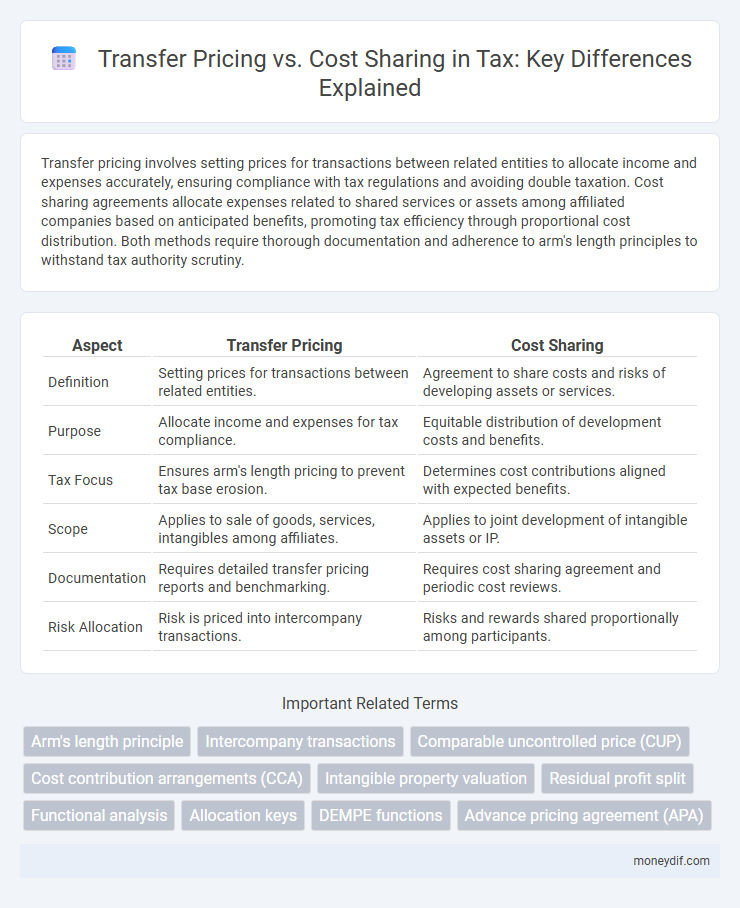

Transfer pricing involves setting prices for transactions between related entities to allocate income and expenses accurately, ensuring compliance with tax regulations and avoiding double taxation. Cost sharing agreements allocate expenses related to shared services or assets among affiliated companies based on anticipated benefits, promoting tax efficiency through proportional cost distribution. Both methods require thorough documentation and adherence to arm's length principles to withstand tax authority scrutiny.

Table of Comparison

| Aspect | Transfer Pricing | Cost Sharing |

|---|---|---|

| Definition | Setting prices for transactions between related entities. | Agreement to share costs and risks of developing assets or services. |

| Purpose | Allocate income and expenses for tax compliance. | Equitable distribution of development costs and benefits. |

| Tax Focus | Ensures arm's length pricing to prevent tax base erosion. | Determines cost contributions aligned with expected benefits. |

| Scope | Applies to sale of goods, services, intangibles among affiliates. | Applies to joint development of intangible assets or IP. |

| Documentation | Requires detailed transfer pricing reports and benchmarking. | Requires cost sharing agreement and periodic cost reviews. |

| Risk Allocation | Risk is priced into intercompany transactions. | Risks and rewards shared proportionally among participants. |

Introduction to Transfer Pricing and Cost Sharing

Transfer pricing refers to the rules and methods for pricing transactions between related entities within multinational corporations, ensuring compliance with tax regulations and preventing profit shifting. Cost sharing agreements allocate the costs and risks of developing, producing, or obtaining assets or services among affiliated entities based on anticipated benefits. Understanding transfer pricing and cost sharing mechanisms is essential for multinational companies to manage tax liabilities and align intercompany transactions with arm's length principles.

