Direct taxes are levied directly on individuals or entities, such as income tax and corporate tax, where the taxpayer bears the tax burden personally. Indirect taxes, including sales tax and value-added tax (VAT), are imposed on goods and services, with the tax cost passed on to the consumer through higher prices. Understanding the distinction between direct and indirect taxes is crucial for effective financial planning and compliance with tax regulations.

Table of Comparison

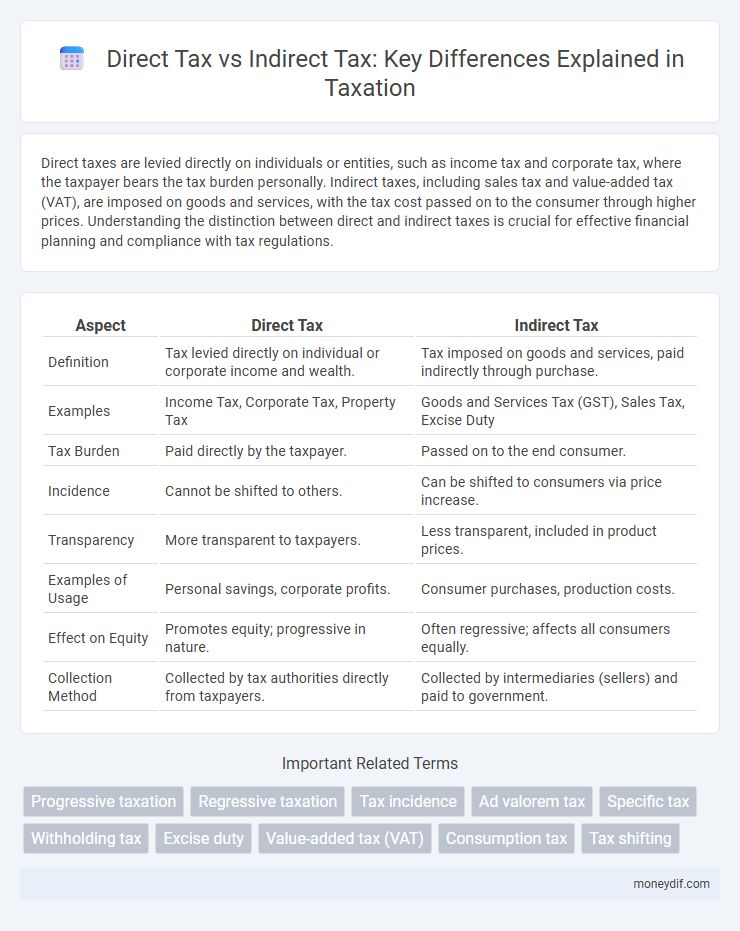

| Aspect | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Tax levied directly on individual or corporate income and wealth. | Tax imposed on goods and services, paid indirectly through purchase. |

| Examples | Income Tax, Corporate Tax, Property Tax | Goods and Services Tax (GST), Sales Tax, Excise Duty |

| Tax Burden | Paid directly by the taxpayer. | Passed on to the end consumer. |

| Incidence | Cannot be shifted to others. | Can be shifted to consumers via price increase. |

| Transparency | More transparent to taxpayers. | Less transparent, included in product prices. |

| Examples of Usage | Personal savings, corporate profits. | Consumer purchases, production costs. |

| Effect on Equity | Promotes equity; progressive in nature. | Often regressive; affects all consumers equally. |

| Collection Method | Collected by tax authorities directly from taxpayers. | Collected by intermediaries (sellers) and paid to government. |

Introduction to Direct and Indirect Taxes

Direct taxes are levied directly on individuals or organizations based on their income, wealth, or property, such as income tax, corporate tax, and property tax. Indirect taxes apply to goods and services, collected by intermediaries like retailers before being passed to the government, examples include goods and services tax (GST), sales tax, and customs duties. Understanding the distinction between direct and indirect taxes is crucial for grasping tax policy, economic impact, and taxpayer obligations.

Definition of Direct Tax

Direct tax refers to taxes imposed directly on an individual or organization's income, wealth, or property, such as income tax, corporate tax, and property tax. These taxes cannot be transferred to another party and must be paid by the taxpayer to the government. Direct taxes are progressive in nature, often designed to redistribute wealth and reduce income inequality.

Definition of Indirect Tax

Indirect tax is a type of tax collected by an intermediary from the person who bears the ultimate economic burden of the tax, typically included in the price of goods or services. Unlike direct taxes, which are paid directly to the government by the individual or organization, indirect taxes are levied on transactions, such as sales tax, value-added tax (VAT), excise duty, and customs duty. These taxes are embedded in the supply chain and passed on to the consumer, impacting consumption rather than income or wealth.

