Tax residency determines where an individual is legally obligated to pay taxes based on the number of days spent in a country, while domicile refers to the country considered a person's permanent home for legal and tax purposes. Residency status can change frequently due to time spent in different locations, whereas domicile is generally fixed and influences inheritance and estate tax liabilities. Understanding the distinction between tax residency and domicile is crucial for complying with tax laws and optimizing tax obligations.

Table of Comparison

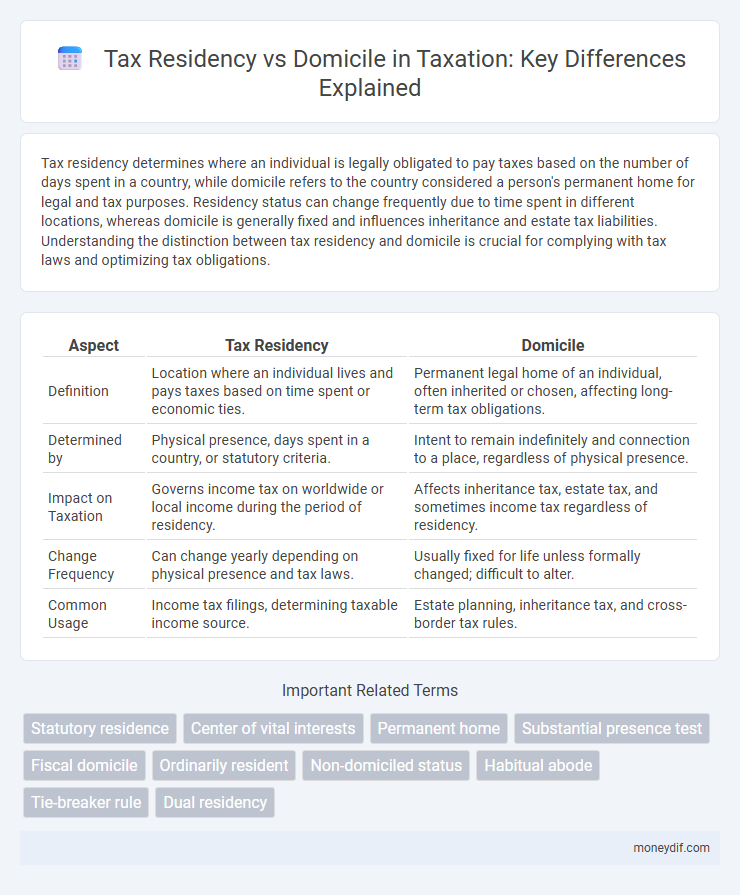

| Aspect | Tax Residency | Domicile |

|---|---|---|

| Definition | Location where an individual lives and pays taxes based on time spent or economic ties. | Permanent legal home of an individual, often inherited or chosen, affecting long-term tax obligations. |

| Determined by | Physical presence, days spent in a country, or statutory criteria. | Intent to remain indefinitely and connection to a place, regardless of physical presence. |

| Impact on Taxation | Governs income tax on worldwide or local income during the period of residency. | Affects inheritance tax, estate tax, and sometimes income tax regardless of residency. |

| Change Frequency | Can change yearly depending on physical presence and tax laws. | Usually fixed for life unless formally changed; difficult to alter. |

| Common Usage | Income tax filings, determining taxable income source. | Estate planning, inheritance tax, and cross-border tax rules. |

Understanding Tax Residency: Key Concepts

Tax residency is determined by the amount of time an individual spends in a country, typically 183 days or more within a tax year, making them liable to pay taxes on worldwide income. Domicile, unlike residency, is a legal concept based on the individual's permanent home or intention to reside indefinitely in a country, influencing inheritance tax and domicile-based tax rules. Understanding these distinctions is crucial for optimizing tax obligations and avoiding double taxation across jurisdictions.

Defining Domicile for Tax Purposes

Domicile for tax purposes refers to the country that an individual considers their permanent home and intends to return to when abroad. It is established based on factors such as the place of birth, long-term residence intentions, and the location of personal and economic ties. Unlike tax residency, which can change annually, domicile is generally a more permanent status that significantly influences inheritance and estate tax liabilities.

Major Differences Between Tax Residency and Domicile

Tax residency determines the country where an individual is liable to pay taxes based on their physical presence or stay duration, while domicile is a legal concept reflecting a person's permanent home or origin. Tax residency can change annually depending on where the individual spends most of their time, but domicile remains fixed unless legally changed through specific processes. Major differences include that tax residency affects income tax obligations in the current tax year, whereas domicile influences inheritance tax and long-term tax liabilities.

How Countries Determine Tax Residency

Countries determine tax residency primarily through physical presence tests, often requiring individuals to spend 183 days or more within their borders annually. Residency can also be established based on the center of vital interests, which considers personal and economic ties such as family, property, and business activities. Tax authorities review documentation like visas, employment contracts, and residential leases to verify an individual's residency status for tax purposes.

The Role of Domicile in International Taxation

Domicile plays a crucial role in international taxation by determining an individual's long-term tax obligations and exposure to global tax regimes. Unlike tax residency, which is often based on physical presence or number of days spent in a country, domicile reflects a more permanent legal relationship and intention to remain in a jurisdiction. Many countries use domicile status to apply estate taxes, inheritance taxes, and worldwide income taxation, impacting cross-border tax planning and compliance strategies.

