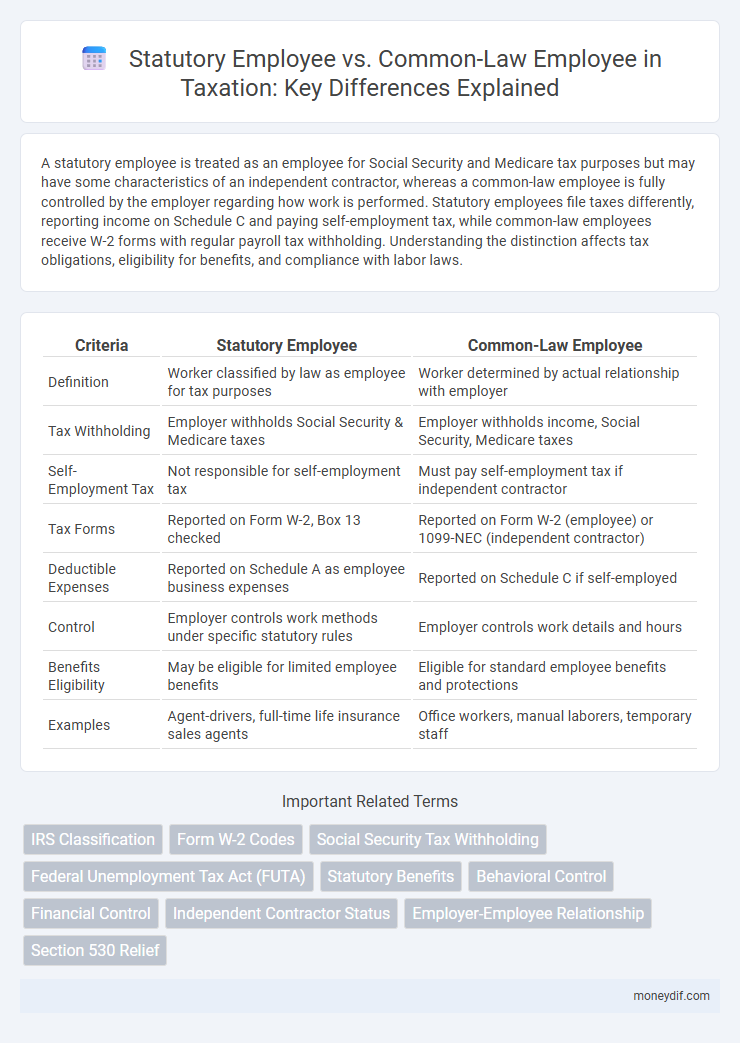

A statutory employee is treated as an employee for Social Security and Medicare tax purposes but may have some characteristics of an independent contractor, whereas a common-law employee is fully controlled by the employer regarding how work is performed. Statutory employees file taxes differently, reporting income on Schedule C and paying self-employment tax, while common-law employees receive W-2 forms with regular payroll tax withholding. Understanding the distinction affects tax obligations, eligibility for benefits, and compliance with labor laws.

Table of Comparison

| Criteria | Statutory Employee | Common-Law Employee |

|---|---|---|

| Definition | Worker classified by law as employee for tax purposes | Worker determined by actual relationship with employer |

| Tax Withholding | Employer withholds Social Security & Medicare taxes | Employer withholds income, Social Security, Medicare taxes |

| Self-Employment Tax | Not responsible for self-employment tax | Must pay self-employment tax if independent contractor |

| Tax Forms | Reported on Form W-2, Box 13 checked | Reported on Form W-2 (employee) or 1099-NEC (independent contractor) |

| Deductible Expenses | Reported on Schedule A as employee business expenses | Reported on Schedule C if self-employed |

| Control | Employer controls work methods under specific statutory rules | Employer controls work details and hours |

| Benefits Eligibility | May be eligible for limited employee benefits | Eligible for standard employee benefits and protections |

| Examples | Agent-drivers, full-time life insurance sales agents | Office workers, manual laborers, temporary staff |

Definition of Statutory Employee

A statutory employee is a worker who, while treated as an independent contractor for certain tax purposes, is classified as an employee under specific IRS statutes. This classification applies to individuals like certain drivers, full-time life insurance sales agents, and home workers who meet defined criteria, allowing their employers to withhold Social Security and Medicare taxes. The designation affects how wages are reported on Form W-2 and determines eligibility for certain tax benefits and deductions.

