Controlled Foreign Corporation (CFC) rules aim to prevent tax deferral by requiring U.S. shareholders to include certain foreign income on their current tax returns, focusing on active income earned abroad. Passive Foreign Investment Company (PFIC) regulations target passive income earned by foreign investment entities, imposing punitive tax and interest charges on U.S. investors to discourage tax avoidance through passive investments. Understanding the distinctions between CFC and PFIC classifications is crucial for compliance and optimizing international tax strategies.

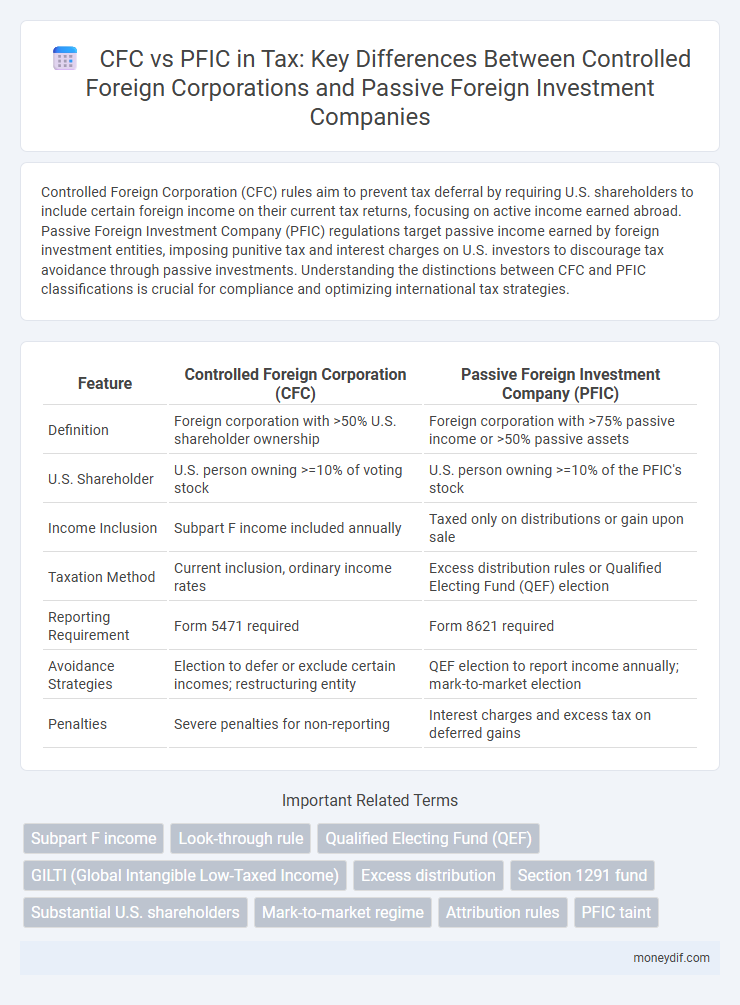

Table of Comparison

| Feature | Controlled Foreign Corporation (CFC) | Passive Foreign Investment Company (PFIC) |

|---|---|---|

| Definition | Foreign corporation with >50% U.S. shareholder ownership | Foreign corporation with >75% passive income or >50% passive assets |

| U.S. Shareholder | U.S. person owning >=10% of voting stock | U.S. person owning >=10% of the PFIC's stock |

| Income Inclusion | Subpart F income included annually | Taxed only on distributions or gain upon sale |

| Taxation Method | Current inclusion, ordinary income rates | Excess distribution rules or Qualified Electing Fund (QEF) election |

| Reporting Requirement | Form 5471 required | Form 8621 required |

| Avoidance Strategies | Election to defer or exclude certain incomes; restructuring entity | QEF election to report income annually; mark-to-market election |

| Penalties | Severe penalties for non-reporting | Interest charges and excess tax on deferred gains |

Introduction to CFCs and PFICs

Controlled Foreign Corporations (CFCs) are foreign entities where U.S. shareholders own more than 50% of the voting stock, triggering specific U.S. anti-deferral tax rules under Subpart F income. Passive Foreign Investment Companies (PFICs) are foreign corporations generating at least 75% passive income or having 50% of assets producing passive income, subjecting U.S. shareholders to unique tax regimes to prevent tax deferral and income shifting. Understanding the distinctions between CFC and PFIC classifications is critical for accurate U.S. tax reporting and minimizing adverse tax consequences on foreign investments.

Key Definitions: What is a CFC?

A Controlled Foreign Corporation (CFC) is a foreign corporation where more than 50% of its stock, by vote or value, is owned by U.S. shareholders who each own at least 10% of the corporation. U.S. shareholders of a CFC are subject to specific IRS rules under Subpart F, requiring inclusion of certain types of income on their U.S. tax returns, regardless of distribution. This classification helps prevent U.S. taxpayers from deferring income by holding assets in foreign entities.

