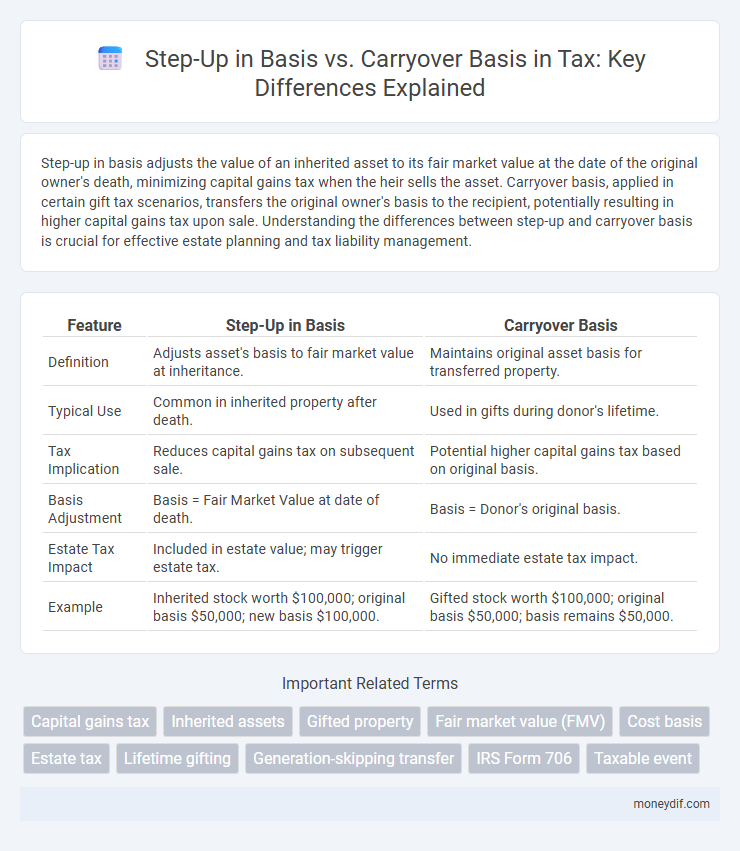

Step-up in basis adjusts the value of an inherited asset to its fair market value at the date of the original owner's death, minimizing capital gains tax when the heir sells the asset. Carryover basis, applied in certain gift tax scenarios, transfers the original owner's basis to the recipient, potentially resulting in higher capital gains tax upon sale. Understanding the differences between step-up and carryover basis is crucial for effective estate planning and tax liability management.

Table of Comparison

| Feature | Step-Up in Basis | Carryover Basis |

|---|---|---|

| Definition | Adjusts asset's basis to fair market value at inheritance. | Maintains original asset basis for transferred property. |

| Typical Use | Common in inherited property after death. | Used in gifts during donor's lifetime. |

| Tax Implication | Reduces capital gains tax on subsequent sale. | Potential higher capital gains tax based on original basis. |

| Basis Adjustment | Basis = Fair Market Value at date of death. | Basis = Donor's original basis. |

| Estate Tax Impact | Included in estate value; may trigger estate tax. | No immediate estate tax impact. |

| Example | Inherited stock worth $100,000; original basis $50,000; new basis $100,000. | Gifted stock worth $100,000; original basis $50,000; basis remains $50,000. |

Understanding Step-Up in Basis: Definition and Purpose

Step-up in basis refers to the adjustment of an inherited asset's value to its fair market value at the date of the decedent's death, minimizing capital gains tax upon sale. This tax provision helps beneficiaries avoid paying taxes on appreciation that occurred during the decedent's lifetime. Understanding the purpose of step-up in basis is crucial for estate planning and optimizing tax liability.

What is Carryover Basis? Key Concepts Explained

Carryover basis refers to the tax basis of an asset that is transferred from one taxpayer to another, maintaining the original cost basis rather than resetting to fair market value. This concept is typically applied in gift transactions where the recipient inherits the donor's basis, affecting future capital gains taxes upon sale. Understanding carryover basis is essential for accurate tax reporting and minimizing unexpected tax liabilities on inherited or gifted property.

How Step-Up in Basis Affects Inherited Assets

Step-up in basis adjusts the value of inherited assets to their fair market value at the decedent's date of death, reducing capital gains tax when the asset is sold. This increased basis often results in significantly lower taxable gains compared to carryover basis, which maintains the original cost basis of the asset. Estate planning strategies frequently leverage step-up in basis to minimize tax liabilities for heirs.

Tax Implications of Carryover Basis Transfers

Carryover basis transfers affect the recipient's tax liability by preserving the original cost basis of the asset, which can result in higher capital gains taxes upon sale. Unlike step-up in basis, where the asset's basis is adjusted to its fair market value at the time of transfer, carryover basis does not reduce the taxable gain. This method is commonly used in gifts, requiring the recipient to track the donor's original basis for accurate tax reporting.

Step-Up in Basis vs. Carryover Basis: Core Differences

Step-up in basis adjusts an asset's value to its fair market value at the time of inheritance, minimizing capital gains tax when the asset is sold. Carryover basis transfers the original purchase price from the giver to the recipient, preserving the asset's historical cost and potentially increasing capital gains tax liability. Understanding these core differences is crucial for effective estate planning and tax strategy optimization.

Calculating Cost Basis: Step-Up vs. Carryover Methods

Calculating cost basis using the step-up method adjusts the asset's basis to its fair market value at the date of inheritance, often minimizing capital gains taxes upon sale. In contrast, the carryover basis method retains the original purchase price of the asset, transferring the donor's basis to the recipient and potentially leading to higher taxable gains. Understanding these distinct approaches is crucial for accurately reporting gain or loss on inherited or gifted property.

