A disregarded entity is a business structure, such as a single-member LLC, that is not separate from its owner for federal tax purposes, meaning income and expenses are reported directly on the owner's tax return. In contrast, a grantor trust treats the grantor as the owner of the trust's assets and income for tax purposes, resulting in all trust income being reported on the grantor's individual tax return. Both structures simplify tax reporting but differ in application and the legal separation between entity and owner.

Table of Comparison

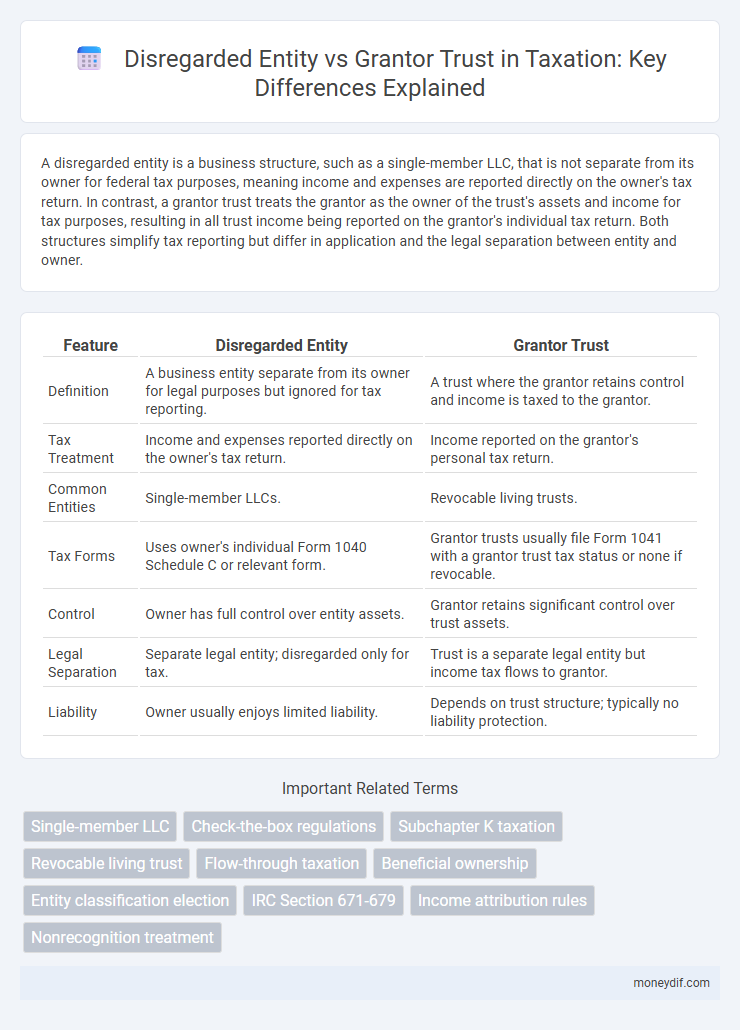

| Feature | Disregarded Entity | Grantor Trust |

|---|---|---|

| Definition | A business entity separate from its owner for legal purposes but ignored for tax reporting. | A trust where the grantor retains control and income is taxed to the grantor. |

| Tax Treatment | Income and expenses reported directly on the owner's tax return. | Income reported on the grantor's personal tax return. |

| Common Entities | Single-member LLCs. | Revocable living trusts. |

| Tax Forms | Uses owner's individual Form 1040 Schedule C or relevant form. | Grantor trusts usually file Form 1041 with a grantor trust tax status or none if revocable. |

| Control | Owner has full control over entity assets. | Grantor retains significant control over trust assets. |

| Legal Separation | Separate legal entity; disregarded only for tax. | Trust is a separate legal entity but income tax flows to grantor. |

| Liability | Owner usually enjoys limited liability. | Depends on trust structure; typically no liability protection. |

Understanding Disregarded Entities

A disregarded entity is a business entity with a single owner that is not separate from its owner for income tax purposes, meaning the entity's income, deductions, and credits are reported directly on the owner's tax return. Common examples include single-member LLCs and certain qualified subchapter S subsidiaries (QSubs). Understanding the tax treatment of disregarded entities is crucial, as they simplify tax filing by avoiding a separate tax return but require careful consideration of state-specific rules and potential self-employment tax implications.

