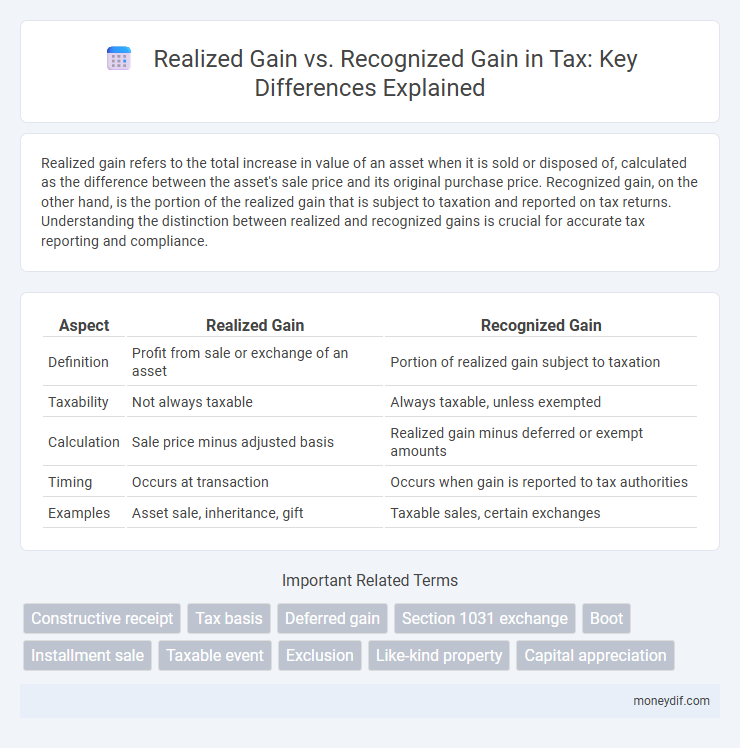

Realized gain refers to the total increase in value of an asset when it is sold or disposed of, calculated as the difference between the asset's sale price and its original purchase price. Recognized gain, on the other hand, is the portion of the realized gain that is subject to taxation and reported on tax returns. Understanding the distinction between realized and recognized gains is crucial for accurate tax reporting and compliance.

Table of Comparison

| Aspect | Realized Gain | Recognized Gain |

|---|---|---|

| Definition | Profit from sale or exchange of an asset | Portion of realized gain subject to taxation |

| Taxability | Not always taxable | Always taxable, unless exempted |

| Calculation | Sale price minus adjusted basis | Realized gain minus deferred or exempt amounts |

| Timing | Occurs at transaction | Occurs when gain is reported to tax authorities |

| Examples | Asset sale, inheritance, gift | Taxable sales, certain exchanges |

Definition of Realized Gain

Realized gain refers to the profit earned from the sale or exchange of an asset, calculated as the difference between the asset's original purchase price (basis) and the amount received from the transaction. This gain becomes realized once the transaction is complete, regardless of whether the gain is subject to taxation. Understanding the realized gain is crucial for determining taxable income and compliance with IRS regulations.

Definition of Recognized Gain

Recognized gain refers to the portion of a realized gain that is taxable and must be reported on a tax return. While realized gain is the total profit from the sale or exchange of an asset, recognized gain is specifically the amount subject to taxation after applying exclusions, exemptions, or deferrals. The distinction between realized and recognized gain is critical for accurate tax compliance and determining the appropriate tax liability.

Key Differences Between Realized and Recognized Gain

Realized gain refers to the total profit earned from the sale or exchange of an asset, calculated as the difference between the asset's cost basis and its selling price. Recognized gain is the portion of the realized gain that is taxable and reported on a tax return, after accounting for deferrals, exclusions, or other tax treatments. Key differences include that realized gain quantifies the economic increase in value, while recognized gain determines the actual taxable income subject to IRS regulations.

When is Gain Realized for Tax Purposes?

Gain is realized for tax purposes when a taxpayer disposes of property in a taxable transaction, such as a sale or exchange, and calculates the difference between the amount realized and the property's adjusted basis. The amount realized includes cash received plus the fair market value of any property or services received. Realized gain becomes recognized gain when it is reported on a tax return and subject to tax unless specific exclusions or deferrals apply.

When is Gain Recognized for Tax Purposes?

Gain is recognized for tax purposes when it is both realized and taxable under the Internal Revenue Code, meaning the transaction has been completed and the taxpayer has obtained an economic benefit. Realized gain occurs upon the actual sale, exchange, or disposition of an asset, but recognition depends on specific tax rules and exceptions, such as like-kind exchanges or involuntary conversions. Taxpayers must report recognized gains on their tax returns, triggering potential tax liabilities according to the asset type and holding period.

Common Transactions Resulting in Realized Gains

Common transactions resulting in realized gains include the sale of investment property, disposal of business assets, and exchange of stocks or securities. Realized gain occurs when the asset's selling price exceeds its adjusted basis, triggering potential tax consequences. Although realized gains represent actual profit, recognized gains are those reported on tax returns and subject to taxation in the current period.

