Capital gains tax is levied on the profit earned from the sale of an asset, such as stocks or real estate, and is typically calculated based on the difference between the purchase price and the sale price. Wealth tax, on the other hand, is imposed on the total value of an individual's or household's assets, including property, investments, and cash, regardless of any transactions. Understanding the distinction between these taxes is crucial for effective financial planning and compliance with tax regulations.

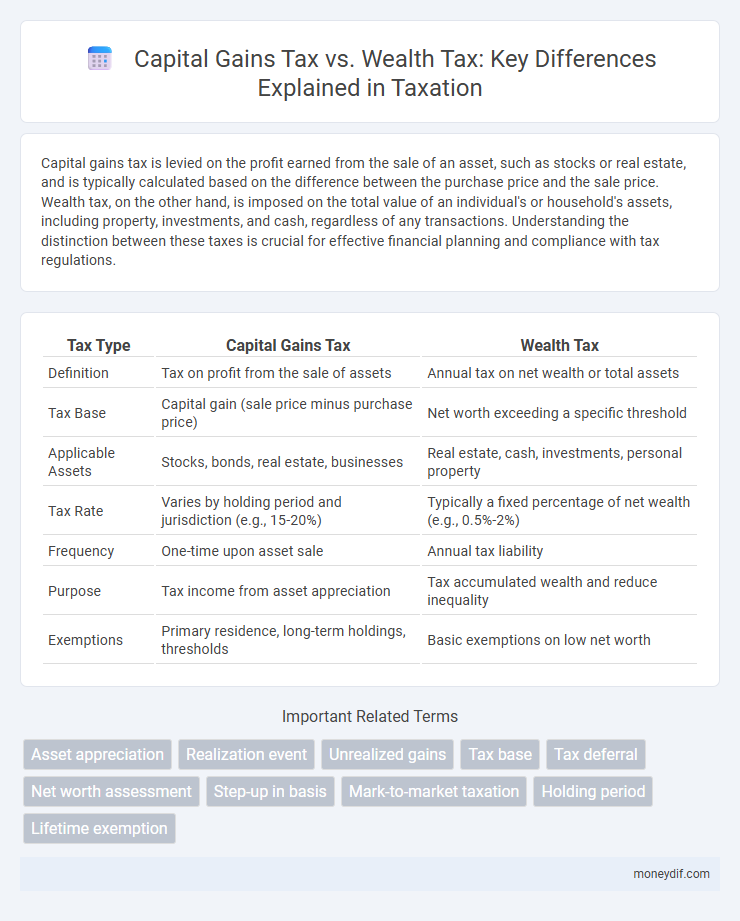

Table of Comparison

| Tax Type | Capital Gains Tax | Wealth Tax |

|---|---|---|

| Definition | Tax on profit from the sale of assets | Annual tax on net wealth or total assets |

| Tax Base | Capital gain (sale price minus purchase price) | Net worth exceeding a specific threshold |

| Applicable Assets | Stocks, bonds, real estate, businesses | Real estate, cash, investments, personal property |

| Tax Rate | Varies by holding period and jurisdiction (e.g., 15-20%) | Typically a fixed percentage of net wealth (e.g., 0.5%-2%) |

| Frequency | One-time upon asset sale | Annual tax liability |

| Purpose | Tax income from asset appreciation | Tax accumulated wealth and reduce inequality |

| Exemptions | Primary residence, long-term holdings, thresholds | Basic exemptions on low net worth |

Introduction to Capital Gains Tax and Wealth Tax

Capital gains tax is levied on the profit realized from the sale of assets such as stocks, bonds, or real estate, calculated based on the difference between the sale price and the original purchase price. Wealth tax, on the other hand, is an annual tax imposed on an individual's net worth, including assets like property, investments, and cash, regardless of any transaction. Understanding the distinctions between capital gains tax and wealth tax is crucial for effective financial planning and compliance with tax regulations.

Key Differences Between Capital Gains Tax and Wealth Tax

Capital gains tax is levied on the profit realized from the sale of assets such as stocks, bonds, or real estate, typically incurred at the point of transaction. Wealth tax, however, is an annual tax on an individual's net assets, including properties, investments, and cash holdings above a specified threshold. The key differences include timing--capital gains tax applies on asset disposal, whereas wealth tax is assessed periodically on the overall value of owned assets.

How Capital Gains Tax Works

Capital gains tax is levied on the profit realized from the sale of assets such as stocks, real estate, or bonds, calculated as the difference between the asset's sale price and its original purchase price. The tax rate varies depending on the holding period, with short-term capital gains taxed at ordinary income rates and long-term gains subjected to lower rates to incentivize investment. In contrast to wealth tax, which applies annually on the net value of assets owned, capital gains tax is only triggered upon the sale or disposition of an asset.

How Wealth Tax Works

Wealth tax is an annual tax imposed on the net value of an individual's assets, including real estate, investments, and cash holdings, above a certain threshold. Unlike capital gains tax, which is levied on the profit from the sale of assets, wealth tax targets the total accumulated wealth regardless of income or transaction activity. Governments implement wealth tax to address wealth inequality and generate revenue by taxing the rich based on their overall asset base.

Tax Rates and Assessment Methods

Capital gains tax is typically levied on the profit realized from the sale of assets, with rates varying between short-term and long-term holdings, often ranging from 0% to 20% depending on jurisdiction and income level. Wealth tax is assessed annually on the net value of an individual's total assets above a specific threshold, with rates commonly spanning 0.1% to 3%, based on the total wealth valuation. The assessment method for capital gains tax is transactional and event-driven, while wealth tax relies on periodic asset valuation and comprehensive reporting of owned properties and financial holdings.

