Schedule C is used to report income or loss from a sole proprietorship or single-member LLC, detailing business income and expenses. Schedule E is designed for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in Real Estate Mortgage Investment Conduits (REMICs). Properly distinguishing between Schedule C and Schedule E ensures accurate tax filing and maximizes allowable deductions based on the nature of the income.

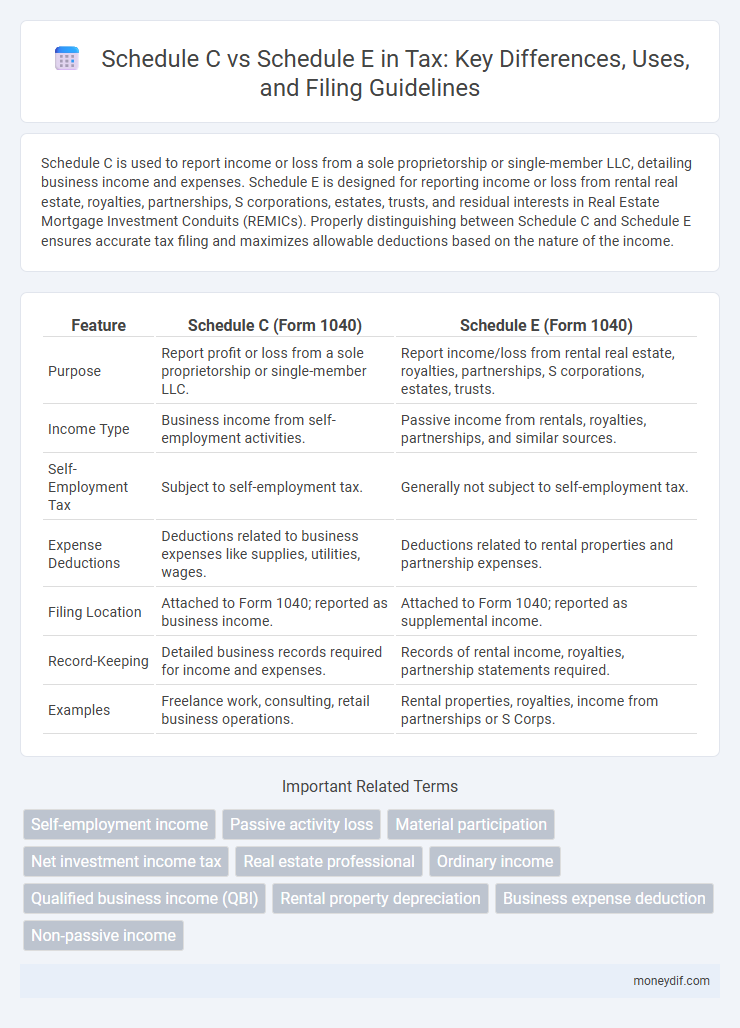

Table of Comparison

| Feature | Schedule C (Form 1040) | Schedule E (Form 1040) |

|---|---|---|

| Purpose | Report profit or loss from a sole proprietorship or single-member LLC. | Report income/loss from rental real estate, royalties, partnerships, S corporations, estates, trusts. |

| Income Type | Business income from self-employment activities. | Passive income from rentals, royalties, partnerships, and similar sources. |

| Self-Employment Tax | Subject to self-employment tax. | Generally not subject to self-employment tax. |

| Expense Deductions | Deductions related to business expenses like supplies, utilities, wages. | Deductions related to rental properties and partnership expenses. |

| Filing Location | Attached to Form 1040; reported as business income. | Attached to Form 1040; reported as supplemental income. |

| Record-Keeping | Detailed business records required for income and expenses. | Records of rental income, royalties, partnership statements required. |

| Examples | Freelance work, consulting, retail business operations. | Rental properties, royalties, income from partnerships or S Corps. |

Understanding Schedule C and Schedule E

Schedule C reports income and expenses from a sole proprietorship or single-member LLC, detailing profit or loss from business activities. Schedule E is used to report income or losses from rental properties, royalties, partnerships, S corporations, estates, and trusts. Understanding the distinction between Schedule C for active business operations and Schedule E for passive income streams is crucial for accurate tax filing and compliance.

