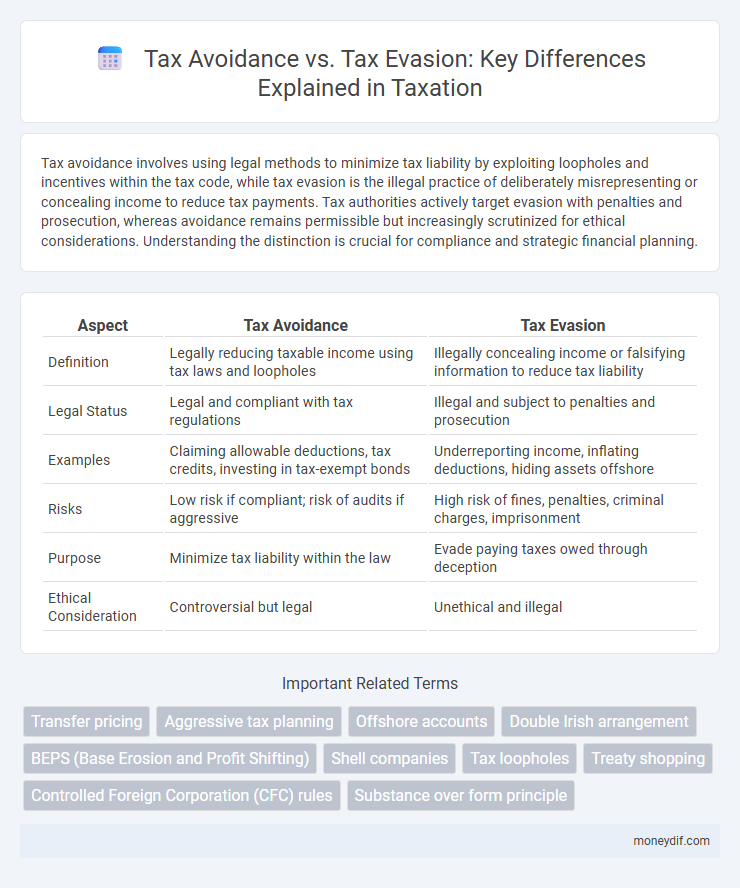

Tax avoidance involves using legal methods to minimize tax liability by exploiting loopholes and incentives within the tax code, while tax evasion is the illegal practice of deliberately misrepresenting or concealing income to reduce tax payments. Tax authorities actively target evasion with penalties and prosecution, whereas avoidance remains permissible but increasingly scrutinized for ethical considerations. Understanding the distinction is crucial for compliance and strategic financial planning.

Table of Comparison

| Aspect | Tax Avoidance | Tax Evasion |

|---|---|---|

| Definition | Legally reducing taxable income using tax laws and loopholes | Illegally concealing income or falsifying information to reduce tax liability |

| Legal Status | Legal and compliant with tax regulations | Illegal and subject to penalties and prosecution |

| Examples | Claiming allowable deductions, tax credits, investing in tax-exempt bonds | Underreporting income, inflating deductions, hiding assets offshore |

| Risks | Low risk if compliant; risk of audits if aggressive | High risk of fines, penalties, criminal charges, imprisonment |

| Purpose | Minimize tax liability within the law | Evade paying taxes owed through deception |

| Ethical Consideration | Controversial but legal | Unethical and illegal |

Understanding Tax Avoidance and Tax Evasion

Tax avoidance involves legally minimizing tax liabilities through legitimate methods such as deductions, credits, and income shifting, aligning with tax regulations. Tax evasion, on the other hand, constitutes illegal activities like underreporting income, inflating deductions, or hiding assets to deliberately evade tax obligations. Differentiating between tax avoidance and tax evasion is essential for compliance and ethical financial management in both individual and corporate taxation.

Key Differences Between Tax Avoidance and Tax Evasion

Tax avoidance involves legally utilizing tax regulations and loopholes to minimize tax liability, while tax evasion is the illegal practice of deliberately misrepresenting income or falsifying information to reduce tax payments. The key difference lies in legality: tax avoidance complies with the law whereas tax evasion violates tax laws and can lead to penalties or imprisonment. Both activities impact government revenue, but tax evasion carries significant legal risks compared to tax avoidance's strategic financial planning.

Legal Implications of Tax Avoidance

Tax avoidance involves using legal methods to minimize tax liabilities, such as exploiting deductions and credits allowed by tax laws, whereas tax evasion constitutes illegal practices like underreporting income or inflating expenses. The legal implications of tax avoidance depend on adherence to statutory regulations and judicial interpretations, with aggressive avoidance strategies potentially triggering audits and penalties. Courts often assess the substance over form to distinguish lawful avoidance from abusive schemes, emphasizing compliance with tax principles and anti-avoidance provisions.

