Controlled Foreign Corporation (CFC) rules define the criteria under which a U.S. shareholder must include certain types of income from foreign subsidiaries in their taxable income, aiming to prevent tax deferral. Subpart F rules specifically outline the types of passive and certain active income categories, such as foreign base company income, that must be included in the shareholder's current income regardless of actual distributions. Understanding the interplay between CFC and Subpart F rules is crucial for effective international tax planning and compliance.

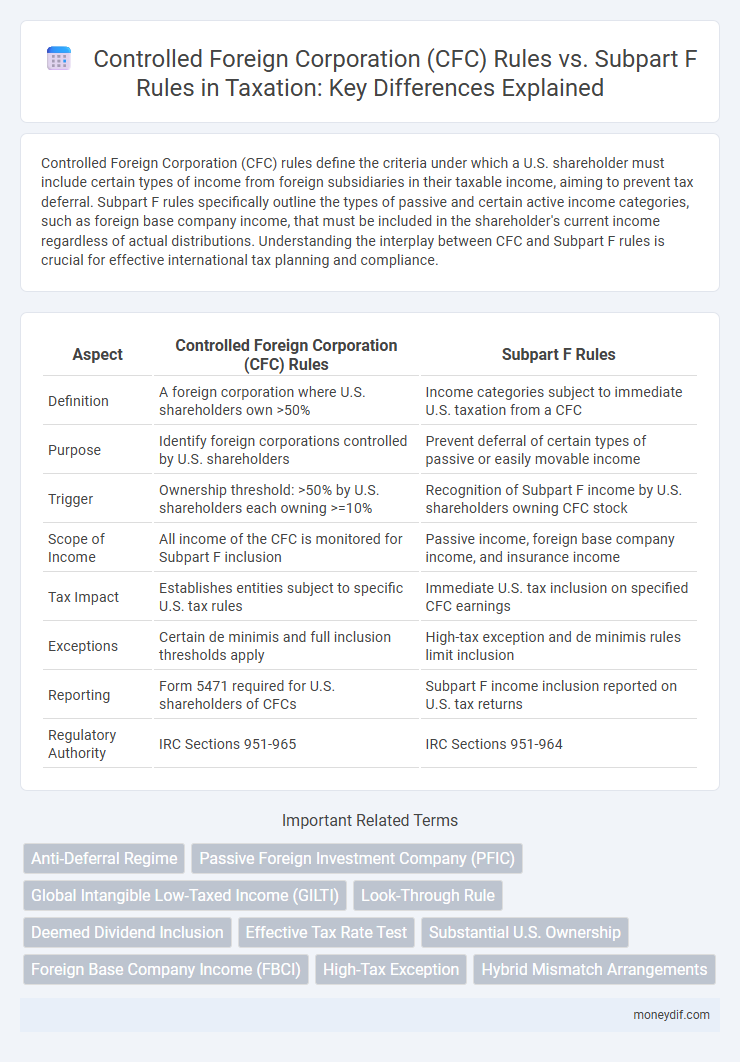

Table of Comparison

| Aspect | Controlled Foreign Corporation (CFC) Rules | Subpart F Rules |

|---|---|---|

| Definition | A foreign corporation where U.S. shareholders own >50% | Income categories subject to immediate U.S. taxation from a CFC |

| Purpose | Identify foreign corporations controlled by U.S. shareholders | Prevent deferral of certain types of passive or easily movable income |

| Trigger | Ownership threshold: >50% by U.S. shareholders each owning >=10% | Recognition of Subpart F income by U.S. shareholders owning CFC stock |

| Scope of Income | All income of the CFC is monitored for Subpart F inclusion | Passive income, foreign base company income, and insurance income |

| Tax Impact | Establishes entities subject to specific U.S. tax rules | Immediate U.S. tax inclusion on specified CFC earnings |

| Exceptions | Certain de minimis and full inclusion thresholds apply | High-tax exception and de minimis rules limit inclusion |

| Reporting | Form 5471 required for U.S. shareholders of CFCs | Subpart F income inclusion reported on U.S. tax returns |

| Regulatory Authority | IRC Sections 951-965 | IRC Sections 951-964 |

Introduction to Controlled Foreign Corporation (CFC) Rules

Controlled Foreign Corporation (CFC) rules target U.S. shareholders owning 10% or more of a foreign corporation, aiming to prevent tax deferral on certain types of income. These regulations require shareholders to include specific types of passive and easily movable income in their current taxable income. The objective is to reduce tax avoidance by ensuring that certain foreign earnings are taxed annually, even if not repatriated.