Definition of Common-Law Employee

A common-law employee is defined by the degree of control an employer has over the worker's duties and how the work is performed, rather than the job title or contract terms. This classification impacts tax obligations, as employers must withhold income taxes, Social Security, Medicare, and pay unemployment taxes for common-law employees. The IRS uses common-law rules to distinguish these employees from independent contractors, affecting both tax reporting and legal responsibilities.

Key Differences Between Statutory and Common-Law Employees

Statutory employees are defined by specific IRS criteria allowing employers to treat them as employees for Social Security and Medicare tax purposes despite certain independent contractor characteristics, while common-law employees are classified based on the employer's right to control the manner and means of work. Key differences include withholding requirements, with statutory employees having Social Security and Medicare taxes withheld but not federal income tax, whereas common-law employees have all applicable taxes withheld. The classification impacts tax reporting, with statutory employees receiving a W-2 that excludes income tax withholding, contrasting with common-law employees who receive a W-2 reflecting full tax withholdings.

Tax Withholding Requirements

Statutory employees have specific tax withholding requirements where employers must withhold Social Security and Medicare taxes but not federal income tax, while common-law employees require withholding of federal income tax, Social Security, Medicare, and potentially state income taxes. Statutory employees report earnings on Schedule C and can deduct business expenses, whereas common-law employees receive a W-2 form reflecting withheld taxes. Proper classification impacts IRS compliance, payroll tax obligations, and employee tax filing accuracy.

Social Security and Medicare Implications

Statutory employees pay Social Security and Medicare taxes through payroll deductions, with employers responsible for withholding and matching these taxes, unlike common-law employees where the employer also handles income tax withholding. Both employee types contribute to Social Security and Medicare, but statutory employees report earnings on Schedule C and deduct business expenses, impacting tax liabilities differently. Understanding these distinctions ensures accurate tax compliance and prevents underpayment of Social Security and Medicare taxes.

Employer Tax Responsibilities

Employers must withhold Social Security and Medicare taxes from statutory employees' wages while also paying the employer's share of these taxes, similar to common-law employees. Statutory employees are exempt from federal unemployment tax (FUTA), reducing the employer's payroll tax obligations compared to common-law employees who require FUTA contributions. Proper classification ensures compliance with IRS tax withholding, reporting requirements, and prevents penalties linked to misclassification of employee status.

Criteria for Classifying Statutory Employees

Statutory employees are classified based on specific criteria set by the IRS, including working under a written contract, performing services personally, and having the right to control the details of work but not the result. Common-law employees are distinguished by employer control over both work performance and output, with no written contract defining statutory employment. Key statutory employee categories include drivers, insurance sales agents, and full-time life insurance sales agents meeting IRS standards.

IRS Guidelines for Employee Classification

The IRS distinguishes statutory employees as workers treated as employees for tax withholding but who may report earnings on Schedule C, while common-law employees have employer-controlled work behavior and are subject to full payroll tax withholding. Statutory employees include specific categories such as certain drivers, life insurance sales agents, and home workers explicitly identified in IRS Publication 15-A. Proper classification affects Social Security, Medicare tax obligations, and eligibility for tax deductions related to business expenses.

Common Pitfalls in Employee Misclassification

Misclassifying statutory employees as common-law employees leads to significant tax liabilities and penalties, including improper withholding of Social Security, Medicare, and income taxes. Employers often overlook IRS guidelines, resulting in failure to provide necessary tax forms such as Form W-2 or Schedule C for statutory employees. Correct classification requires careful evaluation of behavioral and financial control factors to avoid costly audits and legal disputes.

Impact on Employee Benefits and Rights

Statutory employees receive specific tax benefits such as Social Security and Medicare deductions handled by employers, but lack typical employee benefits like health insurance and retirement plans common to common-law employees. Common-law employees are entitled to comprehensive employee benefits and protections, including minimum wage laws, workers' compensation, and unemployment insurance. Understanding employment classification is crucial for ensuring correct tax withholding and accessing appropriate employee rights and benefits.

