Territorial tax systems tax income earned within a country's borders, exempting foreign income from domestic tax obligations. Worldwide tax systems require residents to report and pay taxes on global income, regardless of where it is earned. Choosing between territorial and worldwide tax regimes impacts multinational businesses' tax liabilities and compliance strategies.

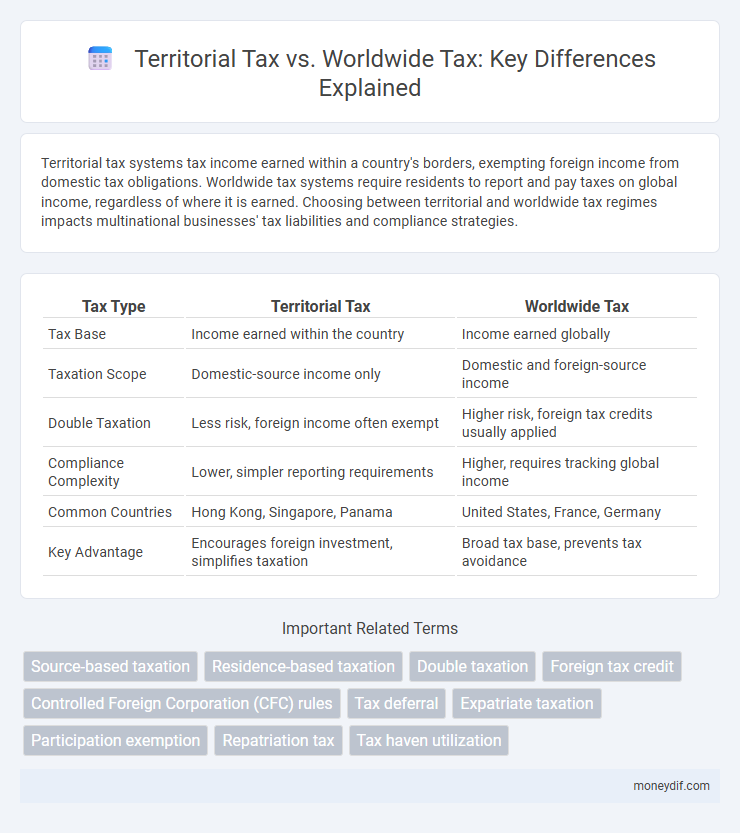

Table of Comparison

| Tax Type | Territorial Tax | Worldwide Tax |

|---|---|---|

| Tax Base | Income earned within the country | Income earned globally |

| Taxation Scope | Domestic-source income only | Domestic and foreign-source income |

| Double Taxation | Less risk, foreign income often exempt | Higher risk, foreign tax credits usually applied |

| Compliance Complexity | Lower, simpler reporting requirements | Higher, requires tracking global income |

| Common Countries | Hong Kong, Singapore, Panama | United States, France, Germany |

| Key Advantage | Encourages foreign investment, simplifies taxation | Broad tax base, prevents tax avoidance |

Introduction to Territorial and Worldwide Tax Systems

Territorial tax systems tax income earned within a country's borders, exempting foreign-sourced income from domestic taxation, which benefits multinational corporations by reducing double taxation risks. Worldwide tax systems require residents to report and pay taxes on global income, ensuring comprehensive revenue collection but often leading to complex tax compliance and potential double taxation without foreign tax credits. Understanding these contrasting frameworks is essential for international tax planning and corporate structuring strategies.

Key Differences Between Territorial and Worldwide Taxation

Territorial taxation taxes only the income earned within a country's borders, whereas worldwide taxation imposes tax on residents' global income regardless of source. Territorial systems often exclude foreign income from domestic tax obligations, reducing double taxation risk, while worldwide systems provide foreign tax credits to mitigate this issue. The choice between these systems impacts tax compliance complexity, international investment decisions, and potential for tax avoidance strategies.

How Territorial Taxation Works

Territorial taxation systems charge taxes only on income earned within a country's borders, excluding foreign-sourced income from domestic tax liability. Businesses and individuals operating under this system benefit from exemptions or reduced tax rates on international earnings, promoting cross-border trade and investment. Countries like Singapore and Hong Kong implement territorial tax regimes to attract global businesses by minimizing the tax burden on foreign income.

How Worldwide Taxation Operates

Worldwide taxation requires residents to report and pay taxes on all global income regardless of where it is earned, ensuring comprehensive tax compliance. This system incorporates foreign tax credits to mitigate double taxation by offsetting taxes paid abroad against domestic tax liabilities. Countries with worldwide tax regimes enforce global income disclosures, necessitating meticulous record-keeping and adherence to international tax treaties.

Advantages of a Territorial Tax System

A territorial tax system allows companies to exclude foreign-sourced income from domestic taxation, reducing the risk of double taxation and simplifying compliance. This system encourages international business expansion by enabling repatriation of foreign profits without additional tax burdens. Lower domestic tax liabilities on global earnings can enhance competitiveness and attract foreign investment.

Benefits and Drawbacks of Worldwide Taxation

Worldwide taxation allows countries to tax their residents on global income, ensuring comprehensive revenue collection and minimizing tax evasion on foreign earnings. Its benefits include increased government revenue and equitable taxation regardless of where income is earned, but drawbacks involve complex compliance requirements and potential double taxation without adequate foreign tax credits. This system can discourage international investment due to the added administrative burden and heightened tax liability for taxpayers with diverse income sources.

