Transfer pricing refers to the rules and methods for pricing transactions between related entities within a multinational corporation, ensuring profits are allocated appropriately across tax jurisdictions. Arm's length pricing requires these intra-company transactions to be conducted as if the parties were unrelated, reflecting market conditions and fair value. Complying with arm's length principles helps prevent tax avoidance by aligning transfer prices with those independent entities would negotiate.

Table of Comparison

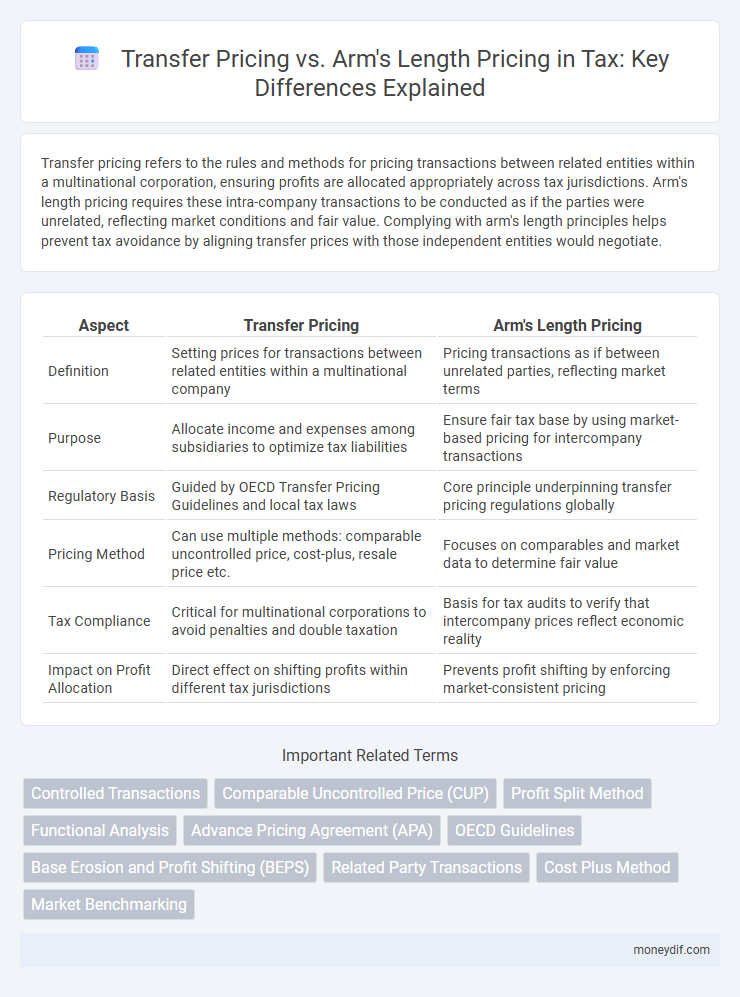

| Aspect | Transfer Pricing | Arm's Length Pricing |

|---|---|---|

| Definition | Setting prices for transactions between related entities within a multinational company | Pricing transactions as if between unrelated parties, reflecting market terms |

| Purpose | Allocate income and expenses among subsidiaries to optimize tax liabilities | Ensure fair tax base by using market-based pricing for intercompany transactions |

| Regulatory Basis | Guided by OECD Transfer Pricing Guidelines and local tax laws | Core principle underpinning transfer pricing regulations globally |

| Pricing Method | Can use multiple methods: comparable uncontrolled price, cost-plus, resale price etc. | Focuses on comparables and market data to determine fair value |

| Tax Compliance | Critical for multinational corporations to avoid penalties and double taxation | Basis for tax audits to verify that intercompany prices reflect economic reality |

| Impact on Profit Allocation | Direct effect on shifting profits within different tax jurisdictions | Prevents profit shifting by enforcing market-consistent pricing |

Introduction to Transfer Pricing and Arm’s Length Pricing

Transfer pricing refers to the pricing of goods, services, and intangibles exchanged between related entities within a multinational enterprise, crucial for tax compliance and profit allocation. Arm's length pricing is the standard used to ensure transactions between related parties are conducted as if they were between independent entities, reflecting market conditions. Understanding the distinction between these concepts is essential for multinational companies to avoid tax adjustments and penalties imposed by tax authorities worldwide.

