Tax authorities prioritize substance over form to ensure that tax liabilities reflect the true economic reality of transactions rather than merely their legal appearance. This approach prevents taxpayers from exploiting formal structures to avoid taxes, emphasizing the actual purpose and effect of arrangements. Conversely, form over substance relies strictly on legal documentation, which can lead to tax avoidance and misrepresentation of financial positions.

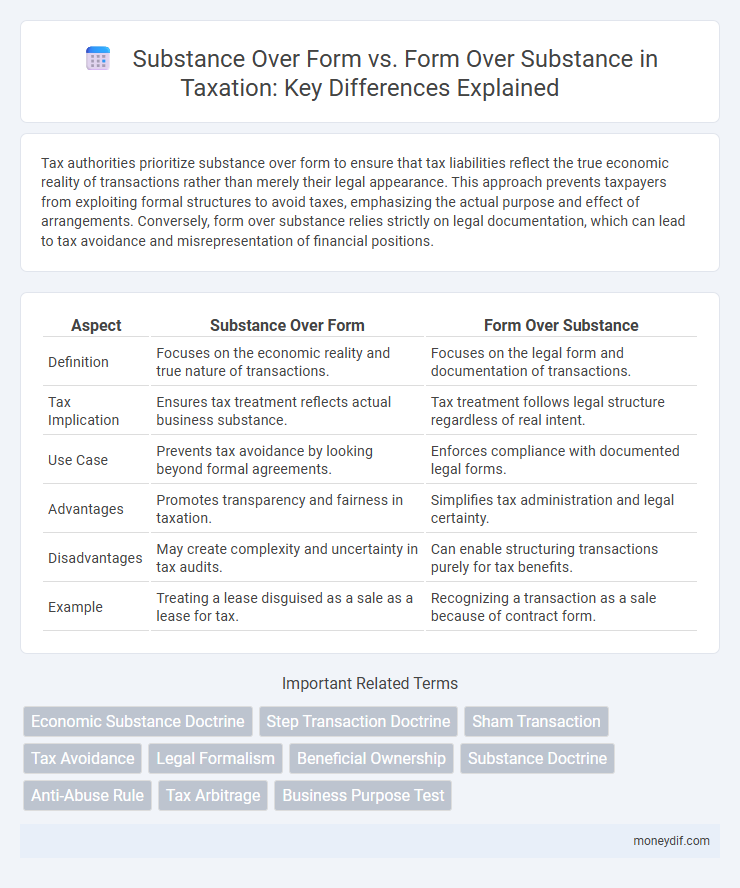

Table of Comparison

| Aspect | Substance Over Form | Form Over Substance |

|---|---|---|

| Definition | Focuses on the economic reality and true nature of transactions. | Focuses on the legal form and documentation of transactions. |

| Tax Implication | Ensures tax treatment reflects actual business substance. | Tax treatment follows legal structure regardless of real intent. |

| Use Case | Prevents tax avoidance by looking beyond formal agreements. | Enforces compliance with documented legal forms. |

| Advantages | Promotes transparency and fairness in taxation. | Simplifies tax administration and legal certainty. |

| Disadvantages | May create complexity and uncertainty in tax audits. | Can enable structuring transactions purely for tax benefits. |

| Example | Treating a lease disguised as a sale as a lease for tax. | Recognizing a transaction as a sale because of contract form. |

Understanding Substance Over Form in Taxation

Understanding substance over form in taxation emphasizes the actual economic reality of transactions rather than their legal documentation, ensuring tax outcomes reflect true substance. Tax authorities prioritize substance to prevent taxpayers from exploiting formal structures for tax avoidance or evasion. This principle enhances tax fairness by aligning taxable events with genuine economic activities, reducing artificial tax benefits stemming from mere legal form.

The Principle of Form Over Substance Explained

The Principle of Form Over Substance in tax law emphasizes that the legal form of a transaction should be recognized and honored as it appears in official documents and contracts, rather than solely focusing on the underlying substance or economic reality. This principle ensures certainty and predictability by upholding the taxpayer's reported legal structures, such as corporations or partnerships, even if the substantive effect suggests a different arrangement. Tax authorities may apply this rule to prevent abuse but generally respect formalities to maintain clear statutory interpretation and compliance.

Historical Development of Substance Over Form

The historical development of substance over form in tax law emerged as a response to taxpayers exploiting formal legal structures to disguise the true economic reality of transactions. Originating in early 20th-century case law, courts increasingly prioritized the actual substance and intent over the strict legal form to prevent tax avoidance schemes. This principle reinforced fair taxation by ensuring that tax liabilities reflect the economic essence rather than mere legal technicalities.

Key Differences Between Substance Over Form and Form Over Substance

Substance over form prioritizes the economic reality of a transaction over its legal structure for accurate tax reporting, ensuring taxable events reflect the true nature of the arrangement. Form over substance emphasizes compliance with the literal legal documents and formalities, often favoring the legal framework regardless of the transaction's actual economic impact. The key difference lies in substance over form focusing on economic substance to prevent tax avoidance, while form over substance adheres strictly to legal form, potentially overlooking underlying tax manipulation.

Case Law Illustrating Substance Over Form

Case law illustrating substance over form emphasizes the economic reality of transactions rather than their formal structure, with landmark rulings like Gregory v. Helvering, where the Supreme Court disallowed a tax avoidance scheme despite its adherence to legal form. In Estate of Goldstein, courts prioritized the substance of the transfer over the formal title documentation, highlighting the necessity to look beyond mere paperwork to determine tax liabilities accurately. These decisions reinforce that taxing authorities often pierce the legal form to capture the true nature of economic events, ensuring tax outcomes reflect actual intent and benefit.

