Withholding tax is deducted at the source by the payer before the income reaches the recipient, ensuring tax is collected proactively on specific payments like salaries or dividends. Advance tax requires taxpayers to estimate and pay their tax liability in installments throughout the year based on expected income. Both methods help governments maintain steady revenue streams and reduce year-end tax burdens for individuals and businesses.

Table of Comparison

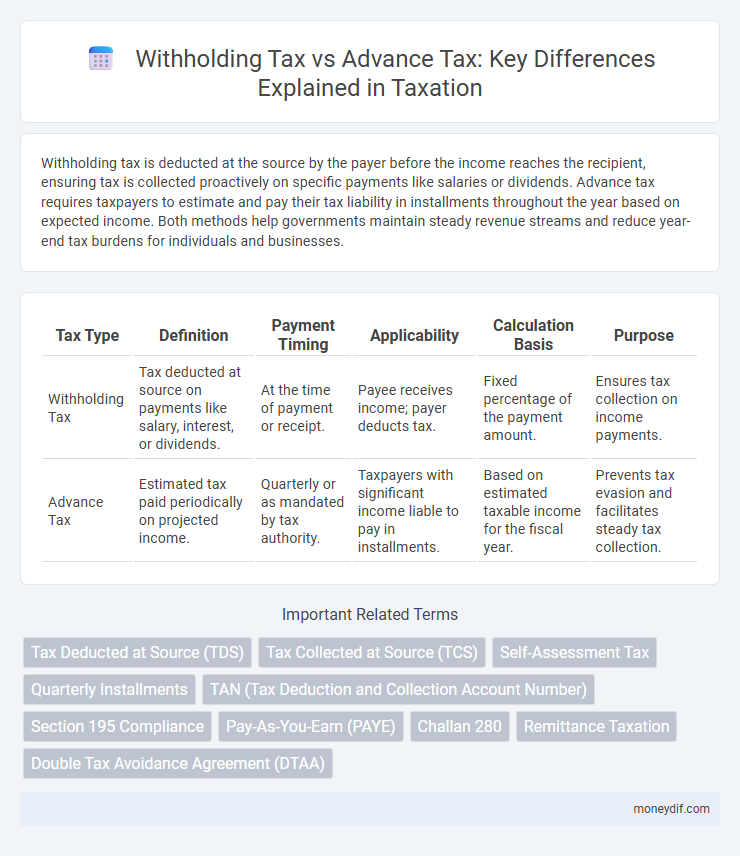

| Tax Type | Definition | Payment Timing | Applicability | Calculation Basis | Purpose |

|---|---|---|---|---|---|

| Withholding Tax | Tax deducted at source on payments like salary, interest, or dividends. | At the time of payment or receipt. | Payee receives income; payer deducts tax. | Fixed percentage of the payment amount. | Ensures tax collection on income payments. |

| Advance Tax | Estimated tax paid periodically on projected income. | Quarterly or as mandated by tax authority. | Taxpayers with significant income liable to pay in installments. | Based on estimated taxable income for the fiscal year. | Prevents tax evasion and facilitates steady tax collection. |

Introduction to Withholding Tax and Advance Tax

Withholding tax is a method where tax is deducted at the source of income, ensuring timely government revenue collection by employers or payers on behalf of employees or recipients. Advance tax requires taxpayers to pay income tax in installments throughout the financial year based on estimated earnings, preventing large tax burdens at year-end. Both withholding tax and advance tax help maintain steady government cash flow and promote compliance in the taxation system.

Key Differences Between Withholding Tax and Advance Tax

Withholding tax is a mechanism where tax is deducted at the source of income, such as salaries or interest payments, ensuring immediate tax collection by the payer. Advance tax, however, requires taxpayers to estimate and pay their tax liability periodically throughout the financial year, based on projected income. The primary difference lies in withholding tax being employer-driven and deducted on actual earnings, whereas advance tax is taxpayer-driven and paid in installments to avoid tax defaults.

Definitions: What is Withholding Tax?

Withholding tax is a government-imposed deduction from payments made to individuals or entities, typically employers deducting tax from employees' salaries or businesses deducting tax from service payments, ensuring tax collection at the source. This mechanism helps streamline tax compliance by requiring payers to withhold a specified percentage of income or payments before disbursing the balance to recipients. It differs from advance tax, which involves taxpayers proactively paying estimated tax liabilities directly to the tax authorities in installments during the financial year.

Definitions: What is Advance Tax?

Advance tax is the income tax paid by taxpayers in installments before the end of the financial year, based on their estimated earnings to avoid lump-sum payments during tax filing. It applies to salaried individuals, professionals, and businesses whose tax liability exceeds a prescribed threshold, ensuring steady government revenue flow. Unlike withholding tax, which is deducted at the source by a third party, advance tax is directly paid by the taxpayer to the tax authorities.

