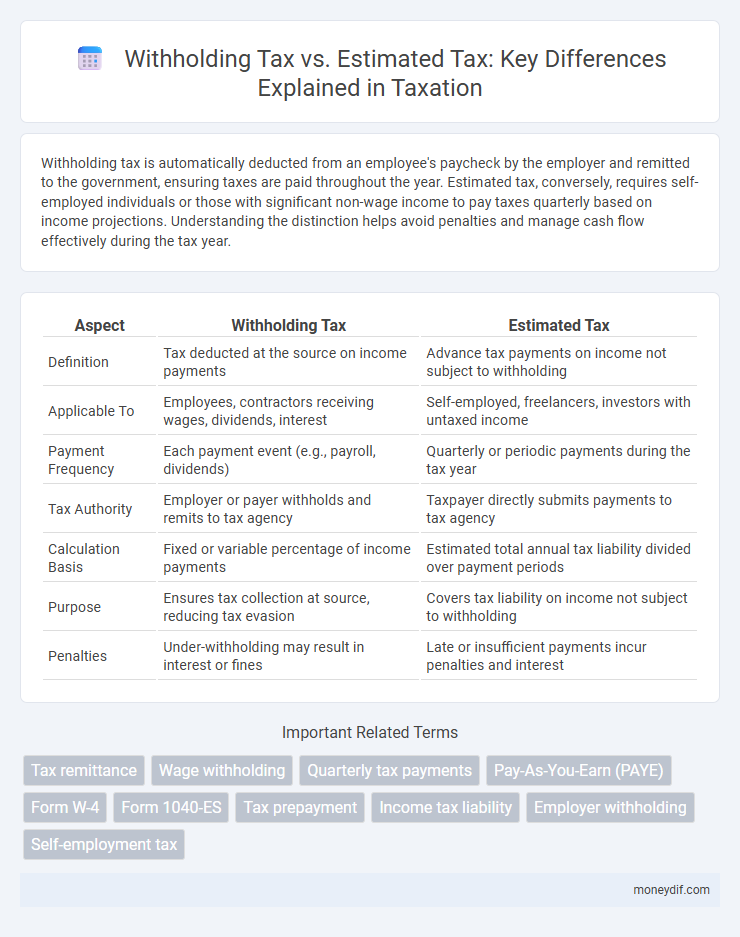

Withholding tax is automatically deducted from an employee's paycheck by the employer and remitted to the government, ensuring taxes are paid throughout the year. Estimated tax, conversely, requires self-employed individuals or those with significant non-wage income to pay taxes quarterly based on income projections. Understanding the distinction helps avoid penalties and manage cash flow effectively during the tax year.

Table of Comparison

| Aspect | Withholding Tax | Estimated Tax |

|---|---|---|

| Definition | Tax deducted at the source on income payments | Advance tax payments on income not subject to withholding |

| Applicable To | Employees, contractors receiving wages, dividends, interest | Self-employed, freelancers, investors with untaxed income |

| Payment Frequency | Each payment event (e.g., payroll, dividends) | Quarterly or periodic payments during the tax year |

| Tax Authority | Employer or payer withholds and remits to tax agency | Taxpayer directly submits payments to tax agency |

| Calculation Basis | Fixed or variable percentage of income payments | Estimated total annual tax liability divided over payment periods |

| Purpose | Ensures tax collection at source, reducing tax evasion | Covers tax liability on income not subject to withholding |

| Penalties | Under-withholding may result in interest or fines | Late or insufficient payments incur penalties and interest |

Understanding Withholding Tax

Withholding tax is an amount withheld by an employer from an employee's salary and paid directly to the government to cover income tax liabilities, ensuring tax compliance throughout the year. It differs from estimated tax, which is paid directly by self-employed individuals or those with non-wage income in quarterly installments. Understanding withholding tax involves recognizing its role in reducing year-end tax burdens and avoiding penalties for underpayment.

What is Estimated Tax?

Estimated tax is a method used by individuals and businesses to pay income tax on earnings not subject to withholding, such as self-employment income, interest, dividends, and rental income. It requires quarterly payments based on expected annual taxable income to avoid penalties for underpayment. The IRS provides Form 1040-ES to calculate and submit these periodic payments, ensuring accurate tax compliance throughout the year.

Key Differences Between Withholding and Estimated Tax

Withholding tax is directly deducted from an employee's paycheck by the employer to cover income tax liabilities, ensuring timely tax payments throughout the year. Estimated tax requires individuals, often self-employed or with significant non-wage income, to make quarterly payments based on projected earnings to avoid underpayment penalties. The key differences lie in payment timing, payer responsibility, and applicability to different income sources.

Who Needs to Pay Withholding Tax?

Withholding tax is primarily required to be paid by employers on behalf of employees, withholding a portion of wages for income tax purposes. Businesses and financial institutions must also deduct withholding tax on certain payments such as dividends, interest, and royalties made to non-resident individuals or entities. Individuals who receive income subject to withholding tax, including freelance contractors or independent service providers, are responsible for ensuring the correct amount is withheld and remitted to tax authorities.

Who is Required to Pay Estimated Tax?

Individuals, including self-employed workers, freelancers, and those with significant income not subject to withholding, are required to pay estimated tax. Estimated tax applies to taxpayers who expect to owe at least $1,000 in tax after subtracting withholding and credits. This obligation ensures timely payment of income taxes on earnings not covered by employer withholding or other sources.

