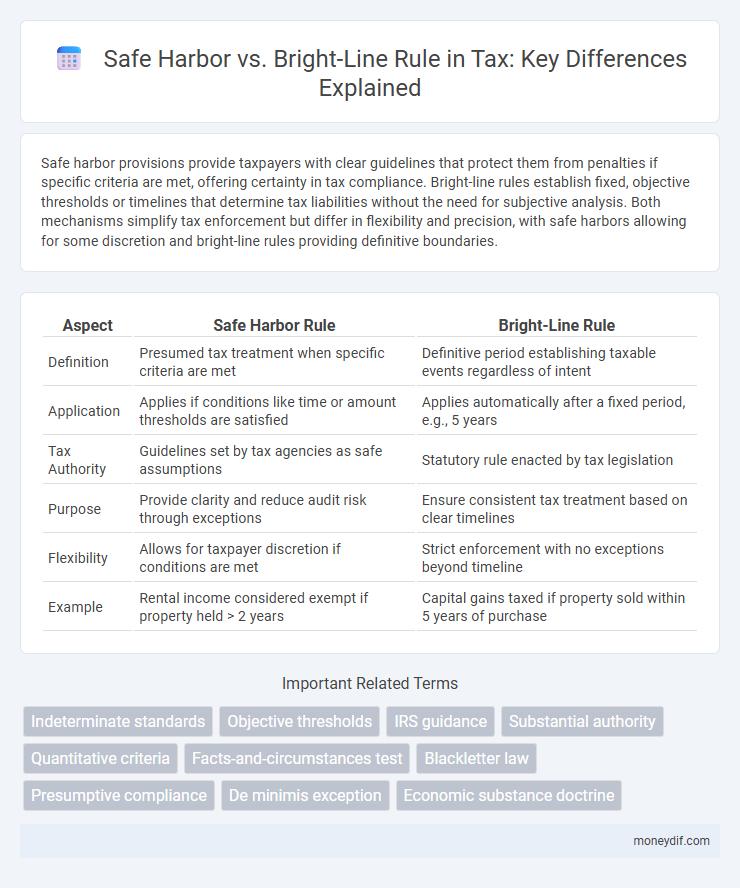

Safe harbor provisions provide taxpayers with clear guidelines that protect them from penalties if specific criteria are met, offering certainty in tax compliance. Bright-line rules establish fixed, objective thresholds or timelines that determine tax liabilities without the need for subjective analysis. Both mechanisms simplify tax enforcement but differ in flexibility and precision, with safe harbors allowing for some discretion and bright-line rules providing definitive boundaries.

Table of Comparison

| Aspect | Safe Harbor Rule | Bright-Line Rule |

|---|---|---|

| Definition | Presumed tax treatment when specific criteria are met | Definitive period establishing taxable events regardless of intent |

| Application | Applies if conditions like time or amount thresholds are satisfied | Applies automatically after a fixed period, e.g., 5 years |

| Tax Authority | Guidelines set by tax agencies as safe assumptions | Statutory rule enacted by tax legislation |

| Purpose | Provide clarity and reduce audit risk through exceptions | Ensure consistent tax treatment based on clear timelines |

| Flexibility | Allows for taxpayer discretion if conditions are met | Strict enforcement with no exceptions beyond timeline |

| Example | Rental income considered exempt if property held > 2 years | Capital gains taxed if property sold within 5 years of purchase |

Introduction to Safe Harbor and Bright-Line Rule in Tax

Safe harbor provisions in tax law provide predefined criteria that, if met, ensure compliance and reduce audit risk by offering clarity and predictability for taxpayers. The bright-line rule establishes a clear, objective threshold--such as a specific time period or monetary limit--to determine tax treatment or liability without subjective interpretation. Both concepts simplify tax decisions by minimizing ambiguity, but they apply differently depending on the nature of the transaction or tax issue involved.

