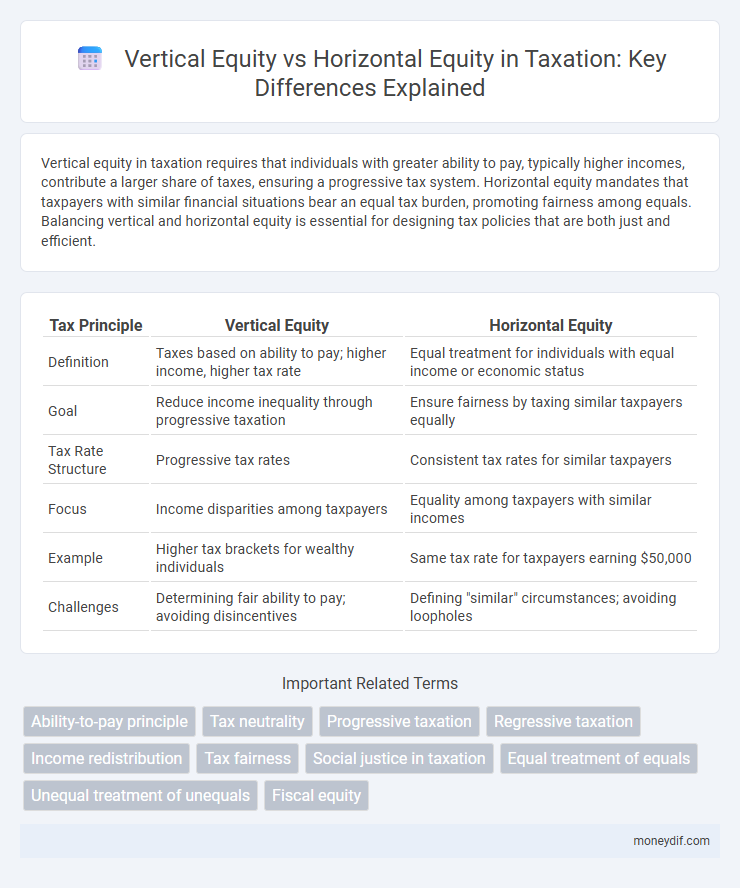

Vertical equity in taxation requires that individuals with greater ability to pay, typically higher incomes, contribute a larger share of taxes, ensuring a progressive tax system. Horizontal equity mandates that taxpayers with similar financial situations bear an equal tax burden, promoting fairness among equals. Balancing vertical and horizontal equity is essential for designing tax policies that are both just and efficient.

Table of Comparison

| Tax Principle | Vertical Equity | Horizontal Equity |

|---|---|---|

| Definition | Taxes based on ability to pay; higher income, higher tax rate | Equal treatment for individuals with equal income or economic status |

| Goal | Reduce income inequality through progressive taxation | Ensure fairness by taxing similar taxpayers equally |

| Tax Rate Structure | Progressive tax rates | Consistent tax rates for similar taxpayers |

| Focus | Income disparities among taxpayers | Equality among taxpayers with similar incomes |

| Example | Higher tax brackets for wealthy individuals | Same tax rate for taxpayers earning $50,000 |

| Challenges | Determining fair ability to pay; avoiding disincentives | Defining "similar" circumstances; avoiding loopholes |

Understanding Vertical Equity in Taxation

Vertical equity in taxation emphasizes the principle that taxpayers with greater ability to pay should contribute a larger share of their income in taxes, ensuring a progressive tax system. It involves imposing higher tax rates on higher-income brackets to reduce income inequality and promote fairness. This approach contrasts with horizontal equity, which requires taxpayers with similar incomes to be taxed equally.

Defining Horizontal Equity in Tax Policy

Horizontal equity in tax policy mandates that individuals or entities with similar income or economic capacity should be taxed at the same rate, ensuring fairness and consistency within the tax system. This principle prevents arbitrary disparities by treating equals equally, reinforcing taxpayer confidence and compliance. Maintaining horizontal equity requires precise income measurement and robust tax code design to avoid unintended advantages or burdens among taxpayers with comparable financial situations.

Key Differences Between Vertical and Horizontal Equity

Vertical equity in taxation refers to the principle that taxpayers with higher incomes should pay a larger percentage of their income in taxes, ensuring a progressive tax system. Horizontal equity emphasizes that individuals with similar income levels should be taxed equally, regardless of their circumstances. The key difference lies in vertical equity addressing income disparities through graduated rates, while horizontal equity demands uniform treatment for equals to promote fairness within income brackets.

Theoretical Foundations of Tax Equity

Vertical equity in tax theory emphasizes taxing individuals based on their ability to pay, ensuring that higher-income earners contribute a larger proportion of their income. Horizontal equity requires taxpayers with similar economic circumstances to be treated equally by the tax system, preventing unfair advantages or disparities. These theoretical foundations aim to balance fairness and efficiency, guiding policy design to achieve just distribution of tax burdens.

