The Alternative Minimum Tax (AMT) ensures taxpayers pay a minimum amount of tax by recalculating income without certain deductions allowed under the regular tax system. Unlike regular tax, AMT disallows specific exemptions and deductions, which can result in a higher tax liability for some individuals. Understanding the differences between AMT and regular tax is crucial for effective tax planning and avoiding unexpected tax bills.

Table of Comparison

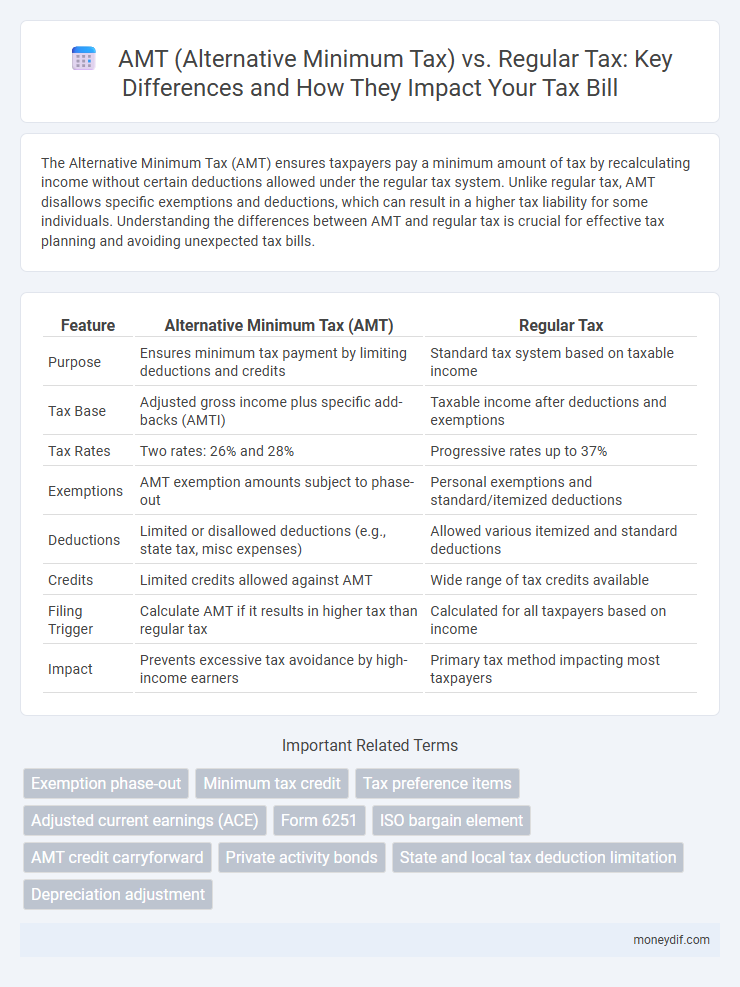

| Feature | Alternative Minimum Tax (AMT) | Regular Tax |

|---|---|---|

| Purpose | Ensures minimum tax payment by limiting deductions and credits | Standard tax system based on taxable income |

| Tax Base | Adjusted gross income plus specific add-backs (AMTI) | Taxable income after deductions and exemptions |

| Tax Rates | Two rates: 26% and 28% | Progressive rates up to 37% |

| Exemptions | AMT exemption amounts subject to phase-out | Personal exemptions and standard/itemized deductions |

| Deductions | Limited or disallowed deductions (e.g., state tax, misc expenses) | Allowed various itemized and standard deductions |

| Credits | Limited credits allowed against AMT | Wide range of tax credits available |

| Filing Trigger | Calculate AMT if it results in higher tax than regular tax | Calculated for all taxpayers based on income |

| Impact | Prevents excessive tax avoidance by high-income earners | Primary tax method impacting most taxpayers |

Overview of AMT and Regular Tax Systems

The Alternative Minimum Tax (AMT) is designed to ensure taxpayers with high income pay a minimum level of tax by adding back certain deductions and exemptions to taxable income, contrasting with the regular tax system which allows standard deductions and credits. The AMT calculation involves specific adjustments and preference items, resulting in an alternative tax liability that taxpayers must pay if it exceeds their regular tax. Understanding the differences between the AMT and regular tax systems is crucial for tax planning, as the AMT sidelines several common tax benefits, potentially increasing overall tax burden.

