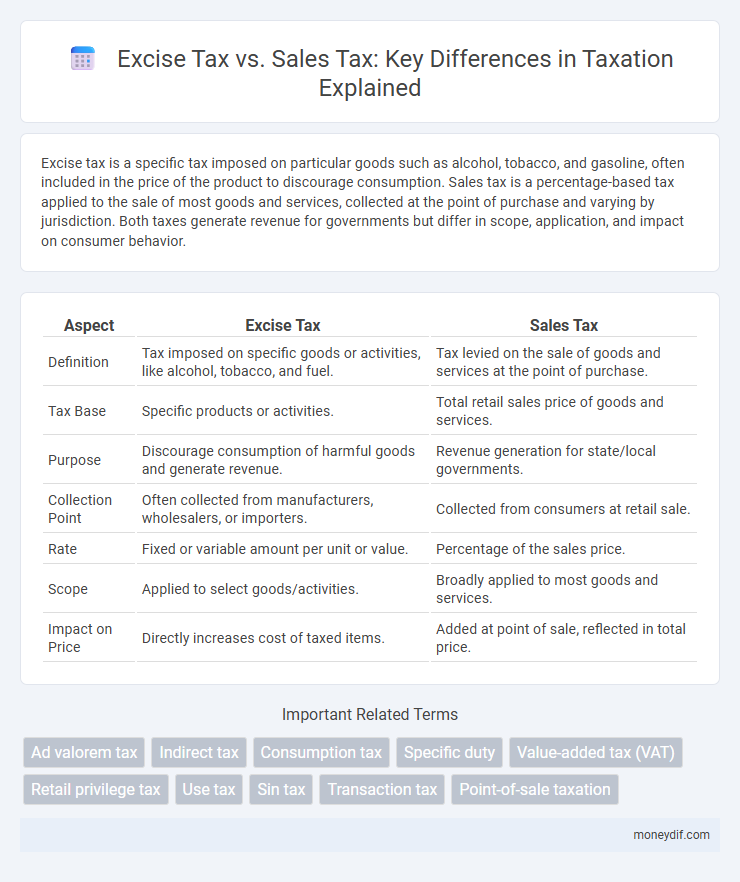

Excise tax is a specific tax imposed on particular goods such as alcohol, tobacco, and gasoline, often included in the price of the product to discourage consumption. Sales tax is a percentage-based tax applied to the sale of most goods and services, collected at the point of purchase and varying by jurisdiction. Both taxes generate revenue for governments but differ in scope, application, and impact on consumer behavior.

Table of Comparison

| Aspect | Excise Tax | Sales Tax |

|---|---|---|

| Definition | Tax imposed on specific goods or activities, like alcohol, tobacco, and fuel. | Tax levied on the sale of goods and services at the point of purchase. |

| Tax Base | Specific products or activities. | Total retail sales price of goods and services. |

| Purpose | Discourage consumption of harmful goods and generate revenue. | Revenue generation for state/local governments. |

| Collection Point | Often collected from manufacturers, wholesalers, or importers. | Collected from consumers at retail sale. |

| Rate | Fixed or variable amount per unit or value. | Percentage of the sales price. |

| Scope | Applied to select goods/activities. | Broadly applied to most goods and services. |

| Impact on Price | Directly increases cost of taxed items. | Added at point of sale, reflected in total price. |

Understanding Excise Tax and Sales Tax

Excise tax is a specific tax levied on the manufacture, sale, or consumption of particular goods such as alcohol, tobacco, and fuel, often included in the price of the product. Sales tax is a percentage-based tax imposed on the retail sale of most goods and services, typically collected at the point of sale. Understanding the distinction between excise tax and sales tax is crucial for compliance, as excise taxes target specific products while sales taxes apply broadly to various transactions.

Key Differences Between Excise Tax and Sales Tax

Excise tax is imposed on specific goods such as gasoline, tobacco, and alcohol, often included in the price at the point of manufacture or import, targeting consumption of particular products. Sales tax applies broadly to the sale of goods and services, calculated as a percentage of the retail price and collected at the point of purchase. Key differences include excise tax being product-specific and usually hidden in the price, while sales tax is a general consumption tax displayed separately to consumers.

Types of Goods and Services Subject to Each Tax

Excise tax primarily targets specific goods such as tobacco, alcohol, gasoline, and luxury items, often imposed to regulate consumption or generate revenue from particular industries. Sales tax applies broadly to most retail sales of tangible personal property and some services, varying by jurisdiction but generally excluding essentials like groceries and prescription medications. These distinctions affect pricing, consumer behavior, and tax revenue distribution across state and local governments.

How Excise Tax Is Calculated

Excise tax is calculated based on the quantity or volume of a specific product, such as per gallon of gasoline or per pack of cigarettes, rather than the sales price. This tax is often a fixed amount per unit or a percentage of the product's price, determined by government regulations. Unlike sales tax, which varies with the total sale amount, excise tax applies directly to the manufacture, sale, or consumption of regulated goods.

How Sales Tax Is Assessed

Sales tax is assessed as a percentage of the retail price of goods and services at the point of sale, typically collected by the retailer and remitted to the state or local tax authority. This tax applies primarily to the final consumer purchase and varies by jurisdiction, with rates fluctuating based on state, county, or city regulations. Exemptions may include certain necessities like groceries or prescription medications, depending on specific local tax laws.

Impact of Excise Tax on Consumers and Businesses

Excise tax increases the cost of specific goods such as tobacco, alcohol, and fuel, directly impacting consumer prices and reducing demand. Businesses face higher production costs, which may lead to decreased profit margins or increased prices passed on to consumers. Unlike sales tax, excise tax targets particular products, influencing both consumer behavior and business strategies in affected industries.