Impact on Capital Gains Taxes for Heirs and Beneficiaries

Step-up in basis resets the asset's basis to its fair market value at the decedent's date of death, minimizing capital gains taxes for heirs when they sell the inherited property. Carryover basis maintains the original owner's cost basis, potentially resulting in higher capital gains taxes for beneficiaries due to the appreciation accumulated during the decedent's lifetime. This distinction significantly affects the taxable gain calculation, influencing estate planning strategies and the ultimate tax burden on inherited assets.

Estate Planning Considerations: Choosing the Right Basis

Step-up in basis resets the asset's value to its fair market value at the decedent's date of death, minimizing capital gains taxes for heirs and simplifying estate tax calculations. Carryover basis, often applied to gifts made before death, transfers the original purchase price to the recipient, potentially increasing capital gains taxes but allowing continued deferral of gains. Estate planning strategies must weigh the tax implications of both approaches to optimize the transfer of wealth and minimize overall tax liabilities.

Step-Up in Basis: Recent Legislative Changes and Proposals

Step-up in basis allows heirs to reset the value of inherited assets to their fair market value at the date of the decedent's death, minimizing capital gains taxes when the asset is sold. Recent legislative changes, such as provisions in the Inflation Reduction Act, have preserved the step-up in basis for most inherited assets despite increased scrutiny of estate tax rules. Proposed reforms in Congress include limiting or eliminating the step-up in basis to increase tax revenue and reduce tax avoidance, impacting estate planning strategies for high-net-worth individuals.

Common Scenarios: When Each Basis Rule Applies

Step-up in basis commonly applies in inheritance scenarios where the property's fair market value is adjusted to the date of the decedent's death, minimizing capital gains tax for heirs. Carryover basis typically applies during gifts, where the recipient inherits the donor's original cost basis, which can lead to higher capital gains taxes upon sale. Understanding these distinctions is crucial for estate planning and tax liability management.

Important Terms

Capital gains tax

Capital gains tax liability varies significantly depending on whether an asset is inherited or gifted, as inherited assets typically receive a step-up in basis to the fair market value at the decedent's date of death, minimizing capital gains upon sale. In contrast, gifted assets retain the carryover basis from the donor, potentially resulting in higher taxable gains if sold.

Inherited assets

Inherited assets benefit from a step-up in basis, which resets the asset's cost basis to its fair market value at the decedent's date of death, potentially reducing capital gains tax upon sale. In contrast, carryover basis applies primarily to gifts made during the giver's lifetime, where the recipient inherits the original cost basis, possibly resulting in higher capital gains tax.

Gifted property

Gifted property typically receives a carryover basis, where the recipient inherits the donor's original cost basis for tax purposes, potentially resulting in capital gains taxes upon sale based on the donor's initial purchase price. Step-up in basis occurs primarily with inherited property, adjusting the property's basis to its fair market value at the decedent's date of death, minimizing capital gains tax liabilities for beneficiaries.

Fair market value (FMV)

Fair market value (FMV) plays a crucial role in determining the step-up in basis, where an asset's basis is adjusted to its FMV at the time of inheritance, minimizing capital gains tax upon sale. In contrast, the carryover basis maintains the original purchase price as the asset's basis, usually applied in gift tax situations, potentially resulting in higher taxable gains.

Cost basis

Cost basis determines the original value of an asset for tax purposes, crucial in calculating capital gains or losses upon sale. Step-up in basis resets the asset's cost basis to its fair market value at inheritance, minimizing tax liability, whereas carryover basis transfers the original purchase price from the decedent to the heir, preserving the initial acquisition value for tax calculations.

Estate tax

Estate tax calculations often influence the decision between step-up in basis and carryover basis for inherited assets; step-up in basis resets the asset's value to its fair market value at the date of death, minimizing capital gains tax liability for heirs. Carryover basis, used primarily in certain family-owned businesses, transfers the original cost basis to beneficiaries, potentially increasing capital gains tax but preserving the estate's valuation for tax reporting.

Lifetime gifting

Lifetime gifting triggers a carryover basis for the recipient, meaning the property's original cost basis transfers to them, potentially increasing capital gains tax upon sale. In contrast, inherited assets benefit from a step-up in basis, adjusting the cost basis to the property's fair market value at the decedent's date of death, often minimizing capital gains tax liability.

Generation-skipping transfer

Generation-skipping transfer (GST) tax involves transferring assets to grandchildren or unrelated individuals more than one generation below the donor, with tax implications affected by the choice between step-up in basis and carryover basis. Assets with a step-up in basis reset their fair market value at the date of inheritance, minimizing capital gains tax, while carryover basis retains the original cost basis, potentially increasing capital gains liability for the recipient.

IRS Form 706

IRS Form 706 is used to report the estate tax and to elect the step-up in basis, which resets the value of inherited assets to their fair market value at the decedent's date of death. Without this election, inherited assets may retain a carryover basis, meaning the beneficiary assumes the original purchase price, potentially increasing capital gains taxes on future sales.

Taxable event

A taxable event occurs when an asset is sold or transferred, triggering recognition of capital gains or losses based on its adjusted basis. Step-up in basis resets the asset's cost basis to its fair market value at the time of inheritance, minimizing capital gains tax liability, whereas carryover basis transfers the original purchase price from the donor to the recipient, preserving unrealized gains for future taxation.

Step-up in basis vs Carryover basis Infographic

moneydif.com

moneydif.com