Key Differences Between AMT and Regular Tax

The Alternative Minimum Tax (AMT) ensures taxpayers pay a minimum level of tax by recalculating income without certain deductions allowed under the Regular Tax system, such as state and local tax deductions. AMT applies a separate set of rates and exempts thresholds, often resulting in higher taxable income for high earners compared to the Regular Tax calculation. Unlike Regular Tax, AMT disallows many credits and deductions, targeting taxpayers who claim excessive incentives, ultimately preventing tax avoidance.

History and Purpose of the Alternative Minimum Tax

The Alternative Minimum Tax (AMT) was established in 1969 to ensure that high-income taxpayers pay a minimum level of tax, targeting those who used numerous deductions and credits to reduce their regular tax liability to very low levels. Initially designed to prevent tax avoidance by wealthy individuals, the AMT recalculates income tax after adding back certain tax preference items, applying a separate set of rules to determine a minimum tax amount. Its historical purpose is to maintain fairness in the tax system by requiring taxpayers to pay at least a baseline tax, regardless of deductions claimed under the regular tax system.

How the Regular Tax is Calculated

Regular tax is calculated based on taxable income using the IRS tax brackets and rates applicable to filing status, incorporating allowable deductions and credits to reduce overall liability. The process involves applying the standard or itemized deductions, calculating adjusted gross income, and then using graduated tax rates to determine the tax owed before credits. Unlike AMT, regular tax computation factors in a broader range of deductions and preferential tax treatments without the specific add-backs required by the AMT system.

Calculating Your AMT Liability

Calculating your AMT liability requires first determining your Alternative Minimum Taxable Income (AMTI) by adding back specific tax preference items to your regular taxable income. Next, subtract the AMT exemption amount, which varies based on filing status, to arrive at the taxable base for AMT. Finally, apply the AMT tax rates, typically 26% or 28%, depending on income level, and compare the result to your regular tax liability to pay the higher amount.

Common Triggers for the AMT

Common triggers for the Alternative Minimum Tax (AMT) include exercising incentive stock options, claiming high state and local tax deductions, and reporting large amounts of miscellaneous itemized deductions. Taxpayers with significant tax preference items such as accelerated depreciation or tax-exempt interest from private activity bonds may also face AMT liability. Identifying these triggers is crucial for accurate tax planning and avoiding unexpected AMT payments.

Deductions and Credits: AMT vs Regular Tax

The Alternative Minimum Tax (AMT) disallows many deductions and credits that are permitted under the regular tax system, such as state and local tax deductions and miscellaneous itemized deductions. Credits like the foreign tax credit may be limited under AMT rules, significantly impacting tax liability for high-income earners. Understanding these differences is critical for tax planning and minimizing exposure to AMT.

Who is Most Affected by the AMT?

High-income earners with multiple deductions or credits, such as state and local tax deductions or incentive stock options, are most affected by the Alternative Minimum Tax (AMT). Taxpayers who live in high-tax states or have large families also face increased AMT liability due to reduced exemptions compared to the regular tax system. Middle-income taxpayers who exercise incentive stock options in a given year may unexpectedly trigger AMT, resulting in higher tax bills despite regular tax calculations.

Strategies to Minimize AMT Impact

Taxpayers can minimize the impact of the Alternative Minimum Tax (AMT) by deferring income, accelerating deductions, and carefully managing incentive stock options (ISOs) to avoid triggering AMT liability. Strategically timing the exercise of ISOs and maximizing deductions such as state and local taxes in AMT-favorable years can reduce exposure. Utilizing AMT credits generated in prior years to offset regular tax in future years also helps mitigate the financial burden associated with AMT.

