Real property tax applies to immovable assets such as land and buildings, assessed based on their value and location, while personal property tax targets movable assets like vehicles, equipment, and furniture. The assessment and rates for real property tax are generally higher due to the fixed nature and potential economic impact of real estate. Personal property tax varies widely by jurisdiction and often includes exemptions or lower rates to encourage business investment.

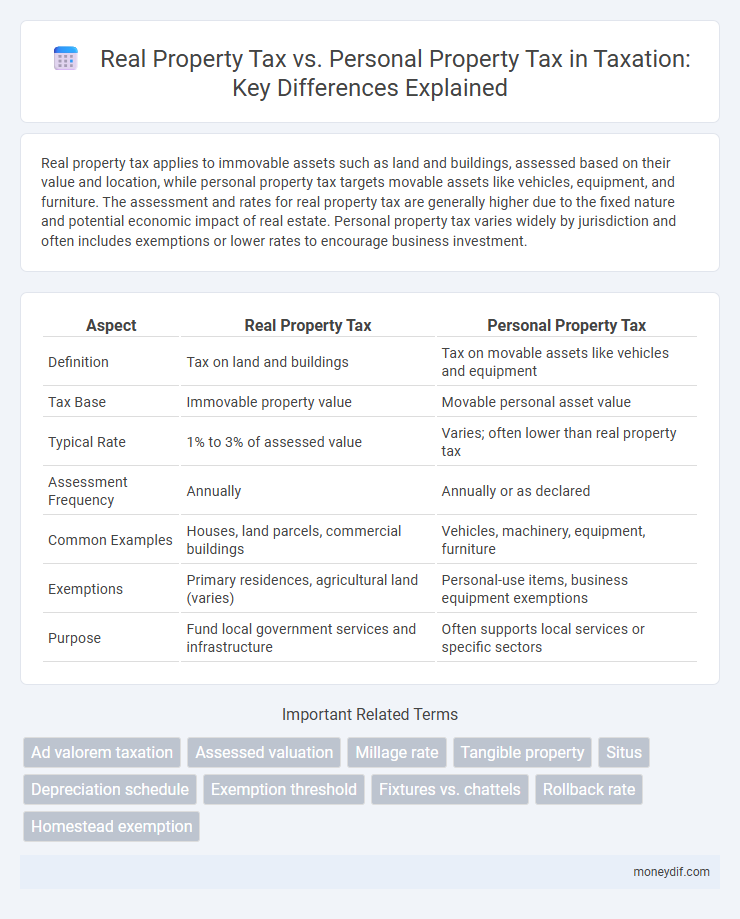

Table of Comparison

| Aspect | Real Property Tax | Personal Property Tax |

|---|---|---|

| Definition | Tax on land and buildings | Tax on movable assets like vehicles and equipment |

| Tax Base | Immovable property value | Movable personal asset value |

| Typical Rate | 1% to 3% of assessed value | Varies; often lower than real property tax |

| Assessment Frequency | Annually | Annually or as declared |

| Common Examples | Houses, land parcels, commercial buildings | Vehicles, machinery, equipment, furniture |

| Exemptions | Primary residences, agricultural land (varies) | Personal-use items, business equipment exemptions |

| Purpose | Fund local government services and infrastructure | Often supports local services or specific sectors |

Introduction to Real Property Tax and Personal Property Tax

Real property tax is levied on immovable assets such as land and buildings, assessed based on the property's value and location. Personal property tax applies to movable assets including vehicles, machinery, and equipment, typically calculated on the assessed value of these tangible items. Understanding the distinction between real property tax and personal property tax is essential for accurate tax compliance and financial planning.

Definition of Real Property Tax

Real property tax is a levy imposed on land and any permanent structures attached to it, such as buildings and improvements, based on the assessed value of the real estate. This tax is typically collected by local governments to fund public services including schools, road maintenance, and emergency services. Unlike personal property tax, which covers movable assets like vehicles and equipment, real property tax specifically targets immovable property.

Definition of Personal Property Tax

Personal property tax is a levy imposed on movable assets owned by individuals or businesses, such as vehicles, equipment, and inventory, excluding real estate. This tax varies by jurisdiction and is typically assessed annually based on the value of the tangible personal property. Unlike real property tax, which targets immovable assets like land and buildings, personal property tax focuses on assets that can be relocated or transferred.

Key Differences Between Real and Personal Property Tax

Real property tax applies to immovable assets such as land and buildings, calculated based on assessed property value and local tax rates. Personal property tax covers movable items like vehicles, machinery, and equipment, with valuation methods varying by jurisdiction but generally linked to market or purchase price. Key differences include the nature of the taxed property, assessment processes, and tax rates, which impact liability and tax administration for property owners.