Tax Implications of Residency Status

Tax residency determines an individual's liability on global income, while domicile affects inheritance tax obligations and long-term tax planning. Residents are generally taxed on worldwide income, whereas non-residents may only be taxed on local income sources. Understanding the distinctions between tax residency and domicile is crucial for optimizing tax efficiency and compliance across jurisdictions.

Changing Your Tax Residency: Rules and Risks

Changing your tax residency involves strict regulatory criteria, including physical presence tests and intent to establish residency, which vary by jurisdiction. Misunderstanding tax residency versus domicile can trigger significant risks such as double taxation, penalties, and back taxes owed due to improper declarations. It is crucial to consult tax professionals and review local rules to navigate the complex process and minimize financial exposure during residency shifts.

Domicile and Inheritance Tax Obligations

Domicile determines long-term tax obligations, especially regarding inheritance tax, as individuals deemed domiciled in a country are subject to taxation on their worldwide estate. Unlike tax residency, which can change yearly based on physical presence, domicile is a permanent legal concept influencing inheritance tax liabilities. Understanding domicile status is crucial for estate planning to minimize inheritance tax exposure and legal complexities across jurisdictions.

Common Misconceptions About Residency and Domicile

Tax residency and domicile are often confused, but they represent distinct legal concepts affecting tax obligations. Residency is typically determined by physical presence or duration of stay in a country, while domicile reflects a permanent home or intention to remain indefinitely. Misunderstandings arise when individuals assume tax residency and domicile are interchangeable, leading to incorrect tax filings or unexpected liabilities.

Practical Steps to Establish or Change Domicile

Establishing or changing domicile for tax purposes requires clear, intentional actions such as acquiring a permanent residence, redirecting personal and professional ties, and demonstrating intent to remain indefinitely in the new location. Maintaining comprehensive records including property deeds, utility bills, voter registration, and local driver's licenses strengthens evidence of domicile. Consistently updating estate plans, tax filings, and financial accounts to reflect the new domicile supports compliance with tax regulations and minimizes residency disputes.

Important Terms

Statutory residence

Statutory residence determines tax residency based on the number of days spent in a country and specific connection tests, influencing an individual's tax obligations for income earned domestically and globally. Unlike domicile, a legal concept reflecting a permanent home or origin, statutory residence primarily affects annual tax liability and eligibility for reliefs under double taxation agreements.

Center of vital interests

The center of vital interests plays a crucial role in determining tax residency by identifying the location where an individual's personal and economic relations are strongest, often overriding domicile in tax assessments. Tax authorities analyze factors such as family, social ties, and economic activities to establish residency status for accurate taxation obligations.

Permanent home

Permanent home is a key factor in determining tax residency and domicile, as it signifies the fixed location where an individual normally lives and intends to return. Tax residency often depends on the presence and duration of stay in a country, whereas domicile reflects the country considered the individual's permanent legal home for inheritance and tax purposes.

Substantial presence test

The Substantial Presence Test determines U.S. tax residency based on the number of days a person is physically present in the country, distinguishing tax residency from domicile, which refers to a person's permanent legal home. Meeting the substantial presence criteria results in being taxed as a U.S. resident, regardless of one's domicile status.

Fiscal domicile

Fiscal domicile refers to the country where an individual or entity is legally recognized for tax purposes, often influencing tax obligations and residency status. Unlike tax residency, which depends on physical presence or duration of stay, fiscal domicile is based on the center of economic interests or permanent home location, impacting double taxation treaties and compliance requirements.

Ordinarily resident

Ordinarily resident status influences tax obligations by indicating where an individual habitually lives, which differs from domicile that reflects a permanent home intent, impacting income tax liabilities and residency claims. Tax residency is determined by physical presence and habitual residence, while domicile involves legal connections and intention, both crucial for defining tax jurisdiction and applicable exemptions.

Non-domiciled status

Non-domiciled status allows individuals to be tax resident in a country without being domiciled there, often resulting in favorable tax treatment by taxing only income remitted to that country. Tax residency is determined by physical presence or ties, while domicile reflects a person's permanent home and intentions, significantly impacting inheritance and global income taxation.

Habitual abode

Habitual abode refers to the place where an individual regularly resides and spends a substantial portion of their time, playing a crucial role in determining tax residency under various international tax treaties. Unlike domicile, which is a permanent legal home or origin, habitual abode focuses on actual physical presence and lifestyle, impacting tax obligations and eligibility for treaty benefits.

Tie-breaker rule

The tie-breaker rule, outlined in double taxation treaties based on the OECD Model Tax Convention, determines an individual's tax residency when they qualify as residents in both countries by evaluating factors such as permanent home, center of vital interests, habitual abode, and nationality. This rule clarifies tax obligations by prioritizing tax residency criteria over domicile, ensuring one clear jurisdiction for taxable income to avoid double taxation conflicts.

Dual residency

Dual residency occurs when an individual qualifies as a tax resident in two different countries simultaneously, often due to conflicting criteria based on physical presence or economic ties. Tax residency determines where an individual is liable for income taxes, while domicile refers to the permanent legal home, influencing estate and inheritance tax obligations.

Tax residency vs Domicile Infographic

moneydif.com

moneydif.com