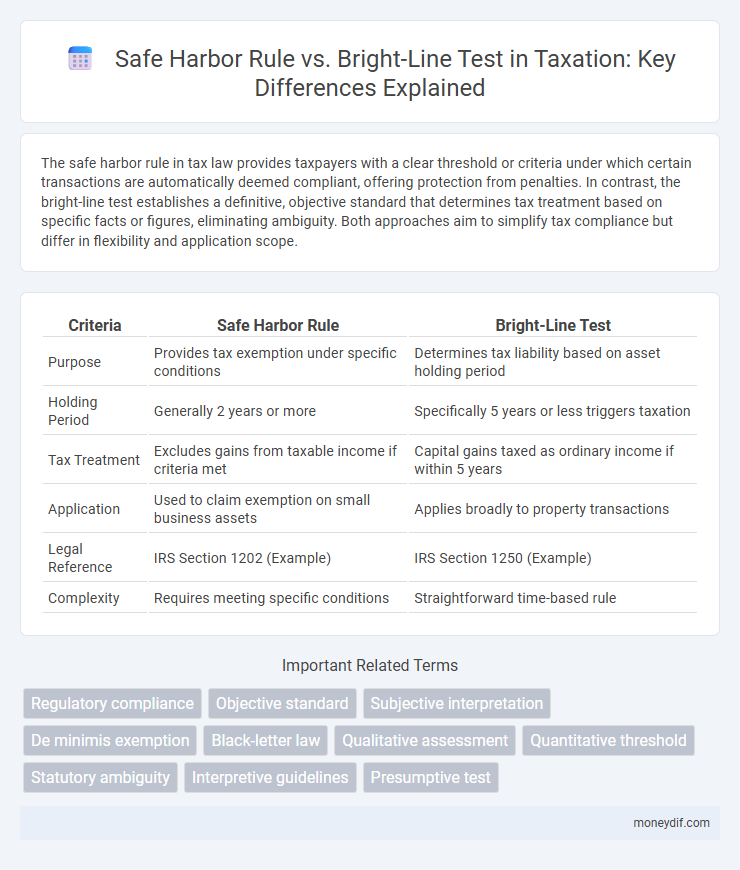

The safe harbor rule in tax law provides taxpayers with a clear threshold or criteria under which certain transactions are automatically deemed compliant, offering protection from penalties. In contrast, the bright-line test establishes a definitive, objective standard that determines tax treatment based on specific facts or figures, eliminating ambiguity. Both approaches aim to simplify tax compliance but differ in flexibility and application scope.

Table of Comparison

| Criteria | Safe Harbor Rule | Bright-Line Test |

|---|---|---|

| Purpose | Provides tax exemption under specific conditions | Determines tax liability based on asset holding period |

| Holding Period | Generally 2 years or more | Specifically 5 years or less triggers taxation |

| Tax Treatment | Excludes gains from taxable income if criteria met | Capital gains taxed as ordinary income if within 5 years |

| Application | Used to claim exemption on small business assets | Applies broadly to property transactions |

| Legal Reference | IRS Section 1202 (Example) | IRS Section 1250 (Example) |

| Complexity | Requires meeting specific conditions | Straightforward time-based rule |

Understanding the Safe Harbor Rule in Taxation

The Safe Harbor Rule in taxation provides clear guidelines that allow taxpayers to avoid disputes with tax authorities by adhering to predetermined criteria, reducing the risk of penalties. Unlike the Bright-Line Test, which strictly defines taxable events based on fixed timeframes or thresholds, the Safe Harbor Rule offers more flexible, rule-based protections under specified conditions. This approach ensures predictable tax outcomes and simplifies compliance for taxpayers who meet the safe harbor requirements.

Defining the Bright-Line Test: Tax Law Essentials

The bright-line test in tax law establishes a specific timeframe or clear criteria to determine tax liability or eligibility, providing a definitive standard that taxpayers and authorities rely on to assess situations objectively. Unlike the safe harbor rule, which offers protection by setting conditions under which taxpayers are exempt from penalties or additional taxes, the bright-line test defines a non-negotiable legal boundary for tax consequences. This test is crucial in areas such as capital gains tax, residency status, or asset transfers, ensuring consistent application and reducing ambiguity in tax compliance and enforcement.

