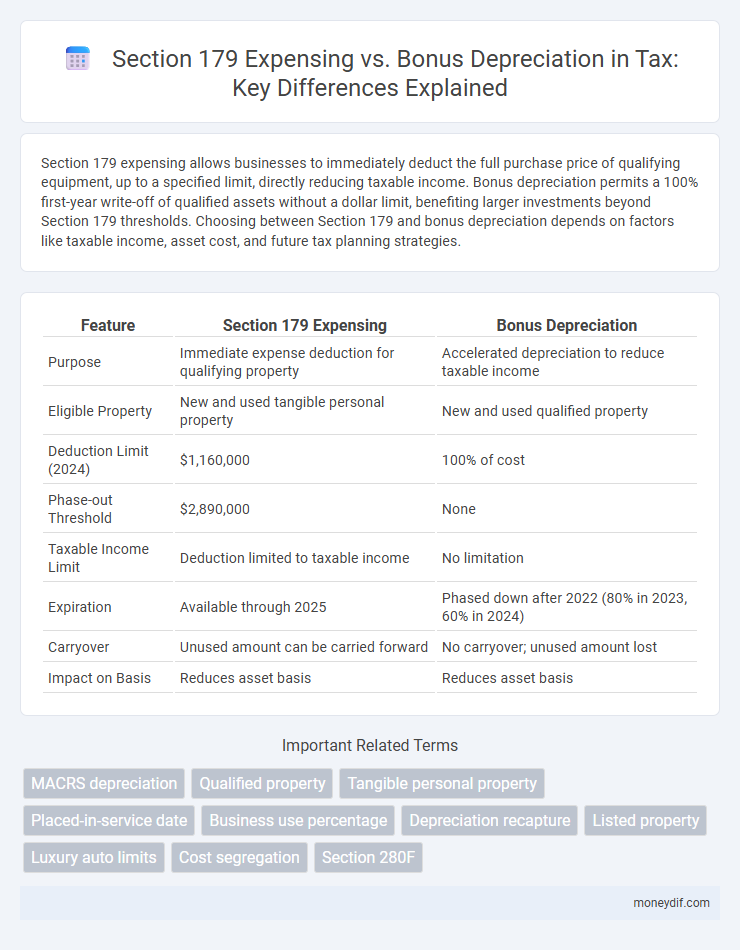

Section 179 expensing allows businesses to immediately deduct the full purchase price of qualifying equipment, up to a specified limit, directly reducing taxable income. Bonus depreciation permits a 100% first-year write-off of qualified assets without a dollar limit, benefiting larger investments beyond Section 179 thresholds. Choosing between Section 179 and bonus depreciation depends on factors like taxable income, asset cost, and future tax planning strategies.

Table of Comparison

| Feature | Section 179 Expensing | Bonus Depreciation |

|---|---|---|

| Purpose | Immediate expense deduction for qualifying property | Accelerated depreciation to reduce taxable income |

| Eligible Property | New and used tangible personal property | New and used qualified property |

| Deduction Limit (2024) | $1,160,000 | 100% of cost |

| Phase-out Threshold | $2,890,000 | None |

| Taxable Income Limit | Deduction limited to taxable income | No limitation |

| Expiration | Available through 2025 | Phased down after 2022 (80% in 2023, 60% in 2024) |

| Carryover | Unused amount can be carried forward | No carryover; unused amount lost |

| Impact on Basis | Reduces asset basis | Reduces asset basis |

Section 179 Expensing vs. Bonus Depreciation: Key Differences

Section 179 expensing allows businesses to immediately deduct the full cost of qualifying property in the year it is placed in service, up to a limit of $1,160,000 for 2023, with a phase-out threshold of $2,890,000. Bonus depreciation provides a 100% first-year deduction on new and used qualified property with no spending cap, but it applies automatically unless the taxpayer elects out. Unlike bonus depreciation, Section 179 requires active use and is limited by taxable income, offering more customization and control over deductions.