Calculation Methods for Withholding Tax

Withholding tax is calculated by applying a predetermined percentage rate to the income earned, often based on tax tables provided by tax authorities. The employer or payer withholds this tax amount from the employee's salary or payment before distribution, ensuring compliance with local tax laws. Different jurisdictions set specific withholding rates depending on income level, type of income, and filing status to accurately estimate the tax liability in advance.

Calculating Your Estimated Tax Payments

Calculating your estimated tax payments involves projecting your annual income, deductions, and credits to determine the total tax liability for the year, then dividing this amount into quarterly payments. Unlike withholding tax, which is automatically deducted from wages by employers, estimated tax requires self-assessment and timely payments to avoid penalties. Accurate income estimation and adjusting payments as income fluctuates are crucial for meeting IRS requirements and minimizing underpayment risks.

Impact on Tax Refunds: Withholding vs Estimated Tax

Withholding tax directly reduces the amount of tax owed at the end of the year by automatically deducting from paychecks, which often leads to a smaller tax refund if the withholding aligns closely with the actual tax liability. Estimated tax payments require the taxpayer to proactively send payments quarterly, and accurate estimation can minimize underpayment penalties while influencing the size of the tax refund depending on overpayment or underpayment. Mismanagement or inaccurate calculations of either withholding or estimated tax payments can result in either a large refund or an unexpected tax bill, impacting overall cash flow and financial planning.

Common Mistakes to Avoid with Both Tax Types

Common mistakes to avoid with withholding tax include underestimating income fluctuations, leading to insufficient tax withholding and potential penalties. For estimated tax, taxpayers often fail to make timely quarterly payments, resulting in interest charges and late fees. Accurate income tracking and adjusting payments proactively help prevent issues with both withholding and estimated taxes.

Choosing the Right Tax Payment Method for Your Situation

Withholding tax is deducted directly from your paycheck or income by an employer or payer, providing a convenient way to meet your tax obligations throughout the year and reducing the risk of underpayment penalties. Estimated tax requires self-calculating and quarterly payments, ideal for freelancers, self-employed individuals, or those with significant non-wage income to avoid large tax bills at year-end. Selecting the right method depends on your income consistency, job type, and cash flow management to optimize tax compliance and avoid payment shortfalls.

Important Terms

Tax remittance

Tax remittance involves submitting withheld amounts such as withholding tax, which employers deduct from employee wages and remit directly to tax authorities, contrasted with estimated tax paid periodically by self-employed individuals or businesses based on projected income. Understanding the distinction between withholding tax and estimated tax ensures accurate compliance with IRS deadlines and prevents underpayment penalties.

Wage withholding

Wage withholding involves an employer deducting income tax directly from an employee's paycheck, serving as a prepayment of the employee's tax liability to the IRS. Unlike estimated tax payments, which are made quarterly by self-employed individuals or those with income not subject to withholding, wage withholding ensures consistent tax collection throughout the year based on payroll amounts.

Quarterly tax payments

Quarterly tax payments are scheduled remittances made to the IRS based on income not subject to withholding, primarily through estimated tax payments calculated on anticipated earnings and deductions. Withholding tax differs as it is automatically deducted from wages or other income sources by employers, reducing the need for large estimated tax payments but requires accurate withholding to avoid underpayment penalties.

Pay-As-You-Earn (PAYE)

Pay-As-You-Earn (PAYE) is a withholding tax system where employers deduct income tax directly from employees' wages, ensuring tax compliance throughout the fiscal year. Unlike estimated tax, which requires self-employed individuals or those with additional income to make periodic payments, PAYE automatically adjusts tax liability in real-time based on actual earnings.

Form W-4

Form W-4 determines the amount of federal income tax withheld from an employee's paycheck, directly affecting withholding tax obligations. Estimated tax payments are separate quarterly payments made by individuals or businesses to cover tax liabilities not fully withheld through payroll, often required for self-employed or those with significant non-wage income.

Form 1040-ES

Form 1040-ES is used by individuals to calculate and pay estimated taxes on income not subject to withholding, such as self-employment earnings or investment income. Unlike withholding tax automatically deducted from wages, estimated tax payments help taxpayers avoid underpayment penalties by covering tax liabilities on income without withholding.

Tax prepayment

Tax prepayment includes withholding tax and estimated tax, where withholding tax is deducted directly by employers or payers from income such as wages or dividends, while estimated tax requires individuals or businesses to pay taxes periodically based on projected earnings. Both methods aim to reduce underpayment penalties and ensure timely revenue collection by aligning tax payments with actual income earned throughout the fiscal year.

Income tax liability

Income tax liability arises from the total tax owed after accounting for taxes withheld by employers (withholding tax) and prepayments made through estimated tax payments. Withholding tax reduces the amount due at filing by automatically deducting taxes from wages, while estimated tax payments must be calculated and submitted quarterly to avoid penalties for underpayment.

Employer withholding

Employer withholding involves deducting income tax directly from an employee's paycheck based on IRS tax tables, ensuring timely tax payments throughout the year. Unlike estimated tax payments, which self-employed individuals or freelancers make quarterly to cover their tax liabilities, withholding tax is automatic and typically more accurate in matching actual tax owed.

Self-employment tax

Self-employment tax primarily covers Social Security and Medicare contributions for independent contractors, differing from withholding tax which employers deduct from wages, and estimated tax payments that self-employed individuals remit quarterly to cover income and self-employment tax liabilities. Accurate quarterly estimated tax payments are crucial for avoiding penalties since no withholding tax automatically applies to self-employment income.

Withholding tax vs Estimated tax Infographic

moneydif.com

moneydif.com