Key Definitions: What is a PFIC?

A Passive Foreign Investment Company (PFIC) is a foreign corporation where at least 75% of its gross income is passive income, such as dividends, interest, rents, or royalties, or at least 50% of its assets produce passive income. The PFIC rules are designed to prevent U.S. taxpayers from deferring tax on passive income by investing in foreign corporations. Unlike Controlled Foreign Corporations (CFCs), which are primarily subject to Subpart F income rules, PFICs are governed by complex tax regimes including excess distribution and mark-to-market rules.

Jurisdictional Differences and Tax Residency

Controlled Foreign Corporation (CFC) rules primarily focus on entities where a U.S. shareholder owns more than 50% of the company, emphasizing attribution of income based on ownership and active business operations within foreign jurisdictions. Passive Foreign Investment Company (PFIC) regulations target investment entities generating predominantly passive income, such as dividends or capital gains, regardless of ownership percentage, highlighting the treatment of passive income from jurisdictions with favorable tax regimes. Jurisdictional differences impact the application of CFC and PFIC rules by determining tax residency, operational substance, and whether income is classified as active or passive for U.S. tax reporting and compliance.

Ownership Thresholds: Who Is Affected?

Controlled Foreign Corporation (CFC) rules apply when U.S. shareholders own 10% or more of the foreign corporation's voting stock, directly or indirectly, while Passive Foreign Investment Company (PFIC) status is triggered if 75% or more of the corporation's gross income is passive or 50% or more of its assets produce passive income. U.S. shareholders meeting the 10% ownership threshold in a CFC must include certain income on their tax returns regardless of actual distributions. Investors in PFICs face complex tax and reporting requirements, often resulting in higher tax rates on distributions and gains.

Taxation Rules for U.S. Shareholders

U.S. shareholders of Controlled Foreign Corporations (CFCs) are subject to Subpart F income rules, requiring them to include certain types of passive and highly mobile income on their current U.S. tax returns, regardless of distribution. Passive Foreign Investment Companies (PFICs) impose a different tax regime, often resulting in punitive tax rates and interest charges on excess distributions and dispositions, unless the shareholder makes a Qualified Electing Fund (QEF) or mark-to-market election. Proper classification and compliance are crucial to avoid double taxation and optimize U.S. tax obligations on foreign investments.

Income Characterization: Active vs Passive

Controlled Foreign Corporation (CFC) income is primarily categorized as active or passive based on the nature of the foreign corporation's underlying activities, with active income typically arising from business operations and passive income from investments. Passive Foreign Investment Company (PFIC) rules focus largely on passive income, such as dividends, interest, and capital gains, which can trigger unfavorable tax treatment and complex reporting requirements for U.S. shareholders. Proper income characterization determines whether U.S. shareholders will benefit from favorable CFC look-through rules or face punitive PFIC tax regimes.

Compliance and Reporting Obligations

Controlled Foreign Corporations (CFCs) require U.S. shareholders to comply with Subpart F income inclusion rules and file Form 5471 to report ownership and earnings, ensuring transparency of foreign income. Passive Foreign Investment Companies (PFICs) mandate U.S. shareholders to file Form 8621 for annual reporting, disclosing distributions and gains to avoid adverse tax consequences. Both regimes impose strict compliance and reporting obligations to prevent tax deferral and ensure accurate IRS taxation of foreign investments.

Common Tax Pitfalls and Planning Strategies

Common tax pitfalls involving Controlled Foreign Corporations (CFCs) and Passive Foreign Investment Companies (PFICs) include misclassification of entities, resulting in incorrect tax treatment and unexpected IRS penalties. Effective planning strategies emphasize accurate entity characterization under IRC Sections 951 and 1291, proactive application of the CFC Subpart F income rules, and timely tax elections to mitigate adverse PFIC tax consequences. Taxpayers should implement robust compliance procedures and consult the latest IRS guidance to optimize foreign income reporting and avoid double taxation.

Practical Examples: CFCs vs PFICs in Practice

Controlled Foreign Corporation (CFC) rules primarily target shareholders who own more than 50% of a foreign corporation to prevent deferral of U.S. tax on foreign income, exemplified by a U.S. parent company being taxed on its controlled subsidiary's income regardless of distribution. Passive Foreign Investment Company (PFIC) regulations apply to corporations with at least 75% passive income or 50% passive assets, often affecting U.S. investors in foreign mutual funds or holding companies where income is mostly from dividends or interest. In practice, a U.S. investor owning 60% of a foreign manufacturing entity falls under CFC rules, while ownership in a foreign passive investment fund triggers PFIC rules, leading to different tax treatments and reporting requirements.

