GAAR (General Anti-Avoidance Rule) targets broad, aggressive tax avoidance schemes by allowing tax authorities to disregard transactions lacking commercial substance designed solely for tax benefits. SAAR (Specific Anti-Avoidance Rule) addresses particular tax avoidance patterns through detailed provisions targeting defined transactions or arrangements. Both mechanisms protect the tax base, with GAAR offering flexibility across various cases and SAAR providing precise, enforceable guidelines.

Table of Comparison

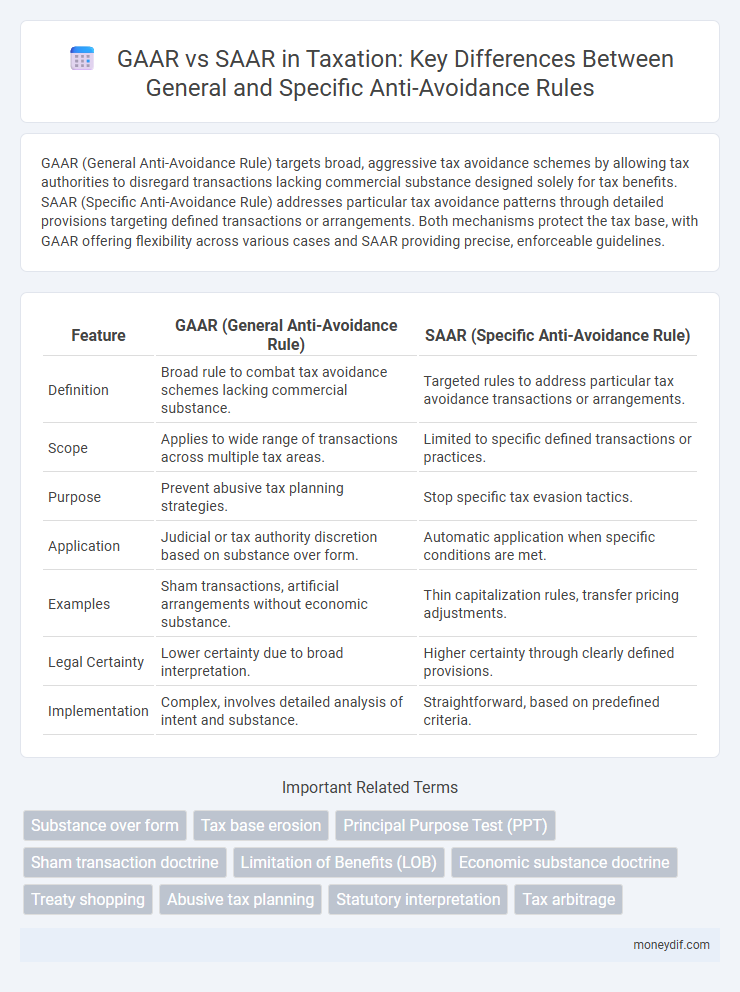

| Feature | GAAR (General Anti-Avoidance Rule) | SAAR (Specific Anti-Avoidance Rule) |

|---|---|---|

| Definition | Broad rule to combat tax avoidance schemes lacking commercial substance. | Targeted rules to address particular tax avoidance transactions or arrangements. |

| Scope | Applies to wide range of transactions across multiple tax areas. | Limited to specific defined transactions or practices. |

| Purpose | Prevent abusive tax planning strategies. | Stop specific tax evasion tactics. |

| Application | Judicial or tax authority discretion based on substance over form. | Automatic application when specific conditions are met. |

| Examples | Sham transactions, artificial arrangements without economic substance. | Thin capitalization rules, transfer pricing adjustments. |

| Legal Certainty | Lower certainty due to broad interpretation. | Higher certainty through clearly defined provisions. |

| Implementation | Complex, involves detailed analysis of intent and substance. | Straightforward, based on predefined criteria. |

Introduction to Anti-Avoidance Rules in Taxation

GAAR (General Anti-Avoidance Rule) provides a broad framework to counteract aggressive tax planning and transactions lacking commercial substance with the primary aim of preventing tax avoidance. SAAR (Specific Anti-Avoidance Rule) targets specific types of tax avoidance schemes defined under the tax law, addressing particular transactions or arrangements. Both GAAR and SAAR serve as critical tools within tax legislation to ensure compliance and protect the integrity of the tax base by disallowing artificially contrived tax benefits.

Defining GAAR: Scope and Core Principles

GAAR (General Anti-Avoidance Rule) empowers tax authorities to counteract transactions or arrangements lacking commercial substance designed primarily for tax avoidance, applying broadly across tax laws. Its core principles include assessing the purpose and effect of transactions, focusing on substance over form, and enabling recharacterization or denial of tax benefits from abusive arrangements. Unlike SAAR, which targets specific tax avoidance schemes, GAAR provides a flexible, overarching mechanism to address novel or complex avoidance strategies.

