Progressive tax imposes higher tax rates on individuals with higher incomes, ensuring that those who earn more contribute a larger share of their earnings. Regressive tax, in contrast, takes a larger percentage from low-income earners than from high-income earners, placing a heavier burden on those with less financial capacity. Understanding the differences between these tax structures is crucial for evaluating their impact on income inequality and economic equity.

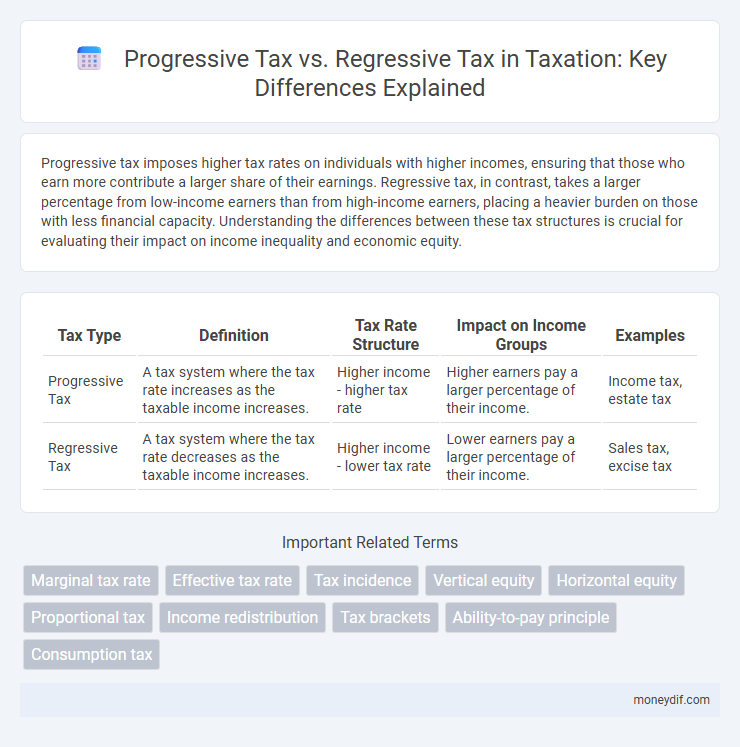

Table of Comparison

| Tax Type | Definition | Tax Rate Structure | Impact on Income Groups | Examples |

|---|---|---|---|---|

| Progressive Tax | A tax system where the tax rate increases as the taxable income increases. | Higher income - higher tax rate | Higher earners pay a larger percentage of their income. | Income tax, estate tax |

| Regressive Tax | A tax system where the tax rate decreases as the taxable income increases. | Higher income - lower tax rate | Lower earners pay a larger percentage of their income. | Sales tax, excise tax |

Introduction to Taxation Systems

Progressive tax systems impose higher tax rates on individuals with greater income, promoting income redistribution and reducing economic inequality. Regressive tax systems apply a disproportionate tax burden on lower-income earners by taxing consumption or flat-rate items, often intensifying financial strain on vulnerable populations. Understanding these contrasting taxation frameworks is critical for evaluating fiscal policies and their social impacts.

Defining Progressive and Regressive Taxes

Progressive tax systems impose higher tax rates on increased income levels, ensuring that individuals with greater earnings contribute a larger percentage of their income, promoting income redistribution and economic equity. Regressive tax structures, in contrast, apply a uniform rate that disproportionately affects lower-income earners by taking a larger share of their earnings relative to wealthier individuals. Understanding these definitions is essential for analyzing tax policy impacts on social welfare and fiscal responsibility.

Key Differences Between Progressive and Regressive Taxes

Progressive tax systems impose higher tax rates on individuals with greater income, ensuring that those who earn more contribute a larger percentage of their earnings, which helps reduce income inequality. Regressive taxes apply a greater burden to lower-income individuals by taxing a higher percentage of their income, often through flat taxes on goods and services like sales tax or excise duties. The key distinction lies in how the tax rate changes relative to income: progressive taxes increase with income, while regressive taxes decrease as income rises.

Examples of Progressive Taxation

Examples of progressive taxation include the United States federal income tax system, where tax rates increase as income rises, starting from 10% and reaching up to 37% for high earners. Other countries like Canada and Germany implement progressive tax brackets that impose higher rates on top-tier income levels to reduce income inequality. Property taxes with escalating rates based on property value also illustrate progressive tax structures.

