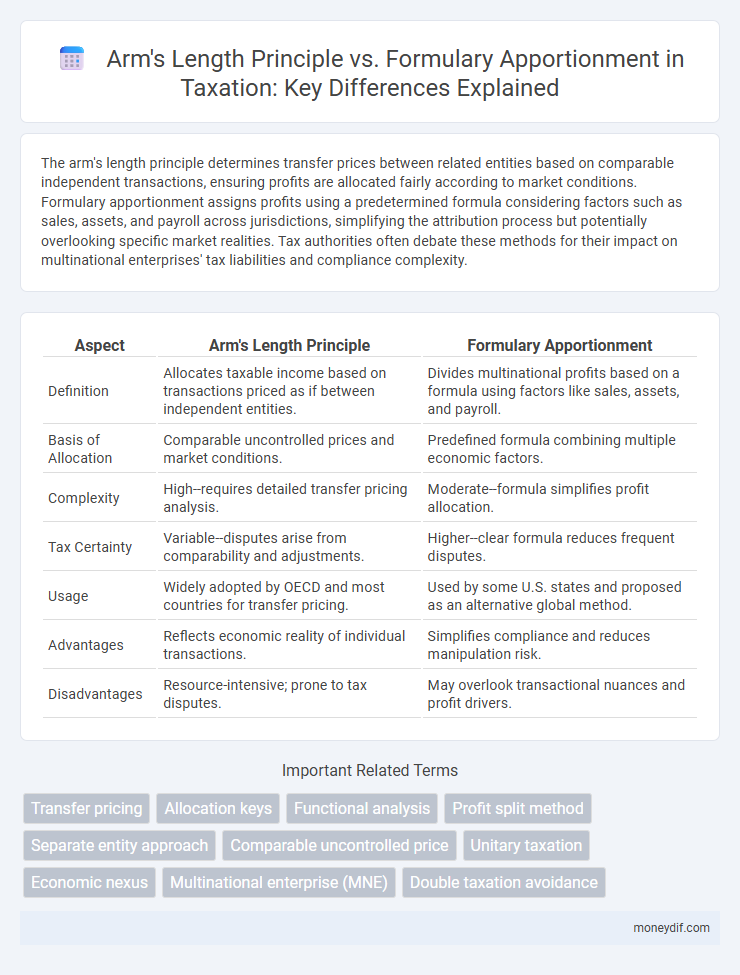

The arm's length principle determines transfer prices between related entities based on comparable independent transactions, ensuring profits are allocated fairly according to market conditions. Formulary apportionment assigns profits using a predetermined formula considering factors such as sales, assets, and payroll across jurisdictions, simplifying the attribution process but potentially overlooking specific market realities. Tax authorities often debate these methods for their impact on multinational enterprises' tax liabilities and compliance complexity.

Table of Comparison

| Aspect | Arm's Length Principle | Formulary Apportionment |

|---|---|---|

| Definition | Allocates taxable income based on transactions priced as if between independent entities. | Divides multinational profits based on a formula using factors like sales, assets, and payroll. |

| Basis of Allocation | Comparable uncontrolled prices and market conditions. | Predefined formula combining multiple economic factors. |

| Complexity | High--requires detailed transfer pricing analysis. | Moderate--formula simplifies profit allocation. |

| Tax Certainty | Variable--disputes arise from comparability and adjustments. | Higher--clear formula reduces frequent disputes. |

| Usage | Widely adopted by OECD and most countries for transfer pricing. | Used by some U.S. states and proposed as an alternative global method. |

| Advantages | Reflects economic reality of individual transactions. | Simplifies compliance and reduces manipulation risk. |

| Disadvantages | Resource-intensive; prone to tax disputes. | May overlook transactional nuances and profit drivers. |

Understanding the Arm’s Length Principle

The Arm's Length Principle (ALP) requires related entities in cross-border transactions to price their dealings as if they were independent parties, ensuring that profits are allocated fairly and tax bases are protected. It relies on comparable uncontrolled transactions to determine appropriate transfer prices, minimizing tax base erosion and transfer pricing manipulation. Understanding ALP is crucial for multinational enterprises and tax authorities to comply with OECD guidelines and avoid double taxation or disputes.

Key Features of Formulary Apportionment

Formulary apportionment allocates a multinational corporation's global taxable income among jurisdictions based on a formula incorporating factors like sales, assets, and payroll. This method reduces tax base erosion by aligning taxable income with economic activity, simplifying transfer pricing disputes inherent in the arm's length principle. Key features include objective allocation criteria, minimized profit shifting, and enhanced tax compliance through standardized global reporting mechanisms.

Historical Development of Both Methods

The arm's length principle, rooted in OECD guidelines since the 1920s, evolved to address transfer pricing by ensuring transactions between related parties mimic those between independent entities. Formulary apportionment, emerging prominently in the mid-20th century, allocates multinational profits based on a formula considering factors such as sales, assets, and payroll across jurisdictions. Both methods reflect historical efforts to prevent tax base erosion and profit shifting, with arm's length focusing on transactional comparability and formulary apportionment emphasizing consolidated income distribution.

Comparative Overview: Arm’s Length vs Formulary Apportionment

The Arm's Length Principle allocates profits based on transactions between related parties at market value, ensuring each entity is taxed where economic activities occur and value is created. Formulary Apportionment assigns profits using a predetermined formula considering factors like sales, assets, and payroll across jurisdictions, simplifying transfer pricing disputes but potentially diverging from actual economic contributions. Both approaches aim to mitigate base erosion and profit shifting (BEPS), with the Arm's Length Principle favored in current international tax frameworks while formulary apportionment gains attention for digital economy challenges.

