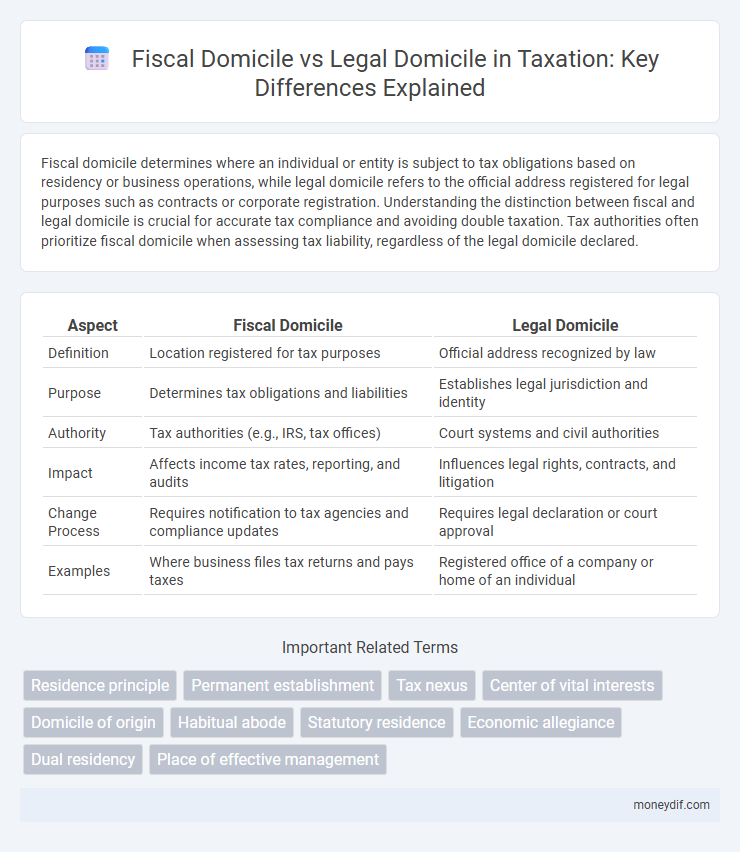

Fiscal domicile determines where an individual or entity is subject to tax obligations based on residency or business operations, while legal domicile refers to the official address registered for legal purposes such as contracts or corporate registration. Understanding the distinction between fiscal and legal domicile is crucial for accurate tax compliance and avoiding double taxation. Tax authorities often prioritize fiscal domicile when assessing tax liability, regardless of the legal domicile declared.

Table of Comparison

| Aspect | Fiscal Domicile | Legal Domicile |

|---|---|---|

| Definition | Location registered for tax purposes | Official address recognized by law |

| Purpose | Determines tax obligations and liabilities | Establishes legal jurisdiction and identity |

| Authority | Tax authorities (e.g., IRS, tax offices) | Court systems and civil authorities |

| Impact | Affects income tax rates, reporting, and audits | Influences legal rights, contracts, and litigation |

| Change Process | Requires notification to tax agencies and compliance updates | Requires legal declaration or court approval |

| Examples | Where business files tax returns and pays taxes | Registered office of a company or home of an individual |

Understanding Fiscal Domicile

Fiscal domicile determines the jurisdiction where an individual or entity is subject to tax obligations based on residency, typically involving criteria such as physical presence, permanent home, and center of vital interests. Unlike legal domicile, which reflects the place established by law for legal purposes like jurisdiction or civil status, fiscal domicile directly impacts income tax liabilities and tax residency status. Accurate identification of fiscal domicile ensures compliance with local tax laws and prevents double taxation through proper application of tax treaties.

Defining Legal Domicile

Legal domicile refers to the official, permanent home established by law where an individual or entity has registered for purposes of legal jurisdiction and taxation. It determines the legal rights and obligations, including taxation authority, irrespective of the physical location or habitual residence. Distinguishing legal domicile from fiscal domicile is crucial, as fiscal domicile relates specifically to tax residency and may differ based on income sources and tax regulations.

Key Differences Between Fiscal and Legal Domicile

Fiscal domicile refers to the location where an individual or business is subject to taxation, based on residency or economic activity, while legal domicile is the official address recognized by law for legal purposes such as contracts and jurisdiction. Key differences include the fact that fiscal domicile determines tax obligations and liability, whereas legal domicile affects legal rights, responsibilities, and the applicable legal system. Understanding these distinctions is crucial for compliance with tax regulations and legal matters, as misclassification can lead to penalties or jurisdictional conflicts.

Importance of Domicile Status in Taxation

Fiscal domicile determines the tax jurisdiction where an individual or entity is liable for income tax, while legal domicile establishes residency for legal purposes. Understanding the distinction is crucial because fiscal domicile influences the scope of taxable income and eligibility for tax treaties. Accurate domicile status helps prevent double taxation and ensures compliance with local tax regulations.