Defining Safe Harbor Provisions

Safe harbor provisions in tax law establish clear thresholds or criteria that, if met, protect taxpayers from penalties or audits by providing predetermined compliance guidelines. These rules offer a protective boundary by allowing taxpayers to rely on specified criteria, reducing uncertainty compared to bright-line rules, which apply strict, objective tests without flexibility. Safe harbor serves as a risk-management tool that simplifies tax compliance in complex transactions by setting practical limits.

Understanding Bright-Line Rules

Bright-line rules provide clear, objective criteria to determine tax liabilities, minimizing ambiguity and disputes with tax authorities. These rules establish specific thresholds or time frames, such as the two-year ownership period for capital gains tax exemption, making compliance straightforward and predictable. Unlike safe harbor provisions, bright-line rules leave little room for interpretation, ensuring consistent application across similar cases.

Key Differences Between Safe Harbor and Bright-Line Rule

Safe harbor provisions offer taxpayers clear criteria to avoid audits or penalties by meeting specified thresholds, while bright-line rules establish fixed, objective tests to determine tax liability or compliance without subjective judgment. Safe harbor typically provides a degree of flexibility and discretion in interpretation, whereas bright-line rules require strict adherence to defined conditions or time frames. Understanding these distinctions is crucial for accurate tax planning and risk management under IRS regulations.

Advantages of Safe Harbor in Tax Compliance

Safe harbor provisions in tax compliance provide clear, predefined criteria that reduce the risk of audits and penalties by offering taxpayers a reliable framework for adherence. These provisions simplify complex tax regulations, enhance predictability, and minimize disputes with tax authorities, leading to greater certainty in tax reporting. Safe harbor rules also save time and resources for both taxpayers and tax administrators by streamlining compliance processes.

Pros and Cons of Bright-Line Rule in Taxation

The bright-line rule offers clarity and reduces disputes by providing a fixed time frame to determine tax liability, enhancing compliance and administrative efficiency. However, it can be overly rigid, failing to account for nuanced cases and potentially leading to unfair tax outcomes. Taxpayers may face challenges due to its inflexibility, as the rule does not consider the substance of transactions beyond the specified period.

Examples of Safe Harbor in Tax Law

Safe harbor examples in tax law include the IRS de minimis safe harbor allowing businesses to deduct tangible property costs up to $2,500 per invoice without capitalization. Another instance is the safe harbor for home office expenses that permits simplified deductions based on square footage rather than actual costs. These provisions help taxpayers avoid audits and penalties by establishing clear, predetermined criteria for compliance.

Notable Cases Involving Bright-Line Rule Applications

The bright-line rule, primarily used for capital gains tax assessments, has been pivotal in cases such as Ramon v. Commissioner, where the court reaffirmed the strict time-based criteria for property sales characterization. Contrastingly, the safe harbor provision offers prescriptive thresholds, but notable cases like Martinez v. IRS highlight its limitations when taxpayers fall just short of clear benchmarks. These rulings emphasize the judiciary's preference for the bright-line rule's clarity in determining tax liabilities on asset disposals.

Choosing Between Safe Harbor and Bright-Line Rule

Choosing between the safe harbor and bright-line rule in tax matters depends on the clarity and certainty needed for compliance. Safe harbor provisions provide taxpayers with predefined thresholds or conditions that, if met, ensure favorable treatment and reduce audit risk, while bright-line rules rely on fixed, objective criteria to determine tax obligations without requiring discretionary judgment. Taxpayers and advisors must evaluate transaction complexity, documentation capabilities, and risk tolerance to select the approach that best balances predictability and flexibility in tax reporting and liability.

Implications for Taxpayers and Practitioners

Safe harbor provisions provide clear thresholds that protect taxpayers from audits or penalties when specific criteria are met, minimizing uncertainty in tax compliance and planning. Bright-line rules establish definitive criteria for tax treatment, which simplifies decision-making but may lead to rigid applications that exclude nuanced circumstances, impacting strategic tax positions. Both frameworks influence how practitioners advise clients on risk management and compliance, with safe harbors offering flexibility and bright-line rules promoting consistency in tax enforcement.

