Double taxation refers to the same income being taxed twice by two different jurisdictions or at two different levels, such as corporate profits taxed at the company level and again at the shareholder level upon distribution. Economic double taxation occurs when the same economic income is taxed multiple times in the hands of different taxpayers, for example, when corporate profits are taxed and then the economic benefits from those profits are taxed again as part of shareholder income. Understanding the distinction between legal double taxation and economic double taxation is crucial for effective tax planning and minimizing overall tax liability.

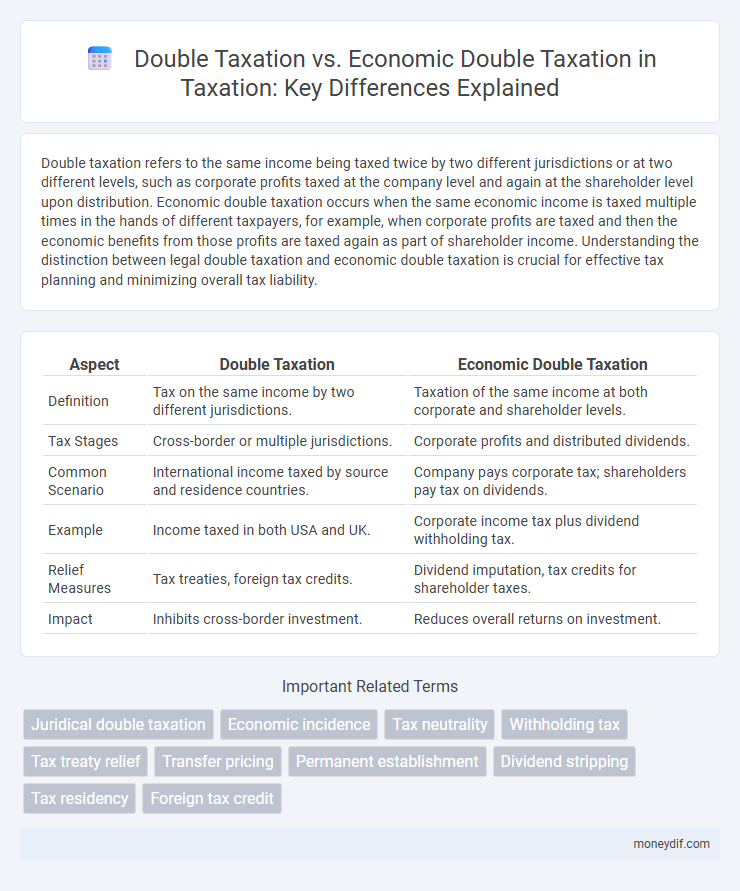

Table of Comparison

| Aspect | Double Taxation | Economic Double Taxation |

|---|---|---|

| Definition | Tax on the same income by two different jurisdictions. | Taxation of the same income at both corporate and shareholder levels. |

| Tax Stages | Cross-border or multiple jurisdictions. | Corporate profits and distributed dividends. |

| Common Scenario | International income taxed by source and residence countries. | Company pays corporate tax; shareholders pay tax on dividends. |

| Example | Income taxed in both USA and UK. | Corporate income tax plus dividend withholding tax. |

| Relief Measures | Tax treaties, foreign tax credits. | Dividend imputation, tax credits for shareholder taxes. |

| Impact | Inhibits cross-border investment. | Reduces overall returns on investment. |

Understanding Double Taxation: Definition and Overview

Double taxation occurs when the same income is taxed twice by different jurisdictions, typically affecting international businesses and individuals with cross-border income. Economic double taxation, on the other hand, refers to the taxation of the same economic income at multiple levels, such as corporate profits being taxed first at the company level and again at the shareholder level when dividends are distributed. Understanding these distinctions is crucial for tax planning and minimizing the overall tax burden in both domestic and international tax systems.