Consequences of Tax Evasion

Tax evasion leads to severe legal consequences including hefty fines, penalties, and potential imprisonment as it involves illegal underreporting or non-payment of taxes. Authorities may also impose interest charges on unpaid taxes, and individuals or businesses caught evading taxes risk damage to their reputation and loss of public trust. Persistent tax evasion can trigger audits and increased scrutiny from tax agencies, resulting in long-term financial and operational difficulties.

Common Strategies for Tax Avoidance

Common strategies for tax avoidance include income deferral, where taxpayers delay receiving income to a later tax year to reduce current tax liability. Utilizing tax deductions and credits such as mortgage interest, charitable donations, and education expenses helps lower taxable income legally. Structure optimization, including forming partnerships or trusts, is also employed to take advantage of favorable tax rates and exemptions within the tax code.

Typical Methods Used in Tax Evasion

Typical methods used in tax evasion include underreporting income, inflating deductions or expenses, and hiding money in offshore accounts to evade detection by tax authorities. Fraudulent documentation and use of shell companies also play significant roles in concealing taxable income. These illegal practices result in severe penalties, including fines and imprisonment, under tax laws worldwide.

The Role of Regulatory Authorities

Regulatory authorities play a crucial role in distinguishing tax avoidance from tax evasion by enforcing tax laws and ensuring compliance through audits and penalties. They implement strict guidelines and monitoring systems to detect and address aggressive tax avoidance strategies that exploit legal loopholes, while criminalizing deliberate tax evasion involving falsification or concealment. Effective regulation promotes tax transparency, reduces revenue losses, and supports fair economic competition.

Ethical Considerations in Tax Planning

Tax avoidance involves legally utilizing loopholes and incentives to minimize tax liability, while tax evasion constitutes illegal practices like underreporting income or inflating deductions. Ethical considerations in tax planning emphasize transparency, compliance with tax laws, and the social responsibility of contributing a fair share to public resources. Businesses and individuals should balance tax efficiency with moral obligations to avoid reputational damage and legal penalties.

Real-World Case Studies: Avoidance vs. Evasion

Real-world case studies reveal clear distinctions between tax avoidance and tax evasion, highlighting that avoidance utilizes legal loopholes to minimize tax liabilities while evasion involves illegal actions such as underreporting income or falsifying documents. Notable examples include multinational corporations employing complex transfer pricing strategies for avoidance and high-profile individuals caught evading taxes through hidden offshore accounts. Regulatory authorities continuously adapt enforcement mechanisms to detect and penalize evasion, as seen in cases like the Panama Papers scandal exposing extensive tax evasion schemes.

Strategies for Minimizing Tax Risk Legally

Employing strategies such as thorough documentation, adhering to clear tax regulations, and utilizing tax credits or deductions effectively helps minimize tax risk legally. Implementing compliant tax planning, including transfer pricing policies and structuring transactions within legal frameworks, further reduces exposure to penalties. Consulting tax professionals for continuous updates on evolving tax laws ensures adherence while optimizing tax liabilities without crossing into evasion.

Important Terms

Transfer pricing

Transfer pricing manipulation often constitutes tax avoidance by legally exploiting tax rules, whereas tax evasion involves illegal underreporting of income to reduce tax liabilities.

Aggressive tax planning

Aggressive tax planning exploits legal loopholes to minimize tax liability, contrasting with tax evasion which involves illegal practices to evade taxes entirely.

Offshore accounts

Offshore accounts are often used for legal tax avoidance by optimizing financial strategies, whereas illegal tax evasion involves deliberately hiding income to evade tax liabilities.

Double Irish arrangement

The Double Irish arrangement legally reduces corporate tax liabilities by exploiting differences in international tax laws, distinguishing it from illegal tax evasion which involves fraudulent concealment of income.

BEPS (Base Erosion and Profit Shifting)

BEPS (Base Erosion and Profit Shifting) involves aggressive tax avoidance strategies that exploit legal gaps to shift profits offshore, distinguishing it from illegal tax evasion which violates tax laws.

Shell companies

Shell companies are often used for tax avoidance by legally minimizing tax liabilities, whereas tax evasion involves illegal practices to evade paying taxes owed.

Tax loopholes

Tax loopholes legally enable tax avoidance by exploiting gaps in tax laws, whereas tax evasion involves illegal practices to evade paying taxes owed.

Treaty shopping

Treaty shopping involves exploiting tax treaties to minimize tax liability legally, distinguishing it from tax evasion, which is the illegal non-payment or underpayment of taxes.

Controlled Foreign Corporation (CFC) rules

Controlled Foreign Corporation (CFC) rules are designed to prevent tax avoidance by attributing income earned by foreign subsidiaries to domestic shareholders, thereby reducing the risk of illicit tax evasion through offshore entities.

Substance over form principle

The substance over form principle ensures tax authorities prioritize the economic reality of transactions over their legal form to distinguish legitimate tax avoidance from illegal tax evasion.

Tax avoidance vs tax evasion Infographic

moneydif.com

moneydif.com