Future Trends and Legislative Changes in AMT

Future trends in AMT indicate potential legislative adjustments aimed at increasing exemption amounts and indexing them to inflation to reduce taxpayer burden. Policymakers are considering reforms to limit AMT applicability on middle-income earners while preserving revenue from high-income taxpayers. Advances in tax software and data analytics will enhance compliance monitoring, making enforcement of AMT provisions more efficient and accurate.

Important Terms

Exemption phase-out

The exemption phase-out for the Alternative Minimum Tax (AMT) reduces the AMT exemption amount as income exceeds specific thresholds, effectively increasing AMT liability for higher earners; this contrasts with the regular tax system where exemption amounts either remain fixed or phase out differently based on filing status. For example, in 2024, the AMT exemption begins to phase out at $578,150 for single filers and $1,156,300 for joint filers, whereas regular tax exemptions and deductions follow distinct phase-out limits influenced by adjusted gross income and tax brackets.

Minimum tax credit

Minimum tax credit allows taxpayers to recover AMT (Alternative Minimum Tax) paid in prior years by offsetting it against their regular tax liability in future years, ensuring they do not pay more tax than intended. This credit specifically applies when AMT exceeds regular tax, allowing for a reduction in regular tax payment by the amount of previously paid AMT credits.

Tax preference items

Tax preference items, such as tax-exempt interest from private activity bonds, depreciation adjustments, and intangible drilling costs, increase the Alternative Minimum Tax (AMT) calculation by adding back specific deductions or exclusions disallowed under AMT rules. These items create a different taxable income base under AMT compared to regular tax, which can result in higher tax liability for individuals or corporations subject to the AMT system.

Adjusted current earnings (ACE)

Adjusted Current Earnings (ACE) serve as a tax preference item that can increase the Alternative Minimum Tax (AMT) liability by adding back certain income modifications not included in regular taxable income. The ACE adjustment ensures that corporations with high economic income but low regular taxable income pay a minimum level of tax under the AMT system, preventing significant tax avoidance.

Form 6251

Form 6251 calculates the Alternative Minimum Tax (AMT) by adding specific tax preference items back to regular taxable income to ensure taxpayers pay a minimum amount of tax. It compares the AMT liability against the regular tax and requires payment of the higher amount to prevent excessive tax avoidance.

ISO bargain element

The ISO bargain element, the difference between the exercise price and the fair market value of Incentive Stock Options (ISOs) at exercise, is included as an adjustment in calculating the Alternative Minimum Tax (AMT). Although this bargain element is not taxable under the regular tax in the year of exercise, it can trigger AMT liability, creating a key difference between AMT and regular tax treatment of ISOs.

AMT credit carryforward

AMT credit carryforward allows taxpayers to apply unused Alternative Minimum Tax payments against future Regular Tax liabilities, reducing double taxation effects. This credit accumulates when AMT paid exceeds regular tax and can be utilized until fully exhausted or expired under IRS rules.

Private activity bonds

Private activity bonds often trigger the Alternative Minimum Tax (AMT) because interest income from these bonds is considered a preference item, unlike tax-exempt bonds for public projects which are generally exempt from AMT. Investors subject to AMT may have higher tax liabilities on earnings from private activity bonds compared to regular tax calculations, necessitating careful tax planning.

State and local tax deduction limitation

The State and Local Tax (SALT) deduction is limited to $10,000 for both regular tax and Alternative Minimum Tax (AMT) calculations, reducing taxpayers' ability to fully offset state and local income, sales, and property taxes. Under AMT, while certain deductions are disallowed, the SALT deduction cap remains fixed, often resulting in higher taxable income compared to regular tax rules.

Depreciation adjustment

Depreciation adjustment for AMT requires calculating Alternative Minimum Taxable Income by adding back the excess depreciation claimed under the regular tax system, often using the adjusted gain or Modified Accelerated Cost Recovery System (MACRS) depreciation with longer recovery periods. This adjustment ensures taxpayers pay a minimum tax by limiting accelerated depreciation methods that significantly reduce regular taxable income compared to AMT calculations.

AMT (Alternative Minimum Tax) vs Regular tax Infographic

moneydif.com

moneydif.com