What is Economic Double Taxation? Key Concepts

Economic double taxation occurs when the same income is taxed twice at different levels, typically corporate profits taxed at the company level and again as dividends at the shareholder level. Key concepts include the distinction from legal double taxation, where the same income is taxed twice in the hands of the same taxpayer, and the impact on business investment decisions and shareholder returns. This form of taxation reduces overall economic efficiency by discouraging dividend distribution and investment growth.

Differences Between Double Taxation and Economic Double Taxation

Double taxation occurs when the same income is taxed by two different jurisdictions, typically in cross-border transactions, leading to tax liabilities for the same taxpayer on identical income. Economic double taxation happens when the same income faces taxation at two different levels, such as corporate profits taxed at the company level and dividends taxed again at the shareholder level. The primary difference lies in the entities taxed: double taxation involves multiple taxing authorities on the same income, while economic double taxation involves multiple layers of taxation within the same economic entity or transaction.

Legal Framework Governing Double Taxation

Double taxation is governed by international tax treaties and domestic tax laws designed to prevent the same income from being taxed twice in different jurisdictions, typically involving income tax treaties based on the OECD Model Tax Convention. Economic double taxation, however, occurs when the same economic income is taxed twice in two distinct phases, such as corporate earnings taxed at both the corporate level and again as shareholder dividends, which domestic tax codes address through mechanisms like dividend imputation systems or tax credits. The legal framework emphasizes clear definitions, relief measures, and coordination between tax authorities to mitigate both juridical and economic double taxation, ensuring fairness and promoting cross-border investment.

Types of Double Taxation: Juridical vs Economic

Double taxation occurs when the same income is taxed by two different jurisdictions, classified as juridical double taxation, where multiple countries impose tax on the same taxpayer. Economic double taxation arises when the same income is taxed multiple times at different stages of production or distribution, often seen in corporate profits taxed at both the corporate and shareholder levels. Juridical double taxation typically involves cross-border income, while economic double taxation relates to multiple taxation layers within the same economy.

Causes and Consequences of Double Taxation

Double taxation occurs when the same income is taxed by two or more jurisdictions, primarily caused by overlapping tax laws or lack of international tax treaties. Economic double taxation arises when corporate profits are taxed at both the corporate level and again as shareholder dividends, leading to reduced investment incentives. This results in increased tax burden, distorted capital allocation, and potential barriers to cross-border trade and investment.

International Treaties Addressing Double Taxation

International treaties addressing double taxation, primarily Double Taxation Avoidance Agreements (DTAAs), aim to eliminate or mitigate tax liabilities on the same income in two jurisdictions, promoting cross-border trade and investment. These treaties often allocate taxing rights, provide tax credits or exemptions, and establish mechanisms for dispute resolution to prevent conventional double taxation. Economic double taxation, involving taxing corporate profits and dividends at the shareholder level, is typically addressed through domestic tax relief measures rather than international treaties.

Strategies to Avoid or Mitigate Double Taxation

Strategies to avoid or mitigate double taxation include utilizing tax treaties, claiming foreign tax credits, and structuring transactions to benefit from exemptions or reduced rates under bilateral agreements. Economic double taxation, where corporate profits are taxed both at the corporate level and again as shareholder dividends, can be alleviated through mechanisms like dividend imputation systems or preferential tax rates on dividends. Businesses and individuals should also consider tax-efficient jurisdiction selection and income deferral techniques to minimize overall tax liabilities.

Impact of Double Taxation on Businesses and Investors

Double taxation imposes a financial burden on businesses and investors by taxing the same income at both corporate and shareholder levels, reducing overall profitability and investment returns. Economic double taxation exacerbates this effect by taxing the same economic income multiple times across different jurisdictions, leading to capital allocation inefficiencies and decreased global investment attractiveness. These layers of taxation can discourage cross-border investments, hinder business expansion, and increase the cost of capital.

Future Trends in Tackling Double Taxation Globally

Future trends in tackling double taxation emphasize the enhancement of bilateral and multilateral tax treaties to prevent both juridical and economic double taxation, ensuring fair tax distribution among countries. Increased adoption of the OECD's Pillar Two framework aims to set a global minimum tax rate, reducing profit shifting and base erosion that contribute to economic double taxation. Advances in digital tax administration and international cooperation through organizations like the UN and OECD promote transparency, dispute resolution, and consistent application of tax rules to efficiently address double taxation challenges worldwide.