Tax Avoidance: Substance vs Form Analysis

Tax avoidance strategies often hinge on the distinction between substance over form, emphasizing the economic reality of transactions rather than their legal facade, and form over substance, which relies on the literal interpretation of legal documents. Courts and tax authorities increasingly prioritize substance over form to curb aggressive tax avoidance schemes, ensuring that the true intent and economic substance of transactions dictate tax liability. This approach reduces loopholes by scrutinizing the actual substance of arrangements, thereby preventing taxpayers from exploiting formalistic legal structures solely to minimize taxes.

Regulatory Approaches: Global Perspectives on Substance Over Form

Regulatory approaches to substance over form emphasize the economic reality of transactions rather than their legal form, ensuring tax compliance aligns with actual business activities. Jurisdictions such as the OECD member countries prioritize substance to combat tax avoidance by scrutinizing the true nature of arrangements beyond formal documentation. This shift towards substance over form enhances transparency and aligns with global anti-base erosion and profit shifting (BEPS) initiatives, reinforcing fair taxation principles.

Practical Implications for Tax Planning

Tax planning prioritizes substance over form to ensure transactions reflect economic reality, preventing artificial arrangements that solely aim to reduce tax liability. Emphasizing substance enables tax authorities to recharacterize or disregard formal structures that lack genuine business purpose, increasing compliance risk. Strategically aligning tax positions with underlying economic activities enhances long-term planning effectiveness and mitigates audit exposure.

Risks and Challenges of Relying on Legal Form

Relying solely on legal form in tax matters poses significant risks, including potential reclassification of transactions by tax authorities that prioritize economic substance over formal documentation. This approach can lead to unexpected tax liabilities, penalties, and increased scrutiny during audits. Ignoring substance over form principles undermines accurate tax reporting and exposes entities to reputational damage and financial uncertainty.

Best Practices for Compliance with Substance Over Form Doctrine

Adhering to the substance over form doctrine requires companies to prioritize economic reality and genuine business intent rather than relying solely on legal documentation. Best practices include maintaining comprehensive records that clearly demonstrate the underlying business purpose of transactions and ensuring consistent application of accounting methods reflecting true economic substance. Regular internal audits and consultation with tax professionals help align financial reporting with regulatory expectations, minimizing risks of tax avoidance challenges.

Important Terms

Economic Substance Doctrine

The Economic Substance Doctrine prioritizes the actual economic reality of a transaction over its legal form, requiring taxpayers to demonstrate a substantial purpose beyond tax avoidance. This principle challenges the form over substance approach by ensuring that tax benefits are only allowed when genuine business substance exists.

Step Transaction Doctrine

The Step Transaction Doctrine consolidates a series of formally separate steps into a single transaction based on the substance over form principle, preventing tax avoidance by recharacterizing actions according to their economic reality rather than their legal form. This doctrine counters the form over substance approach, which rigidly adheres to the literal legal steps, ensuring that tax outcomes align with the true intent and practical effect of the transactions.

Sham Transaction

Sham transactions are arrangements lacking genuine economic substance, designed to create a misleading appearance of legal validity that prioritizes form over substance. Tax authorities and courts emphasize substance over form to disregard such artificial setups and ensure transactions reflect their true economic reality.

Tax Avoidance

Tax avoidance strategies often exploit the legal distinction between substance over form and form over substance, where substance over form prioritizes the economic reality of a transaction, while form over substance focuses on the formal documentation. Courts and tax authorities increasingly favor substance over form to prevent artificial arrangements designed solely to reduce tax liability without genuine economic substance.

Legal Formalism

Legal formalism emphasizes strict adherence to procedural rules and the literal interpretation of legal texts, prioritizing form over substance to maintain consistency and predictability in judicial decisions. This approach contrasts with substantive interpretation, which focuses on the underlying intent or fairness of the law, favoring substance over form to achieve just outcomes in individual cases.

Beneficial Ownership

Beneficial ownership focuses on the true economic owner of an asset or interest, prioritizing substance over form to reveal hidden control and prevent fraud or tax evasion. Regulatory frameworks increasingly emphasize substance over form to ensure transparency, as relying solely on legal ownership structures can obscure the real beneficiaries.

Substance Doctrine

The Substance Doctrine prioritizes the actual economic reality of a transaction over its legal form to prevent tax avoidance and ensure accurate financial reporting. This principle contrasts with form over substance, which emphasizes the legal documentation rather than the true nature of the transaction.

Anti-Abuse Rule

The Anti-Abuse Rule prioritizes substance over form by ensuring transactions are evaluated based on their economic reality rather than their legal structure, preventing taxpayers from exploiting formal compliance to avoid tax obligations. This principle helps tax authorities identify and counteract artificial arrangements designed solely for tax avoidance, reinforcing the integrity of tax enforcement.

Tax Arbitrage

Tax arbitrage exploits differences between the legal form and economic substance of transactions, leveraging the principle of form over substance to minimize tax liabilities. However, tax authorities increasingly apply substance over form doctrines to recharacterize transactions based on their true economic effect, limiting opportunities for tax arbitrage.

Business Purpose Test

The Business Purpose Test evaluates whether a transaction has a genuine economic rationale beyond mere tax benefits, emphasizing substance over form by focusing on the actual intent and economic reality rather than just the legal documentation. This approach contrasts with form over substance, where legal form and arrangement are prioritized regardless of their underlying economic substance or business purpose.

substance over form vs form over substance Infographic

moneydif.com

moneydif.com