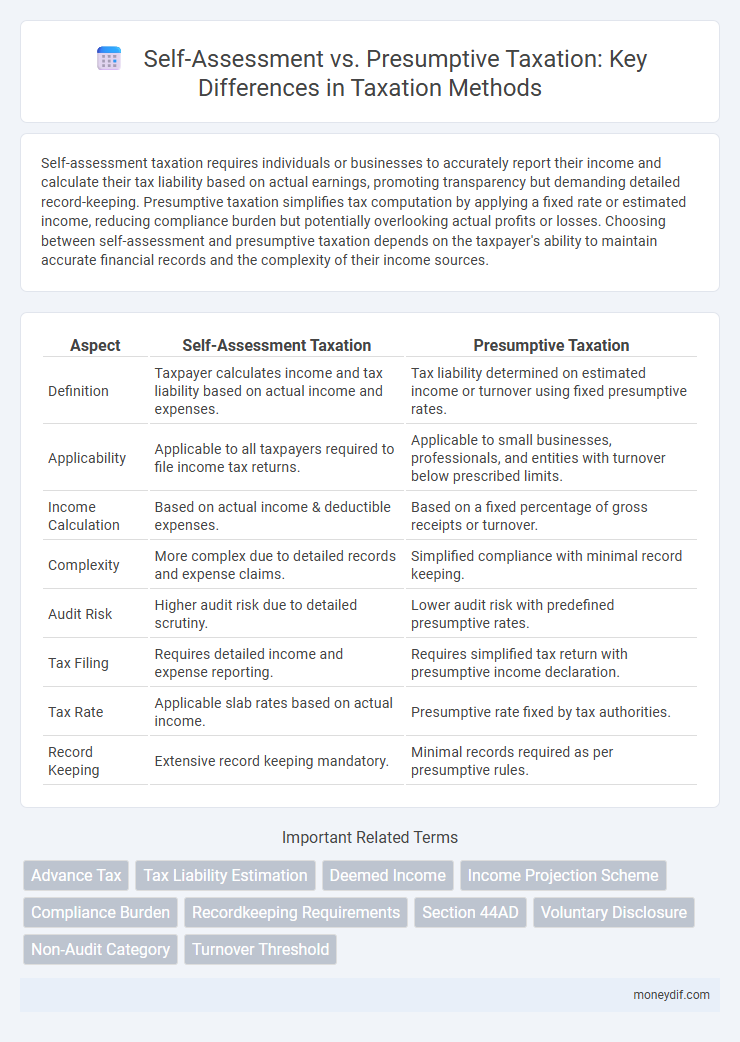

Self-assessment taxation requires individuals or businesses to accurately report their income and calculate their tax liability based on actual earnings, promoting transparency but demanding detailed record-keeping. Presumptive taxation simplifies tax computation by applying a fixed rate or estimated income, reducing compliance burden but potentially overlooking actual profits or losses. Choosing between self-assessment and presumptive taxation depends on the taxpayer's ability to maintain accurate financial records and the complexity of their income sources.

Table of Comparison

| Aspect | Self-Assessment Taxation | Presumptive Taxation |

|---|---|---|

| Definition | Taxpayer calculates income and tax liability based on actual income and expenses. | Tax liability determined on estimated income or turnover using fixed presumptive rates. |

| Applicability | Applicable to all taxpayers required to file income tax returns. | Applicable to small businesses, professionals, and entities with turnover below prescribed limits. |

| Income Calculation | Based on actual income & deductible expenses. | Based on a fixed percentage of gross receipts or turnover. |

| Complexity | More complex due to detailed records and expense claims. | Simplified compliance with minimal record keeping. |

| Audit Risk | Higher audit risk due to detailed scrutiny. | Lower audit risk with predefined presumptive rates. |

| Tax Filing | Requires detailed income and expense reporting. | Requires simplified tax return with presumptive income declaration. |

| Tax Rate | Applicable slab rates based on actual income. | Presumptive rate fixed by tax authorities. |

| Record Keeping | Extensive record keeping mandatory. | Minimal records required as per presumptive rules. |

Understanding Self-Assessment Taxation

Self-assessment taxation requires taxpayers to accurately calculate and report their income, deductions, and tax liabilities based on actual financial records, ensuring compliance with local tax laws. This system promotes transparency and accountability, allowing individuals and businesses to maintain detailed documentation to support their tax returns. Unlike presumptive taxation, which estimates tax based on fixed criteria or turnover, self-assessment reflects the true economic position of the taxpayer, enabling precise tax computation.