Key Differences Between Schedule C and Schedule E

Schedule C reports income and expenses from sole proprietorships or single-member LLCs, directly impacting self-employment taxes and Medicare contributions. Schedule E is used for supplemental income such as rental properties, royalties, and partnerships, typically avoiding self-employment tax on income reported. Understanding the distinction affects tax liability, deductions, and filing requirements for business versus passive income streams.

Who Should Use Schedule C?

Self-employed individuals, sole proprietors, and single-member LLC owners should use Schedule C to report income and expenses from their business activities. Schedule C is essential for those actively operating a trade or business and seeking to claim deductions directly related to business operations. Freelancers, independent contractors, and small business owners commonly file Schedule C to calculate their net profit or loss for tax purposes.

Who Should Use Schedule E?

Schedule E is designed for taxpayers who earn income from rental real estate, royalties, partnerships, S corporations, estates, and trusts. Individuals with passive income sources, such as rental property owners or partners in a business, should file Schedule E to report income and deductions accurately. Unlike Schedule C, which is for self-employed business income, Schedule E focuses on supplemental income streams and passive investments.

Reporting Business Income on Schedule C

Schedule C reports business income and expenses for sole proprietors, encompassing revenue from self-employment activities. This form requires detailed documentation of gross receipts, cost of goods sold, and deductible business expenses to calculate net profit or loss, which directly impacts taxable income. Unlike Schedule E, which reports passive income from rental real estate, royalties, and partnerships, Schedule C is essential for accurately reflecting active business earnings to the IRS.

Reporting Rental and Passive Income on Schedule E

Schedule E is specifically designed for reporting rental real estate, royalties, partnerships, S corporations, estates, and trusts income, capturing passive income accurately. Unlike Schedule C, which focuses on active business income from sole proprietorships, Schedule E requires detailed reporting of rental expenses and income, highlighting passive activity losses and credits. Proper use of Schedule E ensures compliance with IRS passive activity loss rules and maximizes allowable deductions related to rental and other passive income sources.

Tax Deductions Available for Schedule C Filers

Schedule C filers can deduct a wide range of business expenses including office supplies, mileage, home office, and advertising costs, which directly reduce taxable income. Unlike Schedule E, which generally covers rental income with limited deductions, Schedule C allows for deductions related to self-employment tax, health insurance premiums, and retirement plan contributions. Maximizing these deductions on Schedule C helps independent contractors and sole proprietors optimize their tax liability.

Tax Deductions Available for Schedule E Filers

Schedule E filers can deduct expenses related to rental properties, such as mortgage interest, property taxes, insurance, maintenance, repairs, and depreciation, which reduce taxable rental income. Unlike Schedule C, which primarily reports income from self-employment with deductions including business expenses and self-employment tax, Schedule E focuses on passive income sources with allowable deductions tied to property management costs. Understanding these differences helps taxpayers optimize deductions by correctly categorizing income and expenses for rental activities under Schedule E.

Filing Requirements and Documentation

Schedule C requires self-employed individuals and sole proprietors to report business income and expenses, necessitating detailed records such as receipts, invoices, and mileage logs. Schedule E is used to report income and losses from rental properties, royalties, partnerships, and S corporations, requiring documentation including lease agreements, mortgage interest statements, and partnership K-1 forms. Accurate record-keeping tailored for each schedule ensures compliance with IRS filing requirements and supports deductions during tax preparation.

Choosing the Right Schedule for Your Situation

Schedule C is designed for reporting income and expenses from a sole proprietorship or single-member LLC engaged in active business operations, making it ideal for self-employed individuals who actively manage their business. Schedule E is used for reporting income or losses from rental real estate, royalties, partnerships, S corporations, estates, and trusts, suited for taxpayers earning passive income streams. Selecting the appropriate schedule depends on whether income is earned through active business activities (Schedule C) or passive investments (Schedule E), directly impacting tax treatment and allowable deductions.

