Stepped-up basis resets the asset's value to its fair market value at the date of inheritance, minimizing capital gains tax when sold. In contrast, carryover basis transfers the original purchase price to the heir, potentially resulting in higher capital gains tax if the asset's value has appreciated. Choosing between these methods significantly affects tax liabilities during asset transfers and estate planning.

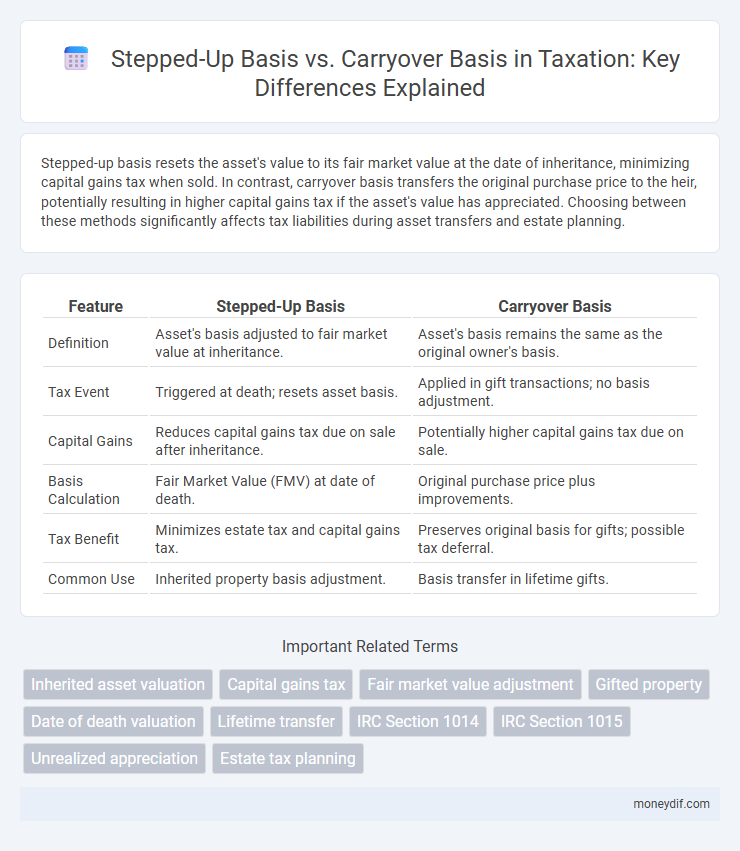

Table of Comparison

| Feature | Stepped-Up Basis | Carryover Basis |

|---|---|---|

| Definition | Asset's basis adjusted to fair market value at inheritance. | Asset's basis remains the same as the original owner's basis. |

| Tax Event | Triggered at death; resets asset basis. | Applied in gift transactions; no basis adjustment. |

| Capital Gains | Reduces capital gains tax due on sale after inheritance. | Potentially higher capital gains tax due on sale. |

| Basis Calculation | Fair Market Value (FMV) at date of death. | Original purchase price plus improvements. |

| Tax Benefit | Minimizes estate tax and capital gains tax. | Preserves original basis for gifts; possible tax deferral. |

| Common Use | Inherited property basis adjustment. | Basis transfer in lifetime gifts. |

Understanding Stepped-Up Basis and Carryover Basis

Stepped-up basis resets the asset's value to its fair market value at the time of inheritance, minimizing capital gains tax for heirs when selling the property. Carryover basis transfers the original purchase price and depreciation to the recipient, maintaining the donor's cost basis and potentially increasing capital gains tax liability. Understanding these concepts is crucial for estate planning and minimizing tax burdens on inherited or gifted property.

Key Differences: Stepped-Up Basis vs. Carryover Basis

Stepped-up basis resets the asset's tax value to its fair market value at the date of the decedent's death, minimizing capital gains tax for heirs upon sale. Carryover basis transfers the original owner's adjusted basis to the beneficiary, preserving historical cost and potentially increasing capital gains tax liability. The stepped-up basis typically applies to inherited property, while carryover basis commonly applies to gifts made during the owner's lifetime.

How Stepped-Up Basis Works in Estate Transfers

Stepped-up basis in estate transfers resets the asset's tax basis to its fair market value at the date of the decedent's death, significantly reducing capital gains tax for heirs upon sale. This adjustment applies to property such as real estate, stocks, and other investments included in the gross estate valuation. The stepped-up basis contrasts with carryover basis, where the original purchase price carries over without adjustment, often resulting in higher tax liabilities.

Carryover Basis Rules for Gifted Assets

Carryover basis rules for gifted assets require the recipient to inherit the donor's original cost basis, which affects capital gains tax calculations upon sale. The recipient's holding period also includes the donor's holding period, influencing long-term or short-term capital gains classification. These rules prevent the reset of the asset's basis, maintaining the original purchase date and value for tax purposes.

Tax Implications of Inheritance vs. Gift Transfers

Stepped-up basis applies to inherited assets, resetting the asset's value to its fair market value at the date of the decedent's death, which minimizes capital gains tax when the asset is sold. Carryover basis applies to gifted assets, where the recipient inherits the donor's original purchase price, potentially resulting in higher capital gains tax upon sale. Understanding these tax implications is crucial for estate planning strategies to optimize tax liabilities on inherited versus gifted property transfers.

