Capital gains are profits earned from the sale of assets held for more than a year and are typically taxed at lower rates than ordinary income, which includes wages, salaries, and interest earnings. Understanding the distinction between capital gains and ordinary income is crucial for tax planning, as it can significantly impact your overall tax liability. Properly categorizing income sources helps maximize tax efficiency and comply with IRS regulations.

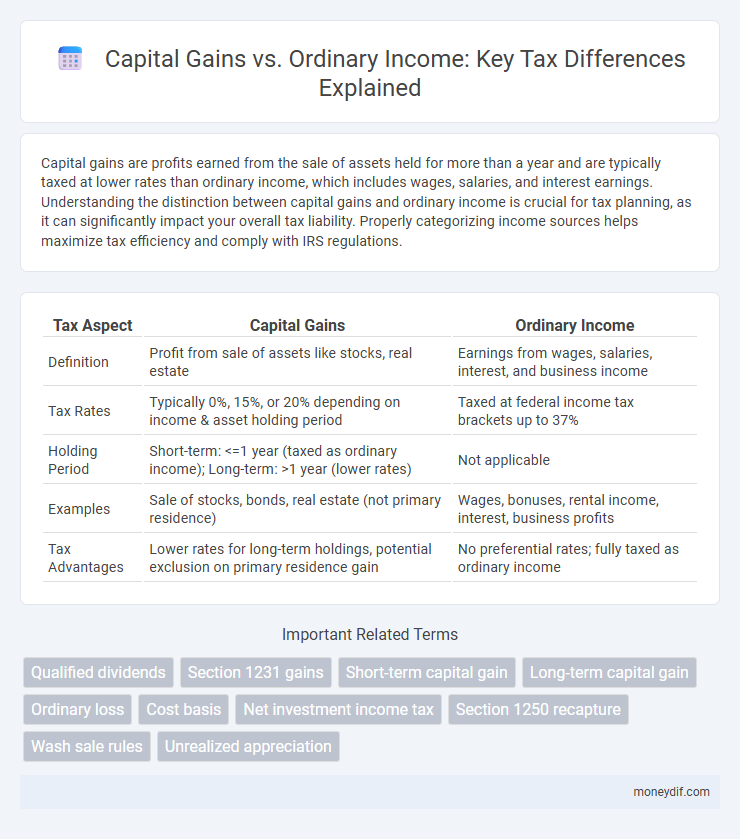

Table of Comparison

| Tax Aspect | Capital Gains | Ordinary Income |

|---|---|---|

| Definition | Profit from sale of assets like stocks, real estate | Earnings from wages, salaries, interest, and business income |

| Tax Rates | Typically 0%, 15%, or 20% depending on income & asset holding period | Taxed at federal income tax brackets up to 37% |

| Holding Period | Short-term: <=1 year (taxed as ordinary income); Long-term: >1 year (lower rates) | Not applicable |

| Examples | Sale of stocks, bonds, real estate (not primary residence) | Wages, bonuses, rental income, interest, business profits |

| Tax Advantages | Lower rates for long-term holdings, potential exclusion on primary residence gain | No preferential rates; fully taxed as ordinary income |

Understanding Capital Gains and Ordinary Income

Capital gains are profits realized from the sale of assets like stocks, real estate, or investments, typically taxed at lower rates compared to ordinary income. Ordinary income includes wages, salaries, and business income, subject to standard federal income tax rates that can be significantly higher. Differentiating between these two income types is crucial for effective tax planning and minimizing overall tax liability.

Key Differences Between Capital Gains and Ordinary Income

Capital gains are profits from the sale of assets held longer than a year, taxed at lower long-term rates, while ordinary income includes wages, salaries, and short-term gains, subject to higher marginal tax rates. Capital gains benefit from preferential tax treatment to encourage investment, whereas ordinary income is fully taxed at ordinary income tax brackets. Understanding these distinctions is crucial for effective tax planning and optimizing overall tax liability.

How Capital Gains Are Taxed

Capital gains are taxed based on the duration the asset is held, with short-term gains taxed at ordinary income rates and long-term gains benefiting from reduced tax rates. Long-term capital gains rates typically range from 0% to 20%, depending on the taxpayer's income bracket, while short-term gains are taxed at the individual's marginal tax rate, which can be as high as 37%. Specific assets, including real estate and collectibles, may have unique tax treatments or additional surtaxes applied.

Taxation of Ordinary Income

Ordinary income is taxed at progressive federal income tax rates ranging from 10% to 37%, based on the taxpayer's income bracket. This category includes wages, salaries, interest, dividends that are not qualified, and business income, all subject to regular tax rates without preferential treatment. Unlike capital gains, ordinary income does not benefit from lower long-term tax rates and is fully subject to payroll and self-employment taxes where applicable.

Short-Term vs. Long-Term Capital Gains

Short-term capital gains are taxed at ordinary income tax rates, which can be as high as 37% under the current U.S. tax brackets, depending on the taxpayer's income level. Long-term capital gains, derived from assets held for more than one year, benefit from reduced tax rates of 0%, 15%, or 20%, incentivizing longer investment horizons. IRS guidelines stipulate the holding period and corresponding tax rates, emphasizing the tax efficiency of long-term capital gains compared to short-term gains.

