Contributions to a nondeductible IRA are made with after-tax dollars, and earnings grow tax-deferred but are taxed upon withdrawal, whereas Roth IRA contributions are also made with after-tax dollars but qualified withdrawals are tax-free. Nondeductible IRAs offer limited tax advantages compared to Roth IRAs, which provide more flexibility for tax-free growth and distributions. Choosing between the two depends on current tax brackets, future income expectations, and retirement goals.

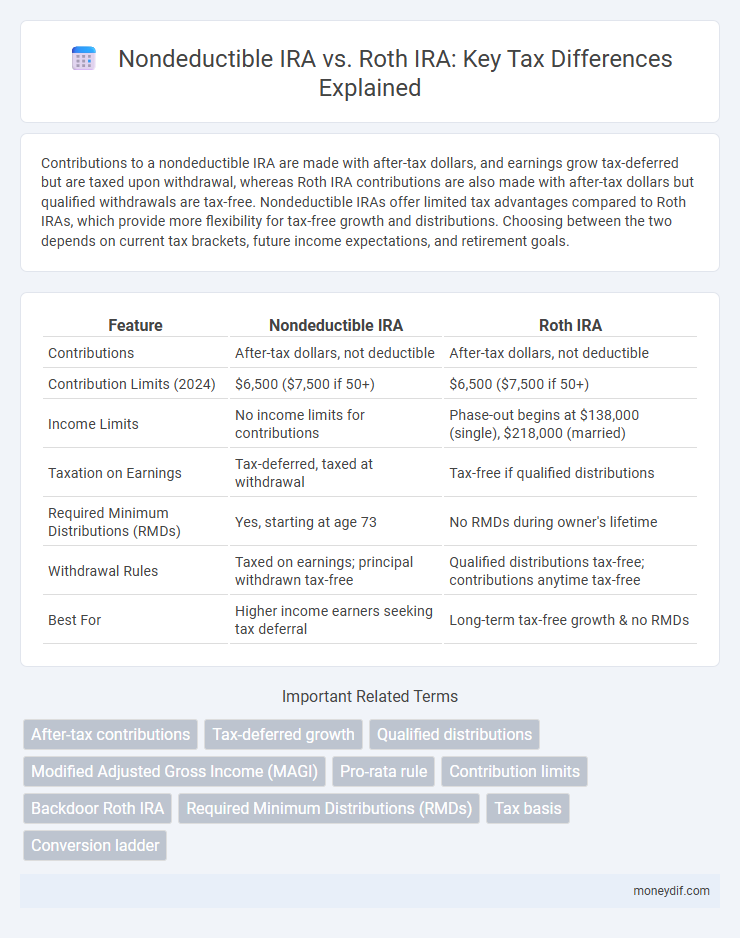

Table of Comparison

| Feature | Nondeductible IRA | Roth IRA |

|---|---|---|

| Contributions | After-tax dollars, not deductible | After-tax dollars, not deductible |

| Contribution Limits (2024) | $6,500 ($7,500 if 50+) | $6,500 ($7,500 if 50+) |

| Income Limits | No income limits for contributions | Phase-out begins at $138,000 (single), $218,000 (married) |

| Taxation on Earnings | Tax-deferred, taxed at withdrawal | Tax-free if qualified distributions |

| Required Minimum Distributions (RMDs) | Yes, starting at age 73 | No RMDs during owner's lifetime |

| Withdrawal Rules | Taxed on earnings; principal withdrawn tax-free | Qualified distributions tax-free; contributions anytime tax-free |

| Best For | Higher income earners seeking tax deferral | Long-term tax-free growth & no RMDs |

Understanding Nondeductible IRAs and Roth IRAs

Nondeductible IRAs allow contributions with after-tax dollars, meaning the funds grow tax-deferred but withdrawals on earnings are taxed as ordinary income. Roth IRAs require contributions with after-tax income but provide tax-free qualified withdrawals, including earnings, if certain conditions are met. Understanding the tax treatment, contribution limits, and eligibility rules of both accounts helps investors optimize retirement savings strategies.