Important Terms

Self-employment income

Self-employment income primarily reported on Schedule C involves active business operations and is subject to self-employment tax, while Schedule E income typically arises from passive activities like rental real estate, royalties, or partnerships and is not subject to self-employment tax unless materially participated. Distinguishing between Schedule C and Schedule E income is crucial for accurate tax filing and maximizing deductions associated with active versus passive income streams.

Passive activity loss

Passive activity loss rules limit the ability to deduct losses from rental properties reported on Schedule E, while losses from active business operations on Schedule C are generally fully deductible against other income. Schedule E losses are subject to passive activity loss limitations unless the taxpayer qualifies as a real estate professional, whereas Schedule C losses reflect non-passive, self-employment income and losses.

Material participation

Material participation determines whether income from rental real estate activities is reported on Schedule C or Schedule E; active involvement typically qualifies for Schedule C, subject to self-employment tax, while passive participation results in reporting income on Schedule E without self-employment tax. The IRS uses specific tests, like hours worked and significant participation, to establish material participation status, impacting tax treatment and potential deductions.

Net investment income tax

Net Investment Income Tax (NIIT) applies to passive income reported on Schedule E, such as rental real estate, royalties, and partnership income, but does not apply to active business income reported on Schedule C. Taxpayers with significant passive income exceeding the NIIT thresholds must calculate 3.8% tax on the lesser of net investment income or excess modified adjusted gross income.

Real estate professional

Real estate professionals must carefully differentiate between Schedule C and Schedule E when reporting income and expenses; Schedule C is used for active business activities, including property development and flipping, while Schedule E is designated for passive rental income and related expenses. Proper classification impacts tax deductions, depreciation methods, and eligibility for real estate professional status under IRS guidelines, directly influencing overall tax liability.

Ordinary income

Ordinary income reported on Schedule C includes net profit or loss from a sole proprietorship or self-employment activity, directly subject to self-employment tax, while ordinary income reported on Schedule E pertains to rental income, royalties, partnerships, and S corporation income, generally not subject to self-employment tax. Schedule C income impacts both income tax and self-employment tax calculations, whereas Schedule E income primarily affects income tax and may involve passive activity loss rules.

Qualified business income (QBI)

Qualified Business Income (QBI) deductions apply to net income reported on Schedule C from sole proprietorships but do not directly apply to passive income typically reported on Schedule E, such as rental properties or royalty income. While Schedule C income qualifies for the 20% QBI deduction under Section 199A, income on Schedule E usually does not unless the rental activity meets the criteria for a trade or business.

Rental property depreciation

Rental property depreciation reported on Schedule E allows property owners to deduct the cost of the property over 27.5 years, reducing taxable rental income from passive activities. In contrast, Schedule C is used for rental properties operated as a business, enabling owners to deduct depreciation alongside active business expenses and self-employment tax considerations.

Business expense deduction

Business expense deductions reported on Schedule C include costs directly associated with self-employment income, such as office supplies, travel, and advertising, reducing taxable income from sole proprietorships or single-member LLCs. Schedule E deductions pertain to rental and royalty properties, focusing on expenses like mortgage interest, property taxes, and repairs, which offset income generated from these passive activities.

Non-passive income

Non-passive income reported on Schedule C typically arises from active business activities where the taxpayer materially participates, such as sole proprietorships or independent contracting, whereas Schedule E is used for reporting income from rental real estate, royalties, partnerships, S corporations, and trusts, which are generally considered passive activities unless the taxpayer meets specific material participation criteria. The distinction between Schedule C and Schedule E impacts self-employment tax liabilities and passive activity loss limitations under IRS regulations.

Schedule C vs Schedule E Infographic

moneydif.com

moneydif.com