Understanding SAAR: Purpose and Applications

SAAR (Specific Anti-Avoidance Rule) targets particular tax avoidance schemes by addressing clearly defined transactions or arrangements that exploit specific provisions in tax laws. Its purpose is to restrict identified methods of tax evasion, ensuring compliance with the intent of tax regulations in areas like transfer pricing, dividend stripping, or interest deductions. SAAR applications involve detailed rules and penalties tailored to precise tax avoidance tactics, providing a focused defense against aggressive tax planning in contrast to the broader, principle-based GAAR framework.

Key Differences Between GAAR and SAAR

GAAR targets broad, complex tax avoidance schemes by allowing tax authorities to disregard transactions lacking commercial substance, while SAAR focuses on explicit, predefined transactions or arrangements identified as tax-avoidance tactics. GAAR involves a comprehensive, principles-based approach granting discretionary power to challenge artificial arrangements, whereas SAAR relies on detailed, rule-based provisions tailored to specific avoidance practices. GAAR typically applies to a wide range of tax planning scenarios, contrasting with SAAR's narrow scope targeting particular transactions with predetermined anti-avoidance measures.

Legal Framework: GAAR vs SAAR in Tax Legislation

GAAR (General Anti-Avoidance Rule) operates as a broad, principle-based legal framework designed to counteract tax avoidance schemes lacking genuine commercial purpose, while SAAR (Specific Anti-Avoidance Rule) targets predefined transactions or arrangements explicitly enumerated in tax legislation. GAAR grants tax authorities discretionary power to disregard or recharacterize transactions, focusing on substance over form, whereas SAAR involves clear, rule-based provisions aimed at particular avoidance strategies outlined by statute. The interplay between GAAR and SAAR ensures comprehensive tax compliance by addressing both general tax avoidance behavior and specific, identified loopholes.

Typical Scenarios: When GAAR or SAAR Applies

GAAR (General Anti-Avoidance Rule) applies in cases where transactions lack commercial substance and are primarily designed to obtain tax benefits through artificially arranged structures. SAAR (Specific Anti-Avoidance Rule) targets particular transactions explicitly identified by tax laws, such as transfer pricing adjustments or misuse of tax exemptions. Typical scenarios for GAAR include complex cross-border arrangements and round-tripping of funds, whereas SAAR is invoked in situations involving specific tax provisions like interest deduction limitations or dividend stripping.

Impact on Tax Planning and Compliance

GAAR targets broad, abusive tax avoidance strategies by empowering tax authorities to disregard transactions lacking commercial substance, significantly increasing compliance scrutiny and risk assessment in tax planning. SAAR addresses specific tax avoidance schemes through clearly defined provisions, offering predictable guidance but limited scope. The interplay between GAAR's wide-reaching authority and SAAR's precise rules compels taxpayers to adopt more robust, transparent tax planning strategies to mitigate potential disputes and penalties.

Global Perspectives: GAAR and SAAR in Different Jurisdictions

GAAR (General Anti-Avoidance Rule) and SAAR (Specific Anti-Avoidance Rule) serve distinct roles in combating tax avoidance worldwide, with GAAR providing a broad, principle-based framework to counteract aggressive tax planning, while SAAR targets particular transactions or arrangements identified as abusive. Jurisdictions like India and Canada have implemented GAAR to address complex avoidance schemes with flexible interpretation, whereas countries such as the UK and Australia rely heavily on SAAR provisions to tackle predefined tax evasion tactics. The global trend indicates a complementary application of GAAR and SAAR to enhance tax compliance, balancing broad preventive measures with explicit rules tailored to local tax landscapes.

Challenges and Controversies in Implementation

GAAR (General Anti-Avoidance Rule) faces challenges due to its broad and subjective criteria, leading to legal uncertainties and disputes in interpretation by taxpayers and tax authorities. SAAR (Specific Anti-Avoidance Rule), while more precise, struggles with limited scope and the need for frequent updates to address emerging tax avoidance schemes, creating implementation complexities. Both rules generate controversies over taxpayer rights, administrative burdens, and potential for misuse or arbitrary application in tax enforcement.

Conclusion: Choosing Between GAAR and SAAR

Selecting between GAAR and SAAR hinges on the complexity and intent of the tax avoidance scheme; GAAR provides a broad, principle-based framework to counteract aggressive tax planning, while SAAR targets specific transactions or arrangements with predefined provisions. GAAR offers greater flexibility and adaptability to evolving tax avoidance tactics, making it suitable for overarching anti-avoidance enforcement, whereas SAAR ensures predictability and clarity by addressing well-identified schemes. Effective tax policy often integrates both approaches, leveraging GAAR's comprehensive coverage alongside SAAR's precision targeting to enhance compliance and deter avoidance.