Applicability and Scope of Withholding Tax

Withholding tax applies to specific payments such as salaries, interest, dividends, and contractor payments, where the payer deducts tax at source before making the payment to the recipient. Its scope is limited to certain types of income and is designed to ensure tax collection at the point of transaction, primarily targeting non-resident individuals or entities lacking a permanent establishment. Advance tax, in contrast, requires taxpayers to estimate and pay their total tax liability in installments throughout the year, covering all taxable income beyond the scope of withholding tax deductions.

Applicability and Scope of Advance Tax

Advance tax applies to individuals, companies, and firms with taxable income exceeding a specified threshold, requiring periodic payments on estimated income during the financial year. Withholding tax is deducted at the source from specified payments like salaries, interest, or rent by the payer before remitting to the tax authorities. Advance tax covers the overall tax liability based on estimated income, while withholding tax targets specific transactions or income streams.

Payment Procedure: Withholding Tax vs Advance Tax

Withholding tax is deducted at the source by the payer and deposited directly with the tax authorities, ensuring timely compliance on behalf of the recipient. Advance tax requires taxpayers to estimate their income and pay a portion of the tax liability in installments throughout the financial year to avoid penalties. The payment procedure for withholding tax is automatic during transactions, whereas advance tax necessitates proactive calculation and multiple remittances by the taxpayer.

Compliance and Documentation Requirements

Withholding tax mandates employers or payers to deduct tax at source and furnish detailed TDS certificates to recipients, ensuring compliance through precise record-keeping and timely government submissions. Advance tax requires taxpayers to estimate and pay taxes in periodic installments based on projected income, demanding accurate financial documentation and adherence to specified deadlines to avoid penalties. Both tax regimes emphasize rigorous documentation and timely compliance to maintain transparency and fulfill statutory obligations.

Implications for Taxpayers and Businesses

Withholding tax impacts cash flow by deducting tax at source on payments such as salaries or contractor fees, reducing immediate tax liabilities for taxpayers but requiring accurate documentation to avoid discrepancies. Advance tax demands proactive estimation and timely payments throughout the fiscal year, ensuring compliance and minimizing interest penalties for both individuals and businesses. Mismanagement of either tax can lead to financial strain and administrative challenges, emphasizing the need for strategic tax planning and record-keeping.

Conclusion: Choosing Between Withholding Tax and Advance Tax

Choosing between withholding tax and advance tax depends on cash flow management and compliance convenience. Withholding tax offers ease by deducting tax at source, reducing year-end liabilities, whereas advance tax requires proactive installment payments based on estimated income. Taxpayers should evaluate their income predictability and administrative capacity to optimize tax compliance and avoid penalties.

Important Terms

Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is a form of withholding tax where a percentage is deducted at the time of payment, unlike advance tax which is paid proactively by taxpayers based on estimated income.

Tax Collected at Source (TCS)

Tax Collected at Source (TCS) is a form of withholding tax where the seller collects tax from the buyer at the time of sale, whereas advance tax is the income tax payable on estimated earnings throughout the financial year before actual tax liability is computed.

Self-Assessment Tax

Self-assessment tax is the taxpayer's responsibility to calculate and pay any tax liabilities exceeding the advance tax and withholding tax already deducted or paid during the financial year.

Quarterly Installments

Quarterly installments for advance tax payments help reduce withholding tax liabilities by prepaying estimated income taxes throughout the fiscal year.

TAN (Tax Deduction and Collection Account Number)

TAN (Tax Deduction and Collection Account Number) is a unique identifier required for entities responsible for deducting or collecting withholding tax, whereas advance tax is paid directly by taxpayers without using TAN for deduction purposes.

Section 195 Compliance

Section 195 compliance mandates withholding tax on cross-border payments, distinguishing it from advance tax which is a prepayment of income tax by the taxpayer themselves.

Pay-As-You-Earn (PAYE)

Pay-As-You-Earn (PAYE) is a withholding tax system where employers deduct tax directly from employees' salaries, ensuring timely government revenue collection and reducing taxpayer compliance burden. In contrast, advance tax requires taxpayers to estimate and pay income tax installments periodically, making PAYE a more streamlined mechanism for salaried individuals.

Challan 280

Challan 280 is used in India to deposit advance tax or self-assessment tax payments, whereas withholding tax is deducted at source by the payer and deposited separately by the deductor.

Remittance Taxation

Remittance taxation involves withholding tax as a prepaid tax deducted at the source from cross-border payments, whereas advance tax is a self-assessed periodic payment made by taxpayers before the final tax liability is determined.

Double Tax Avoidance Agreement (DTAA)

The Double Tax Avoidance Agreement (DTAA) reduces withholding tax rates on cross-border income to prevent double taxation while advance tax is pre-paid on estimated taxable income to avoid penalties.

Withholding tax vs advance tax Infographic

moneydif.com

moneydif.com