Key Differences Between Transfer Pricing and Cost Sharing

Transfer pricing involves setting prices for transactions between related entities, ensuring compliance with tax regulations and fair market value principles, while cost sharing allocates expenses and risks of joint ventures or projects among participating companies based on benefits received. Transfer pricing primarily addresses profit allocation and tax base erosion concerns, whereas cost sharing emphasizes equitable distribution of costs and benefits for joint development or production activities. Key differences include the transaction focus in transfer pricing versus the collaborative expense allocation in cost sharing, as well as distinct documentation and regulatory compliance requirements under OECD guidelines.

Legal Framework Governing Transfer Pricing and Cost Sharing

The legal framework governing transfer pricing and cost sharing is primarily outlined in the OECD Transfer Pricing Guidelines, which set standards for arm's length pricing and allocation of costs among related entities. Transfer pricing rules require documentation and adherence to market conditions to prevent tax base erosion, while cost sharing agreements must comply with specific regulations to ensure equitable distribution of expenses and benefits in multinational enterprises. National laws often complement international guidelines, imposing penalties for non-compliance and requiring detailed reporting to tax authorities.

Objectives and Principles of Transfer Pricing

Transfer pricing aims to allocate profits between related entities based on the arm's length principle, ensuring transactions reflect market conditions to prevent tax base erosion and profit shifting. The primary objective is to achieve fair tax liability distribution among jurisdictions by accurately pricing intercompany transactions. Transfer pricing principles emphasize comparability, documentation, and consistency to maintain compliance with tax regulations and avoid disputes with tax authorities.

Objectives and Principles of Cost Sharing

Cost sharing agreements aim to allocate costs equitably among related entities benefiting from joint development or acquisition of intangibles, ensuring each participant pays based on its anticipated benefits. The primary objective is to promote fairness and prevent tax base erosion by aligning contributions and rights to benefits derived from shared assets. Principles of cost sharing emphasize proportionality, economic reality, and transparency, requiring participants to share costs consistent with their expected use and to document agreements thoroughly for compliance with transfer pricing regulations.

Tax Implications of Transfer Pricing

Transfer pricing involves setting prices for transactions between related entities, impacting taxable income across jurisdictions and subjecting companies to scrutiny by tax authorities to prevent profit shifting. Cost sharing arrangements allocate expenses for developing, producing, or obtaining assets or services, requiring compliant documentation to avoid disputes over transfer pricing adjustments. Misalignment in transfer pricing policies can lead to significant tax adjustments, penalties, and double taxation risks, emphasizing the need for robust transfer pricing strategies aligned with OECD guidelines.

Tax Implications of Cost Sharing

Cost sharing arrangements impact tax liabilities by requiring participating entities to allocate expenses based on anticipated benefits, which can affect taxable income and deductions. Tax authorities closely scrutinize cost sharing agreements to ensure that cost allocations reflect arm's length principles, preventing profit shifting and base erosion. Proper documentation and compliance with transfer pricing regulations are essential to mitigate risks of tax adjustments and penalties related to cost sharing.

Compliance Requirements for Multinational Enterprises

Transfer pricing compliance requires multinational enterprises to document and justify intercompany transaction prices based on the arm's length principle, adhering to local tax regulations and OECD guidelines. Cost sharing arrangements demand detailed agreements outlining the allocation of costs and economic benefits to ensure transparency and prevent tax base erosion. Both mechanisms necessitate rigorous documentation, timely reporting, and alignment with country-specific compliance obligations to mitigate audit risks and penalties.

Common Challenges and Risks in Transfer Pricing and Cost Sharing

Transfer pricing and cost sharing both face challenges such as compliance with diverse international tax regulations and accurately documenting intercompany transactions to avoid disputes with tax authorities. Transfer pricing risks include potential adjustments and double taxation due to misaligned profit allocation, while cost sharing arrangements carry risks of improper cost allocation and complexities in justifying shared expenses. Both approaches require robust economic analysis and consistent documentation to mitigate audit risks and ensure regulatory compliance.