Impact on Investors and Asset Holders

Capital gains tax directly affects investors by taxing the profits realized from the sale of assets, potentially influencing the timing and frequency of asset transactions. Wealth tax imposes an annual charge on the net value of an individual's assets, impacting long-term asset holders by reducing overall wealth accumulation. Understanding these tax structures is critical for strategic financial planning and optimizing investment returns.

International Comparisons: Global Approaches

Capital gains tax and wealth tax differ significantly in international application, with countries like the United States and the United Kingdom primarily emphasizing capital gains taxation on asset sales, while nations such as Switzerland and Norway implement wealth taxes targeting net asset values annually. The capital gains tax rates vary globally, ranging from 0% in tax havens to over 30% in high-tax jurisdictions, reflecting diverse fiscal policies and economic priorities. Wealth taxes remain less common but are gaining attention for addressing inequality, with rates typically set between 0.1% and 2.5% on net wealth thresholds, highlighting varying approaches to wealth redistribution worldwide.

Pros and Cons of Capital Gains Tax

Capital gains tax incentivizes long-term investment by taxing profits from asset sales, promoting economic growth through capital allocation. However, it can discourage asset turnover and realization of gains, leading to potential market inefficiencies and deferred tax revenue. Unlike wealth tax, capital gains tax targets actual profit events rather than holding wealth, minimizing administrative complexity and valuation disputes.

Pros and Cons of Wealth Tax

Wealth tax targets the net value of an individual's assets, promoting wealth redistribution and potentially reducing economic inequality by taxing the rich more heavily. It may encourage asset liquidation and pose administrative challenges due to valuation complexities and compliance costs. However, wealth tax can generate steady revenue streams for governments while disincentivizing excessive wealth accumulation.

Policy Considerations and Future Trends

Capital gains tax targets profits from asset sales, influencing investment behavior and market liquidity, while wealth tax imposes levies on net assets to address wealth inequality and generate steady revenue. Policy debates center on balancing economic growth incentives against fairness and administrative feasibility, with capital gains tax linked to potential realization timing distortions and wealth tax challenged by valuation complexities. Future trends suggest increased consideration of wealth taxes amid rising inequality, alongside refined capital gains tax structures to close loopholes and enhance progressivity.

Important Terms

Asset appreciation

Asset appreciation increases the market value of investments, potentially triggering capital gains tax upon sale, which taxes the profit realized from the asset's sale price exceeding its purchase price. Wealth tax, in contrast, is levied annually on the total value of owned assets, including appreciated assets, independent of any transaction or sale.

Realization event

Realization events trigger capital gains tax liabilities by converting asset appreciation into taxable income, whereas wealth tax assesses the total net value of assets without requiring a sale or transfer. Understanding the timing and nature of realization events is crucial for effective tax planning in jurisdictions where both capital gains tax and wealth tax coexist.

Unrealized gains

Unrealized gains represent the increase in value of an asset that has not yet been sold and are typically not subject to capital gains tax until realized through a transaction. Wealth tax, contrastingly, may apply annually on the total net assets including unrealized gains, depending on jurisdiction, impacting overall tax liability independent of asset sale.

Tax base

Capital gains tax is levied on the profit realized from the sale of assets like stocks or property, focusing solely on the increase in value during the holding period, whereas wealth tax is imposed annually on the total net worth of an individual or household, encompassing all assets including cash, real estate, and investments. The tax base for capital gains tax is the net gain from asset transactions, while wealth tax targets the aggregate market value of owned assets at a specific point in time.

Tax deferral

Tax deferral strategies enable investors to postpone capital gains tax liabilities, preserving capital for reinvestment and enhancing long-term growth potential. Unlike wealth tax, which is imposed annually based on net assets, capital gains tax is triggered only upon realization of asset sales, making deferral a key tool for optimizing tax efficiency.

Net worth assessment

Net worth assessment calculates the total value of assets held, which serves as a critical factor in determining exposure to wealth tax, whereas capital gains tax is levied on the profit realized from the sale of assets rather than on overall asset value. Understanding the difference between capital gains tax, which targets transaction profits, and wealth tax, based on total net worth, is essential for effective tax planning and compliance.

Step-up in basis

Step-up in basis adjusts the value of an inherited asset to its fair market value at the date of the decedent's death, effectively reducing the capital gains tax liability upon sale by minimizing the taxable gain. This adjustment does not apply to wealth tax calculations, which typically assess the total value of assets owned regardless of their basis, thereby distinguishing capital gains tax obligations from wealth tax liabilities.

Mark-to-market taxation

Mark-to-market taxation requires investors to report unrealized gains on assets annually as if they were sold, contrasting with capital gains tax, which is applied only upon the actual sale or realization of an asset. Wealth tax targets an individual's total net worth, including all assets, regardless of transactions, making mark-to-market taxation more closely aligned with capturing annual income fluctuations through asset value changes.

Holding period

Holding period significantly influences capital gains tax rates, with longer durations typically qualifying for lower tax rates on asset appreciation, unlike wealth tax which is levied annually on the net value of assets irrespective of holding period. Capital gains tax depends on the period an asset is held before sale, whereas wealth tax assesses overall asset value at a specific point in time.

Lifetime exemption

The lifetime exemption for capital gains tax allows individuals to exclude a specific amount of profit from the sale of assets, reducing their taxable income, while wealth tax is imposed annually on the net value of an individual's total assets above a certain threshold. Capital gains tax focuses on realized gains from asset sales, whereas wealth tax targets the overall accumulated wealth regardless of any transactions.

Capital gains tax vs wealth tax Infographic

moneydif.com

moneydif.com