Overview of Subpart F Provisions

Subpart F provisions target the income of Controlled Foreign Corporations (CFCs) by requiring U.S. shareholders to include certain types of passive and easily movable income, such as foreign base company income, in their current taxable income. These rules aim to prevent tax deferral by taxing passive income earned offshore, irrespective of actual distribution. Subpart F income categories include foreign personal holding company income, foreign base company sales income, and insurance income, effectively curbing tax avoidance through profit shifting.

Key Differences Between CFC Rules and Subpart F Rules

Controlled Foreign Corporation (CFC) rules are broadly designed to attribute income of foreign subsidiaries to U.S. shareholders, while Subpart F rules specifically target certain types of passive and easily shiftable income for immediate U.S. taxation. The scope of CFC rules encompasses overall ownership thresholds and income inclusions, whereas Subpart F rules define specific income categories like foreign base company income that trigger current inclusion. Compliance with CFC rules requires a focus on ownership percentage, while Subpart F rules emphasize income character and anti-deferral provisions.

Scope of Application: CFC Rules vs. Subpart F

Controlled Foreign Corporation (CFC) rules apply broadly to entities where U.S. shareholders collectively own more than 50% of the foreign corporation, making the U.S. shareholders responsible for reporting and taxation. Subpart F rules, a subset of CFC regulations, specifically target certain types of income such as passive, foreign base company income, aiming to prevent deferral of U.S. tax on these earnings. The scope of CFC rules encompasses ownership and control thresholds, while Subpart F focuses on the nature and source of income within these controlled entities.

Definitions: CFC and Subpart F Income Explained

Controlled Foreign Corporation (CFC) rules define a CFC as a foreign corporation where more than 50% of its stock is owned by U.S. shareholders, each holding at least 10% ownership. Subpart F income refers to specific categories of passive and mobile income earned by a CFC, such as foreign base company income and insurance income, which U.S. shareholders must include in their taxable income even if not distributed. Understanding these definitions is crucial for accurate compliance with U.S. international tax regulations targeting income deferral and base erosion.

Reporting Requirements for CFCs and Subpart F Income

Controlled Foreign Corporation (CFC) rules require U.S. shareholders owning 10% or more of a foreign corporation to report their share of the CFC's income, including Subpart F income, on their U.S. tax returns. Subpart F rules specifically target certain types of passive and easily movable income earned by CFCs, mandating inclusion in U.S. shareholder income regardless of actual distribution. Reporting requirements compel detailed disclosures of income, earnings, and taxes paid by the CFC to ensure compliance and prevent tax deferral on foreign income.

Taxation Implications for U.S. Shareholders

Controlled Foreign Corporation (CFC) rules and Subpart F rules both aim to prevent U.S. shareholders from deferring U.S. tax on certain types of income earned by foreign corporations. CFC rules require U.S. shareholders owning 10% or more of a foreign corporation to include their proportionate share of Subpart F income, which consists of passive and easily movable income, in their current taxable income. Failure to comply results in tax deferral loss and potential penalties, making these rules critical for ensuring U.S. tax compliance and preventing income shifting to low-tax jurisdictions.

Common Exceptions and Exclusions

Controlled Foreign Corporation (CFC) rules and Subpart F rules both aim to prevent tax deferral through offshore income but contain specific common exceptions and exclusions that mitigate their impact. Key exceptions include the de minimis rule, which excludes CFCs with minimal Subpart F income, and the full inclusion rule's exclusion for certain insurance income and foreign base company sales and services income under specific thresholds. Both frameworks also exclude income that qualifies as high-taxed income, providing relief when foreign tax rates exceed defined safe harbor limits.

Compliance Challenges and Risk Areas

Controlled Foreign Corporation (CFC) rules and Subpart F regulations present significant compliance challenges due to their complex definitions and varying thresholds for income inclusion. Taxpayers face heightened risk areas including misclassification of income types, failure to identify related parties accurately, and incorrect timing of income recognition, which can result in substantial penalties and interest. Navigating these regulatory frameworks requires robust documentation and vigilant monitoring of global income streams to mitigate audit risks and ensure proper tax reporting.

Recent Updates and Legislative Trends

Recent updates in Controlled Foreign Corporation (CFC) rules emphasize stricter reporting requirements and expanded definitions of income to capture more offshore earnings under taxation. Legislative trends indicate a global move towards alignment with OECD's Base Erosion and Profit Shifting (BEPS) guidelines, influencing Subpart F rules to address income shifting and profit repatriation more effectively. Enhanced transparency measures and increased penalty provisions aim to reduce tax avoidance through multinational entities operating in low-tax jurisdictions.