Common Sources of Capital Gains

Common sources of capital gains include the sale of stocks, bonds, real estate, and mutual funds, where the asset's value has appreciated since purchase. These gains are typically taxed at lower rates compared to ordinary income, which comes from wages, salaries, and business profits. Understanding the distinction between capital gains and ordinary income is crucial for effective tax planning and maximizing after-tax returns.

Ordinary Income Examples and Sources

Ordinary income includes wages, salaries, tips, interest income, rental income, and business profits, all taxed at standard income tax rates. Examples of ordinary income sources encompass earnings from employment, self-employment income, dividends from non-qualified stocks, and royalties. Understanding these income types is essential for accurate tax reporting and optimizing tax liability.

Tax Rates: Capital Gains vs. Ordinary Income

Capital gains tax rates are generally lower than ordinary income tax rates, with long-term capital gains taxed at 0%, 15%, or 20% depending on income brackets, while ordinary income can be taxed up to 37% at the federal level. Short-term capital gains, those on assets held for less than a year, are taxed as ordinary income, eliminating the preferential rate advantage. Understanding the distinction between these rates is crucial for tax planning, as it can significantly impact the net returns on investments.

Strategies to Minimize Tax on Gains and Income

Implement tax-loss harvesting to offset capital gains with realized losses, reducing your overall taxable income. Invest in tax-advantaged accounts such as IRAs or 401(k)s to defer or exempt ordinary income and capital gains from immediate taxation. Consider holding investments longer than one year to benefit from lower long-term capital gains tax rates compared to higher ordinary income tax rates.

Reporting Capital Gains and Ordinary Income on Tax Returns

Capital gains and ordinary income are reported differently on tax returns, with capital gains typically reported on Schedule D and Form 8949, while ordinary income appears directly on Form 1040. Long-term capital gains benefit from lower tax rates compared to ordinary income, which is taxed at standard marginal rates. Accurate categorization and reporting ensure proper tax liability calculation and compliance with IRS regulations.

Important Terms

Qualified dividends

Qualified dividends are taxed at the lower long-term capital gains rates, which range from 0% to 20% depending on the taxpayer's income bracket, contrasting with ordinary income tax rates that can be as high as 37%. This preferential tax treatment makes qualified dividends more advantageous than ordinary income, while non-qualified dividends are taxed similar to ordinary income.

Section 1231 gains

Section 1231 gains arise from the sale of depreciable business property and land used in a trade or business for more than one year, and they are taxed preferentially as capital gains if the net result is a gain, but treated as ordinary income if there is a net loss. This special tax treatment allows for favorable rates on long-term gains while providing ordinary loss benefits, distinguishing Section 1231 gains from typical capital gains or ordinary income classifications.

Short-term capital gain

Short-term capital gains are profits from the sale of assets held for one year or less and are taxed at ordinary income tax rates, which are typically higher than long-term capital gains rates. Unlike long-term capital gains that benefit from reduced tax rates, short-term gains are treated as regular income by the IRS, impacting overall tax liability.

Long-term capital gain

Long-term capital gains are profits from the sale of assets held for more than one year, taxed at lower rates compared to ordinary income, which is subject to standard federal income tax brackets. Understanding the distinction between capital gains and ordinary income is crucial for effective tax planning and maximizing after-tax returns.

Ordinary loss

Ordinary loss arises when deductible business or investment expenses exceed income, reducing taxable ordinary income, while capital gains represent profits from asset sales taxed at preferential rates. Unlike capital gains, which receive favorable tax treatment, ordinary losses offset ordinary income dollar-for-dollar, directly lowering an individual's or corporation's tax liability.

Cost basis

Cost basis represents the original value of an asset used to calculate capital gains or losses, directly impacting the taxable amount upon sale; capital gains tax rates are generally lower than ordinary income rates, which apply to wages and other regular income types. Accurately determining cost basis is crucial for minimizing tax liability, as it distinguishes profits taxed at preferential capital gains rates from those taxed at higher ordinary income rates.

Net investment income tax

Net Investment Income Tax (NIIT) applies a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income over threshold amounts, impacting capital gains, interest, dividends, rental income, and other passive income. Capital gains are often subject to lower long-term rates but still contribute to net investment income, whereas ordinary income is taxed at regular income tax rates and generally not subject to NIIT unless it arises from passive activities.

Section 1250 recapture

Section 1250 recapture applies to gains from the sale of depreciable real property, converting a portion of what would be capital gains into ordinary income by taxing the accumulated straight-line depreciation deductions at a maximum rate of 25%. This recapture ensures that depreciation benefits are partially reversed, distinguishing the ordinary income portion from the remaining capital gains subject to lower long-term capital gains tax rates.

Wash sale rules

Wash sale rules disallow the deduction of a loss on the sale of a security if a substantially identical security is purchased within 30 days before or after the sale, impacting the calculation of capital gains and ordinary income. These rules prevent taxpayers from claiming capital losses to offset ordinary income, causing the disallowed loss to be added to the cost basis of the repurchased security, deferring the recognition of the loss until the new security is sold.

Unrealized appreciation

Unrealized appreciation refers to the increase in the value of an asset that has not yet been sold, meaning the gain is not subject to capital gains tax until realized through a transaction. Capital gains are typically taxed at lower rates than ordinary income, making the timing of asset sales a crucial factor in tax strategy and wealth management.

Capital gains vs Ordinary income Infographic

moneydif.com

moneydif.com