What Is a Grantor Trust?

A grantor trust is a legal entity where the grantor retains control over the trust assets and is responsible for reporting income, deductions, and credits on their personal tax return. Unlike disregarded entities, which are treated as part of the owner for tax purposes, a grantor trust specifically attributes all income and tax liabilities to the grantor, ensuring transparent tax reporting. The IRS treats grantor trusts as extensions of the grantor, simplifying tax administration while preserving the trust's legal protections.

Key Differences: Disregarded Entity vs Grantor Trust

A disregarded entity, typically a single-member LLC, is treated as a separate legal entity for liability purposes but is ignored for federal tax purposes, with income and expenses reported directly on the owner's tax return. A grantor trust is a trust where the grantor retains control, causing the trust's income, deductions, and credits to be reported on the grantor's individual tax return. Key differences include the ownership structure--disregarded entities are business entities, while grantor trusts are estate planning tools--and the nature of tax reporting and regulatory treatment under IRS rules.

Tax Treatment of Disregarded Entities

Disregarded entities, such as single-member LLCs, are treated as pass-through entities for tax purposes, meaning their income, deductions, and credits are reported directly on the owner's tax return, avoiding separate entity-level taxation. In contrast, grantor trusts are treated as owned by the grantor, who reports trust income and deductions on their individual tax return, effectively disregarding the trust as a separate taxpayer. Both structures enable transparency in income reporting, but disregarded entities specifically apply to business entities rather than trusts.

Tax Implications of Grantor Trusts

Grantor trusts are treated as owned by the grantor for income tax purposes, resulting in all income, deductions, and credits being reported on the grantor's individual tax return, thereby avoiding entity-level taxation. Unlike disregarded entities, which typically pertain to single-member LLCs where income flows directly to the owner without a separate tax entity, grantor trusts allow for specific estate planning benefits while maintaining transparency in taxation. The tax implications of grantor trusts include potential income shifting and estate tax advantages, but taxpayers must carefully manage grantor trust provisions to ensure compliance and optimize tax outcomes.

Entity Classification for Federal Income Tax

A disregarded entity is a business entity with a single owner that is not separate from its owner for federal income tax purposes, often treated as a sole proprietorship or branch. A grantor trust, on the other hand, is a trust where the grantor retains control and ownership benefits, resulting in the trust's income being taxable directly to the grantor. The entity classification impacts tax reporting obligations, deductions, and liability, with disregarded entities simplifying tax filings compared to the more complex rules governing grantor trusts.

Pros and Cons: Disregarded Entities

Disregarded entities offer simplified tax reporting by allowing income and expenses to flow directly to the owner's personal tax return, eliminating corporate-level taxation. They provide flexibility in tax treatment and ease of administration, but can expose the owner to personal liability since the entity does not offer separate legal protection. However, disregarded entities may face limitations in raising capital and complicate state tax compliance due to varying state regulations.

Pros and Cons: Grantor Trusts

Grantor trusts offer significant tax advantages, including income being taxed directly to the grantor, simplifying reporting and avoiding double taxation. These trusts provide flexibility in trust management and potential estate tax benefits but lack the asset protection found in other trust forms. A key disadvantage is that all income, deductions, and credits flow through to the grantor, which could increase the grantor's taxable income and limit creditor protection.

Choosing Between a Disregarded Entity and a Grantor Trust

Choosing between a disregarded entity and a grantor trust depends largely on the desired tax treatment and asset protection goals. A disregarded entity, such as a single-member LLC, provides pass-through taxation and simplicity in reporting income on the owner's tax return, while a grantor trust offers flexible income distribution options and potential estate planning benefits under IRS grantor trust rules. Evaluating factors such as liability protection, administrative complexity, and long-term succession planning will guide the optimal entity selection for tax efficiency and legal compliance.

Reporting Requirements and Compliance Considerations

A disregarded entity, such as a single-member LLC, requires no separate tax return since its income and expenses are reported directly on the owner's personal tax return via Schedule C or relevant forms. A grantor trust, under IRS rules, is treated as owned by the grantor, so all income and deductions are reported on the grantor's individual tax return using Form 1041 with a grantor trust status or directly on Schedule E or Schedule D, depending on the income type. Compliance considerations for disregarded entities focus on proper classification and avoidance of inadvertent corporate status, while grantor trusts demand meticulous tracking of trust assets and income attribution to ensure accurate reporting and prevent tax disputes.

