Source-based taxation levies taxes on income earned within a country regardless of the taxpayer's residence, whereas residence-based taxation imposes tax on the worldwide income of residents irrespective of where the income is generated. Source-based systems are commonly used to tax non-residents and foreign businesses operating domestically, ensuring income derived within the jurisdiction contributes to public revenues. Residence-based taxation emphasizes the taxpayer's domicile or habitual residence, taxing global income to maintain equity and prevent tax evasion through offshore income concealment.

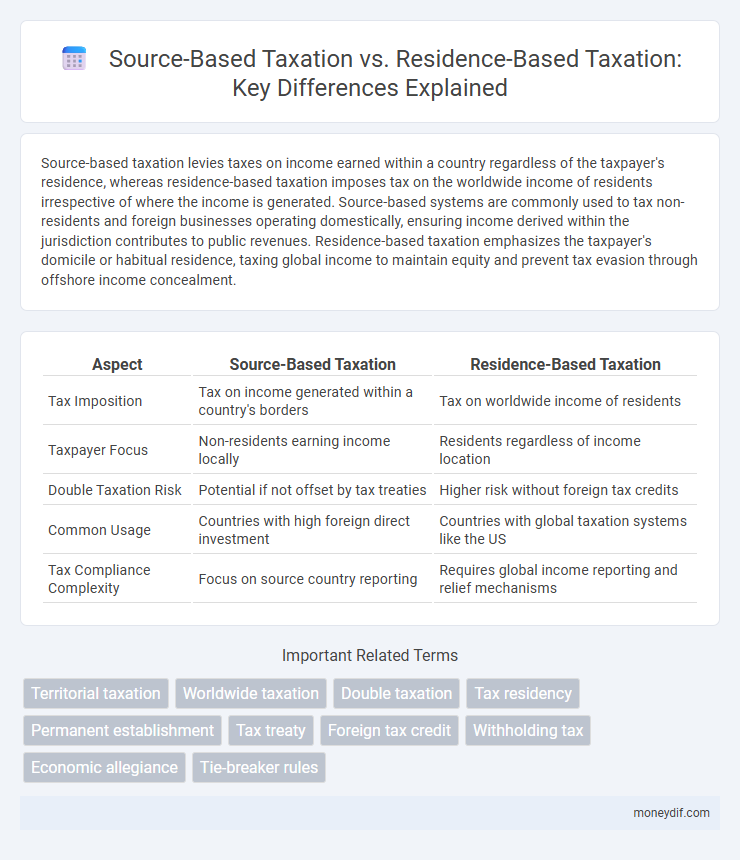

Table of Comparison

| Aspect | Source-Based Taxation | Residence-Based Taxation |

|---|---|---|

| Tax Imposition | Tax on income generated within a country's borders | Tax on worldwide income of residents |

| Taxpayer Focus | Non-residents earning income locally | Residents regardless of income location |

| Double Taxation Risk | Potential if not offset by tax treaties | Higher risk without foreign tax credits |

| Common Usage | Countries with high foreign direct investment | Countries with global taxation systems like the US |

| Tax Compliance Complexity | Focus on source country reporting | Requires global income reporting and relief mechanisms |

Introduction to Source-Based and Residence-Based Taxation

Source-based taxation imposes tax liabilities on income generated within a country's borders, regardless of the taxpayer's residency status, targeting earnings like wages, business profits, and dividends sourced locally. Residence-based taxation requires taxpayers to report worldwide income to the tax authorities of their country of residence, promoting global income transparency and tax compliance. Understanding the distinctions between these systems is crucial for multinational corporations and individuals with cross-border income to optimize tax obligations and avoid double taxation.

Defining Source-Based Taxation

Source-based taxation assigns tax liability to income generated within a country's borders, regardless of the taxpayer's residence. This system targets profits, wages, and capital gains produced domestically, ensuring foreign investors and non-resident earners contribute tax on in-source income. Corporations and individuals earning income sourced from real estate, business activities, or employment inside the jurisdiction are typically subject to source-based taxes.

Understanding Residence-Based Taxation

Residence-based taxation imposes tax on individuals and entities according to their domicile or primary residence, capturing global income regardless of where it is earned. This system relies on criteria such as physical presence, citizenship, or permanent home to determine tax liability and often includes mechanisms to avoid double taxation through treaties. Understanding the principles of residence-based taxation is crucial for global taxpayers to comply with reporting requirements and optimize tax obligations effectively.

Key Differences Between the Two Systems

Source-based taxation imposes taxes on income generated within a country's borders regardless of the taxpayer's residency, emphasizing location of income origin. Residence-based taxation taxes individuals or entities based on their residency status, taxing worldwide income regardless of where it is earned. The key difference lies in the scope of taxable income: source-based systems limit taxation to domestic income, while residence-based systems include global income.

Benefits of Source-Based Taxation

Source-based taxation offers the benefit of taxing income where it is generated, ensuring fair allocation of tax revenue to jurisdictions providing economic infrastructure and public services. This system reduces tax avoidance opportunities by capturing income at the point of origin, increasing compliance and revenue collection efficiency. Multinational corporations often face clearer tax obligations under source-based taxation, simplifying administration and reducing disputes over tax liabilities.