Important Terms

Juridical double taxation

Juridical double taxation occurs when the same income is taxed by two different jurisdictions on the same taxpayer, often resulting from cross-border transactions, whereas economic double taxation arises when the same income is taxed twice in the hands of different taxpayers, such as corporate profits and subsequent shareholder dividends. Understanding the distinction is critical for designing tax treaties and domestic laws to prevent overlapping tax burdens and promote international economic cooperation.

Economic incidence

Economic incidence refers to the actual burden of a tax on individuals or businesses, differing from statutory incidence that names who pays the tax. In the context of double taxation, economic double taxation occurs when the same income is taxed multiple times at the corporate and personal levels, exacerbating the economic incidence by reducing post-tax returns more severely than legal double taxation alone.

Tax neutrality

Tax neutrality ensures that businesses face a consistent tax burden regardless of corporate structures, minimizing distortions in investment decisions. Double taxation occurs when the same income is taxed at both corporate and shareholder levels, whereas economic double taxation refers to the taxation of the same economic income in different jurisdictions or stages, undermining tax neutrality principles.

Withholding tax

Withholding tax serves as a prepayment mechanism to prevent double taxation by allowing source countries to tax income before remittance abroad, reducing the risk of the same income being taxed both domestically and internationally. Economic double taxation occurs when the same income is taxed at both the corporate level and again as dividends at the shareholder level, which withholding tax mechanisms can mitigate through tax treaties and credits.

Tax treaty relief

Tax treaty relief primarily addresses double taxation by allocating taxing rights between countries to prevent the same income from being taxed twice at the individual or corporate level. Economic double taxation occurs when both the company's profits and the shareholder's dividends are taxed separately, which tax treaties typically do not eliminate but focus on avoiding juridical double taxation through mechanisms like tax credits or exemption methods.

Transfer pricing

Transfer pricing involves setting prices for transactions between related entities to allocate income and expenses appropriately, impacting how profits are reported across tax jurisdictions. It plays a critical role in avoiding both double taxation, where the same income is taxed twice by different countries, and economic double taxation, where income is taxed at both the corporate level and again as shareholder dividends.

Permanent establishment

Permanent establishment (PE) refers to a fixed place of business through which a foreign enterprise conducts business, triggering tax obligations in that jurisdiction; double taxation arises when the same income is taxed by both the source country and the residence country due to the PE's activities. Economic double taxation occurs when the same income is taxed multiple times at different stages, such as corporate profits and dividends, whereas double taxation linked to PE focuses on overlapping tax claims between countries on cross-border business profits.

Dividend stripping

Dividend stripping involves purchasing shares just before a dividend payment and selling them afterward to capture the dividend income, which may trigger double taxation where the same income is taxed at both corporate and shareholder levels; economic double taxation occurs when tax reduces the efficiency of income allocation by taxing the same economic gain multiple times across different entities, impacting investment decisions. This distinction is critical in tax policy design to minimize the adverse effects of double taxation while addressing dividend stripping strategies that exploit tax timing differences.

Tax residency

Tax residency determines the jurisdiction where an individual or entity is subject to income tax, critically influencing the application of double taxation treaties designed to prevent the same income from being taxed twice by different countries. Economic double taxation arises when income, such as corporate profits, is taxed both at the corporate level and again at the shareholder level as dividends, a situation distinct from legal double taxation addressed by tax residency rules and international agreements.

Foreign tax credit

The Foreign Tax Credit (FTC) mitigates double taxation by allowing taxpayers to offset taxes paid to a foreign government against their domestic tax liabilities, thereby preventing tax on the same income by two different jurisdictions. Unlike economic double taxation, where both corporate profits and shareholder dividends are taxed separately, the FTC primarily addresses juridical double taxation arising from overlapping tax claims on identical income.

Double taxation vs economic double taxation Infographic

moneydif.com

moneydif.com