The marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, indicating how additional income is taxed. The effective tax rate represents the average rate paid on total income, calculated by dividing total taxes owed by total income. Understanding the difference between marginal and effective tax rates helps taxpayers evaluate their actual tax burden versus the taxes on incremental earnings.

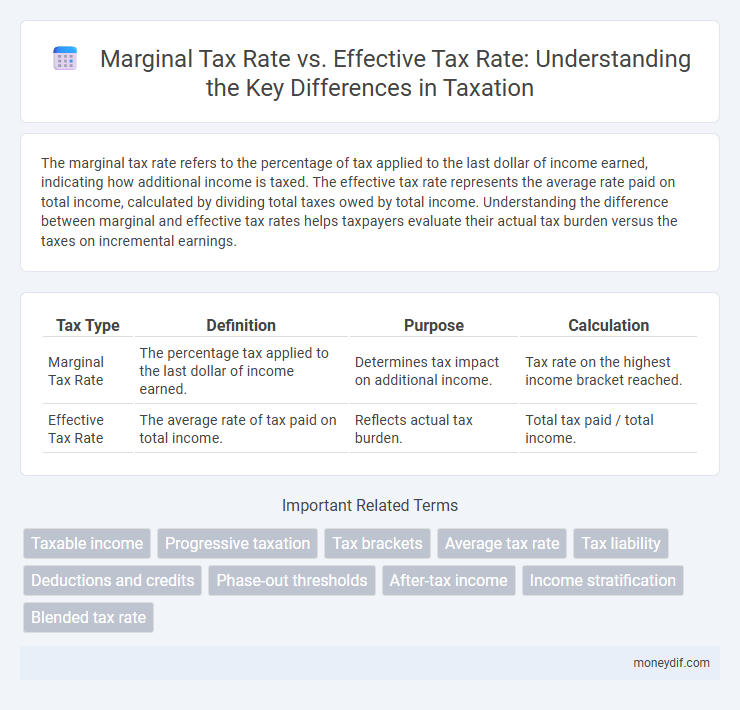

Table of Comparison

| Tax Type | Definition | Purpose | Calculation |

|---|---|---|---|

| Marginal Tax Rate | The percentage tax applied to the last dollar of income earned. | Determines tax impact on additional income. | Tax rate on the highest income bracket reached. |

| Effective Tax Rate | The average rate of tax paid on total income. | Reflects actual tax burden. | Total tax paid / total income. |

Understanding Marginal Tax Rate

The marginal tax rate is the percentage of tax applied to the last dollar of taxable income, influencing decisions about earning additional income. It differs from the effective tax rate, which is the overall average rate paid on total income after deductions. Understanding the marginal tax rate is essential for optimizing income strategies and anticipating the tax impact of incremental earnings.

What Is Effective Tax Rate?

Effective tax rate represents the average percentage of income paid in taxes, calculated by dividing total tax paid by total taxable income. It reflects the actual tax burden on an individual or business, incorporating all deductions, credits, and varying income tax brackets. Unlike the marginal tax rate, which applies to the last dollar earned, the effective tax rate provides a comprehensive view of overall tax liability.

Key Differences Between Marginal and Effective Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, impacting decisions on additional earnings or investments. Effective tax rate represents the average rate of tax paid on total income, calculated by dividing total tax liability by total taxable income, providing a clearer picture of overall tax burden. Key differences include marginal tax rate influencing incremental income decisions, while effective tax rate reflects the actual proportion of income paid in taxes over a period.

How Marginal Tax Rate Is Calculated

The marginal tax rate is calculated by determining the tax rate applied to the last dollar of income earned, reflecting the percentage owed on additional income within the highest tax bracket reached. This involves identifying the tax brackets relevant to the taxpayer's income level and applying the rate assigned to the top bracket containing their marginal income. Unlike the effective tax rate, which averages tax paid over total income, the marginal tax rate focuses on the incremental taxation applied to additional earnings.

Calculating Your Effective Tax Rate

Calculating your effective tax rate involves dividing the total tax paid by your total taxable income, providing a more accurate reflection of your actual tax burden compared to the marginal tax rate. The marginal tax rate indicates the rate applied to the last dollar earned, while the effective tax rate represents the average rate across all taxable income. Understanding your effective tax rate helps in budgeting and tax planning by revealing the percentage of income paid in taxes after deductions and credits.

Impact of Deductions on Tax Rates

Deductions lower taxable income, directly reducing the effective tax rate by decreasing the amount of income subject to tax, while the marginal tax rate remains the rate applied to the next dollar earned. The effective tax rate reflects the actual percentage of total income paid in taxes after deductions, credits, and exemptions, providing a more accurate measure of tax burden. High deductions can significantly shrink the effective tax rate, even when the marginal tax rate is relatively high, influencing taxpayer behavior and financial planning.