Impacts on Multinational Corporations

Territorial tax systems tax multinational corporations only on income earned within national borders, reducing the complexity of foreign income reporting and potentially lowering overall tax liabilities. Worldwide tax systems require corporations to report and pay taxes on global income, often leading to increased compliance costs but facilitating tax credits and avoiding double taxation through treaties. The choice between these systems impacts multinational strategies in profit allocation, transfer pricing, and tax planning to optimize global tax burdens.

Effects on Tax Compliance and Avoidance

Territorial tax systems simplify tax compliance by taxing only income earned within national borders, reducing the complexity of reporting foreign earnings and thereby lowering administrative burdens for taxpayers. Worldwide tax systems subject residents to taxation on global income, increasing compliance requirements and incentivizing sophisticated tax avoidance strategies such as income shifting and the use of offshore tax havens. Empirical studies indicate that territorial regimes correlate with lower compliance costs and reduced tax evasion risks, while worldwide taxation often drives increased use of legal tax avoidance mechanisms to minimize global tax liabilities.

Global Trends in Tax System Adoption

Global trends indicate a growing number of countries shifting from worldwide tax systems to territorial tax systems to enhance competitiveness and attract foreign investment. Territorial tax regimes typically tax only domestic income, reducing the tax burden on multinational corporations' foreign earnings. This shift aligns with international efforts to prevent double taxation and promote economic growth by streamlining cross-border tax obligations.

Choosing the Optimal Tax System for Economic Growth

Selecting between territorial tax and worldwide tax systems significantly impacts economic growth by influencing foreign investment and corporate behavior. The territorial tax system encourages multinational corporations to repatriate profits without additional taxation, fostering domestic reinvestment and job creation. In contrast, the worldwide tax system taxes global income, potentially discouraging cross-border trade and limiting capital inflows essential for economic expansion.

Important Terms

Source-based taxation

Source-based taxation levies taxes on income generated within a country's borders, aligning closely with territorial tax systems that tax only domestic income. In contrast, worldwide tax systems impose taxes on global income regardless of the source, often requiring credits for foreign taxes paid to avoid double taxation.

Residence-based taxation

Residence-based taxation imposes tax on individuals or entities based on their residency status, taxing worldwide income regardless of source, in contrast to territorial tax systems that only tax income earned within the country's borders. Countries with residence-based taxation typically require residents to report and pay taxes on global earnings, leading to comprehensive tax obligations compared to the selective taxation approach of territorial systems.

Double taxation

Double taxation occurs when the same income is taxed by both the source country under a territorial tax system and the residence country using a worldwide tax approach, leading to potential financial strain on taxpayers. Tax treaties and foreign tax credits are essential mechanisms employed to mitigate this overlap and prevent taxpayers from being taxed twice on identical income.

Foreign tax credit

The Foreign Tax Credit (FTC) allows taxpayers under a worldwide tax system to offset foreign taxes paid against their domestic tax liability, preventing double taxation on the same income. In contrast, territorial tax systems typically exempt foreign income from domestic taxation, reducing or eliminating the need for a foreign tax credit.

Controlled Foreign Corporation (CFC) rules

Controlled Foreign Corporation (CFC) rules aim to prevent tax avoidance by requiring residents to include certain income from foreign subsidiaries under a worldwide tax system, contrasting with territorial tax systems that tax only domestic income. These rules ensure that income earned through CFCs in low-tax jurisdictions is appropriately taxed, maintaining equitable tax collection across jurisdictions.

Tax deferral

Tax deferral allows taxpayers under a territorial tax system to postpone reporting foreign income until it is repatriated, whereas under a worldwide tax system, income is taxed immediately regardless of its source location. This distinction impacts multinational corporations' cash flow management and influences decisions on where to reinvest earnings abroad.

Expatriate taxation

Expatriate taxation varies significantly between territorial tax systems, which tax income earned within a country's borders, and worldwide tax systems, which tax residents on their global income regardless of source. Understanding the distinction is essential for expatriates to optimize tax liabilities and comply with local regulations in countries like the United States, which employs a worldwide tax system, versus jurisdictions like Hong Kong that use a territorial tax approach.

Participation exemption

Participation exemption enables companies in territorial tax systems to exclude dividends from foreign subsidiaries from taxable income, reducing double taxation and promoting international investment. In contrast, worldwide tax systems tax global income but often provide participation exemptions or foreign tax credits to mitigate double taxation on foreign earnings.

Repatriation tax

Repatriation tax applies when companies bring foreign-earned profits back to their home country under a worldwide tax system, resulting in additional tax liabilities. In contrast, territorial tax systems generally exempt foreign income from domestic taxation, minimizing or eliminating repatriation taxes on repatriated earnings.

Tax haven utilization

Tax haven utilization often exploits territorial tax systems by shielding foreign income from domestic taxation, contrasting with worldwide tax regimes that tax global income regardless of source. Multinational corporations and high-net-worth individuals leverage territorial tax policies in jurisdictions such as Singapore and Hong Kong to minimize tax liabilities and maximize after-tax profits.

territorial tax vs worldwide tax Infographic

moneydif.com

moneydif.com