Best Practices for Effective Tax Planning

Transfer pricing and cost sharing are critical components of effective tax planning, requiring meticulous documentation and adherence to local regulatory frameworks to minimize tax risks. Best practices include conducting thorough functional analyses to establish arm's length pricing and implementing robust cost allocation methodologies that reflect the economic reality of shared resources. Leveraging advanced data analytics and maintaining consistent intercompany agreements help ensure compliance and optimize global tax outcomes.

Important Terms

Arm's length principle

The Arm's length principle ensures that transactions between related parties, such as those involving transfer pricing, are conducted as if they were between independent entities, reflecting market conditions for accurate profit allocation. Cost sharing agreements allocate expenses and risks among participants based on their anticipated benefits, with transfer pricing adjustments applied to maintain compliance with the Arm's length standard.

Intercompany transactions

Intercompany transactions involve the exchange of goods, services, or intangibles between related entities within a multinational corporation, requiring compliance with transfer pricing regulations to ensure arm's length pricing and avoid tax penalties. Transfer pricing focuses on setting prices for intercompany transactions, while cost sharing arrangements allocate the costs and benefits of developing intangible assets among related entities based on their anticipated contributions and usage.

Comparable uncontrolled price (CUP)

Comparable Uncontrolled Price (CUP) method determines transfer prices by comparing controlled transactions with similar uncontrolled transactions, ensuring compliance with the arm's length principle. In contrast, cost sharing agreements allocate expenses based on anticipated benefits, focusing on joint development rather than direct price comparison.

Cost contribution arrangements (CCA)

Cost Contribution Arrangements (CCAs) involve multiple related parties sharing costs and risks of joint activities, distinct from traditional transfer pricing which typically focuses on setting intercompany prices for goods or services exchanged. In contrast to cost sharing agreements, CCAs emphasize collaborative contributions and allocation of expenses based on expected benefits, ensuring compliance with arm's length principles under transfer pricing regulations.

Intangible property valuation

Intangible property valuation in transfer pricing involves determining arm's length royalties or transaction prices based on comparability analyses, considering factors such as market conditions, rights, and economic benefits. Cost sharing agreements allocate development costs and resulting intangible assets proportionally among participants, emphasizing proportionality and expected benefits rather than direct market transactions.

Residual profit split

Residual profit split methods allocate profits after basic returns are assigned to routine functions, emphasizing value created by unique intangibles in transfer pricing. Cost sharing arrangements focus on allocating costs and risks of developing intangibles, whereas residual profit splits determine profit distribution reflecting the economic contributions and risks of related entities involved.

Functional analysis

Functional analysis in transfer pricing identifies the economically significant activities, assets, and risks undertaken by related entities to determine proper pricing structures, ensuring compliance with the arm's length principle. In cost sharing agreements, functional analysis allocates costs based on the relative benefits and contributions of each participant, aligning compensation with the actual functions performed and risks assumed in joint development or production activities.

Allocation keys

Allocation keys determine the proportionate distribution of costs or revenues among related entities in transfer pricing and cost sharing arrangements. In transfer pricing, they ensure compliance with arm's length principles by fairly allocating transaction prices, while in cost sharing, they reflect each participant's expected use or benefit, based on measurable metrics like sales volume or headcount.

DEMPE functions

DEMPE functions--Development, Enhancement, Maintenance, Protection, and Exploitation--are critical in evaluating transfer pricing to ensure functions generating intangibles' value are accurately compensated between related parties. In cost-sharing arrangements, DEMPE activities determine each participant's contribution and rights, ensuring allocations reflect their involvement in developing and exploiting shared intangibles.

Advance pricing agreement (APA)

Advance Pricing Agreements (APAs) establish agreed transfer pricing methods between related parties in cross-border transactions, reducing disputes and ensuring compliance with tax authorities. Unlike cost sharing arrangements that allocate expenses based on anticipated benefits, APAs provide certainty on transaction pricing, directly addressing transfer pricing concerns and minimizing the risk of double taxation.

Transfer pricing vs cost sharing Infographic

moneydif.com

moneydif.com