Key Differences Between Nondeductible IRA and Roth IRA

Nondeductible IRAs allow after-tax contributions without income limits, but earnings grow tax-deferred and withdrawals are taxed as income, whereas Roth IRAs require after-tax contributions with income eligibility restrictions, offering tax-free growth and tax-free qualified withdrawals. Nondeductible IRA contributions do not reduce taxable income, while Roth IRA contributions are made with after-tax dollars but provide potential tax-free distributions. Required Minimum Distributions (RMDs) apply to nondeductible IRAs starting at age 73, but Roth IRAs have no RMDs during the owner's lifetime.

Eligibility Requirements for Nondeductible IRA vs Roth IRA

Nondeductible IRA contributions are available to taxpayers regardless of income, but the ability to deduct those contributions depends on participation in an employer-sponsored retirement plan and income limits. Roth IRA eligibility requires earned income below specific thresholds, which for 2024 phase out starting at $138,000 for single filers and $218,000 for married filing jointly. Unlike Roth IRAs, nondeductible IRAs do not have income limits restricting contributions but lack the tax-free growth benefits offered by Roth IRAs.

Contribution Limits and Rules

Nondeductible IRA contributions are subject to the same annual limits as traditional IRAs, with a maximum of $6,500 for individuals under 50 and $7,500 for those 50 and older in 2024. Roth IRA contributions also share these limits but require income eligibility, phasing out at modified adjusted gross incomes between $138,000 and $153,000 for single filers in 2024. Unlike nondeductible IRAs, Roth IRAs allow for tax-free qualified withdrawals and do not mandate required minimum distributions during the owner's lifetime.

Tax Implications: Contributions, Growth, and Withdrawals

Nondeductible IRA contributions are made with after-tax dollars, allowing for tax-deferred growth but taxable earnings upon withdrawal, whereas Roth IRA contributions are also after-tax but offer tax-free growth and withdrawals if qualified. Nondeductible IRA earnings are taxed as ordinary income at distribution, while Roth IRA withdrawals of both contributions and earnings are tax-free after the age of 59 1/2 and meeting the five-year rule. The tax treatment of distributions distinguishes these accounts, with Roth IRAs providing a strategic advantage for tax-free retirement income.

Required Minimum Distributions (RMDs): What to Know

Nondeductible IRAs require Required Minimum Distributions (RMDs) starting at age 73, which are taxable on the earnings portion, whereas Roth IRAs do not mandate RMDs during the account holder's lifetime, allowing for tax-free growth. Understanding the RMD rules is crucial for retirement planning and tax strategy, as failing to take RMDs from nondeductible IRAs can result in a 25% penalty on the amount not withdrawn. Roth IRAs offer greater flexibility by eliminating RMD requirements, making them preferable for those seeking to maximize tax-free income and estate planning benefits.

Access to Funds: Withdrawal Flexibility Comparison

Nondeductible IRAs impose taxes on earnings upon withdrawal, limiting access to funds without penalty before age 59 1/2, whereas Roth IRAs allow contributions to be withdrawn tax- and penalty-free at any time. Earnings in Roth IRAs become accessible tax-free after a five-year holding period and reaching age 59 1/2, offering greater withdrawal flexibility. This fundamental difference makes Roth IRAs more advantageous for individuals seeking early access to contributions without incurring taxes or penalties.

Pros and Cons of Nondeductible IRA vs Roth IRA

A Nondeductible IRA allows after-tax contributions with potential tax-deferred growth but requires paying taxes on earnings upon withdrawal, whereas a Roth IRA offers tax-free growth and tax-free qualified withdrawals since contributions are made with after-tax dollars. Nondeductible IRAs have no income limits for contributions, making them accessible for high earners, but they require careful record-keeping to avoid double taxation. Roth IRAs provide greater long-term tax benefits and withdrawal flexibility but have strict income limits and contribution caps that may restrict eligibility.

IRA Conversion Strategies: When Does It Make Sense?

IRA conversion strategies make sense when anticipating higher future tax rates, as converting a nondeductible IRA to a Roth IRA allows tax-free growth and withdrawals. Evaluating current income levels, expected retirement income, and tax brackets is crucial to determine the timing and benefit of the conversion. Taxpayers with taxable income near the threshold or expecting increased earnings may optimize long-term savings by executing timely Roth IRA conversions.

