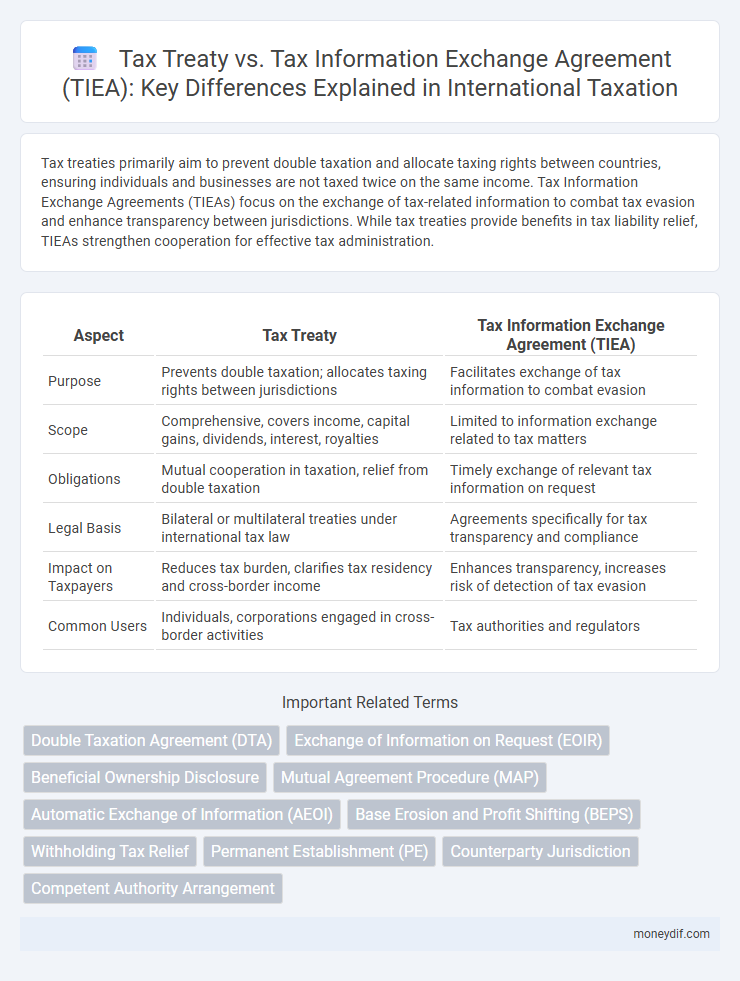

Tax treaties primarily aim to prevent double taxation and allocate taxing rights between countries, ensuring individuals and businesses are not taxed twice on the same income. Tax Information Exchange Agreements (TIEAs) focus on the exchange of tax-related information to combat tax evasion and enhance transparency between jurisdictions. While tax treaties provide benefits in tax liability relief, TIEAs strengthen cooperation for effective tax administration.

Table of Comparison

| Aspect | Tax Treaty | Tax Information Exchange Agreement (TIEA) |

|---|---|---|

| Purpose | Prevents double taxation; allocates taxing rights between jurisdictions | Facilitates exchange of tax information to combat evasion |

| Scope | Comprehensive, covers income, capital gains, dividends, interest, royalties | Limited to information exchange related to tax matters |

| Obligations | Mutual cooperation in taxation, relief from double taxation | Timely exchange of relevant tax information on request |

| Legal Basis | Bilateral or multilateral treaties under international tax law | Agreements specifically for tax transparency and compliance |

| Impact on Taxpayers | Reduces tax burden, clarifies tax residency and cross-border income | Enhances transparency, increases risk of detection of tax evasion |

| Common Users | Individuals, corporations engaged in cross-border activities | Tax authorities and regulators |

Introduction to Tax Treaties and Tax Information Exchange Agreements (TIEA)

Tax treaties are bilateral agreements between countries designed to prevent double taxation and fiscal evasion by allocating taxing rights on cross-border income. Tax Information Exchange Agreements (TIEAs) facilitate the exchange of tax-related information between tax authorities to enhance transparency and combat tax evasion. Both instruments are crucial for international tax cooperation but differ in scope, with tax treaties focusing on tax relief and TIEAs emphasizing information sharing.

Definition and Purpose of Tax Treaties

Tax treaties are bilateral agreements between countries designed to avoid double taxation and prevent tax evasion by allocating taxing rights on income and capital across jurisdictions. Their primary purpose is to promote cross-border trade and investment by establishing clear rules for taxing income such as dividends, interest, royalties, and business profits. Unlike Tax Information Exchange Agreements (TIEAs) that focus solely on sharing tax-related information to combat tax evasion, tax treaties provide comprehensive frameworks for taxing rights and relief mechanisms.

