Cost basis represents the original value of an asset used to calculate capital gains or losses for tax purposes. Fair market value refers to the price an asset would sell for on the open market between a willing buyer and seller. Understanding the distinction between cost basis and fair market value is essential for accurate tax reporting and minimizing tax liabilities.

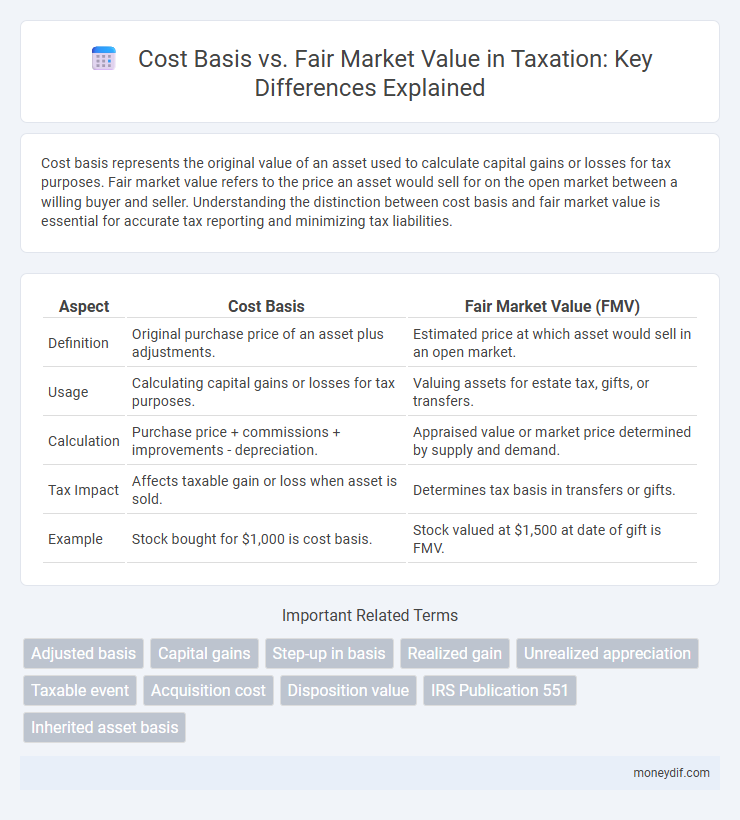

Table of Comparison

| Aspect | Cost Basis | Fair Market Value (FMV) |

|---|---|---|

| Definition | Original purchase price of an asset plus adjustments. | Estimated price at which asset would sell in an open market. |

| Usage | Calculating capital gains or losses for tax purposes. | Valuing assets for estate tax, gifts, or transfers. |

| Calculation | Purchase price + commissions + improvements - depreciation. | Appraised value or market price determined by supply and demand. |

| Tax Impact | Affects taxable gain or loss when asset is sold. | Determines tax basis in transfers or gifts. |

| Example | Stock bought for $1,000 is cost basis. | Stock valued at $1,500 at date of gift is FMV. |

Understanding Cost Basis in Taxation

Cost basis represents the original value of an asset for tax purposes, used to calculate capital gains or losses upon sale. It includes the purchase price plus any associated acquisition costs such as commissions, fees, and improvements. Accurate determination of cost basis is crucial for minimizing tax liability and ensuring compliance with IRS regulations.

Defining Fair Market Value

Fair Market Value (FMV) refers to the estimated price at which an asset would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts. FMV is a critical component in tax calculations, especially when determining capital gains or losses, as it establishes a standardized valuation basis independent of the asset's purchase price. Accurate FMV assessment ensures compliance with IRS regulations and can impact tax liabilities significantly when assets are gifted, inherited, or sold.

Key Differences: Cost Basis vs Fair Market Value

Cost basis represents the original purchase price of an asset, including any associated acquisition costs, while fair market value is the estimated price an asset would sell for in an open market between a willing buyer and seller. Cost basis is crucial for calculating capital gains or losses during a sale, whereas fair market value is often used for tax reporting, such as gift or estate valuations. Understanding these distinctions impacts accurate tax compliance and financial reporting.

Importance of Cost Basis for Investors

Cost basis represents the original value of an asset for tax purposes, crucial in calculating capital gains or losses upon sale. Understanding cost basis helps investors accurately determine taxable income and avoid overpaying taxes. Maintaining precise records of cost basis ensures compliance with IRS regulations and optimizes tax outcomes.

How Fair Market Value Affects Tax Reporting

Fair market value (FMV) plays a crucial role in tax reporting by determining the value of an asset at the time of sale, donation, or inheritance, directly affecting capital gains calculations and tax liability. When assets are sold, the difference between the FMV and the cost basis determines taxable gains or losses reported to the IRS. Accurate FMV assessment ensures proper tax compliance and avoids underreporting income or overpaying taxes.

