Apportioned income refers to the division of business income among multiple taxing jurisdictions based on a formula considering factors such as property, payroll, and sales within each area. Allocated income, however, involves assigning specific income items directly to a jurisdiction without using a formula, typically for non-business income like interest or rents. Understanding the distinction between apportioned and allocated income is essential for accurate tax reporting and compliance across states.

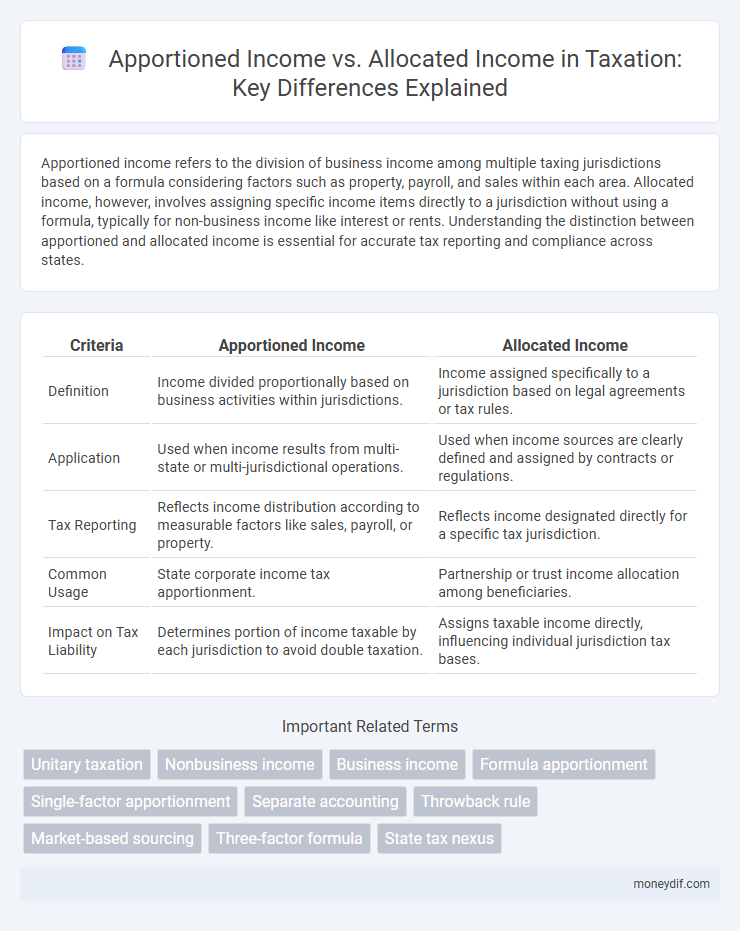

Table of Comparison

| Criteria | Apportioned Income | Allocated Income |

|---|---|---|

| Definition | Income divided proportionally based on business activities within jurisdictions. | Income assigned specifically to a jurisdiction based on legal agreements or tax rules. |

| Application | Used when income results from multi-state or multi-jurisdictional operations. | Used when income sources are clearly defined and assigned by contracts or regulations. |

| Tax Reporting | Reflects income distribution according to measurable factors like sales, payroll, or property. | Reflects income designated directly for a specific tax jurisdiction. |

| Common Usage | State corporate income tax apportionment. | Partnership or trust income allocation among beneficiaries. |

| Impact on Tax Liability | Determines portion of income taxable by each jurisdiction to avoid double taxation. | Assigns taxable income directly, influencing individual jurisdiction tax bases. |

Understanding Apportioned vs Allocated Income

Apportioned income refers to the division of income among various jurisdictions based on a specific formula, often related to the taxpayer's presence, sales, payroll, or property in each location. Allocated income, in contrast, is income assigned directly to a particular state or jurisdiction because it is inherently connected to that area, such as income from real estate or a permanent establishment within a state. Understanding the distinction between apportioned and allocated income is crucial for accurate state tax reporting and compliance.

Key Definitions: Apportionment and Allocation

Apportioned income refers to the process of dividing income among different states based on a specific formula, ensuring each state taxes only the portion of income earned within its jurisdiction. Allocation involves directly assigning specific types of income, such as interest or royalties, to a particular state or source based on predetermined rules. Understanding apportionment and allocation is crucial for accurate multistate tax reporting and compliance with state tax regulations.

How Tax Jurisdictions Use Apportioned Income

Tax jurisdictions use apportioned income to fairly distribute taxable income among multiple states or countries based on specific formulas involving property, payroll, and sales factors. This method ensures that each jurisdiction taxes only the portion of income generated within its borders, reducing double taxation risks. Apportioned income differs from allocated income by applying standardized calculations rather than assigning specific income items to particular jurisdictions.

Allocated Income: What It Means for Taxpayers

Allocated income refers to the portion of income distributed to different jurisdictions for tax purposes based on specific criteria like property, payroll, or sales. Taxpayers must report allocated income accurately to comply with state tax laws, ensuring proper allocation of tax liabilities across states. Understanding allocated income helps avoid double taxation and ensures fair tax distribution among multiple taxing authorities.

Apportionment Methods in Multi-State Taxation

Apportioned income in multi-state taxation refers to the portion of a business's income fairly divided among states based on specific apportionment methods such as the three-factor formula involving property, payroll, and sales. These methods aim to accurately reflect the extent of a taxpayer's business activities within each state, ensuring equitable tax liability distribution. Understanding the nuances of apportionment formulas, including single sales factor and double weighted sales, is essential for compliant state tax reporting and minimizing audit risks.