Implementation Challenges and Compliance Issues

Implementing the arm's length principle faces challenges such as complex transfer pricing documentation and difficulties in accurately determining comparable uncontrolled prices. Formulary apportionment encounters compliance issues related to agreeing on the formula components and the allocation of income among jurisdictions. Both approaches struggle with cross-border coordination and increased administrative burdens for multinational enterprises and tax authorities.

Impact on Multinational Enterprise Taxation

The Arm's length principle allocates profits among multinational enterprises (MNEs) based on comparable independent transactions, ensuring that each jurisdiction taxes profits corresponding to actual economic activities. In contrast, formulary apportionment distributes global profits using a formula considering factors like sales, assets, and payroll, which reduces transfer pricing disputes but may ignore specific transactional nuances. The choice between these approaches significantly affects MNE tax liabilities, compliance costs, and the allocation of taxable income across different tax jurisdictions.

Transfer Pricing Risks and Dispute Resolution

The Arm's length principle, relying on comparables to set transfer prices, introduces risks such as inaccurate benchmarking and inconsistent application across jurisdictions, often leading to prolonged transfer pricing disputes. Formulary apportionment mitigates these risks by using a predetermined formula to allocate income, reducing reliance on subjective comparability but raising concerns about harmonizing rules internationally. Effective dispute resolution mechanisms, including Advanced Pricing Agreements (APAs) and Mutual Agreement Procedures (MAPs), play a crucial role in addressing uncertainties under both approaches and minimizing double taxation risks.

International Consensus and OECD Guidelines

The Arm's Length Principle (ALP) remains the cornerstone of international tax rules, endorsed by the OECD Transfer Pricing Guidelines to ensure that related parties transact as if they were independent. Formulary apportionment, although discussed, lacks broad international consensus due to challenges in uniformly allocating profits across jurisdictions. The OECD continues to reinforce ALP in addressing Base Erosion and Profit Shifting (BEPS) while exploring complementary approaches without abandoning established transfer pricing frameworks.

Economic Implications for Global Tax Policy

The arm's length principle allocates profits based on independent entity transactions, ensuring taxable income aligns with where economic activities and value creation occur, which supports tax sovereignty but may encourage base erosion through transfer pricing manipulation. Formulary apportionment distributes taxable income using a formula based on factors like sales, assets, and payroll, reducing profit shifting but raising concerns over harmonizing tax bases and potential double taxation. Economic implications for global tax policy revolve around balancing tax fairness, minimizing litigation costs, and fostering multinational investment while addressing tax avoidance and maintaining national revenue stability.

Future Trends in Cross-Border Taxation

Future trends in cross-border taxation reveal an increasing emphasis on the arm's length principle, supported by enhanced transfer pricing documentation and real-time data analytics for accurate profit allocation. However, formulary apportionment gains traction as multinational enterprises and tax authorities seek simplified and more transparent methods of dividing taxable income based on factors like sales, assets, and payroll. Emerging global tax frameworks, such as the OECD's Pillar One and Two initiatives, reflect a hybrid approach combining these methods to address digital economy challenges and curb base erosion effectively.

Important Terms

Transfer pricing

Transfer pricing relies heavily on the Arm's length principle, which mandates that transactions between related entities be priced as if between independent parties to ensure fair taxation. In contrast, formulary apportionment allocates multinational profits based on a predetermined formula considering factors like assets, sales, and payroll, providing an alternative method to address profit distribution across jurisdictions.

Allocation keys

Allocation keys determine the method for dividing income or expenses among parties in transfer pricing, ensuring compliance with the Arm's Length Principle by reflecting independent market conditions. In contrast, formulary apportionment uses a predetermined formula, such as sales, assets, and payroll, to allocate income without relying on comparability analysis.

Functional analysis

Functional analysis evaluates the economic activities and risks of related parties to determine transfer prices consistent with the Arm's Length Principle, contrasting with formulary apportionment which allocates income based on a formulaic distribution of factors like sales, assets, and payroll.

Profit split method

The profit split method allocates income between related entities based on their relative economic contributions under the arm's length principle, contrasting with formulary apportionment which divides profits according to a predetermined formula without direct reference to market transactions.

Separate entity approach

The separate entity approach under the Arm's length principle requires independent transactions between related entities to be priced as if between unrelated parties, contrasting with formulary apportionment that allocates income based on a predetermined formula across jurisdictions.

Comparable uncontrolled price

Comparable uncontrolled price (CUP) method aligns with the Arm's length principle by relying on market-based pricing of similar transactions, whereas formulary apportionment allocates income based on a formula without explicit reliance on comparable market prices.

Unitary taxation

Unitary taxation allocates global profits of a multinational enterprise based on formulary apportionment using factors like sales, assets, and payroll, contrasting with the arm's length principle which assigns income to separate entities based on comparable uncontrolled transactions.

Economic nexus

Economic nexus determines tax obligations based on significant business presence in a jurisdiction, contrasting with the Arm's Length Principle which allocates profits through independent party transactions, while formulary apportionment distributes income using a formula considering factors like sales, assets, and payroll.

Multinational enterprise (MNE)

Multinational enterprises (MNEs) face complex transfer pricing challenges as the arm's length principle requires pricing transactions between related entities as if they were unrelated, while formulary apportionment allocates profits based on a predetermined formula considering factors like sales, assets, and employees across jurisdictions.

Double taxation avoidance

Double taxation avoidance hinges on the application of the Arm's length principle, which ensures transactions between related entities are priced as if between independent parties to prevent profit shifting and tax base erosion. In contrast, formulary apportionment allocates combined profits across jurisdictions based on factors like sales, assets, and payroll, offering a standardized method to mitigate double taxation by dividing income rather than relying on transfer pricing.

Arm’s length principle vs formulary apportionment Infographic

moneydif.com

moneydif.com