Important Terms

Single-member LLC

A Single-member LLC is typically treated as a disregarded entity for federal tax purposes, meaning its income and expenses are reported directly on the owner's tax return, simplifying tax filings and avoiding double taxation. In contrast, a grantor trust is a separate legal entity where the grantor retains control and must report income on their individual tax return, but it operates under trust rules which can impact estate planning and asset protection strategies.

Check-the-box regulations

Check-the-box regulations allow certain entities, including disregarded entities and grantor trusts, to choose their tax classification for federal purposes, impacting how income is reported and taxed. A disregarded entity is treated as a sole proprietorship or branch while a grantor trust is recognized for income tax purposes as owned by the grantor, influencing the flow-through taxation and reporting requirements under IRS rules.

Subchapter K taxation

Subchapter K taxation governs partnership income, allocating profits, losses, deductions, and credits among partners based on their interests, while disregarded entities are treated as sole proprietorships or branch divisions for tax purposes, not separate from their owners. Grantor trusts, under the grantor trust rules, attribute all income, deductions, and credits directly to the grantor, contrasting with Subchapter K entities that require formal partnership tax reporting, affecting income recognition and transparency.

Revocable living trust

A revocable living trust is often structured as a grantor trust for tax purposes, meaning the grantor retains control and the trust income is reported on their personal tax return, whereas a disregarded entity typically refers to a business structure like an LLC that is separate from the grantor but ignored for tax purposes. Understanding the distinction between a grantor trust and a disregarded entity is crucial for estate planning and tax compliance, as it affects income reporting, asset protection, and transferability.

Flow-through taxation

Flow-through taxation allows income to be reported on the owner's tax return, avoiding entity-level taxation commonly applied to disregarded entities like single-member LLCs and grantor trusts. Disregarded entities are treated as extensions of the owner for tax purposes, while grantor trusts specifically attribute income and deductions directly to the grantor, both facilitating pass-through of tax obligations.

Beneficial ownership

Beneficial ownership in a disregarded entity is attributed directly to the single owner, meaning income, deductions, and credits pass through to that individual for tax purposes, whereas in a grantor trust, the grantor retains control and recognizes all income, loss, and deductions on their personal tax return despite the trust's existence. Both entities disregard separate taxable status, but the grantor trust specifically involves trust instruments where the grantor maintains significant powers, impacting beneficial ownership recognition and tax reporting.

Entity classification election

Entity classification elections enable taxpayers to select how their business entities are treated for tax purposes, influencing whether an entity is classified as a disregarded entity or treated under a grantor trust status. A disregarded entity, typically a single-member LLC, is ignored for federal tax purposes and income is reported on the owner's tax return, whereas a grantor trust classification involves the trust's grantor retaining control and reporting income on their personal return under Internal Revenue Code Sections 671-679.

IRC Section 671-679

IRC Sections 671-679 govern the taxation of grantor trusts, which are treated as disregarded entities for income tax purposes, allowing the grantor to be taxed directly on trust income. Unlike typical disregarded entities, these sections specify when a grantor trust's income, deductions, and credits are attributed to the grantor, ensuring transparent tax reporting and compliance.

Income attribution rules

Income attribution rules distinguish a disregarded entity as a single tax entity with its owner directly responsible for reporting all income and losses, while a grantor trust attributes income directly to the grantor, who retains control and is taxed on all trust income. The IRS treats disregarded entities under Internal Revenue Code Section 1366 for pass-through taxation, whereas grantor trusts follow Sections 671-679 for income attribution, affecting the timing and character of income reported.

Nonrecognition treatment

Nonrecognition treatment allows tax-deferred transfers of assets between a disregarded entity and its owner or a grantor trust and its grantor, maintaining continuity of tax basis and holding periods. Unlike disregarded entities, which are treated as extensions of the owner for tax purposes, grantor trusts grant the owner direct income tax responsibility, enabling tax attributes to flow through without recognition events.

Disregarded entity vs Grantor trust Infographic

moneydif.com

moneydif.com