Tax deductions reduce taxable income by allowing specific expenses to be subtracted, thereby lowering the overall tax liability. Tax exemptions exclude certain income or entities from taxation entirely, preventing that portion from being subject to tax. Understanding the distinction between deductions and exemptions is essential for optimizing tax savings and ensuring compliance with tax regulations.

Table of Comparison

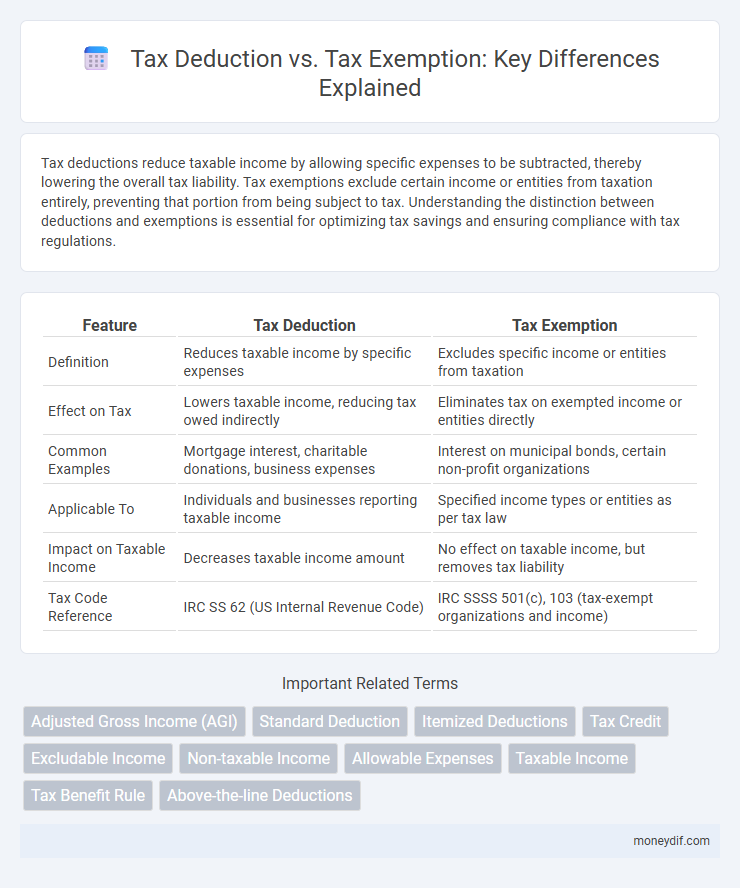

| Feature | Tax Deduction | Tax Exemption |

|---|---|---|

| Definition | Reduces taxable income by specific expenses | Excludes specific income or entities from taxation |

| Effect on Tax | Lowers taxable income, reducing tax owed indirectly | Eliminates tax on exempted income or entities directly |

| Common Examples | Mortgage interest, charitable donations, business expenses | Interest on municipal bonds, certain non-profit organizations |

| Applicable To | Individuals and businesses reporting taxable income | Specified income types or entities as per tax law |

| Impact on Taxable Income | Decreases taxable income amount | No effect on taxable income, but removes tax liability |

| Tax Code Reference | IRC SS 62 (US Internal Revenue Code) | IRC SSSS 501(c), 103 (tax-exempt organizations and income) |

Understanding Tax Deductions and Exemptions

Tax deductions reduce taxable income by allowing specific expenses, such as mortgage interest or charitable donations, to be subtracted from gross income, lowering the overall tax liability. Tax exemptions exclude certain income or entities from taxation altogether, such as personal exemptions for dependents or exemptions for nonprofit organizations. Understanding the difference between deductions and exemptions is essential for accurate tax planning and minimizing tax payments legally.

Key Differences Between Deductions and Exemptions

Tax deductions reduce taxable income by allowing specific expenses to be subtracted, directly lowering the amount of income subject to tax. Exemptions exclude a fixed amount of income from taxation based on the taxpayer's status or dependents, decreasing overall taxable income. Key differences include that deductions are linked to incurred expenses, while exemptions are based on personal or dependent qualifications, affecting how taxable income is calculated.

Types of Tax Deductions

Tax deductions reduce taxable income by allowing taxpayers to subtract specific expenses such as mortgage interest, charitable contributions, and medical expenses from their gross income. Common types of tax deductions include standard deductions, itemized deductions, business expenses, and education-related expenses like student loan interest. These deductions directly lower the amount of income subject to tax, thereby decreasing the overall tax liability.

Common Tax Exemptions Explained

Common tax exemptions include personal exemptions, dependent exemptions, and specific income exemptions such as interest from municipal bonds, which reduce taxable income and effectively lower tax liability. Exemptions differ from deductions as they often apply to fixed amounts, directly excluding certain income or taxpayers from taxation rather than reducing taxable income through incurred expenses. Understanding these exemptions can help taxpayers maximize their tax benefits and ensure compliance with tax regulations.

Eligibility Criteria for Deductions and Exemptions

Eligibility criteria for tax deductions typically require taxpayers to incur specific expenses, such as mortgage interest, charitable donations, or medical costs, directly related to income generation or personal circumstances. Tax exemptions are often granted based on factors like taxpayer status, income thresholds, age, disability, or dependent relationships, allowing certain income amounts to be excluded from taxable income. Understanding the distinct eligibility requirements for deductions and exemptions is essential for optimizing tax liabilities and ensuring compliance with tax laws.

