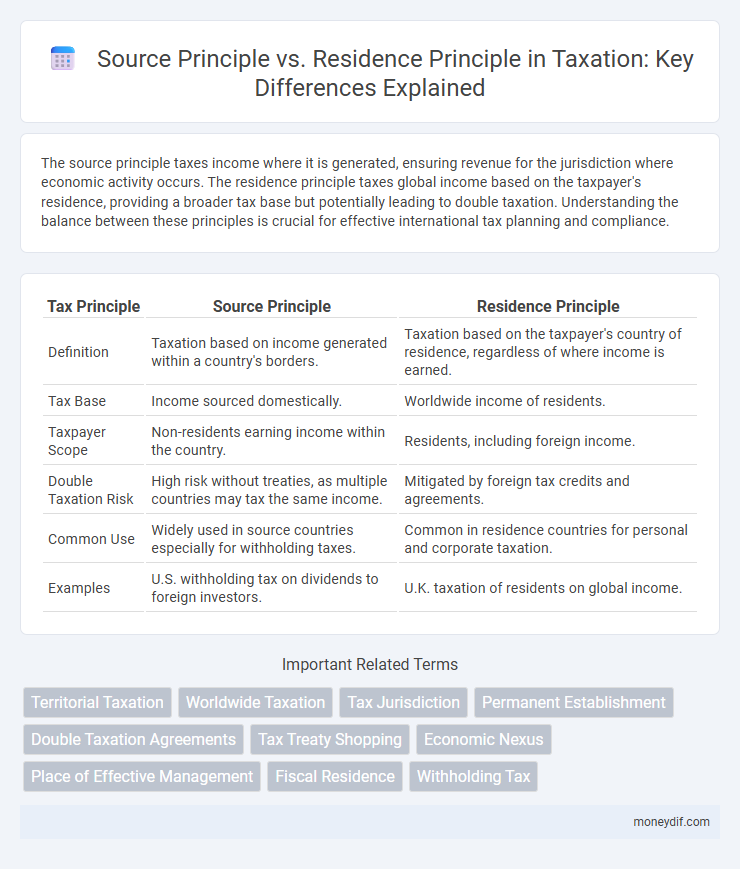

The source principle taxes income where it is generated, ensuring revenue for the jurisdiction where economic activity occurs. The residence principle taxes global income based on the taxpayer's residence, providing a broader tax base but potentially leading to double taxation. Understanding the balance between these principles is crucial for effective international tax planning and compliance.

Table of Comparison

| Tax Principle | Source Principle | Residence Principle |

|---|---|---|

| Definition | Taxation based on income generated within a country's borders. | Taxation based on the taxpayer's country of residence, regardless of where income is earned. |

| Tax Base | Income sourced domestically. | Worldwide income of residents. |

| Taxpayer Scope | Non-residents earning income within the country. | Residents, including foreign income. |

| Double Taxation Risk | High risk without treaties, as multiple countries may tax the same income. | Mitigated by foreign tax credits and agreements. |

| Common Use | Widely used in source countries especially for withholding taxes. | Common in residence countries for personal and corporate taxation. |

| Examples | U.S. withholding tax on dividends to foreign investors. | U.K. taxation of residents on global income. |

Understanding the Source Principle in Taxation

The source principle in taxation mandates that income is taxed in the country where it is generated, regardless of the taxpayer's residence. This principle ensures that host countries receive tax revenue from economic activities occurring within their borders, such as business profits, royalties, and dividends. Understanding the source principle is crucial for multinational enterprises to navigate international tax obligations and avoid double taxation through treaties and transfer pricing regulations.

The Residence Principle: Overview and Fundamentals

The residence principle taxes individuals and entities based on their domicile or habitual residence, ensuring worldwide income is subject to tax in the resident country. This principle aims to prevent tax evasion by capturing global earnings regardless of where income is generated. Countries applying the residence principle use residency criteria such as physical presence, permanent home, or citizenship to determine tax obligations.

Key Differences Between Source and Residence Principles

The source principle taxes income where it is generated, focusing on the location of economic activity, while the residence principle taxes based on the taxpayer's domicile or residency regardless of where income is earned. Under the source principle, countries levy taxes on income sourced within their borders, ensuring local economic benefits are taxed, whereas the residence principle imposes taxes on global income of residents, promoting comprehensive taxation of worldwide earnings. Key differences include the scope of taxable income, administrative complexity, and implications for cross-border income allocation and double taxation.

International Taxation: Implications of Source vs Residence

International taxation hinges on the source principle, which taxes income where it is generated, and the residence principle, where taxation is based on the taxpayer's domicile or residency. The source principle emphasizes taxing cross-border earnings at the point of economic activity, impacting multinational enterprises' profit allocation and transfer pricing strategies. In contrast, the residence principle affects worldwide income taxation, requiring residents to report global earnings, often necessitating double taxation treaties to mitigate cross-jurisdictional tax burdens.