Key Differences Between Direct and Indirect Taxes

Direct taxes are levied directly on individuals or entities, such as income tax and corporate tax, ensuring the taxpayer bears the full burden. Indirect taxes, like GST and excise duty, are applied on goods and services, with the tax incidence often shifted to the consumer through increased prices. Key differences include the point of collection, tax burden incidence, and the transparency of payment, where direct taxes are more progressive and indirect taxes tend to be regressive.

Examples of Direct Taxes

Direct taxes are levied directly on individuals or organizations and include income tax, corporate tax, property tax, and wealth tax. These taxes are paid directly to the government by the taxpayer and are based on the ability to pay, reflecting personal or business income and assets. Examples of direct taxes demonstrate the government's approach to taxing earnings, property ownership, and capital accumulation to fund public services.

Examples of Indirect Taxes

Indirect taxes include value-added tax (VAT), excise duty, sales tax, and customs duty, which are levied on goods and services rather than directly on income or profits. These taxes are collected by intermediaries such as retailers or manufacturers and passed on to the government, increasing the cost of products for consumers. Popular examples of indirect taxes are VAT applied on retail sales, excise duty on tobacco and alcohol, and customs duty on imported goods.

Advantages of Direct Taxes

Direct taxes provide a transparent revenue source, ensuring taxpayers are aware of their financial obligations and fostering a sense of accountability. They promote income redistribution by imposing higher rates on wealthier individuals, thereby reducing economic inequality. Furthermore, direct taxes are less likely to cause market distortions compared to indirect taxes, leading to more efficient resource allocation.

Advantages of Indirect Taxes

Indirect taxes offer advantages such as ease of collection since they are included in the price of goods and services, reducing the burden of direct assessment. They promote a broader tax base by taxing consumption rather than income, leading to stable revenue for governments even in fluctuating economic conditions. Additionally, indirect taxes can encourage responsible consumption through levies on luxury or harmful goods, aiding in social and environmental objectives.

Challenges and Limitations of Each Tax Type

Direct taxes face challenges such as tax evasion and difficulty in accurate income assessment, resulting in enforcement complexities and potential revenue shortfalls. Indirect taxes often lead to regressive effects on lower-income groups, along with compliance burdens on businesses due to complex collection mechanisms. Both tax types encounter administrative costs and potential market distortions, impacting economic efficiency and equity.

Impact of Direct and Indirect Taxes on the Economy

Direct taxes, such as income tax and corporate tax, redistribute wealth by taxing individuals and businesses based on their ability to pay, thereby influencing income inequality and consumer spending. Indirect taxes, including sales tax and VAT, affect consumption patterns and can lead to higher prices, potentially reducing demand for goods and services. The balance between direct and indirect taxes shapes economic growth, government revenue stability, and the overall distribution of financial burdens within an economy.

Important Terms

Progressive taxation

Progressive taxation, a form of direct tax, imposes higher tax rates on increasing income levels, unlike indirect taxes which are levied uniformly on goods and services regardless of an individual's income.

Regressive taxation

Regressive taxation imposes a higher relative burden on low-income individuals and is more commonly associated with indirect taxes like sales tax, whereas direct taxes such as income tax are typically progressive or proportional.

Tax incidence

Tax incidence reveals that direct taxes primarily burden income earners while indirect taxes shift the financial responsibility to consumers through higher prices.

Ad valorem tax

Ad valorem tax is a type of direct tax calculated as a fixed percentage of the assessed value of goods, property, or services, contrasting with indirect taxes which are levied on transactions or consumption rather than the asset's value.

Specific tax

Specific tax is a fixed amount levied on goods or services, directly impacting indirect taxes like sales tax rather than direct taxes such as income tax.

Withholding tax

Withholding tax is a form of direct tax deducted at source from income such as salaries, interest, or dividends before payment reaches the recipient, ensuring timely tax collection. Unlike indirect taxes, which are levied on goods and services and paid by consumers during transactions, withholding tax directly impacts the income of individuals or businesses by reducing their taxable income upfront.

Excise duty

Excise duty is an indirect tax imposed on the manufacture or sale of goods within a country, differing from direct taxes which are levied directly on individuals or organizations based on income or property.

Value-added tax (VAT)

Value-added tax (VAT) is an indirect tax levied on the consumption of goods and services at each stage of production or distribution, different from direct taxes like income tax which are imposed directly on individuals or entities. VAT is collected by businesses on behalf of the government and is ultimately borne by the end consumer, making it a key source of revenue in many countries' tax systems.

Consumption tax

Consumption tax is a type of indirect tax levied on the purchase of goods and services, unlike direct taxes which are imposed directly on individuals' or entities' income or wealth.

Tax shifting

Tax shifting occurs when the economic burden of direct taxes like income tax is transferred to others through changes in prices, while indirect taxes such as sales tax are typically passed directly to consumers.

Direct tax vs indirect tax Infographic

moneydif.com

moneydif.com