Important Terms

IRS Classification

IRS classification distinguishes statutory employees, who perform services under specific IRS-defined categories and file taxes differently, from common-law employees, whose employer controls their work details and practices standard payroll tax withholding; proper classification affects tax liabilities, Social Security, Medicare contributions, and eligibility for employee benefits. Misclassification can lead to penalties, audits, and incorrect tax reporting, making understanding IRS guidelines critical for compliance in employment relationships.

Form W-2 Codes

Form W-2 codes such as Code "X" and Code "S" help distinguish statutory employees, who receive wages subject to Social Security and Medicare taxes but not unemployment tax, from common-law employees, whose employment relationship is defined by the degree of behavioral control and financial control exercised by the employer. Statutory employees report income on Schedule C but do not pay self-employment tax on those wages, whereas common-law employees report wages on Form W-2 and have different tax withholding and reporting requirements.

Social Security Tax Withholding

Social Security tax withholding for statutory employees is reported on Form W-2, with employers withholding Social Security and Medicare taxes directly, while common-law employees have these taxes withheld as part of standard payroll deductions. Statutory employees can deduct business expenses on Schedule C without self-employment tax, whereas common-law employees do not pay self-employment tax but cannot claim business expense deductions in the same way.

Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act (FUTA) imposes taxes primarily on employers to fund unemployment benefits, with statutory employees treated differently from common-law employees regarding tax withholding and reporting requirements. Statutory employees, who perform work under specific IRS-defined conditions, have their Social Security and Medicare taxes withheld by the employer but report income and expenses differently than common-law employees, who are subject to full withholding and reporting under standard employer-employee guidelines.

Statutory Benefits

Statutory employees receive specific statutory benefits such as Social Security and Medicare taxes withheld by employers, workers' compensation coverage, and unemployment insurance eligibility, whereas common-law employees are entitled to a broader range of employer-provided benefits including health insurance, retirement plans, and paid leave. The distinction affects tax treatment and benefit eligibility, with statutory employees classified under IRS guidelines providing compliance requirements for payroll tax withholding.

Behavioral Control

Behavioral control determines whether a worker is classified as a statutory employee or a common-law employee by evaluating the extent to which the employer directs or manages how tasks are performed, including instructions on when, where, and how to work. In statutory employment, workers may follow specific behavioral guidelines set by the employer but retain more independence compared to common-law employees who are closely supervised and controlled in their work methods.

Financial Control

Financial control in distinguishing statutory employees from common-law employees involves assessing the extent to which an employer directs or controls the financial aspects of the worker's job, including how business expenses are handled and whether the worker has unreimbursed expenses or opportunity for profit or loss. Statutory employees typically have less financial control over their work, as employers often bear the costs and provide tools, whereas common-law employees exercise more independent financial decision-making in their work activities.

Independent Contractor Status

Independent contractor status differs significantly from statutory and common-law employee classifications, impacting tax obligations and legal protections under IRS guidelines. Statutory employees receive specific tax treatment with withheld Social Security and Medicare taxes, while common-law employees are subject to employer control criteria, unlike independent contractors who maintain autonomy over work methods and schedules.

Employer-Employee Relationship

The employer-employee relationship differentiates statutory employees, who are recognized under specific tax laws and receive certain benefits like Social Security and Medicare withholding, from common-law employees, defined by behavioral control and the degree of supervision an employer exercises over their work. Understanding these distinctions is crucial for compliance with IRS regulations and proper tax treatment of wages and benefits.

Section 530 Relief

Section 530 Relief provides protection from employment tax liabilities for employers who misclassify workers as independent contractors instead of statutory or common-law employees, under strict criteria set by the IRS. This relief applies when the taxpayer has consistently treated the worker as a contractor, files all required tax returns, and has a reasonable basis for the classification, thereby avoiding back taxes, penalties, and interest.

Statutory employee vs Common-law employee Infographic

moneydif.com

moneydif.com