Impact on Taxable Income: Deduction vs. Exemption

Deductions reduce taxable income by lowering the amount of income subject to tax through allowable expenses or contributions, directly decreasing the tax base. Exemptions exclude specific portions of income or certain individuals from taxation, effectively reducing the overall income considered for tax calculations. Both mechanisms impact taxable income but differ in application, with deductions typically tied to expenses and exemptions often related to personal or dependent allowances.

How to Claim Tax Deductions and Exemptions

Tax deductions reduce taxable income by allowing specific expenses to be subtracted, while exemptions exclude certain income or individuals from taxation. To claim tax deductions, taxpayers must itemize eligible expenses like mortgage interest or charitable contributions on their tax return using appropriate IRS forms. Claiming exemptions involves reporting dependents and qualifying circumstances directly on the tax return, ensuring proper documentation to validate eligibility and maximize tax benefits.

Pros and Cons of Deductions Versus Exemptions

Tax deductions reduce taxable income by the amount of the expense, lowering overall tax liability, while exemptions directly reduce taxable income by permitting specific amounts to be excluded for dependents or personal reasons. Deductions benefit taxpayers with higher expenses but require detailed record-keeping, whereas exemptions offer straightforward tax relief without additional documentation. However, exemptions may result in less tax savings for high-income earners compared to deductions, which can be strategically maximized.

Mistakes to Avoid When Applying for Deductions or Exemptions

Misunderstanding the specific eligibility criteria for deductions versus exemptions often leads to erroneous tax filings and potential penalties. Failing to maintain proper documentation or receipts can result in disallowed claims during audits, negating anticipated tax benefits. Taxpayers should avoid claiming deductions or exemptions that overlap or contradict IRS guidelines to ensure compliance and optimize their tax returns.

Maximizing Savings: Choosing Between Deduction and Exemption

Choosing between a tax deduction and an exemption significantly impacts overall tax savings by reducing taxable income differently. Deductions lower taxable income based on specific expenses, such as mortgage interest or charitable donations, while exemptions directly reduce taxable income by a fixed amount per eligible individual. Analyzing income level, filing status, and eligible amounts helps optimize tax strategy for maximum financial benefit.

Important Terms

Adjusted Gross Income (AGI)

Adjusted Gross Income (AGI) is the total gross income minus specific adjustments, serving as the basis for calculating taxable income after deductions but before exemptions. Unlike exemptions, which reduce taxable income by a fixed amount per individual, deductions lower AGI by subtracting allowable expenses such as mortgage interest or retirement contributions.

Standard Deduction

Standard deduction reduces taxable income by a fixed amount without requiring itemized documentation, unlike exemptions which specifically lower taxable income based on personal status or dependents; the 2024 U.S. standard deduction amounts to $13,850 for single filers and $27,700 for married filing jointly. This distinction simplifies tax calculations while exemptions have been largely eliminated under current tax law, emphasizing the importance of the standard deduction in minimizing tax liability.

Itemized Deductions

Itemized deductions allow taxpayers to subtract specific expenses such as mortgage interest, medical expenses, and charitable contributions from their taxable income, often resulting in greater tax savings compared to the standard deduction. Unlike exemptions, which reduce taxable income by a fixed amount per taxpayer or dependent, itemized deductions require detailed documentation and directly lower the adjusted gross income based on eligible expenses.

Tax Credit

Tax credits directly reduce the amount of tax owed, offering dollar-for-dollar savings, whereas deductions lower taxable income, decreasing the tax base before calculation. Exemptions, often personal or dependent, reduce taxable income similarly to deductions but are specific allowances that exclude a portion of income from taxation.

Excludable Income

Excludable income refers to specific types of income that taxpayers can legally omit from their gross income for tax purposes, which differs from deductions that reduce taxable income but must be included initially. While exemptions directly reduce taxable income by allowing certain amounts per taxpayer or dependent, excludable income is income not subject to tax at all, such as municipal bond interest or certain employee fringe benefits.

Non-taxable Income

Non-taxable income includes earnings such as gifts, scholarships, and municipal bond interest that are excluded from gross income, whereas deductions reduce taxable income by allowing specific expenses like mortgage interest or charitable donations to be subtracted. Unlike exemptions, which reduce taxable income based on the number of dependents, non-taxable income is entirely excluded from taxation, providing distinct benefits in tax planning.

Allowable Expenses

Allowable expenses directly reduce taxable income by being deductible from gross income, lowering the overall tax liability, whereas exemptions exclude a fixed amount or certain income types from taxation altogether. Understanding the distinction between deductions and exemptions is crucial for accurate tax filing and maximizing tax benefits.

Taxable Income

Taxable income is calculated by subtracting allowable deductions and exemptions from gross income, where deductions reduce taxable income based on specific expenses, and exemptions directly reduce the income amount based on personal or dependent criteria. Understanding the distinction between deductions, such as mortgage interest or charitable contributions, and exemptions, like personal or dependent exemptions, helps optimize tax liability effectively.

Tax Benefit Rule

The Tax Benefit Rule requires taxpayers to include previously deducted amounts in gross income if the original deduction produced a tax benefit and the amount is later recovered. This rule distinguishes between deductions, which reduce taxable income and can trigger income inclusion upon recovery, and exemptions, which are permanently excluded and generally not subject to recapture.

Above-the-line Deductions

Above-the-line deductions directly reduce your gross income before calculating adjusted gross income (AGI), offering a significant tax advantage compared to exemptions, which reduce taxable income after AGI is determined. Common above-the-line deductions include student loan interest, educator expenses, and contributions to traditional IRAs, enabling taxpayers to lower their overall tax liability more effectively than exemptions.

Deduction vs exemption Infographic

moneydif.com

moneydif.com