Determining Your Fiscal Domicile

Determining your fiscal domicile involves identifying the primary location where you are subject to tax obligations, which may differ from your legal domicile registered for official purposes. Tax authorities evaluate factors such as the center of economic interests, duration of stay, and habitual residence to establish your fiscal domicile. Understanding these criteria ensures accurate tax compliance and helps avoid double taxation issues.

Criteria for Establishing Legal Domicile

Legal domicile is established based on physical presence and intention to remain indefinitely at a specific location, supported by factors such as voter registration, driver's license issuance, and property ownership. Courts often consider where an individual's family lives, the address used for tax returns, and the location of personal belongings to determine legal domicile. Unlike fiscal domicile, which focuses on tax residency for income tax purposes, legal domicile has broader implications for legal jurisdiction and civic responsibilities.

Tax Implications of Fiscal vs Legal Domicile

Fiscal domicile determines where an individual or entity is subject to taxation based on economic activities and residency, while legal domicile establishes the official registered address for legal purposes. Tax authorities primarily consider fiscal domicile to assess income tax liabilities, thereby influencing tax obligations, reporting requirements, and eligibility for tax treaties. Misalignment between fiscal and legal domiciles can result in double taxation or disputes over tax residency status, making accurate domicile classification essential for compliance and optimal tax planning.

Cross-Border Tax Issues and Domicile

Fiscal domicile determines the jurisdiction for tax obligations, influencing income tax, capital gains, and inheritance taxes across borders. Legal domicile, often tied to personal legal rights and obligations, may differ from fiscal domicile, complicating tax residency status and treaty benefits. Understanding the distinction is essential for cross-border tax planning, avoiding double taxation, and ensuring compliance with international tax regulations.

Domicile Changes and Tax Residency Rules

Fiscal domicile determines tax obligations based on where an individual primarily resides and manages their economic interests, while legal domicile refers to the official address registered for legal purposes. Changes in domicile require careful assessment of both physical presence and intent, as tax residency rules differ by jurisdiction and impact liability for income, capital gains, and inheritance taxes. Understanding the tax residency criteria, including the statutory period of stay and center of vital interests, is essential for compliance and optimizing tax outcomes during domicile transitions.

Common Mistakes in Declaring Domicile for Taxes

Errors in declaring domicile for tax purposes often arise from confusing fiscal domicile with legal domicile, leading to incorrect tax residency claims. Taxpayers may overlook that fiscal domicile refers to the center of economic interests, while legal domicile is the official legal residence, causing discrepancies in tax filings. Such mistakes result in potential penalties, double taxation risks, and issues with compliance under international tax treaties.

Important Terms

Residence principle

The Residence Principle determines tax liability based on an individual's fiscal domicile, which refers to the place where they have their habitual residence and tax obligations, distinct from their legal domicile that is established by law and may influence legal rights but not necessarily tax responsibilities.

Permanent establishment

Permanent establishment determines tax obligations based on the fiscal domicile, which may differ from the legal domicile used for corporate registration.

Tax nexus

Tax nexus is primarily determined by fiscal domicile, which refers to the location of effective tax administration, rather than the legal domicile that denotes a person's or entity's registered legal address.

Center of vital interests

The center of vital interests determines an individual's fiscal domicile by identifying the primary location of personal and economic ties, which may differ from their legal domicile used for formal jurisdictional purposes.

Domicile of origin

Domicile of origin establishes a person's initial legal residence for tax purposes, serving as a baseline that differs from fiscal domicile, which is determined by actual tax residency criteria, and legal domicile, which refers to the place recognized by law for personal jurisdiction and legal rights.

Habitual abode

Habitual abode refers to the place where an individual regularly lives and stays, distinguishing it from fiscal domicile, which is tied to tax obligations, and legal domicile, which is the officially recognized permanent residence for legal purposes.

Statutory residence

Statutory residence determines tax obligations based on physical presence and time spent in a jurisdiction, distinguishing it from fiscal domicile, which focuses on the primary location of economic interests, and legal domicile, defined as the official address for legal purposes.

Economic allegiance

Economic allegiance primarily depends on fiscal domicile, which determines tax obligations, while legal domicile establishes jurisdiction for legal rights and responsibilities.

Dual residency

Dual residency occurs when an individual is considered a tax resident in two countries simultaneously due to differences between fiscal domicile, which determines tax obligations, and legal domicile, which establishes official residence for legal purposes.

Place of effective management

The place of effective management determines a company's tax residency by identifying where key management and commercial decisions occur, which may differ from its legal domicile used for corporate registration.

Fiscal domicile vs legal domicile Infographic

moneydif.com

moneydif.com