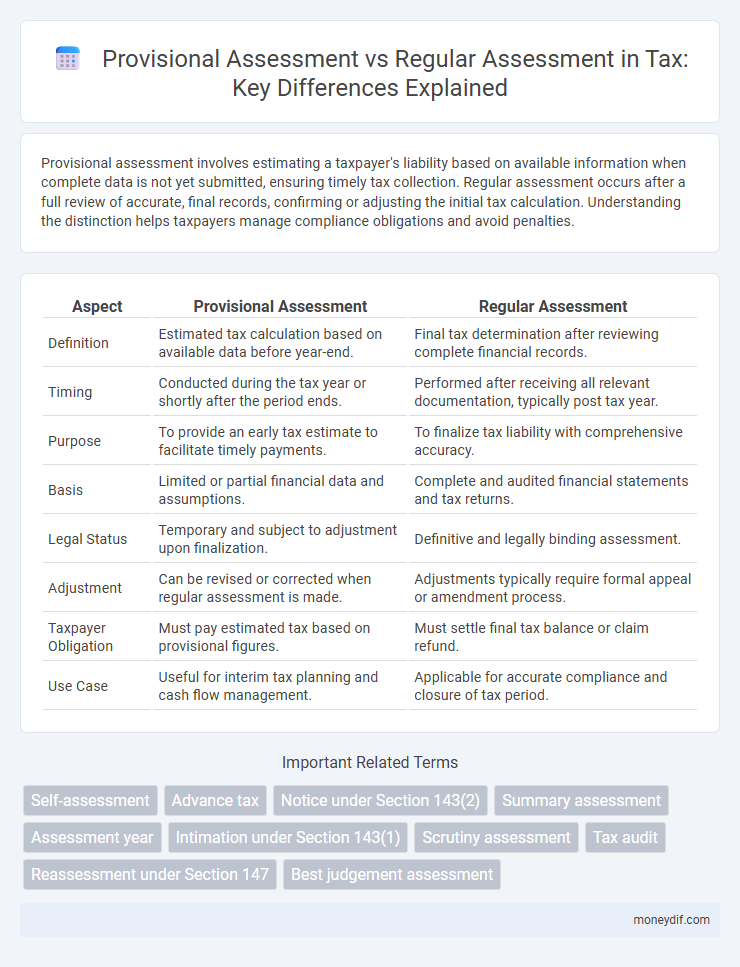

Provisional assessment involves estimating a taxpayer's liability based on available information when complete data is not yet submitted, ensuring timely tax collection. Regular assessment occurs after a full review of accurate, final records, confirming or adjusting the initial tax calculation. Understanding the distinction helps taxpayers manage compliance obligations and avoid penalties.

Table of Comparison

| Aspect | Provisional Assessment | Regular Assessment |

|---|---|---|

| Definition | Estimated tax calculation based on available data before year-end. | Final tax determination after reviewing complete financial records. |

| Timing | Conducted during the tax year or shortly after the period ends. | Performed after receiving all relevant documentation, typically post tax year. |

| Purpose | To provide an early tax estimate to facilitate timely payments. | To finalize tax liability with comprehensive accuracy. |

| Basis | Limited or partial financial data and assumptions. | Complete and audited financial statements and tax returns. |

| Legal Status | Temporary and subject to adjustment upon finalization. | Definitive and legally binding assessment. |

| Adjustment | Can be revised or corrected when regular assessment is made. | Adjustments typically require formal appeal or amendment process. |

| Taxpayer Obligation | Must pay estimated tax based on provisional figures. | Must settle final tax balance or claim refund. |

| Use Case | Useful for interim tax planning and cash flow management. | Applicable for accurate compliance and closure of tax period. |

Understanding Provisional Assessment in Taxation

Provisional assessment in taxation allows tax authorities to estimate a taxpayer's liability when complete information is unavailable, serving as a temporary measure until finalized data is provided. Unlike regular assessment, which is based on complete and verified financial records, provisional assessments rely on available data, often requiring adjustments upon submission of accurate returns. This mechanism ensures timely tax collection while providing flexibility for taxpayers to update their filings and avoid penalties.

What is Regular Assessment?

Regular assessment refers to the official evaluation of a taxpayer's income, assets, and liabilities conducted by tax authorities to determine the accurate tax liability for a specific fiscal year. It involves a detailed review based on submitted tax returns, financial documents, and applicable tax laws, ensuring compliance and correct computation of tax dues. This process differs from provisional assessment, which is an initial, estimated evaluation subject to later adjustment upon completion of the regular assessment.

Key Differences Between Provisional and Regular Assessment

Provisional assessment involves an initial estimate of tax liability based on available information, often used when complete data is unavailable, whereas regular assessment is a final determination after thorough review of detailed financial records. Provisional assessments can be adjusted or revised upon submission of accurate documents, while regular assessments are definitive and legally binding. The main difference lies in the timing and certainty, with provisional assessments facilitating quicker tax collection and regular assessments ensuring precise compliance.

Legal Provisions Governing Provisional and Regular Assessments

Legal provisions governing provisional and regular tax assessments are primarily outlined under the Income Tax Act, which empowers tax authorities to issue provisional assessments when a regular assessment cannot be completed within the prescribed time frame. Provisional assessments serve as interim measures to secure tax dues and prevent revenue loss, pending final determination through regular assessment procedures. Regular assessments involve a comprehensive review based on filed returns and additional information, ensuring accurate tax liability determination under detailed statutory guidelines.

When Does Provisional Assessment Apply?

Provisional assessment applies when the tax authorities require an estimated tax calculation due to insufficient information or incomplete returns submitted by the taxpayer. This assessment is typically used to expedite tax collection pending full verification and finalization of the tax liability. Provisional assessments may be issued in cases of late filing, complex audits, or disputes over reported income or deductions.