Examples of Vertical Equity in Practice

Progressive income tax systems exemplify vertical equity by imposing higher tax rates on individuals with greater ability to pay, ensuring wealthier taxpayers contribute a larger share. Estate taxes target large inheritances to reduce wealth concentration, reinforcing vertical equity by taxing those with substantial assets more heavily. Social welfare programs funded through taxation redistribute resources from high-income earners to low-income groups, reflecting vertical equity principles in practice.

Illustrations of Horizontal Equity in Tax Systems

Horizontal equity in tax systems ensures that individuals with similar income levels pay comparable taxes, promoting fairness by treating equals equally. For instance, two taxpayers each earning $50,000 annually should face similar tax liabilities regardless of their job types or sources of income. Examples include flat tax rates applied uniformly across similar income brackets and standard deductions that do not favor specific groups.

Social Justice Implications of Tax Equity

Vertical equity in taxation demands higher tax rates for individuals with greater ability to pay, addressing income inequality by redistributing wealth. Horizontal equity ensures taxpayers with similar financial capacity bear equivalent tax burdens, promoting fairness among equals. The social justice implications of tax equity require balancing these principles to reduce economic disparities while maintaining public trust in the tax system.

Policy Challenges in Achieving Tax Equity

Tax policy faces significant challenges in balancing vertical equity, which demands higher taxes on the wealthy, with horizontal equity, requiring equal treatment of taxpayers with similar income levels. Differentiating taxpayers' abilities to pay while avoiding distortions and ensuring administrative simplicity complicates enforcement and compliance efforts. Policy-makers must navigate trade-offs between progressivity and fairness, addressing issues like tax avoidance, income measurement, and socioeconomic diversity.

Measuring Fairness: Vertical vs. Horizontal Approaches

Measuring fairness in taxation involves comparing vertical equity, which emphasizes taxing individuals based on their differing ability to pay, and horizontal equity, which stresses equal treatment of people with similar financial circumstances. Vertical equity supports progressive tax rates where higher earners contribute a larger share of taxes, reflecting disparities in income and wealth. Horizontal equity requires that taxpayers with similar incomes face similar tax burdens, ensuring consistent and non-discriminatory tax policies.

Balancing Equity Considerations in Tax Reform

Balancing vertical equity and horizontal equity is crucial in tax reform to ensure fairness and efficiency. Vertical equity involves taxing individuals according to their ability to pay, often resulting in progressive tax rates, while horizontal equity requires individuals with similar economic circumstances to be taxed equally. Effective tax reform must strike a balance by designing tax policies that fairly distribute tax burdens without creating excessive complexity or loopholes, thereby promoting social justice and economic growth.

Important Terms

Ability-to-pay principle

The ability-to-pay principle supports vertical equity by suggesting that individuals with higher income should pay more taxes, whereas horizontal equity requires taxpayers with similar ability to pay to be taxed equally.

Tax neutrality

Tax neutrality aims to minimize economic distortions by ensuring that individuals with similar economic capacity bear comparable tax burdens, thereby aligning more closely with horizontal equity rather than the redistribution focus of vertical equity.

Progressive taxation

Progressive taxation enhances vertical equity by taxing higher incomes at higher rates while striving to maintain horizontal equity by treating individuals with similar incomes equally.

Regressive taxation

Regressive taxation disproportionately burdens lower-income individuals, challenging vertical equity by taxing people unequally based on ability to pay, while often violating horizontal equity by imposing different tax rates on individuals with similar incomes.

Income redistribution

Income redistribution aims to reduce economic inequalities by reallocating wealth, emphasizing vertical equity which ensures individuals with higher incomes contribute proportionally more taxes. Horizontal equity demands that individuals with similar economic capacity be treated equally within the tax system, maintaining fairness across comparable income groups.

Tax fairness

Tax fairness requires balancing vertical equity, which ensures taxpayers with greater ability to pay contribute more, with horizontal equity, which mandates equal taxation for individuals with similar financial circumstances.

Social justice in taxation

Social justice in taxation demands vertical equity by imposing higher taxes on individuals with greater ability to pay, while horizontal equity requires taxpayers with similar income levels to be taxed equally.

Equal treatment of equals

Equal treatment of equals, also known as horizontal equity, ensures individuals with similar economic circumstances bear comparable tax burdens, contrasting with vertical equity that focuses on taxing individuals differently based on income levels or ability to pay for fairness in resource distribution. Policymakers balance horizontal equity by minimizing tax discrimination among equals, while vertical equity justifies progressive tax systems to address income inequality.

Unequal treatment of unequals

Vertical equity demands unequal treatment of unequals by allocating resources based on differing abilities to pay, while horizontal equity insists on equal treatment for individuals with similar financial situations.

Fiscal equity

Fiscal equity ensures fair taxation by balancing vertical equity, which demands higher taxes from those with greater ability to pay, against horizontal equity, which requires equal treatment for individuals with similar economic status.

Vertical equity vs horizontal equity Infographic

moneydif.com

moneydif.com