Eligibility Criteria for Section 179 and Bonus Depreciation

Section 179 expensing allows businesses to immediately deduct the cost of qualifying equipment up to a specified limit, provided the property is purchased and placed in service during the tax year and used more than 50% for business purposes. Bonus depreciation applies to new and used property acquired after September 27, 2017, with no limit on the amount that can be deducted but requires that the property have a recovery period of 20 years or less. Eligibility for Section 179 is restricted by annual investment caps and taxable income limitations, while bonus depreciation permits full expensing without such caps, making it beneficial for larger asset purchases.

Qualifying Property: What Can You Deduct?

Section 179 expensing allows businesses to immediately deduct the cost of qualifying property, including tangible personal property, off-the-shelf software, and certain improvements to nonresidential real property, up to specified limits. Bonus depreciation applies to new and used qualified property with a recovery period of 20 years or less, including machinery, equipment, and qualified improvement property, enabling 100% expensing in the first year. Both methods exclude land and inventory, but Section 179 is limited by taxable income and aggregate spending caps, whereas bonus depreciation has no income limit.

Deduction Limits: Section 179 vs. Bonus Depreciation

Section 179 allows businesses to deduct up to $1,160,000 of qualifying equipment costs in the tax year, subject to a phase-out threshold of $2,890,000 in total asset purchases. Bonus depreciation offers a 100% immediate deduction on eligible new and used assets with no upper limit, but it applies to the entire purchase amount rather than being capped. Section 179's deduction benefits smaller to mid-sized businesses with limits, while bonus depreciation provides larger firms unlimited first-year expensing.

Timing of Deductions for Maximum Tax Benefits

Section 179 expensing allows businesses to immediately deduct the full cost of qualifying equipment up to a specified limit, providing immediate tax relief within the purchase year. Bonus depreciation permits a 100% deduction on new and used asset acquisitions but can be spread over multiple years depending on tax regulations and asset class. Choosing between Section 179 and bonus depreciation hinges on timing the deduction to match profits, optimizing tax benefits by either accelerating expenses or balancing taxable income across periods.

Impact on Taxable Income and Cash Flow

Section 179 expensing allows businesses to immediately deduct the full cost of qualifying assets up to a specified limit, directly reducing taxable income and improving cash flow in the purchase year. Bonus depreciation applies to new and used property without a limit, creating larger upfront deductions that can significantly lower taxable income and enhance cash flow, especially for high-value acquisitions. Businesses must evaluate their income levels and tax planning strategies to optimize the interplay of Section 179 and bonus depreciation for maximum tax efficiency and cash flow benefits.

State Tax Treatment of Section 179 and Bonus Depreciation

State tax treatment of Section 179 expensing varies significantly, with some states conforming fully to the federal deduction limits while others impose lower caps or disallow the deduction entirely. Bonus depreciation is often treated differently at the state level, as many states either decouple from the federal bonus depreciation provisions or have phased it out, leading to adjustments in taxable income for state tax purposes. Businesses must carefully analyze each state's tax code to optimize both Section 179 expensing and bonus depreciation benefits during tax planning.

Recapture Rules and Considerations

Section 179 expensing allows businesses to immediately deduct the cost of qualifying property, but if the asset is sold or ceases to be used for business before the end of its recovery period, recapture rules require adding back previously deducted amounts to taxable income. Bonus depreciation offers 100% first-year expensing with no dollar limit and typically does not have recapture provisions unless the asset is converted to personal use or sold within a short timeframe. Careful consideration of recapture rules is essential for tax planning, as early disposition of Section 179 assets can trigger income inclusion, while bonus depreciation offers more flexibility but requires tracking for potential adjustments.

Planning Strategies for Small Business Owners

Section 179 expensing allows small business owners to immediately deduct the full cost of qualifying equipment up to $1,160,000 for 2023, optimizing cash flow and reducing taxable income. Bonus depreciation enables businesses to depreciate 80% of the cost of eligible property placed in service in 2023, particularly beneficial for those exceeding the Section 179 limits or investing in new equipment. Strategic use of both Section 179 and bonus depreciation maximizes tax savings by balancing current-year deductions and managing taxable income thresholds effectively.

Choosing the Best Deduction Method for Your Business

Section 179 expensing allows businesses to immediately deduct the cost of qualifying property up to a specific limit, providing flexibility in managing taxable income, while bonus depreciation offers a 100% deduction on eligible assets without annual limits but requires taking the full deduction in the year of purchase. Choosing the best deduction method depends on factors like the business's taxable income, future profit projections, and investment strategy. Small to mid-sized businesses with sufficient taxable income often benefit from Section 179's deduction cap and phase-out thresholds, whereas larger companies or those with lower current income might prefer bonus depreciation to maximize deductions quickly.