Examples of Regressive Taxation

Sales taxes and excise taxes exemplify regressive taxation because they impose the same rate on all consumers regardless of income, disproportionately impacting lower-income households. Payroll taxes, such as Social Security contributions, also function regressively by capping taxable income, which benefits higher earners. These taxes reduce disposable income more significantly for individuals with lower earnings, intensifying economic inequality.

Effects on Income Inequality

Progressive tax systems reduce income inequality by imposing higher tax rates on higher income brackets, thereby redistributing wealth more effectively. Regressive taxes disproportionately burden lower-income individuals, exacerbating income disparities by taxing a larger percentage of their earnings compared to wealthier individuals. Empirical studies consistently show that progressive taxation narrows the income gap, while regressive tax structures contribute to wider economic inequality.

Economic Impacts of Progressive vs Regressive Taxes

Progressive taxes increase rates as income rises, promoting income redistribution and reducing economic inequality by funding social programs. Regressive taxes, such as sales taxes, disproportionately burden lower-income households, limiting their spending power and potentially slowing economic growth. Economic impacts of these tax systems influence consumer behavior, labor supply, and overall market efficiency.

Advantages of Progressive Tax Structures

Progressive tax structures ensure higher earners contribute a larger percentage of their income, promoting income redistribution and reducing economic inequality. This system enhances government revenue stability by aligning tax rates with taxpayers' ability to pay, supporting funding for essential public services. Progressive taxes also incentivize social mobility by easing the tax burden on lower-income individuals, fostering a more equitable economic environment.

Criticisms of Regressive Tax Models

Regressive tax models disproportionately burden low-income individuals, reducing their disposable income and exacerbating economic inequality. These taxes, such as sales taxes on essential goods, do not account for taxpayers' ability to pay, leading to increased financial strain on vulnerable populations. Critics argue that regressive taxation undermines social equity and limits opportunities for economic mobility.

Choosing the Right Tax System for Societal Goals

A progressive tax system increases tax rates as income rises, promoting income equality and funding social programs effectively, while a regressive tax system imposes a higher burden on lower-income individuals, potentially widening economic disparities. Choosing the right tax system depends on societal goals such as reducing poverty, encouraging economic growth, or ensuring fiscal sustainability. Policymakers must balance fairness, efficiency, and revenue generation to align tax policy with broader social and economic objectives.

Important Terms

Marginal tax rate

Marginal tax rate increases progressively in progressive tax systems while it decreases or remains constant in regressive tax systems.

Effective tax rate

The effective tax rate measures the actual percentage of income paid in taxes, reflecting the impact of progressive tax systems where rates increase with income, leading to higher earners paying a larger share. In contrast, regressive tax systems impose a higher tax burden on lower-income individuals, causing the effective tax rate to decrease as income rises.

Tax incidence

Tax incidence reveals that progressive taxes disproportionately burden higher-income earners, while regressive taxes place a greater relative tax load on lower-income individuals.

Vertical equity

Vertical equity focuses on the principle that taxpayers with higher incomes should pay a larger percentage of their income in taxes, which is a hallmark of progressive tax systems where tax rates increase with income levels. In contrast, regressive tax systems place a disproportionate burden on lower-income individuals by taking a larger percentage of their income, conflicting with the goals of vertical equity.

Horizontal equity

Horizontal equity ensures individuals with equal ability to pay are taxed equally, highlighting fairness differences between progressive tax systems that increase rates with income and regressive tax systems that place a heavier burden on lower-income earners.

Proportional tax

Proportional tax imposes a fixed tax rate on all income levels, contrasting with progressive tax, which increases rates as income rises, and regressive tax, where the effective rate decreases for higher incomes. This flat tax system aims to simplify taxation and maintain fairness, though critics argue it may disproportionately burden lower-income earners compared to progressive taxation structures.

Income redistribution

Progressive taxes increase income redistribution by taxing higher incomes at higher rates, while regressive taxes reduce redistribution by imposing a larger relative burden on lower incomes.

Tax brackets

Tax brackets determine the rate of progressive tax applied as income rises, whereas regressive tax imposes a higher relative burden on lower incomes regardless of tax brackets.

Ability-to-pay principle

The ability-to-pay principle supports progressive taxes that increase rates with income, unlike regressive taxes that disproportionately burden lower-income individuals.

Consumption tax

Consumption tax disproportionately affects lower-income individuals, making it regressive compared to progressive taxes that increase rates based on income levels.

Progressive tax vs regressive tax Infographic

moneydif.com

moneydif.com