Deferred tax assets arise from deductible temporary differences and carryforwards that reduce future taxable income, while deferred tax liabilities stem from taxable temporary differences increasing future tax payments. Businesses recognize deferred tax assets when it is probable that future profits will allow utilization of tax benefits, whereas deferred tax liabilities represent expected future tax obligations. Accurate assessment and reporting of these deferred taxes are crucial for precise financial statements and tax planning.

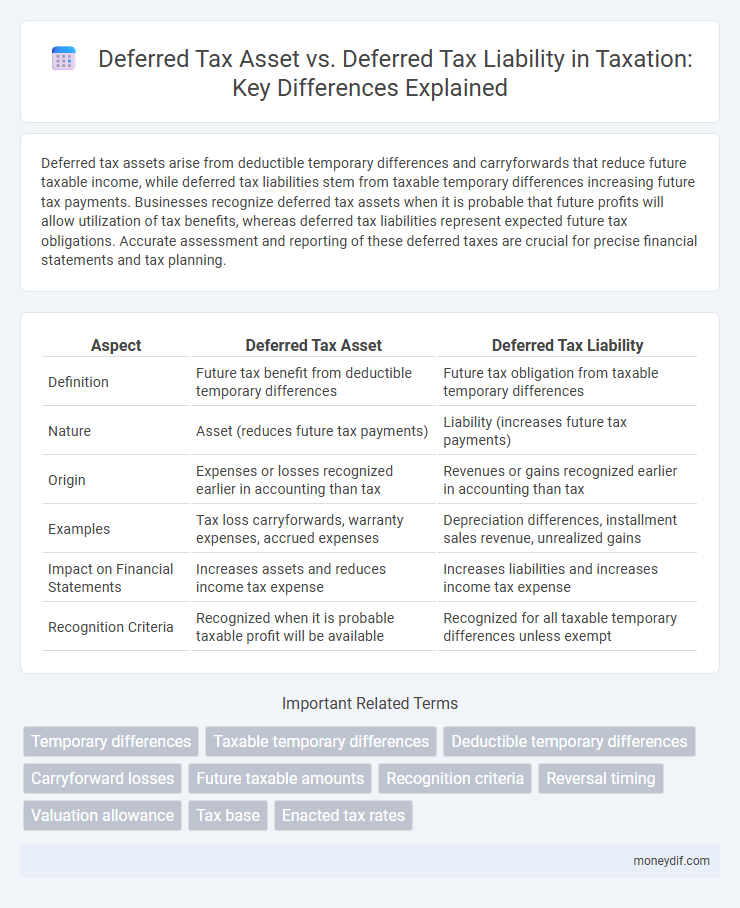

Table of Comparison

| Aspect | Deferred Tax Asset | Deferred Tax Liability |

|---|---|---|

| Definition | Future tax benefit from deductible temporary differences | Future tax obligation from taxable temporary differences |

| Nature | Asset (reduces future tax payments) | Liability (increases future tax payments) |

| Origin | Expenses or losses recognized earlier in accounting than tax | Revenues or gains recognized earlier in accounting than tax |

| Examples | Tax loss carryforwards, warranty expenses, accrued expenses | Depreciation differences, installment sales revenue, unrealized gains |

| Impact on Financial Statements | Increases assets and reduces income tax expense | Increases liabilities and increases income tax expense |

| Recognition Criteria | Recognized when it is probable taxable profit will be available | Recognized for all taxable temporary differences unless exempt |

Introduction to Deferred Tax Concepts

Deferred tax assets arise when taxable income is higher than accounting income due to temporary differences, leading to future tax benefits for a company. Deferred tax liabilities occur when accounting income exceeds taxable income, resulting in future tax obligations. Understanding these concepts is essential for accurate financial reporting and tax planning under accounting standards like IFRS and GAAP.

What Is a Deferred Tax Asset?

A deferred tax asset arises when a company has overpaid taxes or paid taxes in advance, allowing it to reduce future tax liabilities. These assets occur due to differences between accounting income and taxable income, such as carryforward of unused tax losses or expenses recognized earlier for accounting purposes than for tax reporting. Recognizing deferred tax assets improves a company's financial position by reflecting potential tax savings on the balance sheet.

What Is a Deferred Tax Liability?

A deferred tax liability arises when taxable income is lower than accounting income due to temporary differences, resulting in future tax payments. It represents taxes owed by a company for income recognized on the financial statements earlier than on the tax return. Deferred tax liabilities typically occur from accelerated depreciation or revenue recognition timing differences.

Key Differences: Deferred Tax Asset vs Deferred Tax Liability

Deferred tax assets arise from deductible temporary differences and tax losses that reduce future taxable income, while deferred tax liabilities result from taxable temporary differences that increase future taxable income. Deferred tax assets represent potential tax benefits, indicating that a company has overpaid taxes or has tax credits to utilize, whereas deferred tax liabilities indicate tax obligations owed due to timing differences in revenue recognition or expense deductions. Recognition of deferred tax assets depends on the likelihood of future taxable profits, unlike deferred tax liabilities which are recognized unconditionally for taxable temporary differences.