Important Terms

MACRS depreciation

MACRS depreciation allows businesses to recover asset costs over a specified recovery period, while Section 179 expensing permits immediate deduction of qualifying property up to a limit, reducing taxable income in the purchase year. Bonus depreciation complements Section 179 by enabling additional first-year deductions on new or used assets, often set at 100%, but it applies after the Section 179 limit is reached, accelerating overall tax benefits.

Qualified property

Qualified property under Section 179 expensing includes tangible personal property, such as machinery and equipment, used more than 50% for business purposes, with an annual deduction limit subject to phase-out thresholds. Bonus depreciation applies to new and used qualified property with a 100% immediate write-off allowed under IRS guidelines, without an annual dollar limit, enabling accelerated cost recovery beyond Section 179 restrictions.

Tangible personal property

Tangible personal property eligible for Section 179 expensing allows businesses to immediately deduct the full purchase price of qualifying assets up to a specific limit, promoting cash flow benefits. Bonus depreciation applies to new and used tangible personal property, enabling a 100% deduction of the asset's cost in the first year, with no dollar limit, but is subject to gradual phase-out rules starting in future tax years.

Placed-in-service date

The placed-in-service date determines eligibility for Section 179 expensing and bonus depreciation, as assets must be in use during the tax year to qualify; Section 179 applies to assets acquired and placed in service within the tax year, while bonus depreciation requires assets to be new or used but unused prior to acquisition. Accurately establishing this date ensures proper calculation of allowable deductions under IRS guidelines for immediate expensing.

Business use percentage

Section 179 expensing allows businesses to immediately deduct the full purchase price of qualifying equipment up to a limit, typically favoring small to mid-sized businesses with significant capital investments, while bonus depreciation offers 100% first-year expensing for new and used assets with no spending cap, benefiting larger businesses with higher acquisition costs. Business use percentage directly impacts the deductible amount under both methods, as only the portion of the asset used for business purposes qualifies for these accelerated deductions.

Depreciation recapture

Depreciation recapture occurs when the sale price of an asset exceeds its depreciated value, triggering taxable income primarily from prior Section 179 expensing, which accelerates immediate deductions but is fully recaptured upon sale. Bonus depreciation allows for larger upfront deductions on qualified property but typically results in a smaller recapture amount since it reduces the asset's adjusted basis differently compared to Section 179 expensing.

Listed property

Listed property, subject to strict IRS limitations under Section 179 expensing, includes vehicles and equipment used for both personal and business purposes, with expensing caps lower than standard assets. Bonus depreciation applies more broadly and can be used to immediately write off 100% of the cost of qualified listed property placed in service after September 27, 2017, but only if the property is used more than 50% for qualified business use.

Luxury auto limits

Luxury auto limits under IRS rules cap the Section 179 expensing deduction and bonus depreciation for passenger vehicles, with 2024 limits set at $12,800 for the first year, including bonus depreciation. The statutory luxury auto depreciation caps restrict deduction amounts, requiring careful allocation between Section 179 expensing and bonus depreciation to maximize tax benefits while complying with IRS luxury vehicle thresholds.

Cost segregation

Cost segregation accelerates asset depreciation by identifying and reclassifying property components into shorter recovery periods, enhancing upfront tax deductions. Section 179 expensing allows immediate deduction of qualifying property costs up to a limit, while bonus depreciation offers a percentage-based immediate write-off with no annual cap, making both strategies complementary for maximizing tax benefits on commercial real estate investments.

Section 280F

Section 280F limits the depreciation deduction for luxury vehicles, impacting the application of Section 179 expensing and bonus depreciation by capping the maximum allowable write-offs for passenger autos. While Section 179 allows immediate expensing of qualifying property up to set limits, bonus depreciation offers a higher first-year deduction but both must comply with Section 280F's luxury auto depreciation caps.

Section 179 expensing vs Bonus depreciation Infographic

moneydif.com

moneydif.com