Important Terms

Indeterminate standards

Indeterminate standards in legal contexts allow flexible interpretation based on specific case facts, contrasting with bright-line rules that offer clear, unequivocal criteria for decision-making; safe harbor provisions provide protection when specific conditions are met, reducing risk despite the inherent uncertainty of indeterminate standards. This balance helps courts and agencies navigate complex issues by combining the adaptability of standards with the predictability and clarity of bright-line rules and safe harbors.

Objective thresholds

Objective thresholds establish clear quantitative criteria that distinguish compliance under safe harbor provisions, reducing ambiguity compared to bright-line rules which rely on strict, inflexible boundaries. Safe harbor frameworks leverage these defined limits to provide legal certainty and protection from penalties when specific conditions are met, whereas bright-line rules impose absolute cutoff points regardless of context.

IRS guidance

IRS guidance distinguishes safe harbor provisions as flexible standards allowing taxpayers to rely on specific criteria to avoid penalties, whereas bright-line rules impose rigid, clear-cut tests that determine tax treatment without room for interpretation. Safe harbors often pertain to issues like valuation and classification, providing protection under defined conditions, while bright-line rules deliver unequivocal determinations on matters such as related-party transactions and income recognition.

Substantial authority

Substantial authority provides a strong legal basis for tax positions, offering a middle ground between safe harbor provisions, which offer protection under specific, clearly defined criteria, and bright-line rules that require strict compliance with explicit thresholds. This standard reduces uncertainty by allowing reasonable interpretation based on authoritative sources, whereas safe harbor ensures protection if predefined conditions are met, and bright-line rules mandate absolute adherence to clear, objective standards.

Quantitative criteria

Quantitative criteria for safe harbor typically involve specific financial thresholds or percentage limits that protect taxpayers from penalties when transactions fall within these predefined limits, while bright-line rules establish fixed, clear numerical triggers such as holding periods or income thresholds that definitively determine tax treatment. Safe harbor provisions focus on flexibility within quantifiable boundaries, whereas bright-line rules emphasize rigid, unequivocal numerical cutoffs for legal certainty in tax compliance.

Facts-and-circumstances test

The Facts-and-Circumstances Test evaluates each case based on the totality of relevant factors to determine compliance, offering flexibility absent in the Safe Harbor or Bright-Line Rule frameworks which rely on predefined criteria or fixed thresholds. Safe Harbor provisions provide protection from penalties when specific conditions are met, while Bright-Line Rules impose clear, objective standards for easier application and predictability in legal or regulatory scenarios.

Blackletter law

Blackletter law provides foundational legal principles clearly established by statutes and precedents, offering a predictable framework in contrast to the flexible, case-specific outcomes of safe harbor provisions and the absolute criteria defined by bright-line rules; safe harbor provisions protect parties who comply with specific conditions from liability, whereas bright-line rules establish clear-cut legal boundaries without room for interpretation. The tension between safe harbor and bright-line rule approaches often influences judicial reasoning and legislative drafting in areas such as copyright, securities regulation, and privacy law.

Presumptive compliance

Presumptive compliance in data privacy frameworks offers organizations a default assumption of adherence when following specific guidelines, contrasting with bright-line rules that demand strict, clear-cut thresholds without flexibility. Safe harbor provisions provide conditional protection based on demonstrated compliance efforts, while bright-line rules impose unequivocal standards that determine compliance status definitively.

De minimis exception

The De minimis exception allows minor infractions to be disregarded under safe harbor provisions, providing flexibility in regulatory enforcement by focusing on insignificant violations without triggering full penalties. Unlike a bright-line rule, which establishes clear, absolute thresholds for compliance, the De minimis exception emphasizes practical tolerance levels that prevent punitive actions for trivial breaches.

Economic substance doctrine

The Economic Substance Doctrine requires transactions to have a substantial purpose beyond tax benefits, serving as a flexible standard to evaluate tax avoidance schemes. Safe harbor provisions offer clear thresholds or criteria that automatically satisfy this doctrine, while bright-line rules provide specific, objective tests to determine compliance with economic substance.

safe harbor vs bright-line rule Infographic

moneydif.com

moneydif.com