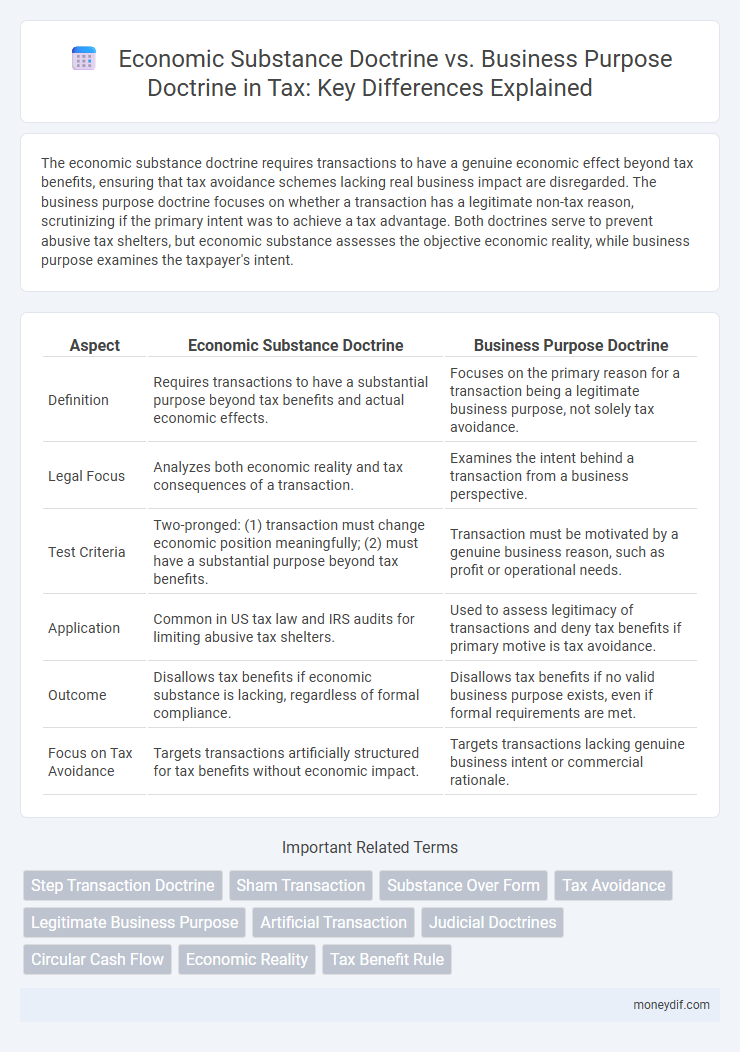

The economic substance doctrine requires transactions to have a genuine economic effect beyond tax benefits, ensuring that tax avoidance schemes lacking real business impact are disregarded. The business purpose doctrine focuses on whether a transaction has a legitimate non-tax reason, scrutinizing if the primary intent was to achieve a tax advantage. Both doctrines serve to prevent abusive tax shelters, but economic substance assesses the objective economic reality, while business purpose examines the taxpayer's intent.

Table of Comparison

| Aspect | Economic Substance Doctrine | Business Purpose Doctrine |

|---|---|---|

| Definition | Requires transactions to have a substantial purpose beyond tax benefits and actual economic effects. | Focuses on the primary reason for a transaction being a legitimate business purpose, not solely tax avoidance. |

| Legal Focus | Analyzes both economic reality and tax consequences of a transaction. | Examines the intent behind a transaction from a business perspective. |

| Test Criteria | Two-pronged: (1) transaction must change economic position meaningfully; (2) must have a substantial purpose beyond tax benefits. | Transaction must be motivated by a genuine business reason, such as profit or operational needs. |

| Application | Common in US tax law and IRS audits for limiting abusive tax shelters. | Used to assess legitimacy of transactions and deny tax benefits if primary motive is tax avoidance. |

| Outcome | Disallows tax benefits if economic substance is lacking, regardless of formal compliance. | Disallows tax benefits if no valid business purpose exists, even if formal requirements are met. |

| Focus on Tax Avoidance | Targets transactions artificially structured for tax benefits without economic impact. | Targets transactions lacking genuine business intent or commercial rationale. |

Introduction to Economic Substance Doctrine and Business Purpose Doctrine

The Economic Substance Doctrine requires transactions to have a meaningful economic effect beyond tax benefits to be recognized for tax purposes. The Business Purpose Doctrine mandates that transactions must serve a valid non-tax business objective to be respected by tax authorities. Both doctrines aim to prevent tax avoidance by ensuring that taxpayers conduct genuine economic activities rather than artificial arrangements solely for tax reduction.