Key Differences Between Safe Harbor and Bright-Line Test

The Safe Harbor rule provides a clear threshold or specific conditions under which taxpayers can avoid penalties or audits, emphasizing predictability and compliance ease. In contrast, the Bright-Line Test relies on objective criteria or fixed timeframes to determine tax obligations, reducing ambiguity in classification or eligibility. Key differences include Safe Harbor's focus on protection within defined limits versus Bright-Line Test's reliance on strict, measurable standards for tax assessment.

Advantages of Safe Harbor Rules for Taxpayers

Safe harbor rules provide taxpayers with clear, predefined criteria that reduce uncertainty and the risk of costly audits or penalties by allowing straightforward compliance measures. These rules simplify tax filing processes, enabling quicker determinations of tax liabilities without extensive documentation or complex calculations. By offering predictable tax outcomes, safe harbor provisions enhance taxpayer confidence and promote voluntary compliance with tax regulations.

Limitations of the Bright-Line Test in Tax Compliance

The Bright-Line Test in tax compliance offers a fixed timeframe to determine tax liability but often fails to capture nuanced financial behaviors and long-term investment intentions. Its rigid application can lead to unintentional tax obligations, ignoring individual circumstances and economic realities. Safe harbor rules provide more flexibility by setting clear thresholds that, if met, guarantee tax compliance without detailed scrutiny, thus reducing disputes and administrative burdens.

Practical Examples of Safe Harbor Rule Applications

The Safe Harbor Rule in tax law provides clear guidelines that protect taxpayers from penalties by establishing predetermined criteria, such as maintaining expenses below a specific threshold or reporting income consistently. For example, small businesses may use the Safe Harbor Rule to deduct home office expenses up to a fixed limit without detailed calculations, simplifying compliance and reducing audits. In contrast, the bright-line test relies on fixed timeframes or quantitative thresholds, like the one-year ownership rule for capital gains tax on property sales, requiring exact measurement rather than compliance with flexible criteria.

Common Scenarios for Applying the Bright-Line Test

The bright-line test is commonly applied in real estate transactions to determine whether a property sale is taxable, focusing on properties held for less than five years to identify short-term gains subject to income tax. Unlike the safe harbor rule, which provides specific monetary thresholds or conditions to avoid penalties, the bright-line test offers a clear, fixed timeframe that eliminates ambiguity in tax liability assessments. This test is frequently used in situations involving residential property sales, especially for investors and homeowners who sell within the specified period, triggering potential tax obligations under the Income Tax Act.

Legal Precedents Shaping Safe Harbor and Bright-Line Tests

Legal precedents have significantly shaped the application of safe harbor rules and bright-line tests in tax law, providing clarity and predictability for taxpayers and authorities. Courts have reinforced safe harbor rules by upholding specific thresholds and conditions that shield taxpayers from penalties or audits if met, ensuring their consistent application. Meanwhile, bright-line tests are established through rulings that create clear, objective criteria for tax obligations, reducing ambiguity and enhancing compliance across diverse tax scenarios.

Tax Planning Strategies: Choosing Safe Harbor vs Bright-Line

Safe harbor rules provide predefined criteria that taxpayers can rely on to avoid IRS audits and penalties, simplifying compliance in complex tax scenarios. Bright-line tests establish clear numerical thresholds or time periods to determine tax liabilities, offering certainty but less flexibility. Tax planning strategies should weigh the predictability of bright-line tests against the protective benefits of safe harbor provisions to optimize tax outcomes and minimize risk exposure.

Regulatory Trends Impacting Safe Harbor and Bright-Line Tests

Recent regulatory trends emphasize tighter scrutiny of safe harbor rules, aiming to prevent abuse of tax benefits without stringent compliance, while bright-line tests are becoming more defined through precise numerical thresholds for clearer taxpayer guidance. Tax authorities increasingly rely on data-driven analyses to adjust safe harbor limits, ensuring they reflect economic realities and mitigate revenue leakage from overly broad interpretations. These changes impact corporate tax planning by reducing ambiguity and necessitating more rigorous documentation to qualify under safe harbor or meet bright-line criteria effectively.