What is Presumptive Taxation?

Presumptive taxation is a simplified tax system where income is estimated based on certain indicators rather than actual profit or income records, helping small businesses and professionals reduce compliance burdens. This method allows taxpayers to pay tax at a fixed percentage of gross receipts or turnover, bypassing complex accounting and audit requirements. It is designed to ease tax administration and encourage voluntary compliance among taxpayers with low or unorganized incomes.

Key Differences Between Self-Assessment and Presumptive Taxation

Self-assessment taxation requires taxpayers to calculate their own taxable income and pay taxes accordingly, ensuring compliance through detailed record-keeping and documentation. Presumptive taxation simplifies tax calculation by applying a fixed rate or percentage to a predetermined base, often used by small businesses or professionals with minimal accounting. Key differences include the accuracy of income reporting, complexity of compliance, and eligibility criteria, with self-assessment promoting transparency and presumptive taxation facilitating ease of filing.

Eligibility Criteria for Self-Assessment Taxation

Eligibility criteria for self-assessment taxation require taxpayers to maintain detailed financial records and accurately report total income, including all sources such as salary, business income, and capital gains. Individuals and businesses must compute their own tax liability based on applicable tax laws without relying on pre-determined tax estimates. This method is generally available to taxpayers whose income exceeds the threshold limits set by the tax authorities and who have the capacity to perform precise tax calculations.

Who Can Opt for Presumptive Taxation?

Presumptive taxation is available for small taxpayers and professionals whose annual turnover or gross receipts do not exceed specified limits set by tax authorities, such as Rs2 crore for businesses under Section 44AD and Rs50 lakh for professionals under Section 44ADA of the Income Tax Act. Eligible individuals include small traders, shopkeepers, consultants, and freelancers who prefer a simplified tax calculation without maintaining extensive books of accounts. This scheme helps reduce compliance burden while ensuring taxable income is calculated on a deemed percentage of turnover or receipts.

Tax Calculation Methods: Self-Assessment vs Presumptive Taxation

Self-assessment taxation requires taxpayers to calculate their taxable income by meticulously accounting for all income sources and allowable expenses, enabling precise tax liability determination. Conversely, presumptive taxation simplifies the process by applying a fixed rate or percentage to estimated income, reducing compliance burdens but potentially overlooking detailed expense deductions. The choice between these methods hinges on business size, complexity, and the taxpayer's ability to maintain accurate financial records.

Compliance Requirements for Each Taxation Method

Self-assessment taxation mandates detailed record-keeping, timely filing of accurate tax returns, and adherence to specific reporting standards set by tax authorities. Presumptive taxation simplifies compliance by requiring taxpayers to report income based on predetermined rates or percentages, reducing documentation and audit frequency. Understanding the regulatory obligations and deadlines unique to each method ensures accurate tax reporting and minimizes penalties.

Advantages of Self-Assessment Taxation

Self-assessment taxation offers taxpayers greater control over accurate income reporting and deduction claims, ensuring compliance with tax laws while potentially reducing audit risks. This method enables detailed documentation of actual earnings and expenses, fostering transparency and precision in tax liability determination. Tax authorities benefit from reliable data, which simplifies enforcement and supports tailored taxpayer services.

Benefits of Presumptive Taxation

Presumptive taxation simplifies compliance by allowing small businesses to pay taxes based on estimated income, reducing the need for detailed accounting records and minimizing audit risks. It offers lower compliance costs and eases the tax filing process for micro and small enterprises, promoting higher voluntary tax participation. This method also provides greater predictability in tax liabilities, enabling better financial planning for taxpayers.