Historical Background and Legal Foundations

The economic substance doctrine emerged from U.S. tax case law in the 1960s and 1970s, emphasizing the necessity for transactions to have a meaningful economic effect beyond mere tax benefits. The business purpose doctrine, rooted in earlier judicial decisions, requires that transactions serve a legitimate business objective beyond tax avoidance. Both doctrines are grounded in legal principles that disallow tax benefits from arrangements lacking substantive economic or commercial rationale.

Defining the Economic Substance Doctrine

The Economic Substance Doctrine requires transactions to have a substantial purpose beyond tax avoidance, ensuring they meaningfully alter the taxpayer's economic position. Unlike the Business Purpose Doctrine, which focuses on the taxpayer's intent for engaging in a transaction, the Economic Substance Doctrine examines both the objective economic impact and genuine business rationale. Courts apply a two-prong test evaluating whether a transaction changes the economic position in a meaningful way and if the taxpayer had a substantial non-tax purpose.

Understanding the Business Purpose Doctrine

The Business Purpose Doctrine requires that a transaction has a genuine commercial motive beyond mere tax avoidance, ensuring that the economic activity reflects legitimate business objectives. Courts evaluate whether the transaction serves a substantial non-tax business purpose by examining factors such as risk, profit potential, and functional changes in the business operation. This doctrine complements the Economic Substance Doctrine by emphasizing the intent and rationale behind business decisions to prevent abusive tax shelters.

Key Differences Between Economic Substance and Business Purpose

The economic substance doctrine requires transactions to have a meaningful change in economic position beyond tax benefits, emphasizing objective financial outcomes. The business purpose doctrine focuses on whether a transaction has a legitimate non-tax reason or motivation, highlighting the taxpayer's subjective intent. Key differences lie in economic substance's objective financial test versus business purpose's reliance on subjective intent to determine tax validity.

Real-World Applications in Tax Law

The economic substance doctrine requires that transactions have a substantial purpose beyond tax avoidance to be respected for tax benefits, emphasizing the genuine economic impact. In contrast, the business purpose doctrine assesses whether a transaction serves a legitimate business objective beyond tax savings, influencing its tax treatment. Courts frequently apply these doctrines to scrutinize tax shelters and complex corporate structures, ensuring compliance with tax laws and preventing abusive tax avoidance strategies.

Landmark Cases Shaping Each Doctrine

The economic substance doctrine, solidified by the landmark case *Gregory v. Helvering* (1935), requires transactions to have a substantial purpose beyond tax avoidance. The business purpose doctrine, established through *Frank Lyon Co. v. United States* (1978), emphasizes that transactions must serve a legitimate business objective demonstrable by profit motive. These cases continue to influence tax courts in distinguishing permissible tax planning from abusive tax shelters.

IRS Guidance and Statutory Codification

The Economic Substance Doctrine, codified under Internal Revenue Code Section 7701(o), requires transactions to have a meaningful change in economic position aside from tax effects to be respected by the IRS. The Business Purpose Doctrine, though not explicitly codified, is supported by IRS guidance demanding that transactions must serve a legitimate business objective beyond tax avoidance. IRS rulings emphasize that failure to meet either doctrine results in disallowance of tax benefits and potential penalties, underscoring their complementary roles in tax compliance enforcement.

Implications for Taxpayers and Tax Planning

The economic substance doctrine requires transactions to have a substantial purpose beyond tax benefits, impacting taxpayers by increasing scrutiny on the legitimacy of deductions and credits claimed. In contrast, the business purpose doctrine focuses on whether a transaction has a genuine business objective, affecting tax planning strategies by emphasizing the necessity of clear, non-tax-driven motives. Both doctrines necessitate careful documentation and thorough analysis to minimize audit risks and optimize tax compliance.

Future Trends and Evolving Interpretations

The economic substance doctrine continues to gain prominence as tax authorities worldwide emphasize genuine economic activity over mere legal formalities, driving stricter enforcement and clearer guidelines. Emerging trends indicate a convergence with the business purpose doctrine, where the alignment of tax benefits with legitimate commercial objectives is increasingly scrutinized. Future interpretations are expected to incorporate advanced data analytics and AI to detect artificial transactions, signaling heightened transparency and compliance standards in international tax regimes.