Exceptions to Recognized Gains (Nonrecognition Rules)

Nonrecognition rules allow taxpayers to defer recognized gains despite realizing gains on certain transactions, thereby postponing tax liability. Common exceptions include like-kind exchanges under IRC Section 1031, involuntary conversions, and transfers between spouses or incident to divorce, each enabling continuation of the property's tax basis without immediate gain recognition. These provisions promote investment continuity and tax deferral by preventing gain recognition upon the exchange or transfer of property meeting specific conditions.

Tax Implications of Realized vs Recognized Gain

Realized gain occurs when an asset is sold for more than its purchase price, but it does not trigger immediate tax liability until the gain is recognized. Recognized gain is the portion of the realized gain subject to taxation in the current period, directly affecting an individual's or corporation's taxable income. Understanding the distinction is crucial for tax planning strategies, as deferred recognition can impact cash flow and tax rates applied to capital gains.

Reporting Requirements for Gains on Tax Returns

Realized gains occur when an asset is sold for more than its adjusted basis, while recognized gains are the portion of realized gains reported on tax returns and subject to taxation. Taxpayers must report recognized gains on IRS forms such as Schedule D and Form 8949, detailing transaction dates, proceeds, and basis. Accurate reporting ensures compliance with IRS regulations and determines the correct capital gains tax liability.

Planning Strategies for Deferring Recognized Gains

Effective tax planning strategies for deferring recognized gains center on timing transactions to delay taxable events, such as using installment sales or like-kind exchanges under IRC Section 1031. Investors leverage these methods to realize gains without immediate recognition, thereby deferring capital gains tax liabilities. Employing tax-deferred retirement accounts or qualified opportunity funds further enhances deferral opportunities, optimizing cash flow and tax efficiency.

Important Terms

Constructive receipt

Constructive receipt occurs when an individual has unrestricted access to income, triggering tax recognition regardless of actual receipt, directly impacting the timing of recognized gain from realized gain. Realized gain represents the total profit from a transaction, while recognized gain is the portion taxable in the current period, influenced by rules such as constructive receipt that determine when income must be declared.

Tax basis

Tax basis determines the initial value of an asset for tax purposes, crucial for calculating both realized and recognized gains. Realized gain reflects the difference between the asset's sale price and its tax basis, while recognized gain is the portion of that gain subject to taxation in a given period.

Deferred gain

Deferred gain occurs when a realized gain from a transaction is not immediately recognized for tax or accounting purposes, often due to specific regulations or deferral provisions such as like-kind exchanges or installment sales. This results in the gain being recorded on the books but postponed from taxable income until a future event triggers recognition.

Section 1031 exchange

Section 1031 exchange allows investors to defer paying taxes on realized gains by reinvesting proceeds from the sale of a like-kind property into a new qualified property. While realized gain refers to the total profit from the sale, recognized gain is the portion of that profit subject to taxation, which is deferred under Section 1031 until a taxable event occurs.

Boot

Boot represents the non-like-kind property value received in an exchange, which affects the realized gain by increasing it beyond the initial property value transferred. The recognized gain is the portion of the realized gain included in taxable income, often limited to the amount of boot received to reflect the actual economic benefit realized.

Installment sale

An installment sale allows the seller to defer recognizing gain for tax purposes by reporting income as payments are received, resulting in a difference between realized gain--the total profit from the sale--and recognized gain, which is the portion taxable in the current period. This method spreads the tax liability over several years, matching recognized gain with actual cash flow and potentially reducing immediate tax burden.

Taxable event

A taxable event occurs when realized gains, the increase in asset value upon sale or exchange, become recognized gains that are reported on tax returns and subject to taxation. Realized gains turn into recognized gains only if the transaction meets IRS criteria, triggering the obligation to pay capital gains tax.

Exclusion

Exclusion refers to the portion of realized gain that is not recognized for tax purposes, effectively reducing taxable income. This concept commonly applies to specific transactions like the sale of a primary residence, where the IRS allows exclusion of up to $250,000 ($500,000 for married couples) of realized gain from recognized gain.

Like-kind property

Like-kind property exchanges under IRS Section 1031 allow deferral of recognized gain even if a realized gain exists, meaning taxpayers do not immediately pay taxes on the realized gain from the sale. The recognized gain is limited or deferred because the transaction qualifies for tax-deferred treatment, facilitating reinvestment without reducing capital.

Capital appreciation

Capital appreciation refers to the increase in the value of an asset over time, which contributes to realized gain when the asset is sold or disposed of, reflecting the actual profit earned. Recognized gain, however, is the portion of the realized gain that is taxable and reported on financial statements, and it may differ due to tax rules, exemptions, or deferrals.

realized gain vs recognized gain Infographic

moneydif.com

moneydif.com