Tax Treaty Provisions: Resolving Source and Residence Conflicts

Tax treaty provisions play a crucial role in resolving conflicts between the source principle and residence principle by clearly defining taxing rights between countries. These treaties often use methods like the exemption or credit method to prevent double taxation and allocate taxing authority based on factors such as income origin and taxpayer residency. Provisions such as permanent establishment rules and tie-breaker clauses ensure clarity and consistency in determining the appropriate jurisdiction for taxation.

Double Taxation: How Source and Residence Rules Interact

Double taxation arises when both the source country and the residence country tax the same income under their respective source and residence principles. The source principle taxes income where it is generated, ensuring countries benefit from taxing local economic activities, while the residence principle taxes worldwide income of residents, preventing tax avoidance by shifting income abroad. Effective double taxation relief mechanisms, such as tax treaties and foreign tax credits, harmonize the interaction between these principles to mitigate the taxpayer's burden.

Corporate Taxation: Source vs Residence Criteria

Corporate taxation hinges on the source and residence principles, which determine tax liability based on where income is generated or where the company is domiciled. The source principle taxes income earned within a jurisdiction regardless of the taxpayer's residence, emphasizing economic activity location and resource exploitation. Conversely, the residence principle taxes global income of companies domiciled in a particular country, focusing on ownership and control for comprehensive tax coverage.

Individual Taxpayers: Global Income and Residency Status

The source principle taxes individual taxpayers based on income earned within a specific jurisdiction, regardless of residency, emphasizing territorial taxation and local-source income. In contrast, the residence principle subjects individuals to tax on their worldwide income if they are considered tax residents of that country, prioritizing global income reporting and comprehensive tax obligations. Understanding residency status is crucial for determining tax liabilities, as non-residents are typically taxed only on income sourced within the taxing country, while residents face taxation on both domestic and foreign-sourced income.

Policy Considerations: Choosing Between Source and Residence Approaches

Choosing between the source principle and residence principle involves balancing revenue allocation and economic efficiency, as source-based taxation targets income where it is generated, while residence-based taxation focuses on the taxpayer's home jurisdiction. Policymakers consider factors such as preventing double taxation, minimizing tax evasion, and ensuring fair burden distribution between countries. The decision impacts cross-border investment flows, international cooperation, and the overall effectiveness of tax administration systems.

Recent Trends and Reforms in International Tax Principles

Recent trends in international tax principles show a shift towards balancing the source principle, where income is taxed where it is generated, and the residence principle, which taxes based on taxpayer domicile. Reforms such as the OECD's Pillar One framework aim to allocate taxing rights more equitably between jurisdictions, addressing challenges from digitalization and cross-border activities. Countries increasingly adopt hybrid approaches to prevent double taxation and tax evasion, reflecting a growing consensus on international cooperation and transparency.

Important Terms

Territorial Taxation

Territorial taxation applies tax only on income sourced within a country, emphasizing the source principle, while residence-based taxation levies tax on a taxpayer's worldwide income regardless of its origin.

Worldwide Taxation

Worldwide taxation applies the residence principle by taxing individuals on global income regardless of source, whereas the source principle taxes income only where it is generated.

Tax Jurisdiction

Tax jurisdiction determines whether income is taxed based on the source principle, taxing income where it is generated, or the residence principle, taxing income based on the taxpayer's domicile.

Permanent Establishment

Permanent Establishment determines tax liability based on the Source principle by taxing income generated within a country where a business operates, contrasting with the Residence principle which taxes income according to the taxpayer's home country regardless of where the income is earned.

Double Taxation Agreements

Double Taxation Agreements allocate taxing rights between countries based on the source principle, which taxes income where it is generated, and the residence principle, which taxes income based on the taxpayer's domicile to prevent income from being taxed twice.

Tax Treaty Shopping

Tax treaty shopping exploits differences between the source principle, which taxes income where it originates, and the residence principle, which taxes based on the taxpayer's domicile, allowing entities to structure transactions to minimize withholding taxes and overall tax liability.

Economic Nexus

Economic nexus determines tax liability based on the source principle, taxing income where it is generated rather than on the residence principle which taxes based on the taxpayer's domicile.

Place of Effective Management

Place of Effective Management determines corporate tax liability by prioritizing the source principle for income allocation while the residence principle attributes global income based on the company's domiciled location.

Fiscal Residence

Fiscal residence determines tax liability based on an individual's or entity's primary location, whereas the source principle taxes income where it is generated regardless of residency.

Withholding Tax

Withholding tax is a tax deducted at the source of income under the source principle, whereas under the residence principle, income is taxed based on the taxpayer's country of residence regardless of where the income is generated.

Source principle vs residence principle Infographic

moneydif.com

moneydif.com