Types of Assets Subject to Each Tax

Real property tax applies to immovable assets such as land, buildings, and permanent structures attached to the land. Personal property tax covers movable assets including vehicles, machinery, furniture, and equipment not permanently affixed to real estate. Distinguishing between these asset types ensures accurate tax assessment and compliance with local taxation laws.

How Real Property Tax is Assessed

Real property tax is assessed based on the property's assessed value, which typically includes land and permanent improvements such as buildings. Local tax assessors evaluate factors like location, size, use, and market value to determine the assessed value. This assessed value is then multiplied by the local tax rate to calculate the real property tax owed by the owner.

How Personal Property Tax is Assessed

Personal property tax is assessed based on the value of movable assets owned by an individual or business, such as vehicles, equipment, and inventory. Local tax authorities determine taxable values through periodic appraisals or self-reporting, often applying depreciation schedules to establish fair market value. Tax rates and assessment procedures vary by jurisdiction, but assessments typically require owners to file detailed asset lists to ensure accurate taxation.

Tax Rates and Payment Procedures

Real property tax rates are typically based on the assessed value of land and buildings, often expressed as a percentage of the property's market value, and vary by jurisdiction, with payment schedules commonly set annually or semi-annually. Personal property tax rates apply to movable assets such as vehicles, machinery, and equipment, with assessments calculated on the declared value or standard tables, and payments are usually due annually or at registration renewal. Both tax types require timely filing of assessment returns, with penalties imposed for late payments, and taxpayers often have options for electronic payments or installment plans depending on local tax authority regulations.

Common Exemptions and Deductions

Real property tax commonly exempts homesteads, agricultural lands, and properties owned by religious or charitable organizations, providing significant relief to landowners and homeowners. Personal property tax deductions often include exemptions for business inventories, household goods, and vehicles under a specified value threshold, reducing tax burdens on individual and commercial assets. Understanding specific local and state regulations is crucial for maximizing these exemptions and deductions in real and personal property tax filings.

Impact on Property Owners and Businesses

Real property tax directly impacts property owners by levying taxes on land and buildings, increasing annual expenses and influencing real estate investment decisions. Personal property tax affects businesses by taxing movable assets, such as equipment and inventory, leading to higher operating costs and potential shifts in asset management strategies. Both taxes play crucial roles in local government revenue but require property owners and businesses to carefully assess their financial planning to mitigate tax burdens.

Important Terms

Ad valorem taxation

Ad valorem taxation applies to both real property tax and personal property tax by assessing tax based on the property's assessed value, with real property tax levied on land and buildings, while personal property tax targets movable assets like vehicles and equipment. Real property tax rates tend to be more stable and significant revenue sources for local governments, whereas personal property tax often varies and may be subject to exemptions depending on jurisdictional policies.

Assessed valuation

Assessed valuation determines the taxable value of real property, such as land and buildings, for real property tax calculations, while personal property tax applies to movable assets like vehicles and equipment based on their assessed worth. Accurate assessed valuations ensure equitable tax distribution between real and personal property, influencing local government revenue and taxpayer obligations.

Millage rate

Millage rate determines the amount of tax charged per $1,000 of assessed value for both real property tax and personal property tax, directly impacting homeowners and vehicle owners differently. Real property tax applies to land and buildings, generally featuring lower millage rates than personal property tax, which targets movable assets like vehicles and can vary significantly by jurisdiction.

Tangible property

Tangible property includes physical assets classified as real property, such as land and buildings taxed under real property tax, and movable assets classified as personal property, like machinery and equipment subject to personal property tax.

Situs

Situs determines the jurisdiction for real property tax assessment based on the property's physical location, unlike personal property tax which is assessed where the owner resides or where the property is used.

Depreciation schedule

Depreciation schedules for real property tax typically involve long-term asset depreciation over 27.5 to 39 years, whereas personal property tax depreciation applies to shorter-lived assets depreciated over 3 to 7 years.

Exemption threshold

The exemption threshold for real property tax typically applies to the assessed value of land and buildings, whereas for personal property tax, it pertains to movable assets and tangible personal belongings, with specific thresholds varying by jurisdiction to determine taxable value limits.

Fixtures vs. chattels

Fixtures are permanently attached items classified as real property subject to real property tax, while chattels are movable personal items taxed under personal property tax regulations.

Rollback rate

The rollback rate adjusts real property tax rates to offset changes in personal property tax assessments, ensuring consistent revenue for local governments.

Homestead exemption

The Homestead exemption primarily applies to real property tax by reducing the taxable value of a primary residence, thereby lowering the homeowner's annual tax liability. This exemption does not generally extend to personal property tax, which is assessed separately on movable assets such as vehicles and equipment.

Real property tax vs personal property tax Infographic

moneydif.com

moneydif.com