Allocation Rules for Specific Income Types

Allocation rules for specific income types dictate how apportioned income is assigned to multiple taxing jurisdictions based on factors such as sales, property, and payroll. Allocated income typically involves income from non-business or investment sources, distributed according to statutory guidelines rather than apportionment formulas. Understanding these distinctions ensures accurate state tax compliance by properly categorizing income under the appropriate allocation or apportionment method.

Comparing Apportioned and Allocated Income Calculations

Apportioned income is calculated by dividing total income among jurisdictions based on a specific formula, often considering factors like property, payroll, and sales within each state. Allocated income, however, assigns particular types of income directly to a jurisdiction, such as interest or royalties, according to defined statutory rules. The key difference lies in apportioned income relying on a proportional formula, while allocated income is determined by explicit income categorization tied to a single jurisdiction.

Common Challenges in Business Tax Reporting

Apportioned income and allocated income often create complexity in business tax reporting due to differing state definitions and calculation methods, leading to potential double taxation or underreporting risks. Businesses must carefully navigate varying nexus standards, apportionment formulas like sales, property, and payroll, and state-specific allocation rules to ensure accurate compliance. Misunderstandings in distinguishing between apportioned income, which is divided among states based on business activity, and allocated income, assigned to a specific state, frequently result in filing errors and audits.

Legal Precedents Impacting Apportionment and Allocation

Legal precedents such as Container Corp. v. Franchise Tax Board and Mobil Oil Corp. v. Commissioner significantly impact the distinction between apportioned income and allocated income in tax law. Courts have consistently emphasized that apportioned income relates to multistate business activities distributed based on a formula reflecting economic presence, whereas allocated income is assigned to a specific state due to particular business attributes or transactions unique to that jurisdiction. These rulings underscore the importance of accurate income division to ensure compliance with state tax regulations and prevent double taxation.

Practical Tips for Tax Compliance and Planning

Apportioned income refers to the division of income among multiple tax jurisdictions based on a specific formula, such as sales, property, or payroll percentages, while allocated income is directly assigned to a particular jurisdiction, often for specific transactions or asset types. Practical tax compliance requires accurate documentation of each jurisdiction's income sources to avoid double taxation and penalties. Effective tax planning involves analyzing apportionment methods under state laws and adjusting business operations to optimize tax liability across jurisdictions.

Important Terms

Unitary taxation

Unitary taxation treats a multinational corporation as a single entity, consolidating global income before apportioning profits to jurisdictions based on factors like sales, assets, and payroll, while apportioned income refers to the portion of consolidated income attributed to each state under a specific formula; allocated income, by contrast, involves directly assigning specific types of income to particular states according to statutory rules, often for items like interest or royalties. This distinction impacts tax liability calculations, with unitary systems emphasizing combined reporting and apportionment to prevent profit shifting, whereas allocation focuses on precise income sourcing to determine tax obligations.

Nonbusiness income

Nonbusiness income refers to earnings not connected to the core operations of a business, often arising from investments or property. Apportioned income is divided based on a business's physical presence or activity in multiple jurisdictions, while allocated income is specifically assigned to a particular state according to statutory rules.

Business income

Apportioned income refers to the division of income among multiple jurisdictions based on a formula considering factors like sales, property, and payroll, whereas allocated income is directly assigned to a specific jurisdiction without the use of a formula. Understanding the distinction between apportioned and allocated income is crucial for accurate state tax reporting and compliance in multi-state business operations.

Formula apportionment

Formula apportionment calculates taxable income by applying a standardized formula--typically based on factors like property, payroll, and sales--to determine each jurisdiction's share, while allocated income refers to specific income items directly assigned to a jurisdiction without using a formula. Understanding the distinction between apportioned income and allocated income is essential for accurate state tax compliance and minimizing tax liabilities.

Single-factor apportionment

Single-factor apportionment calculates taxable income based solely on one factor, typically sales, simplifying the determination of apportioned income for multistate businesses. Apportioned income refers to the portion of total income subject to tax within a state using this method, while allocated income involves direct assignment of specific income items to a state, distinct from the single-factor calculation.

Separate accounting

Separate accounting distinguishes between apportioned income, which is income divided based on a specific statutory formula reflecting business activity in different jurisdictions, and allocated income, which is income assigned directly to a jurisdiction due to the source or nature of the income. Apportioned income is typically used for multi-state or multinational tax reporting, while allocated income pertains to specific income items linked to one taxing authority.

Throwback rule

The Throwback rule prevents taxpayers from avoiding tax by withholding apportioned income from states with throwback provisions, requiring income from sales not timely allocated to the state to be included in that state's taxable income. This rule contrasts apportioned income, which is distributed to states based on the taxpayer's business activity, with allocated income, assigned directly to specific states without being subject to throwback adjustments.

Market-based sourcing

Market-based sourcing determines apportionment of income based on the location of customers purchasing goods or services, thereby aligning revenue recognition with market demand. Apportioned income divides total business income proportionally across states using factors like sales, property, and payroll, while allocated income assigns specific income types directly to a particular state according to statutory rules.

Three-factor formula

The Three-factor formula, commonly used in state taxation, apportions income based on the weighted values of property, payroll, and sales within a taxing jurisdiction, providing a method to calculate apportioned income for multistate businesses. This differs from allocated income, which involves assigning specific income items entirely to one state based on their source or activity, rather than dividing income proportionally.

State tax nexus

State tax nexus determines a business's tax obligations based on its connection to a state, influencing whether income is apportioned or allocated for tax purposes. Apportioned income applies to multistate businesses distributing income based on a formula of property, payroll, and sales, while allocated income assigns specific income directly to a particular state, often related to non-business or uniquely sourced income.

Apportioned income vs allocated income Infographic

moneydif.com

moneydif.com