Common Causes of Deferred Tax Assets

Deferred tax assets commonly arise from carryforward of unused tax losses, deductible temporary differences like warranty expenses, and provisions for doubtful debts that reduce taxable income in future periods. These assets represent future tax benefits due to timing differences between accounting profit and taxable income recognition under tax laws. Identifying deferred tax assets involves analyzing temporary differences that will reverse and generate deductible amounts in subsequent reporting periods.

Typical Sources of Deferred Tax Liabilities

Typical sources of deferred tax liabilities include accelerated depreciation on fixed assets, where tax deductions occur earlier than accounting expenses, and installment sales, which recognize income for tax purposes before financial reporting. Other common causes are unrealized gains on revalued assets and differences in revenue recognition between tax laws and accounting standards. These timing differences create taxable temporary differences, resulting in deferred tax liabilities on the balance sheet.

Impact on Financial Statements

Deferred tax assets increase net income by reducing future tax expenses, reflecting deductible temporary differences that can be utilized to offset taxable income. Deferred tax liabilities represent future tax obligations arising from taxable temporary differences, decreasing net income by increasing future tax expenses. Both affect the balance sheet, where deferred tax assets are recorded as non-current assets and deferred tax liabilities as non-current liabilities, impacting equity through retained earnings.

Recognition Criteria and Measurement

Deferred tax assets are recognized when there are deductible temporary differences or carryforward of unused tax losses and credits, while deferred tax liabilities arise from taxable temporary differences. Measurement of deferred tax assets and liabilities is based on the tax rates expected to apply in the periods when the asset is realized or the liability settled, using enacted or substantively enacted tax laws. The recognition of deferred tax assets requires probable future taxable profits, whereas deferred tax liabilities are recognized regardless of future profit expectations.

Real-World Examples and Case Studies

Deferred tax assets commonly arise in companies like pharmaceutical firms with significant research and development expenses, where tax-deductible losses exceed taxable income periods, as seen in GlaxoSmithKline's financial reports. Deferred tax liabilities often appear in manufacturing firms employing accelerated depreciation methods for tax purposes, such as General Motors, where taxable income is lower initially than accounting income, creating future tax obligations. Case studies reveal that understanding industry-specific tax treatments is crucial for accurate financial forecasting and compliance.

Best Practices for Managing Deferred Taxes

Effective management of deferred tax assets and liabilities requires thorough documentation to ensure accurate timing differences and clear recognition criteria under IFRS or GAAP are met. Regular reconciliation between tax returns and financial statements helps identify potential misstatements, while proactive evaluation of deferred tax asset realizability supports timely valuation allowance adjustments. Implementing robust tax planning strategies minimizes exposure to deferred tax liabilities, optimizing overall corporate tax efficiency and cash flow management.

Important Terms

Temporary differences

Temporary differences arise when the carrying amount of an asset or liability in the balance sheet differs from its tax base, leading to the recognition of deferred tax assets or deferred tax liabilities. Deferred tax assets represent future tax benefits from deductible temporary differences, while deferred tax liabilities reflect future taxable amounts from taxable temporary differences.

Taxable temporary differences

Taxable temporary differences generate deferred tax liabilities, while deductible temporary differences give rise to deferred tax assets.

Deductible temporary differences

Deductible temporary differences create deferred tax assets by reducing taxable income in future periods, while taxable temporary differences generate deferred tax liabilities by increasing future taxable income.

Carryforward losses

Carryforward losses create a deferred tax asset by allowing future tax reductions, while deferred tax liabilities represent taxes owed due to temporary differences increasing taxable income.

Future taxable amounts

Future taxable amounts arise when temporary differences create deferred tax liabilities, while future deductible amounts generate deferred tax assets that reduce taxable income in subsequent periods.

Recognition criteria

Recognition criteria for deferred tax assets require probable future taxable profit to utilize deductible temporary differences, whereas deferred tax liabilities are recognized for taxable temporary differences regardless of probability.

Reversal timing

Reversal timing determines when deferred tax assets and deferred tax liabilities offset each other on the balance sheet, reflecting the future taxable income against deductible temporary differences.

Valuation allowance

A valuation allowance reduces deferred tax assets to the amount expected to be realized, ensuring accurate net recognition against deferred tax liabilities.

Tax base

The tax base represents the amount attributed to an asset or liability for tax purposes, which determines whether a deferred tax asset or deferred tax liability is recognized based on temporary differences between accounting carrying amounts and tax bases.

Enacted tax rates

Enacted tax rates determine the measurement of both deferred tax assets and deferred tax liabilities, reflecting the tax consequences expected to be realized when temporary differences reverse. Changes in these rates require adjustments to deferred tax balances, impacting future taxable income and financial statement accuracy.

Deferred tax asset vs deferred tax liability Infographic

moneydif.com

moneydif.com