Definition and Core Principles

Transfer pricing refers to the pricing of goods, services, or intangibles between related entities within a multinational corporation, ensuring profits are allocated appropriately across jurisdictions. Arm's length pricing is the standard that mandates these intercompany transactions be conducted as if between independent parties, reflecting market conditions. The core principle is to prevent profit shifting and ensure tax compliance by aligning transfer prices with market rates.

Key Differences Between Transfer Pricing and Arm’s Length Pricing

Transfer pricing refers to the prices set for transactions between related entities within a multinational corporation, while arm's length pricing ensures these transactions reflect market conditions as if between unrelated parties. Key differences include the regulatory focus: transfer pricing governs internal pricing strategies to prevent tax base erosion, whereas arm's length pricing acts as a compliance benchmark set by tax authorities to align transfer prices with market value. Furthermore, transfer pricing strategies often involve documentation and adjustments, whereas arm's length pricing relies heavily on comparable uncontrolled price data to justify tax positions.

Global Regulatory Frameworks

Global regulatory frameworks for transfer pricing emphasize adherence to the arm's length principle, which requires transactions between related parties to be priced as if conducted between independent entities. The OECD Transfer Pricing Guidelines provide the primary reference for multinational enterprises and tax authorities to ensure compliance and avoid double taxation. Countries increasingly align their tax regulations with these standards to maintain transparency and consistent tax practices across borders.

Significance in International Taxation

Transfer pricing plays a crucial role in international taxation by determining how transactions between related entities across borders are valued for tax purposes. Arm's length pricing serves as the benchmark, ensuring that intercompany transactions reflect market conditions similar to those between unrelated parties, preventing profit shifting and tax base erosion. Compliance with arm's length principles is essential for multinational enterprises to avoid transfer pricing adjustments, penalties, and double taxation in cross-border tax audits.

OECD Guidelines and Local Regulations

Transfer pricing refers to the pricing of transactions between related entities within a multinational enterprise, with the OECD Guidelines providing a framework to ensure these prices comply with the arm's length principle, which requires that transactions be priced as if between unrelated parties. Local regulations may vary but generally align with the OECD's arm's length standard to prevent tax base erosion and profit shifting by ensuring that intercompany transactions reflect market conditions. Compliance with both OECD Guidelines and local tax laws is essential to mitigate risks of transfer pricing adjustments, penalties, and double taxation.

Methods of Determining Arm’s Length Prices

Methods of determining arm's length prices include the Comparable Uncontrolled Price (CUP) method, which compares prices charged in comparable transactions between independent parties. The Resale Price Method calculates prices based on the resale margin of products sold between related entities and independent buyers. The Cost Plus Method allocates a markup on production costs to set transfer prices aligned with market conditions, ensuring compliance with arm's length standards.

Compliance Challenges and Documentation

Transfer pricing compliance challenges primarily stem from differing interpretations of the arm's length principle, which requires transactions between related parties to be priced as if they were between independent entities. Documentation must meticulously detail comparability analyses, functional profiles, and economic conditions to substantiate transfer prices and avoid penalties during audits. Inadequate or inconsistent documentation increases the risk of adjustments and double taxation, making precise record-keeping and adherence to local regulations critical for multinational enterprises.

Risks of Non-Compliance and Penalties

Non-compliance with transfer pricing regulations and arm's length pricing requirements exposes multinational corporations to significant risks, including severe tax penalties, increased audit scrutiny, and potential double taxation. Tax authorities impose stringent penalties for inaccurate transfer pricing documentation, failure to adhere to the arm's length principle, or underreporting taxable income, which can lead to costly adjustments and interest charges. Effective compliance reduces exposure to financial risks and reputational damage while ensuring alignment with local and international tax laws such as the OECD Transfer Pricing Guidelines.