Important Terms

Step Transaction Doctrine

The Step Transaction Doctrine consolidates multiple formally separate steps into a single transaction for tax purposes, preventing tax avoidance by dissecting a series of interdependent actions with no independent economic significance. It intersects with the Economic Substance Doctrine, which requires a transaction to have a substantial purpose beyond tax benefits, and the Business Purpose Doctrine, which insists the transaction must have a legitimate non-tax business reason, thus ensuring that tax benefits are disallowed when transactions lack genuine economic or business motivations.

Sham Transaction

Sham transactions, often scrutinized under the economic substance doctrine, lack genuine business purpose and fail to alter an entity's economic position meaningfully, contrasting with the business purpose doctrine that evaluates if the transaction serves a legitimate commercial objective. Courts apply the economic substance doctrine to disallow tax benefits from these transactions by requiring both a substantial economic effect and a valid business reason, ensuring that tax avoidance schemes without real economic impact are invalidated.

Substance Over Form

The Substance Over Form principle prioritizes the economic reality of transactions over their legal form, playing a critical role in the economic substance doctrine that requires transactions to have genuine economic effects beyond tax benefits. In contrast, the business purpose doctrine focuses on the taxpayer's intent, disallowing transactions lacking a legitimate non-tax business purpose despite appearing compliant on paper.

Tax Avoidance

Tax avoidance often intersects with the economic substance doctrine, which requires transactions to have a genuine economic effect beyond tax benefits, contrasting with the business purpose doctrine that focuses on whether transactions possess a legitimate non-tax business rationale. Courts use the economic substance doctrine to scrutinize aggressive tax avoidance schemes lacking real economic impact, while the business purpose doctrine targets arrangements without a bona fide business motive, both shaping tax compliance and legal interpretations.

Legitimate Business Purpose

The Legitimate Business Purpose serves as a critical standard distinguishing valid economic activities under the Economic Substance Doctrine, which requires a transaction to have meaningful economic effects beyond tax benefits, from the broader Business Purpose Doctrine that focuses primarily on the taxpayer's intent to engage in genuine business objectives. Courts and tax authorities emphasize compliance with both doctrines to prevent tax avoidance schemes, ensuring that transactions reflect genuine economic realities and substantive business motivations.

Artificial Transaction

Artificial transactions designed to manipulate financial results often violate the economic substance doctrine, which requires transactions to have a genuine economic effect beyond tax benefits. The business purpose doctrine contrasts by focusing on whether the primary motive for the transaction serves a legitimate business objective, making both doctrines critical in scrutinizing tax avoidance schemes.

Judicial Doctrines

Judicial doctrines such as the Economic Substance Doctrine require transactions to have a substantial purpose beyond tax benefits, emphasizing genuine economic effects, while the Business Purpose Doctrine focuses on verifying that a transaction serves a legitimate business objective rather than solely generating tax advantages. Courts often apply both doctrines to scrutinize and invalidate tax avoidance schemes lacking real economic impact or valid commercial rationale.

Circular Cash Flow

Circular cash flow involves transactions that recycle funds within affiliated entities, often scrutinized under the economic substance doctrine which requires transactions to have genuine economic impact beyond tax benefits. In contrast, the business purpose doctrine assesses whether transactions have a legitimate business rationale, emphasizing the intent behind cash flows rather than their purely cyclical nature.

Economic Reality

Economic reality emphasizes the genuine financial and operational conditions of a transaction, contrasting with the economic substance doctrine that requires transactions to have a meaningful economic effect beyond tax benefits. The business purpose doctrine focuses on whether a transaction has a legitimate non-tax business objective, often assessed alongside economic substance to determine tax compliance.

Tax Benefit Rule

The Tax Benefit Rule ensures that taxpayers must include previously deducted amounts as income if those deductions later produce a tax benefit reversal, intersecting with the Economic Substance Doctrine which disallows transactions lacking genuine economic effect beyond tax benefits. The Business Purpose Doctrine requires that transactions have a legitimate non-tax business reason, creating a framework where both doctrines prevent tax avoidance while the Tax Benefit Rule addresses timing and recognition of deductions and income.

economic substance doctrine vs business purpose doctrine Infographic

moneydif.com

moneydif.com