Marginal vs Effective Tax Rate: Real-Life Examples

Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, while effective tax rate represents the average tax paid on total income. For example, a person with a marginal tax rate of 30% might have an effective tax rate of 20% due to deductions and credits reducing overall taxable income. Real-life scenarios often show that high earners with progressive tax brackets face high marginal rates but lower effective rates, reflecting actual tax burdens more accurately.

Why Both Rates Matter for Tax Planning

Marginal tax rate represents the percentage of tax applied to the last dollar of income earned, crucial for understanding the tax impact of additional earnings or deductions. Effective tax rate reflects the average tax paid on total income, providing a realistic view of overall tax burden and cash flow. Both rates matter for tax planning as the marginal rate guides decisions on income adjustments and deductions, while the effective rate helps evaluate long-term tax liabilities and investment strategies.

Common Misconceptions About Tax Rates

Many taxpayers confuse marginal tax rates with effective tax rates, mistakenly believing that the highest tax bracket applies to all their income. The marginal tax rate only applies to income within the top bracket, whereas the effective tax rate reflects the average rate paid on total income after deductions and credits. Understanding this distinction helps prevent overestimating tax liability and aids in more accurate financial planning.

Marginal and Effective Tax Rates: Which Matters More?

Marginal tax rate represents the percentage of tax applied to the last dollar of income earned, directly influencing decisions on additional work or investment. Effective tax rate calculates the average tax paid across total income, providing a comprehensive view of an individual's or corporation's overall tax burden. For strategic financial planning, understanding marginal tax rate is crucial for evaluating immediate tax impacts on new income, while effective tax rate better reflects long-term tax efficiency and total tax liability.

Important Terms

Taxable income

Taxable income determines the portion of earnings subject to taxation, influencing how the marginal tax rate applies incrementally to each additional dollar earned, while the effective tax rate represents the average rate paid overall. Understanding the distinction helps taxpayers evaluate their true tax burden versus the rate applied to their next dollar of income.

Progressive taxation

Progressive taxation imposes higher marginal tax rates on increasing income brackets, ensuring that individuals with greater earnings pay a larger percentage on their last dollar earned. The effective tax rate, which reflects the average tax burden on total income, is typically lower than the marginal tax rate due to income taxed at lower rates in earlier brackets.

Tax brackets

Tax brackets define income ranges taxed at increasing marginal tax rates, which apply only to income within each bracket, while the effective tax rate represents the average rate paid on total taxable income. Understanding the difference between marginal and effective tax rates helps taxpayers estimate their true tax burden and plan financial decisions accordingly.

Average tax rate

Average tax rate represents the total taxes paid divided by total income, while marginal tax rate refers to the tax rate applied to the last dollar of income earned. Effective tax rate measures the overall percentage of income paid in taxes after accounting for deductions and credits, providing a real-world perspective different from the purely statutory marginal tax rate.

Tax liability

Tax liability is directly influenced by both the marginal tax rate, which applies to the last dollar earned, and the effective tax rate, which represents the average rate paid on total income, offering a comprehensive view of overall tax burden. The marginal tax rate dictates the cost of earning additional income, while the effective tax rate reflects total tax paid relative to total income, crucial for understanding actual tax obligations.

Deductions and credits

Deductions reduce taxable income, lowering the marginal tax rate on each additional dollar earned, while tax credits directly decrease the total tax liability, impacting the effective tax rate by reducing the actual amount paid. Understanding the interplay between deductions and credits is essential for optimizing tax outcomes and minimizing overall tax burden.

Phase-out thresholds

Phase-out thresholds reduce the benefits of tax credits and deductions as income rises, effectively increasing the marginal tax rate above the nominal rate by lowering the net gain from additional earnings. This creates a divergence between the marginal tax rate, which measures the tax on the next dollar earned, and the effective tax rate, which reflects the average tax paid on total income after accounting for phase-outs.

After-tax income

After-tax income is directly influenced by the marginal tax rate, which determines the tax applied to the next dollar of income, and the effective tax rate, representing the average tax paid across total income. Understanding the distinction between these rates is crucial for accurately estimating net earnings and developing tax-efficient strategies.

Income stratification

Income stratification significantly influences the disparity between marginal tax rates and effective tax rates, as higher-income earners often face steep marginal tax brackets but benefit from deductions and credits that lower their effective tax rate. This divergence underscores the progressive tax system's complexity and highlights how income levels alter actual tax burdens beyond statutory rates.

Blended tax rate

Blended tax rate combines multiple tax rates into a single average percentage, reflecting the overall tax burden on income from various sources or brackets. It differs from the marginal tax rate, which applies to the last dollar earned, and the effective tax rate, which represents the total taxes paid as a percentage of total income.

Marginal tax rate vs effective tax rate Infographic

moneydif.com

moneydif.com