Impact of Sales Tax on Consumers and Businesses

Sales tax directly affects consumers by increasing the overall cost of goods and services, potentially reducing disposable income and altering purchasing behavior. For businesses, sales tax collection imposes compliance costs, including administrative burdens and the need for accurate record-keeping, which can affect cash flow and profitability. Variations in sales tax rates across regions also influence competitive dynamics, potentially impacting market entry and pricing strategies.

Government Revenue: Excise Tax vs. Sales Tax

Excise tax generates targeted government revenue by taxing specific goods such as tobacco, alcohol, and fuel, often resulting in higher per-unit revenue compared to sales tax. Sales tax applies broadly to most consumer purchases, providing a steady and substantial revenue stream due to its wide base across retail transactions. Governments balance these revenue sources to optimize tax efficiency and fund public services effectively.

Compliance and Reporting for Excise and Sales Taxes

Excise tax compliance requires detailed record-keeping for specific goods such as alcohol, tobacco, and fuel, with reporting often mandated on a periodic basis to federal and state tax authorities. Sales tax compliance involves collecting the appropriate rates from consumers, accurately maintaining transaction records, and filing returns that reflect taxable sales within each jurisdiction. Both taxes demand precise documentation and timely submission to avoid penalties and ensure adherence to regulatory requirements.

Excise Tax vs. Sales Tax: Which Is More Significant?

Excise tax is levied on specific goods like gasoline, alcohol, and tobacco, often included in the product price, making it a targeted tax aimed at controlling consumption and generating revenue from luxury or harmful items. Sales tax applies broadly to retail transactions, calculated as a percentage of the purchase price and collected at the point of sale, providing a widespread revenue source for state and local governments. The significance of excise tax versus sales tax depends on factors such as tax base scope, economic impact, and policy goals, with sales tax generally generating more total revenue while excise tax influences consumer behavior and supports public health initiatives.

Important Terms

Ad valorem tax

Ad valorem tax is calculated based on the assessed value of goods or property, differing from excise tax which is a fixed amount per unit, and sales tax which is a percentage applied at the point of sale. Excise taxes typically target specific products like alcohol or tobacco for regulatory purposes, while sales taxes apply broadly to consumer purchases and ad valorem taxes adjust with the value of the item, affecting both real estate and luxury goods.

Indirect tax

Indirect taxes include excise tax and sales tax, both levied on goods and services but differing in application; excise tax targets specific products like alcohol or tobacco at the production or import level, while sales tax is charged at the point of sale to the consumer. Excise taxes often aim to discourage consumption of harmful goods and generate revenue internally, whereas sales taxes provide broader tax bases and are collected by retailers to fund state and local governments.

Consumption tax

Consumption tax encompasses both excise tax and sales tax, where excise tax is levied on specific goods like alcohol, tobacco, and fuel, often included in the price at the manufacturing or import level, while sales tax is applied as a percentage of the sale price at the point of purchase for goods and services. These taxes aim to generate government revenue, influence consumer behavior, and can vary significantly by jurisdiction in rates and application scope.

Specific duty

Specific duty in excise tax is a fixed amount imposed per unit of a product, such as per liter of alcohol or per pack of cigarettes, directly targeting the quantity rather than the value. Sales tax, in contrast, is a percentage-based tax applied to the sale price of goods and services, calculated on the transaction value at the point of sale.

Value-added tax (VAT)

Value-added tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution, distinguishing it from excise tax which targets specific goods like alcohol and tobacco, and sales tax which is imposed only at the point of sale to the final consumer. Unlike sales tax that is collected once, VAT is collected incrementally across the supply chain, providing a more comprehensive revenue system and reducing tax evasion.

Retail privilege tax

Retail privilege tax, often categorized under excise taxes, is levied on the privilege of selling goods within a jurisdiction, differing from sales tax which is imposed directly on the consumer at the point of sale. Excise-related retail privilege taxes typically target specific industries or products, whereas sales taxes apply broadly to retail transactions, impacting pricing structures and compliance requirements for businesses.

Use tax

Use tax applies to the storage, use, or consumption of goods when sales tax has not been paid, ensuring tax compliance alongside excise tax, which targets specific goods like fuel or tobacco through per-unit levies. Unlike sales tax imposed at the point of purchase, use tax prevents tax avoidance on out-of-state acquisitions and complements excise tax's role in regulating products with additional social or health-related costs.

Sin tax

Sin tax targets specific goods like alcohol and tobacco to reduce consumption and generate revenue, functioning as a form of excise tax levied per unit or volume. Excise tax is imposed on production or sale of particular goods, while sales tax applies as a percentage on the total retail price of most goods and services.

Transaction tax

Transaction tax encompasses various forms including excise tax and sales tax, each applied at different stages of the supply chain; excise tax targets specific goods like alcohol and fuel, imposed on producers or importers, while sales tax is levied on the retail sale of goods and services, paid by the end consumer. Excise taxes are often included in the price of the product, influencing production costs, whereas sales taxes are calculated as a percentage of the sale price, directly affecting consumer purchases.

Point-of-sale taxation

Point-of-sale taxation varies significantly between excise tax and sales tax, with excise tax being a fixed or percentage-based levy imposed on specific goods like tobacco, alcohol, and gasoline at the time of production or importation, often included in the product's price. Sales tax, however, is a consumption tax collected at the point of sale on most goods and services purchased by the end consumer, calculated as a percentage of the sale price and remitted by retailers to government authorities.

excise tax vs sales tax Infographic

moneydif.com

moneydif.com