Future Trends in Transfer Pricing Enforcement

Future trends in transfer pricing enforcement point towards increased use of advanced data analytics and artificial intelligence to detect pricing anomalies and ensure compliance with arm's length principles. Tax authorities are investing in sophisticated technologies to scrutinize intercompany transactions, enhancing transparency and risking stricter penalties for non-compliance. Global cooperation among tax administrations is intensifying to address base erosion and profit shifting (BEPS), leading to more uniform enforcement of transfer pricing regulations worldwide.

Important Terms

Controlled Transactions

Controlled transactions involve exchanges between related parties where transfer pricing sets the prices to ensure compliance with tax regulations, aligning closely with the arm's length principle that requires prices to be comparable to those charged between independent entities under similar conditions. Ensuring accurate transfer pricing in controlled transactions prevents profit shifting and minimizes tax risks by reflecting fair market value consistent with arm's length pricing standards.

Comparable Uncontrolled Price (CUP)

Comparable Uncontrolled Price (CUP) method determines transfer prices by comparing the price charged in a controlled transaction to the price charged in a comparable uncontrolled transaction between unrelated parties, ensuring compliance with arm's length pricing principles. This technique is highly effective for transactional transfer pricing analysis when identical or very similar goods or services are exchanged under comparable conditions.

Profit Split Method

The Profit Split Method allocates combined profits between related entities based on their relative contributions, aligning transfer pricing with the arm's length principle by reflecting each party's economic activities. This method is particularly effective for integrated operations where comparable uncontrolled transactions are scarce, ensuring compliance with international tax regulations.

Functional Analysis

Functional analysis in transfer pricing evaluates the roles, risks, and assets of related entities to determine appropriate pricing for intercompany transactions, ensuring comparability to similar independent transactions under the arm's length principle. This analysis focuses on economic activities and value creation to align transfer prices with market conditions, preventing tax base erosion and compliance risks.

Advance Pricing Agreement (APA)

Advance Pricing Agreements (APAs) establish pre-agreed transfer pricing methods between related entities to ensure compliance with arm's length pricing standards, reducing the risk of tax disputes and double taxation. APAs provide certainty on transfer pricing by aligning intra-group transactions with market-based arm's length principles mandated by tax authorities globally.

OECD Guidelines

OECD Guidelines emphasize transfer pricing practices based on the arm's length principle, ensuring transactions between related parties reflect prices that independent enterprises would charge under comparable circumstances. Adhering to these guidelines minimizes tax avoidance risks and promotes fairness in international taxation by aligning profits with economic activities and value creation.

Base Erosion and Profit Shifting (BEPS)

Base Erosion and Profit Shifting (BEPS) addresses strategies multinational enterprises use to exploit gaps in tax rules, significantly impacting transfer pricing practices by enforcing adherence to arm's length pricing standards set by the OECD. Arm's length pricing requires transactions between related entities to be priced as if they were between independent parties, preventing profit shifting and ensuring tax base protection across jurisdictions.

Related Party Transactions

Related party transactions often require transfer pricing methods to ensure compliance with tax regulations by setting prices that reflect market conditions. Arm's length pricing is the standard benchmark used to determine fair value in these transactions, ensuring that intercompany prices match those that would be agreed upon between independent entities under similar circumstances.

Cost Plus Method

The Cost Plus Method calculates transfer prices by adding an appropriate markup to the production cost, aligning with arm's length pricing by reflecting profits consistent with comparable uncontrolled transactions. This approach ensures that intercompany pricing adheres to international tax regulations by establishing fair market value based on cost base and market-based profit margins.

Market Benchmarking

Market benchmarking in transfer pricing involves comparing controlled transactions to comparable uncontrolled transactions to ensure compliance with the arm's length principle, which requires prices charged between related parties to reflect market conditions. Accurate benchmarking analyzes relevant financial data and market transactions, ensuring taxable income is appropriately allocated and minimizing risks of transfer pricing adjustments by tax authorities.

Transfer pricing vs arm’s length pricing Infographic

moneydif.com

moneydif.com