Choosing the Right Taxation Method for Your Business

Self-assessment taxation requires maintaining detailed financial records and reporting actual income, making it ideal for businesses with complex transactions and fluctuating revenues. Presumptive taxation simplifies compliance by estimating income based on predefined criteria, benefiting small businesses and startups with limited bookkeeping capabilities. Selecting the appropriate method depends on business size, record-keeping capacity, and the predictability of earnings to optimize tax liability and regulatory adherence.

Important Terms

Advance Tax

Advance tax requires taxpayers to pay estimated income tax in installments based on actual or expected earnings, ensuring timely revenue collection. Self-assessment tax applies when the tax liability exceeds advance tax paid, while presumptive taxation offers simplified tax computation with fixed profit rates, reducing compliance burden for small businesses and professionals.

Tax Liability Estimation

Tax liability estimation for self-assessment requires detailed reporting of actual income and allowable deductions, resulting in accurate tax calculation based on individual financial records. Presumptive taxation simplifies this process by applying a fixed rate or percentage on estimated turnover or income, reducing compliance burden but potentially overlooking specific expenses and deductions.

Deemed Income

Deemed income under self-assessment allows taxpayers to report income based on actual earnings and allowable deductions, facilitating precise tax calculations, while presumptive taxation simplifies the process by estimating income at a fixed rate or percentage, reducing compliance burden for small businesses and professionals. Understanding the distinctions helps optimize tax liability and ensures adherence to tax regulations in jurisdictions offering both methods.

Income Projection Scheme

Income Projection Scheme helps taxpayers estimate future income under Self-assessment, which involves detailed income reporting and tax calculation based on actual profits, contrasted with Presumptive Taxation that allows simplified tax computation using a fixed percentage of gross receipts or turnover. Opting for Self-assessment provides flexibility to declare accurate income but requires extensive documentation, whereas Presumptive Taxation reduces compliance burden by applying standardized income assumptions for small businesses and professionals.

Compliance Burden

Compliance burden in self-assessment taxation involves detailed record-keeping, accurate income reporting, and timely filing, often requiring professional assistance to avoid errors and penalties. Presumptive taxation eases compliance by allowing taxpayers to declare income based on fixed criteria or estimated turnover, reducing paperwork and audit risks but possibly limiting deductions and tax planning opportunities.

Recordkeeping Requirements

Self-assessment taxation requires detailed and accurate recordkeeping of income, expenses, and financial transactions to calculate taxable income precisely. Presumptive taxation simplifies recordkeeping by allowing taxpayers to pay tax based on a fixed percentage of gross receipts or turnover, reducing the need for extensive documentation.

Section 44AD

Section 44AD of the Income Tax Act allows small businesses with turnover up to Rs2 crore to opt for presumptive taxation at 8% of total turnover, simplifying compliance by eliminating detailed expense calculations. Self-assessment requires calculating actual profits and filing returns accordingly, which can involve extensive record-keeping, unlike the streamlined approach under presumptive taxation in Section 44AD.

Voluntary Disclosure

Voluntary disclosure allows taxpayers to reveal previously unreported income, providing an opportunity to rectify tax liabilities under both self-assessment and presumptive taxation regimes. Self-assessment requires detailed income verification and accurate computation of tax dues, whereas presumptive taxation offers simplified tax calculations based on fixed presumptive income rates, making voluntary disclosure more straightforward for small businesses and professionals.

Non-Audit Category

Non-audit category services typically exclude mandatory financial statement audits but may include self-assessment procedures where taxpayers evaluate their own tax liabilities using defined criteria. Presumptive taxation simplifies tax compliance by allowing fixed income estimation without detailed audits, reducing the need for extensive documentation or verification in non-audit scenarios.

Turnover Threshold

Turnover threshold determines eligibility for self-assessment or presumptive taxation schemes, where businesses below a specific revenue limit qualify for simplified presumptive tax calculations. Exceeding the turnover threshold mandates detailed self-assessment, requiring comprehensive income reporting and tax computations.

Self-assessment vs presumptive taxation Infographic

moneydif.com

moneydif.com