Definition and Function of Tax Information Exchange Agreements (TIEA)

Tax Information Exchange Agreements (TIEAs) are bilateral treaties focused on the exchange of tax-related information between jurisdictions to combat tax evasion and ensure compliance. Unlike comprehensive tax treaties that address issues such as double taxation and tax rates, TIEAs specifically facilitate cooperation by providing mechanisms for requesting, obtaining, and sharing taxpayer information. The primary function of TIEAs is to enhance transparency and improve enforcement of tax laws by enabling authorities to access necessary data for investigation and audit purposes.

Key Differences Between Tax Treaties and TIEAs

Tax treaties primarily focus on avoiding double taxation and preventing fiscal evasion by allocating taxing rights between countries, whereas Tax Information Exchange Agreements (TIEAs) are designed to facilitate the exchange of tax-related information for enforcement purposes. While tax treaties include provisions related to residency, income types, and dispute resolution, TIEAs concentrate exclusively on transparency and cooperation in tax administration. The key difference lies in their scope: tax treaties govern tax obligations and relief, whereas TIEAs enhance international tax compliance through information sharing.

Legal Framework: How Tax Treaties and TIEAs Are Established

Tax treaties are established through bilateral negotiations between countries and require ratification by the respective governments, creating legally binding agreements under international law. Tax Information Exchange Agreements (TIEAs) are often negotiated separately or alongside tax treaties but specifically focus on the exchange of tax-relevant information to combat evasion, typically without broader tax allocation provisions. Both frameworks rely on formal diplomatic channels and adherence to domestic legal processes to ensure enforceability and compliance with international fiscal transparency standards.

Scope of Coverage: Income Types and Jurisdictions

Tax treaties generally provide comprehensive coverage on various income types, including dividends, interest, royalties, and business profits, with broad applicability across the contracting jurisdictions to prevent double taxation and promote cross-border trade. Tax Information Exchange Agreements (TIEAs) are more narrowly focused on facilitating the exchange of tax-related information between jurisdictions, without addressing the reduction or elimination of taxes on specific income types. While tax treaties aim to regulate tax treatment on income across multiple countries, TIEAs primarily enhance transparency and cooperation in tax matters between signatory nations.

Exchange of Information: Mechanisms in Tax Treaties vs TIEAs

Tax treaties establish comprehensive frameworks for exchanging taxpayer information, including automatic, spontaneous, and on-request exchanges, facilitating cross-border tax compliance and preventing double taxation. Tax Information Exchange Agreements (TIEAs) focus specifically on on-request information exchange, targeting transparency and cooperation between jurisdictions to combat tax evasion and avoidance. The mechanisms in tax treaties integrate broader cooperation provisions, while TIEAs provide streamlined, targeted channels primarily for information exchange without the broader obligations of tax treaties.

Implications for Individuals and Multinational Corporations

Tax treaties primarily aim to prevent double taxation and provide mechanisms for resolving cross-border tax disputes, benefiting individuals and multinational corporations by clarifying tax liabilities and reducing withholding taxes. Tax Information Exchange Agreements (TIEAs) focus on transparency and the sharing of tax-related information to combat tax evasion, enabling tax authorities to obtain relevant data on foreign assets and income. For multinational corporations and individuals, these agreements create a framework that combines tax relief with enhanced compliance requirements, influencing global tax planning and reporting obligations.

Impact on Tax Evasion and Global Transparency

Tax treaties primarily aim to prevent double taxation and promote cross-border investment, often incorporating provisions to reduce tax evasion through mutual agreement procedures and exchange of tax information. Tax Information Exchange Agreements (TIEAs) are specifically designed to enhance global transparency by enabling countries to share detailed tax-related data, thereby strengthening efforts to detect and combat tax evasion more effectively. The combined use of tax treaties and TIEAs significantly increases international cooperation, reduces opportunities for tax avoidance, and improves compliance with global tax standards.

Choosing Between a Tax Treaty and a TIEA: Practical Considerations

Choosing between a tax treaty and a Tax Information Exchange Agreement (TIEA) depends on the scope of tax cooperation desired; tax treaties primarily focus on eliminating double taxation and facilitating cross-border trade and investment, while TIEAs are designed to enhance transparency and the exchange of tax information. Tax treaties usually include provisions on reduced withholding tax rates and allocate taxing rights between jurisdictions, making them more comprehensive for resident taxpayers. In contrast, TIEAs are more limited in scope and used mainly for combating tax evasion through information sharing, making practical considerations like the extent of economic activity and compliance needs crucial in deciding between the two.