Important Terms

Anti-Deferral Regime

The Anti-Deferral Regime encompasses Controlled Foreign Corporation (CFC) rules that prevent U.S. taxpayers from deferring income recognition by using foreign entities, principally under Subpart F income inclusions which require immediate taxation of certain types of passive and related-party income. Subpart F rules specifically target income such as foreign base company income and insurance income to limit tax avoidance through offshore subsidiaries, ensuring timely U.S. tax on specified earnings.

Passive Foreign Investment Company (PFIC)

Passive Foreign Investment Company (PFIC) rules primarily target U.S. shareholders' tax treatment of foreign corporations with predominantly passive income or assets, while Controlled Foreign Corporation (CFC) rules focus on U.S. shareholders controlling a foreign corporation and require inclusion of Subpart F income, which generally covers certain types of passive and easily movable income. PFIC rules impose complex tax and interest charges on excess distributions and gains, contrasting with Subpart F rules that mandate current inclusion of specified foreign income to prevent deferral.

Global Intangible Low-Taxed Income (GILTI)

Global Intangible Low-Taxed Income (GILTI) targets income earned by Controlled Foreign Corporations (CFCs) that exceeds a routine return, aiming to discourage profit shifting to low-tax jurisdictions. While Subpart F rules require current inclusion of certain types of CFC income like passive and insurance income, GILTI extends taxation to a broader base of intangible income at a reduced effective rate, complementing Subpart F by addressing income not captured under its provisions.

Look-Through Rule

The Look-Through Rule allows U.S. shareholders of Controlled Foreign Corporations (CFCs) to treat certain distributions from CFCs as qualified dividends, impacting the taxation under Subpart F rules by potentially reducing immediate income inclusions. This rule focuses on dividends, interest, rents, and royalties received from related CFCs, enabling these amounts to be "looked through" to the underlying earnings and profits, thereby preventing double taxation and providing alignment with treaty benefits.

Deemed Dividend Inclusion

Deemed dividend inclusion under Controlled Foreign Corporation (CFC) rules requires U.S. shareholders to include certain undistributed earnings of CFCs in their taxable income, aligning closely with Subpart F rules that mandate immediate taxation of specified income types such as foreign base company income. Both frameworks aim to prevent income deferral and erosion of the U.S. tax base by attributing income from CFCs to U.S. shareholders, but Subpart F rules specifically define categories of income subject to current inclusion, while CFC rules focus on ownership thresholds and aggregation of income for inclusion.

Effective Tax Rate Test

The Effective Tax Rate Test evaluates whether income earned by a Controlled Foreign Corporation (CFC) is subject to low foreign tax rates, influencing the application of Subpart F rules that require U.S. shareholders to include certain types of CFC income in their taxable income. This test helps determine if the CFC's income qualifies for deferral or immediate inclusion under Subpart F, impacting the timing and amount of U.S. tax liability on foreign earnings.

Substantial U.S. Ownership

Substantial U.S. ownership in Controlled Foreign Corporation (CFC) rules is defined as U.S. shareholders owning at least 10% of the foreign corporation's voting stock, triggering income inclusion under Subpart F rules that target certain types of passive or easily movable income. Subpart F rules require U.S. shareholders to include their pro-rata share of the CFC's specified income, such as foreign base company income, in their gross income even if no distributions are made, preventing deferral of U.S. tax on income earned abroad.

Foreign Base Company Income (FBCI)

Foreign Base Company Income (FBCI) refers to specific types of income earned by a Controlled Foreign Corporation (CFC) that are subject to taxation under the U.S. tax code, designed to prevent deferral of income through offshore entities. Subpart F rules target FBCI by requiring U.S. shareholders to include certain types of passive and highly mobile income, such as foreign base company sales income and foreign base company service income, in their current taxable income, thereby limiting tax deferral advantages.

High-Tax Exception

The High-Tax Exception under U.S. Controlled Foreign Corporation (CFC) rules exempts certain foreign income taxed at a high effective rate from inclusion under Subpart F income, thereby reducing double taxation on foreign earnings. This exception applies when the foreign effective tax rate exceeds 90% of the U.S. corporate tax rate, allowing CFCs to avoid immediate U.S. taxation on such high-taxed income.

Hybrid Mismatch Arrangements

Hybrid mismatch arrangements exploit differences between Controlled Foreign Corporation (CFC) rules and Subpart F rules to achieve tax benefits by generating deductions in one jurisdiction without corresponding income inclusions in another. These structures often involve entities or instruments treated differently for U.S. tax purposes under CFC regimes versus Subpart F income recognition, leading to tax base erosion and profit shifting.

Controlled Foreign Corporation (CFC) rules vs Subpart F rules Infographic

moneydif.com

moneydif.com