Process Flow: Provisional Assessment vs Regular Assessment

Provisional assessment involves a temporary evaluation of tax liability based on estimated data, allowing taxpayers to make payments before final figures are verified. Regular assessment follows a detailed examination of accurate financial records, resulting in a definitive tax amount determined by tax authorities. The process flow of provisional assessment prioritizes speed and interim compliance, while regular assessment ensures accuracy through thorough review and potential adjustments.

Advantages and Disadvantages of Each Assessment

Provisional assessment allows taxpayers to estimate their tax liability based on available information, offering quicker processing and flexibility to adjust figures as more data becomes available; however, it may lead to inaccuracies and potential penalties if final calculations differ significantly. Regular assessment involves a detailed review by tax authorities, ensuring accuracy and compliance but often requiring more time and documentation, which can delay refunds or increase administrative burden. Choosing between provisional and regular assessment depends on the taxpayer's need for speed versus accuracy and the complexity of their financial situation.

Rights and Obligations of Taxpayers

Provisional assessment grants taxpayers the right to provisionally determine their tax liability based on estimated income, with the obligation to finalize and pay any additional tax upon final assessment. Regular assessment involves the tax authority's determination of the exact tax liability after a complete review, obligating taxpayers to comply with the final tax computation and possible penalties if discrepancies are found. Both assessments ensure taxpayers have the right to appeal and request reassessment, maintaining a balance between administrative efficiency and taxpayer protection.

Common Issues and Disputes

Common issues in provisional assessment often involve disputes over tax liability amounts due to incomplete information or estimated figures provided by tax authorities. Regular assessment disputes typically arise from disagreements regarding the interpretation of tax laws, missed deductions, or errors identified during formal tax return reviews. Both assessments may lead to prolonged negotiations or appeals when taxpayers challenge the accuracy or fairness of the determined tax obligations.

Impact on Tax Compliance and Refunds

Provisional assessment allows taxpayers to obtain a quick determination of their tax liabilities, promoting timely compliance by addressing uncertainties early, whereas regular assessment involves a more detailed review that may extend the compliance timeline. Provisional assessments often expedite the refund process by providing interim decisions, reducing delays commonly associated with thorough audits during regular assessments. Tax authorities benefit from provisional assessments by managing workload more efficiently, enhancing overall tax compliance and timely refund issuance.

Important Terms

Self-assessment

Provisional assessment involves an initial, temporary evaluation of tax liabilities based on estimated income or incomplete data, subject to adjustment once the final figures are available. Regular assessment, in contrast, constitutes a definitive examination of tax returns after complete financial information is submitted, leading to a final tax determination and liability.

Advance tax

Advance tax is a method where taxpayers pay their income tax in installments throughout the financial year based on estimated income, while provisional assessment allows taxpayers to estimate and pay tax on income when exact details are not yet available. Regular assessment follows the completion of the financial year, involving a thorough evaluation of actual income and deductions to determine the final tax liability.

Notice under Section 143(2)

Notice under Section 143(2) of the Income Tax Act initiates a provisional assessment by allowing the tax department to scrutinize and verify the return filed, often leading to reassessment or adjustments. Regular assessment, in contrast, follows the completion of this process with a final determination of tax liability based on detailed examination and assessment orders.

Summary assessment

Provisional assessments are temporary tax evaluations based on estimated income or transactions, subject to adjustment once actual data is available, whereas regular assessments are final determinations grounded on verified and complete financial records. The accuracy and completeness of documentation directly influence the transition from provisional to regular assessment, impacting final tax liabilities and compliance status.

Assessment year

Assessment year refers to the financial year following the income year in which the income is assessed for tax purposes. Provisional assessment involves an initial evaluation based on estimated income and is subject to revision, while regular assessment is the final determination of tax liability after thorough scrutiny of actual income and documentation.

Intimation under Section 143(1)

Intimation under Section 143(1) of the Income Tax Act provides a provisional assessment by summarizing the income declared and calculated deductions without detailed scrutiny, serving as a preliminary step before the regular assessment. Regular assessment involves a comprehensive examination of the tax return, including verification of income, claims, and liabilities, and may result in demand notices or refunds based on detailed scrutiny beyond the scope of Section 143(1) intimation.

Scrutiny assessment

Scrutiny assessment involves a detailed examination of a taxpayer's returns to verify income, deductions, and tax liability, often triggered under Section 143(3) of the Income Tax Act. Provisional assessment differs as it provides a temporary tax liability based on available information, subject to regular assessment which finalizes the actual tax obligation after comprehensive verification.

Tax audit

Tax audits involve examining taxpayer records to verify accuracy and compliance, where provisional assessments serve as temporary tax determinations pending final evaluation. Regular assessments are definitive tax calculations completed after thorough review during tax audits, ensuring accurate tax liabilities based on audited financial data.

Reassessment under Section 147

Section 147 of the Income Tax Act empowers the tax authorities to initiate reassessment proceedings when income escaping assessment is detected, ensuring provisional assessments made under Section 144 can be scrutinized and converted into regular assessments. Provisional assessments, typically invoked when the taxpayer fails to disclose full income, are temporary and subject to regular assessment, which provides a comprehensive examination of the taxpayer's financial records for accurate tax determination.

Best judgement assessment

Best judgement assessment applies when insufficient data prevents regular assessment, relying on estimations based on available information. Provisional assessment is a temporary measure pending final documentation, with regular assessment finalized after comprehensive data review, ensuring precise liability determination.

Provisional assessment vs regular assessment Infographic

moneydif.com

moneydif.com