Important Terms

Double Taxation Agreement (DTA)

A Double Taxation Agreement (DTA) primarily aims to prevent individuals and businesses from being taxed twice on the same income by allocating taxing rights between countries, whereas a Tax Information Exchange Agreement (TIEA) focuses on promoting transparency and cooperation by enabling the exchange of tax-related information to combat tax evasion. DTAs typically include provisions on income allocation, withholding taxes, and dispute resolution, while TIEAs emphasize confidentiality, request procedures, and mutual assistance in tax investigations.

Exchange of Information on Request (EOIR)

Exchange of Information on Request (EOIR) provisions facilitate the sharing of tax-relevant data between jurisdictions under both Tax Treaties and Tax Information Exchange Agreements (TIEAs), enabling efficient investigation of tax evasion and avoidance. While tax treaties encompass wider tax matters including double taxation relief and are generally bilateral agreements, TIEAs focus solely on tax information exchange and often serve as a preliminary tool for non-treaty partners to enhance transparency and compliance.

Beneficial Ownership Disclosure

Beneficial Ownership Disclosure ensures transparency by identifying the individuals who ultimately own or control a legal entity, which is crucial for enforcing tax treaties designed to prevent double taxation and tax evasion. Tax Information Exchange Agreements (TIEAs) facilitate the sharing of detailed ownership and financial information between jurisdictions, supporting effective beneficial ownership disclosure and strengthening international tax compliance.

Mutual Agreement Procedure (MAP)

Mutual Agreement Procedure (MAP) is a dispute resolution mechanism under tax treaties that allows competent authorities of contracting states to resolve taxation conflicts and eliminate double taxation for taxpayers, ensuring consistent application of treaty provisions. Tax Information Exchange Agreements (TIEAs), on the other hand, focus on exchanging tax-related information to prevent tax evasion and improve compliance, without providing a framework for resolving tax disputes or addressing double taxation issues.

Automatic Exchange of Information (AEOI)

Automatic Exchange of Information (AEOI) facilitates the systematic and periodic sharing of financial account information between countries under international standards like the OECD's Common Reporting Standard (CRS), enhancing tax transparency beyond traditional bilateral frameworks. Tax Treaties typically establish rules for taxing cross-border income and may include limited information exchange provisions, whereas Tax Information Exchange Agreements (TIEAs) are focused specifically on exchanging tax-related information upon request, making AEOI distinct by enabling proactive, automatic data transfers without prior requests.

Base Erosion and Profit Shifting (BEPS)

Base Erosion and Profit Shifting (BEPS) involves strategies multinational companies use to exploit gaps in tax rules to shift profits to low or no-tax locations, undermining tax sovereignty. Tax treaties primarily address cross-border taxation allocation while preventing double taxation, whereas Tax Information Exchange Agreements (TIEAs) focus on transparency and exchanging tax-related information to combat tax evasion and enhance compliance.

Withholding Tax Relief

Withholding Tax Relief under tax treaties typically provides reduced tax rates or exemptions on cross-border income such as dividends, interest, and royalties to avoid double taxation, based on mutually agreed terms between countries. Tax Information Exchange Agreements (TIEAs) focus on the exchange of tax-related information to enhance transparency and prevent tax evasion but do not generally offer direct benefits like withholding tax rate reductions.

Permanent Establishment (PE)

Permanent Establishment (PE) determines a fixed place of business generating taxable income under tax treaties, facilitating allocation of taxing rights between countries based on substantial economic presence. Tax Information Exchange Agreements (TIEAs) focus on administrative cooperation by enabling countries to share financial and tax data, supporting transparency and compliance rather than defining taxable nexus like PE under tax treaties.

Counterparty Jurisdiction

Counterparty jurisdiction determines the applicable tax treaty or Tax Information Exchange Agreement (TIEA) governing cross-border financial transactions, impacting withholding tax rates and information sharing protocols. Tax treaties typically provide comprehensive relief from double taxation and detailed dispute resolution mechanisms, while TIEAs focus on enhancing transparency by facilitating the exchange of tax-relevant information between jurisdictions.

Competent Authority Arrangement

The Competent Authority Arrangement establishes a framework for resolving tax disputes and ensuring effective cooperation between countries under tax treaties, facilitating mutual agreement procedures and avoidance of double taxation. In contrast, Tax Information Exchange Agreements (TIEAs) focus primarily on the exchange of tax-related information to prevent tax evasion, lacking provisions for dispute resolution but enhancing transparency and compliance enforcement.

tax treaty vs tax information exchange agreement (TIEA) Infographic

moneydif.com

moneydif.com