Advantages of Residence-Based Taxation

Residence-based taxation allows individuals and businesses to benefit from tax treaties that prevent double taxation, ensuring fair tax treatment across jurisdictions. It provides stable and predictable tax obligations based on the taxpayer's domicile rather than fluctuating income sources, enhancing compliance and financial planning. This system supports social welfare funding by aligning tax liability with citizenship or residence, promoting equity in public service contributions.

Challenges and Criticisms of Source-Based Taxation

Source-based taxation faces challenges such as difficulties in accurately determining the origin of income, leading to disputes and potential double taxation. It may also incentivize profit shifting and tax avoidance by multinational corporations exploiting varying tax rates across jurisdictions. Critics argue that this system can create complexity and inconsistencies, undermining fairness and efficiency in international tax policy.

Limitations of Residence-Based Taxation

Residence-based taxation limits tax authorities to taxing only worldwide income of residents, posing enforcement challenges for cross-border income and assets. Taxpayers may exploit mismatches between residence and source jurisdictions, leading to double non-taxation or tax evasion. Complex residency rules create administrative burdens and disputes, reducing tax compliance and efficiency.

Global Practices and Country Examples

Source-based taxation imposes tax on income generated within a country, as exemplified by the United States taxing income earned on its soil regardless of taxpayer residence. Residence-based taxation, used by countries like the United Kingdom, taxes global income of residents regardless of where it is earned. Many jurisdictions combine both systems, such as Canada, which taxes residents on worldwide income while also applying source-based rules for non-residents earning income within Canadian borders.

Impact on Taxpayers and International Businesses

Source-based taxation requires taxpayers and international businesses to pay taxes on income generated within a country's borders, which can lead to complex compliance requirements for cross-border activities. Residence-based taxation imposes tax obligations on global income regardless of where it is earned, potentially increasing the administrative burden for individuals and companies with multinational operations. These differing approaches impact tax planning strategies, risk of double taxation, and the allocation of tax liabilities across jurisdictions.

Important Terms

Territorial taxation

Territorial taxation imposes tax only on income earned within a country's borders, aligning closely with source-based taxation that taxes income where it originates. In contrast, residence-based taxation requires taxpayers to report and pay tax on their worldwide income regardless of source, focusing on the taxpayer's domicile or residency status.

Worldwide taxation

Source-based taxation imposes tax on income earned within a country's borders regardless of the taxpayer's residency, while residence-based taxation taxes global income of residents regardless of where it is earned. Countries like the United States implement residence-based systems with worldwide taxation, whereas many others, such as Singapore, favor source-based taxation focusing on income generated domestically.

Double taxation

Double taxation occurs when both the source-based taxation system, which taxes income where it is earned, and the residence-based taxation system, which taxes residents on worldwide income, apply simultaneously on the same income. Tax treaties and foreign tax credits are essential mechanisms to mitigate the economic burden caused by overlapping source and residence tax claims.

Tax residency

Tax residency determines an individual's or entity's tax obligations based on their residence or the source of income, with source-based taxation taxing income where it is generated while residence-based taxation taxes global income of residents. Countries adopting source-based taxation focus on jurisdictional source rules, whereas those using residence-based taxation emphasize the taxpayer's domicile or habitual abode for comprehensive income reporting.

Permanent establishment

Permanent establishment (PE) serves as a critical nexus for source-based taxation, allowing countries to tax profits generated within their jurisdiction by foreign enterprises with a fixed place of business. In contrast, residence-based taxation imposes tax on worldwide income of residents regardless of PE, but tax treaties often reconcile these principles to prevent double taxation by allocating taxing rights between source and residence countries.

Tax treaty

Tax treaties allocate taxing rights between countries by determining whether income is taxed based on its source location or the taxpayer's residence, reducing double taxation. Source-based taxation taxes income where it is generated, while residence-based taxation taxes worldwide income of residents, with treaties balancing these principles to prevent tax conflicts.

Foreign tax credit

Foreign tax credit mitigates double taxation by allowing taxpayers to offset taxes paid to a source country under source-based taxation against their residence country's tax liability. This credit system balances the tax burden between residence-based taxation, which taxes global income, and source-based taxation, which taxes income generated within a jurisdiction.

Withholding tax

Withholding tax is a mechanism related to source-based taxation, where tax is deducted at the point income originates, such as dividends or interest paid by a resident entity to a non-resident. In contrast, residence-based taxation requires taxpayers to report and pay taxes on worldwide income, regardless of source, making withholding tax a tool to prevent tax evasion on cross-border payments.

Economic allegiance

Economic allegiance influences the choice between source-based taxation, which levies taxes where income is generated, and residence-based taxation, which taxes individuals or entities based on their domicile. Countries prioritizing economic allegiance often adopt residence-based taxation to align tax obligations with citizens' global economic activities, while source-based systems emphasize taxing income within national borders.

Tie-breaker rules

Tie-breaker rules in tax treaties determine residency when an individual or entity qualifies as a resident in both the source and residence countries, preventing double taxation under source-based and residence-based taxation systems. These rules prioritize factors such as permanent home, center of vital interests, habitual abode, and nationality to assign exclusive tax residency and clarify taxing rights.

Source-based taxation vs residence-based taxation Infographic

moneydif.com

moneydif.com