Choosing the Right IRA for Your Retirement Plan

Choosing the right IRA for your retirement plan requires understanding the key tax differences between nondeductible IRAs and Roth IRAs. Nondeductible IRA contributions are made with after-tax dollars, but earnings grow tax-deferred, and withdrawals are taxed on the earnings portion; Roth IRAs, however, offer tax-free growth and tax-free qualified withdrawals since contributions are made with after-tax dollars. Assessing factors such as current tax bracket, expected tax rate in retirement, and eligibility limits helps optimize long-term tax advantages and maximize retirement savings growth.

Important Terms

After-tax contributions

After-tax contributions to a Nondeductible IRA grow tax-deferred but are taxed as ordinary income upon withdrawal of earnings, whereas Roth IRA contributions are made with after-tax dollars and qualified withdrawals, including earnings, are tax-free. Unlike Nondeductible IRAs, Roth IRAs have income limits for eligibility and provide more favorable tax treatment on distributions.

Tax-deferred growth

Tax-deferred growth in a Nondeductible IRA allows investments to grow without current tax, but withdrawals of earnings are taxed as ordinary income, unlike a Roth IRA where qualified distributions are tax-free. Contributions to a Nondeductible IRA are made with after-tax dollars, whereas Roth IRA contributions also use after-tax dollars but benefit from tax-free growth and withdrawals after meeting specific requirements.

Qualified distributions

Qualified distributions from a Roth IRA are tax-free and penalty-free if taken after age 59 1/2 and the account has been held for at least five years, while distributions from a nondeductible IRA are taxed only on earnings, as contributions are made with after-tax dollars but subject to ordinary income tax on gains. Unlike Roth IRAs, nondeductible IRAs do not offer tax-free growth or withdrawal benefits, making the timing and nature of distributions critical for optimizing tax outcomes.

Modified Adjusted Gross Income (MAGI)

Modified Adjusted Gross Income (MAGI) determines eligibility for Roth IRA contributions and impacts the tax treatment of nondeductible IRA contributions. High MAGI limits direct Roth IRA contributions, making nondeductible IRAs a strategy to convert funds to Roth IRAs through a backdoor conversion.

Pro-rata rule

The pro-rata rule requires investors to consider both deductible and nondeductible contributions when converting a traditional IRA to a Roth IRA, resulting in taxable income based on the ratio of after-tax contributions to the total IRA balance. This rule prevents taxpayers from converting solely nondeductible IRA funds to a Roth IRA without incurring taxes on pre-tax amounts.

Contribution limits

Nondeductible IRA contributions have an annual limit combined with traditional IRAs capped at $6,500 for individuals under 50 and $7,500 for those 50 or older in 2024; Roth IRA contributions follow the same limits but are subject to income phase-outs starting at $138,000 for singles and $218,000 for married couples filing jointly. Unlike Nondeductible IRA contributions, Roth IRA contributions grow tax-free and qualified withdrawals are also tax-free, making contribution limits critical for effective tax planning.

Backdoor Roth IRA

A Backdoor Roth IRA enables high-income earners to bypass income limits by contributing to a nondeductible traditional IRA and then converting those funds to a Roth IRA, allowing for tax-free growth and withdrawals. Unlike a direct Roth IRA contribution, nondeductible IRA funds are contributed post-tax, which requires careful tracking of basis to avoid double taxation during conversion.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) apply to Nondeductible IRAs starting at age 73, mandating annual withdrawals based on IRS life expectancy tables, while Roth IRAs are exempt from RMDs during the account owner's lifetime, allowing tax-free growth without forced distributions. Understanding these differences is crucial for retirement planning to minimize taxable income and maximize tax-advantaged growth potential.

Tax basis

Tax basis in nondeductible IRAs represents after-tax contributions on which taxes have already been paid, resulting in those amounts being excluded from future taxable distributions; in contrast, Roth IRAs are funded with after-tax dollars, allowing qualified withdrawals, including earnings, to be tax-free, reflecting their fully taxed basis at contribution. Understanding the tax basis distinction is crucial for accurate tax reporting and minimizing tax liability upon IRA distributions.

Conversion ladder

The conversion ladder strategy enables gradual transfers of nondeductible IRA funds into a Roth IRA, minimizing tax liabilities by spreading income over multiple years. This approach leverages tax-free growth in the Roth IRA while circumventing early withdrawal penalties during retirement.

Nondeductible IRA vs Roth IRA Infographic

moneydif.com

moneydif.com