Impact on Capital Gains Taxes

Stepped-up basis resets the asset's cost basis to its fair market value at the date of inheritance, minimizing capital gains taxes when sold by heirs. Carryover basis transfers the original purchase price to heirs, potentially increasing capital gains taxes due upon sale since appreciation during the original owner's lifetime is not eliminated. Choosing stepped-up basis generally results in lower taxable capital gains, while carryover basis can lead to higher tax liabilities.

Stepped-Up Basis: Benefits for Heirs and Beneficiaries

Stepped-up basis allows heirs to reset the asset's cost basis to its fair market value at the date of the decedent's death, minimizing capital gains tax when the asset is eventually sold. This tax provision benefits beneficiaries by reducing their taxable gain, potentially saving significant amounts in federal and state taxes. It is especially advantageous for appreciating assets like real estate and stocks, ensuring heirs retain maximum value from inheritances.

Carryover Basis: Considerations for Gift Givers and Recipients

Carryover basis applies when a gift asset retains the original cost basis of the donor, which impacts capital gains tax calculations upon sale by the recipient. Gift givers should document the original purchase price and holding period to ensure accurate tax reporting, while recipients must be aware that unrealized gains or losses carry over, potentially affecting future tax liabilities. Proper understanding of carryover basis helps both parties strategize to minimize unexpected tax burdens on gifted assets.

Recent Legal Changes and Proposed Reforms

Recent legal changes have refined the application of stepped-up basis rules, primarily affecting inherited property valuation for capital gains tax purposes. Proposed reforms aim to limit or eliminate the stepped-up basis to increase tax revenue by taxing unrealized gains at death, impacting estate planning strategies. These adjustments influence the carryover basis method by potentially expanding its use, which requires heirs to assume the original cost basis of inherited assets, possibly increasing future tax liabilities.

Strategies for Tax Planning: Choosing the Right Approach

Choosing between stepped-up basis and carryover basis significantly impacts estate tax planning and capital gains taxation. Utilizing a stepped-up basis resets the property's value to its fair market value at the owner's death, minimizing capital gains tax for heirs. Alternatively, electing a carryover basis can preserve the original purchase price, which may benefit specific trust arrangements or tax strategies involving capital losses.

Important Terms

Inherited asset valuation

Inherited asset valuation primarily involves determining the stepped-up basis, where the asset's value is adjusted to its fair market value at the decedent's date of death, minimizing capital gains tax for the heir. In contrast, carryover basis requires the inheritor to assume the original purchase value of the asset, potentially leading to higher capital gains taxes upon sale.

Capital gains tax

Capital gains tax is influenced by whether an asset receives a stepped-up basis or a carryover basis upon inheritance; a stepped-up basis resets the asset's value to its fair market value at the owner's death, potentially minimizing taxable gains, while a carryover basis maintains the original purchase price, which can increase capital gains tax liability. Understanding these basis rules is essential for optimizing estate planning and minimizing tax burdens on inherited property.

Fair market value adjustment

Fair market value adjustment impacts stepped-up basis by resetting an asset's book value to its current market value at the time of transfer, eliminating built-in gains or losses for tax purposes. Carryover basis preserves the original purchase price and holding period, which can result in deferred capital gains taxation upon a subsequent sale.

Gifted property

Gifted property typically receives a carryover basis, meaning the recipient inherits the donor's original cost basis for tax purposes, affecting capital gains calculations upon sale. Stepped-up basis applies mainly to inherited property, where the basis is adjusted to the property's fair market value at the time of the owner's death, potentially reducing capital gains tax liability.

Date of death valuation

Date of death valuation determines the fair market value of inherited assets, establishing a stepped-up basis that minimizes capital gains tax liability upon sale. This contrasts with a carryover basis, where the beneficiary assumes the decedent's original cost basis, potentially resulting in higher capital gains taxes.

Lifetime transfer

Lifetime transfers often trigger a carryover basis, meaning the recipient inherits the donor's original cost basis in the asset, which can result in higher capital gains taxes upon sale. In contrast, stepped-up basis applies primarily to inherited assets, where the asset's basis is adjusted to its fair market value at the decedent's date of death, minimizing capital gains tax liability for heirs.

IRC Section 1014

IRC Section 1014 establishes the stepped-up basis rule, which resets the tax basis of inherited property to its fair market value at the decedent's date of death, minimizing capital gains taxes for beneficiaries. This contrasts with the carryover basis method, where the beneficiary assumes the decedent's original basis, potentially leading to higher capital gains taxes upon sale.

IRC Section 1015

IRC Section 1015 establishes the carryover basis rule for property acquired by gift, meaning the recipient inherits the donor's original basis to determine gain or loss. This contrasts with the stepped-up basis applied at inheritance, which resets the property's basis to its fair market value at the time of the decedent's death, minimizing capital gains tax upon sale.

Unrealized appreciation

Unrealized appreciation refers to the increase in the value of an asset that has not yet been sold or converted into cash, affecting tax liabilities depending on whether a stepped-up basis or carryover basis is applied. A stepped-up basis resets the asset's value to its fair market value at the time of inheritance, minimizing capital gains tax on unrealized appreciation, while a carryover basis transfers the original purchase price, potentially increasing taxable gains.

Estate tax planning

Estate tax planning involves strategies to minimize tax liabilities by choosing between a stepped-up basis and a carryover basis for inherited assets. The stepped-up basis resets the asset's value to its fair market value at the decedent's death, reducing capital gains taxes upon sale, while the carryover basis retains the original purchase price, potentially increasing tax burdens but allowing for more precise tracking of asset appreciation.

stepped-up basis vs carryover basis Infographic

moneydif.com

moneydif.com