Important Terms

Substance over form

Substance over form principle emphasizes the economic reality of transactions over their legal form, crucially applied in GAAR to identify and counteract tax avoidance schemes that exploit legal formalities. GAAR targets broad, abusive avoidance strategies by examining the substance and purpose of arrangements, whereas SAAR focuses on preventing specific, predefined tax avoidance transactions outlined in tax laws.

Tax base erosion

Tax base erosion occurs when taxpayers exploit loopholes to minimize taxable income, prompting the implementation of GAAR (General Anti-Avoidance Rule) which targets broad, abusive tax avoidance strategies, while SAAR (Specific Anti-Avoidance Rule) focuses on predefined transactions or arrangements deemed abusive. GAAR provides tax authorities with discretionary powers to counteract unprincipled tax planning, whereas SAAR offers clear, rule-based provisions addressing specific tax avoidance schemes to protect the integrity of the tax base.

Principal Purpose Test (PPT)

The Principal Purpose Test (PPT) under GAAR targets arrangements primarily designed to obtain tax benefits, contrasting with SAAR which addresses specific identified avoidance schemes through targeted provisions. PPT's broad, principle-based approach enables tax authorities to disregard transactions lacking genuine commercial substance, whereas SAAR applies predefined rules to particular avoidance scenarios, ensuring precise enforcement against known tax avoidance strategies.

Sham transaction doctrine

The Sham Transaction Doctrine under GAAR targets transactions lacking genuine commercial substance to prevent tax avoidance, whereas SAAR addresses specific tax-avoidance strategies explicitly outlined in tax laws. GAAR provides a broad, principle-based framework allowing tax authorities to disregard artificial arrangements, while SAAR applies to clearly defined transactions with predetermined anti-avoidance rules.

Limitation of Benefits (LOB)

Limitation of Benefits (LOB) provisions in tax treaties restrict treaty benefits to residents genuinely entitled under domestic law, preventing treaty abuse and treaty shopping, particularly when analyzed alongside General Anti-Avoidance Rules (GAAR) which broadly target abusive tax arrangements without specific criteria. In contrast, Specific Anti-Avoidance Rules (SAAR) focus on particular transactions or types of arrangements, offering precise tools to counteract tax avoidance scenarios that may not be fully addressed by LOB clauses or the overarching GAAR framework.

Economic substance doctrine

The Economic Substance Doctrine requires transactions to have genuine economic purpose beyond tax benefits, complementing GAAR by addressing broader schemes lacking real commercial substance, whereas SAAR targets specific tax avoidance transactions with predefined rules. GAAR provides flexible, principle-based anti-avoidance measures applicable to various aggressive tax planning arrangements, while SAAR enforces narrow, rule-based restrictions on particular tax strategies identified by legislation.

Treaty shopping

Treaty shopping involves structuring transactions or entities to exploit favorable tax treaty provisions, often challenged under GAAR, which targets broad anti-avoidance strategies, whereas SAAR addresses narrowly defined, specific avoidance schemes. GAAR's flexible framework counters treaty shopping by examining the substance over form, while SAAR applies precise rules targeting particular transactions or arrangements.

Abusive tax planning

Abusive tax planning exploits loopholes to gain tax benefits, prompting the application of GAAR, which targets broad schemes lacking commercial substance, whereas SAAR addresses specific, predefined tax avoidance transactions. GAAR provides a flexible framework to counter complex avoidance strategies, while SAAR relies on detailed rules targeting particular tax avoidance methods.

Statutory interpretation

Statutory interpretation of GAAR (General Anti-Avoidance Rule) focuses on broad principles to deter tax avoidance schemes lacking commercial substance, while SAAR (Specific Anti-Avoidance Rule) targets particular abusive transactions explicitly defined by law. Courts apply purposive interpretation to GAAR provisions to ensure flexibility against evolving tax avoidance strategies, contrasting with the literal approach often used for SAAR's narrowly tailored provisions.

Tax arbitrage

Tax arbitrage involves exploiting differences in tax rules to minimize liabilities, often challenged under GAAR (General Anti-Avoidance Rule) which broadly targets abusive tax avoidance transactions, while SAAR (Specific Anti-Avoidance Rule) focuses on particular transactions or arrangements defined by statute. GAAR provides tax authorities with discretionary power to counteract schemes lacking commercial substance, contrasting with SAAR's precise targeting based on explicit legislative provisions designed to curb known loopholes.

GAAR (General Anti-Avoidance Rule) vs SAAR (Specific Anti-Avoidance Rule) Infographic

moneydif.com

moneydif.com