Important Terms

Subpart F income

Subpart F income pertains to specific types of income earned by a Controlled Foreign Corporation (CFC) that U.S. shareholders must include in their taxable income, regardless of distribution. In contrast, Passive Foreign Investment Company (PFIC) rules target primarily passive income and gains of foreign investment vehicles, triggering distinct tax consequences such as the excess distribution regime and interest charge, separate from Subpart F income inclusion.

Look-through rule

The Look-through rule applies in the context of Controlled Foreign Corporations (CFCs) and Passive Foreign Investment Companies (PFICs) by allowing U.S. shareholders to attribute income and deductions of certain underlying entities to determine the character of income for U.S. tax purposes. This rule helps prevent double taxation by ensuring that dividends paid by a CFC or PFIC are treated consistently with the income earned by the foreign corporation's subpart, influencing U.S. shareholders' tax liabilities and reporting requirements.

Qualified Electing Fund (QEF)

A Qualified Electing Fund (QEF) election allows U.S. shareholders of a Passive Foreign Investment Company (PFIC) to include their share of the PFIC's income annually, thereby avoiding the default excess distribution regime, whereas Controlled Foreign Corporations (CFCs) are subject to Subpart F income rules that require current inclusion of certain types of income by U.S. shareholders. The QEF election provides a method to treat PFIC income similarly to CFC income, facilitating more favorable tax treatment and compliance with complex international tax regulations.

GILTI (Global Intangible Low-Taxed Income)

GILTI (Global Intangible Low-Taxed Income) targets income earned by Controlled Foreign Corporations (CFCs) exceeding a 10% return on tangible assets, aiming to prevent profit shifting to low-tax jurisdictions. Unlike GILTI, PFIC (Passive Foreign Investment Company) rules impose onerous tax and reporting requirements on passive income investments by U.S. shareholders in foreign corporations with predominantly passive income or assets, emphasizing different aspects of foreign income taxation.

Excess distribution

Excess distribution to a U.S. shareholder from a Controlled Foreign Corporation (CFC) is generally treated as a dividend subject to Subpart F income rules, whereas in a Passive Foreign Investment Company (PFIC), excess distributions trigger special tax and interest charge rules under the PFIC regime. Both regimes aim to prevent tax deferral, but CFC rules focus on active income inclusions while PFIC rules address passive income accumulation and associated excess distributions.

Section 1291 fund

Section 1291 funds arise when U.S. shareholders own Passive Foreign Investment Companies (PFICs), triggering complex tax rules including excess distribution taxation and interest charges. Controlled Foreign Corporations (CFCs) involve different U.S. tax provisions under Subpart F income and GILTI, focusing on active business income rather than the passive investment focus of PFICs.

Substantial U.S. shareholders

Substantial U.S. shareholders of a Controlled Foreign Corporation (CFC) are defined as U.S. persons owning 10% or more of the total combined voting power, triggering specific tax rules such as Subpart F income inclusions. In contrast, passive foreign investment company (PFIC) shareholders face different tax regimes based on the passive income or asset tests, with less emphasis on ownership percentage but greater focus on passive income distributions and gains.

Mark-to-market regime

The mark-to-market regime for a Controlled Foreign Corporation (CFC) facilitates taxation of unrealized gains on specified assets, contrasting with the Passive Foreign Investment Company (PFIC) rules that impose tax and interest charges on distributions and gains without annual mark-to-market adjustments. CFC rules aim to prevent tax deferral on income of related foreign entities, while PFIC regulations deter investment in passive income-generating foreign funds through punitive tax treatment.

Attribution rules

Attribution rules for Controlled Foreign Corporations (CFCs) primarily focus on ownership thresholds and constructive ownership principles to determine U.S. shareholders' inclusion of Subpart F income, while Passive Foreign Investment Companies (PFICs) emphasize passive income and asset tests to classify income subject to special tax regimes. These rules ensure accurate U.S. tax reporting by attributing income and ownership interests through family, entity, and stock attribution to prevent tax deferral and erosion in offshore investments.

PFIC taint

A PFIC taint occurs when a Controlled Foreign Corporation (CFC) holds passive foreign investment company (PFIC) stock, causing the CFC's earnings to potentially be treated as PFIC income, which subjects U.S. shareholders to punitive tax and reporting rules under the Internal Revenue Code. This intersection complicates international tax planning for U.S. investors by triggering unfavorable tax consequences, including excess distribution rules and interest charges on deferred taxes.

controlled foreign corporation (CFC) vs passive foreign investment company (PFIC) Infographic

moneydif.com

moneydif.com