Calculating Cost Basis for Assets

Calculating cost basis for assets involves determining the original value paid for the property, including purchase price, commissions, and related acquisition costs. This figure serves as the foundation for capital gains or losses when the asset is sold, reflecting the investor's actual investment in the asset. Accurate cost basis calculation is essential for precise tax reporting and compliance with IRS regulations, differentiating it from the fair market value, which represents the asset's current market price.

When to Use Fair Market Value in Taxes

Fair market value (FMV) is used in taxes when determining the value of assets acquired through gifts, inheritance, or non-sale transactions, as the IRS requires reporting based on FMV at the date of acquisition. FMV also applies when calculating capital gains for assets donated to charity, ensuring the deduction reflects the asset's current market value. Using FMV helps accurately assess taxable income, compliance with IRS regulations, and prevents under- or over-reporting of tax liabilities.

Impact on Capital Gains and Losses

Cost basis determines the original value of an asset for tax purposes, directly affecting the calculation of capital gains or losses upon sale. Fair market value represents the asset's current worth and is crucial when receiving assets as gifts or inheritance, as it can reset the cost basis. Accurate tracking of cost basis and fair market value minimizes tax liability by ensuring correct computation of capital gains or losses.

IRS Rules and Guidelines

IRS rules require taxpayers to use cost basis, the original purchase price plus any adjustments, to calculate capital gains or losses when selling an asset. Fair market value (FMV) is used to determine the value of gifted or inherited property at the date of transfer, affecting basis calculations under IRS guidelines. Accurate application of IRS cost basis and FMV rules ensures proper reporting and compliance with tax regulations.

Common Mistakes to Avoid

Cost basis and fair market value are critical components in calculating gains or losses for tax purposes, and confusing the two can lead to inaccurate tax reporting. Common mistakes include using the purchase price as the cost basis without accounting for commissions, fees, or adjustments like stock splits, and mistakenly applying the fair market value at the wrong date, such as acquisition rather than sale date. Ensuring accurate documentation of the original cost basis and verifying the appropriate fair market value on transaction dates prevents costly errors and potential IRS penalties.

Important Terms

Adjusted basis

Adjusted basis represents the original cost basis of an asset modified by factors such as improvements, depreciation, or other adjustments, providing a more accurate measure of the asset's value for tax purposes. Unlike fair market value, which reflects the current market price of the asset, adjusted basis is used to calculate capital gains or losses upon sale.

Capital gains

Capital gains are calculated by subtracting the cost basis--the original purchase price plus any improvements or associated expenses--from the fair market value, which reflects the asset's current market price at sale. Accurate determination of cost basis and fair market value is essential for precise tax reporting and minimizing capital gains tax liability.

Step-up in basis

Step-up in basis adjusts an inherited asset's cost basis to its fair market value at the date of the decedent's death, minimizing capital gains taxes for the heir. This adjustment replaces the original purchase price with the asset's market value, optimizing tax efficiency when the asset is eventually sold.

Realized gain

Realized gain occurs when an asset is sold for more than its cost basis, which is the original purchase price adjusted for any improvements or depreciation. The difference between the fair market value at sale and the cost basis determines the taxable profit recognized at the time of the transaction.

Unrealized appreciation

Unrealized appreciation represents the increase in an asset's value over its original cost basis but has not yet been sold or realized, measured by the difference between the fair market value and the cost basis. This metric is crucial for investors to assess potential gains, as the cost basis reflects the initial investment amount while the fair market value shows the current worth of the asset.

Taxable event

A taxable event occurs when an asset is sold or exchanged, triggering tax liability based on the difference between the cost basis--the original purchase price plus adjustments--and the fair market value at the time of the transaction. Accurate calculation of cost basis versus fair market value is essential to determine capital gains or losses for tax reporting purposes.

Acquisition cost

Acquisition cost refers to the original amount paid to obtain an asset, which forms the basis for its cost basis, while fair market value represents the current price that an asset would fetch in an open market transaction between willing buyers and sellers. Understanding the distinction between cost basis and fair market value is crucial for accurately calculating capital gains, depreciation, and tax liabilities associated with asset transactions.

Disposition value

Disposition value represents the amount received upon selling an asset, serving as a crucial figure in calculating capital gains or losses by comparing it to the cost basis, which is the original purchase price including adjustments. The difference between disposition value and fair market value at the time of sale can impact tax liabilities, especially when fair market value reflects current asset value more accurately than cost basis.

IRS Publication 551

IRS Publication 551 clarifies the difference between cost basis, which is the original purchase price of an asset including adjustments, and fair market value, the price an asset would sell for on the open market. Understanding these values is essential for accurately reporting gains or losses on asset sales and calculating taxable income.

Inherited asset basis

Inherited asset basis typically uses the fair market value (FMV) at the date of the previous owner's death as the cost basis, which often results in a stepped-up basis that minimizes capital gains taxes upon sale. This contrasts with the original cost basis, where the asset's initial purchase price is used, potentially leading to higher taxable gains if the FMV has appreciated significantly.

Cost basis vs Fair market value Infographic

moneydif.com

moneydif.com