Important Terms

Regulatory compliance

Regulatory compliance in data privacy often hinges on the Safe Harbor Rule, which allows businesses to self-certify adherence to data protection standards between the U.S. and EU, whereas the Bright-Line Test provides a clear, objective criterion for determining jurisdictional applicability based on explicit thresholds. Understanding the distinctions between these frameworks is critical for companies managing cross-border data transfers to avoid legal risks and ensure full compliance with international regulations.

Objective standard

The Objective Standard in employment law evaluates conduct based on reasonable perceptions rather than subjective intent, serving as a critical benchmark in applying the Safe Harbor Rule, which protects employers from liability if they act in good faith under clearly defined guidelines. In contrast, the Bright-Line Test establishes strict, unequivocal criteria that must be met to determine liability, offering less flexibility but greater predictability compared to the nuanced assessments under the Objective Standard.

Subjective interpretation

Subjective interpretation in copyright law often complicates the application of the Safe Harbor Rule, as it relies on the service provider's awareness or intent, whereas the Bright-Line Test provides an objective standard by establishing clear, easily measurable criteria to determine infringement or compliance. The contrast between these approaches highlights the tension between flexible case-by-case evaluation and the need for predictable legal boundaries in digital content protection.

De minimis exemption

The De minimis exemption limits regulatory scrutiny by exempting transactions or holdings below a specific threshold, aligning closely with safe harbor rules that provide protection when certain quantitative criteria are met. Unlike the bright-line test, which enforces rigid, binary thresholds regardless of context, safe harbor rules offer more flexibility by defining a clear but optional standard that ensures compliance within specified minimal impact levels.

Black-letter law

Black-letter law establishes the foundational principles of the Safe Harbor Rule by providing clear statutory frameworks that protect entities from liability under specified conditions, whereas the Bright-Line Test offers a definitive standard to determine compliance or violation by delineating explicit criteria. The Safe Harbor Rule emphasizes protection through adherence to established guidelines, while the Bright-Line Test seeks legal certainty by applying rigid, objective benchmarks in dispute resolutions.

Qualitative assessment

Qualitative assessment emphasizes the nuanced evaluation of transaction contexts under the Safe Harbor Rule, allowing flexibility based on intent and substance rather than rigid numeric thresholds seen in the Bright-Line Test, which strictly categorizes outcomes using predetermined criteria. This approach supports a more comprehensive understanding of compliance, focusing on qualitative factors such as the nature of actions and documentation instead of solely quantitative measures.

Quantitative threshold

The quantitative threshold in safe harbor rules provides a specific numerical limit that protects taxpayers from penalties when earnings or transactions fall below it, ensuring compliance clarity. In contrast, the bright-line test applies a clear-cut standard based on precise criteria, such as holding periods or transaction values, to determine tax obligations without subjective interpretation.

Statutory ambiguity

Statutory ambiguity arises when legal provisions, such as the Safe Harbor Rule and the Bright-Line Test, lack clear definitions or criteria, leading to challenges in consistent application and interpretation by courts and regulators. The Safe Harbor Rule offers protection if specific conditions are met, whereas the Bright-Line Test establishes clear, objective standards, creating tension between flexible discretion and rigid enforcement in ambiguous statutory contexts.

Interpretive guidelines

Interpretive guidelines clarify the application of the Safe Harbor Rule by providing flexible criteria to avoid penalties, whereas the Bright-Line Test employs fixed, objective standards for definitive compliance determination. The Safe Harbor Rule emphasizes context and good faith efforts, while the Bright-Line Test relies on clear, quantifiable thresholds to ensure straightforward regulatory adherence.

Presumptive test

The presumptive test in tax law evaluates whether transactions fall under the Safe Harbor Rule, allowing automatic compliance if criteria are met, versus the Bright-Line Test, which requires clear, objective evidence to determine tax treatment. Safe Harbor Rules provide predefined thresholds for simplified tax classification, whereas Bright-Line Tests demand concrete proof to classify transactions, impacting enforcement and dispute resolution.

Safe harbor rule vs bright-line test Infographic

moneydif.com

moneydif.com