Origin-based sourcing determines sales tax based on the seller's location, while destination-based sourcing applies tax according to the buyer's location. Businesses must carefully evaluate these methods, as they affect tax rates, compliance requirements, and reporting procedures. Understanding state-specific regulations is crucial to ensure accurate tax collection and avoid penalties.

Table of Comparison

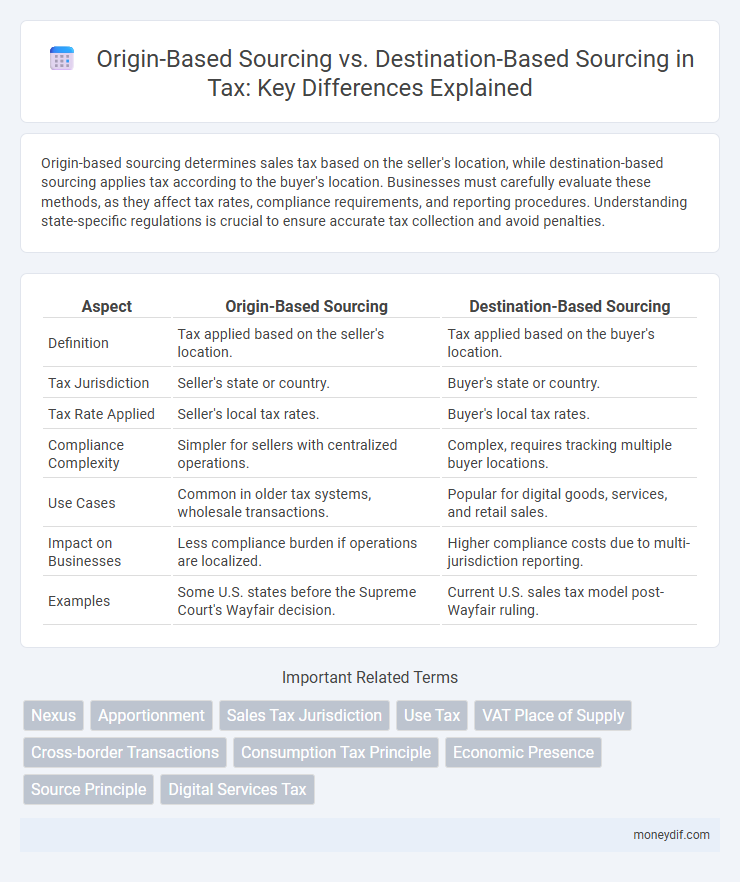

| Aspect | Origin-Based Sourcing | Destination-Based Sourcing |

|---|---|---|

| Definition | Tax applied based on the seller's location. | Tax applied based on the buyer's location. |

| Tax Jurisdiction | Seller's state or country. | Buyer's state or country. |

| Tax Rate Applied | Seller's local tax rates. | Buyer's local tax rates. |

| Compliance Complexity | Simpler for sellers with centralized operations. | Complex, requires tracking multiple buyer locations. |

| Use Cases | Common in older tax systems, wholesale transactions. | Popular for digital goods, services, and retail sales. |

| Impact on Businesses | Less compliance burden if operations are localized. | Higher compliance costs due to multi-jurisdiction reporting. |

| Examples | Some U.S. states before the Supreme Court's Wayfair decision. | Current U.S. sales tax model post-Wayfair ruling. |

Understanding Origin-Based Sourcing

Origin-based sourcing determines sales tax obligations based on the seller's location rather than the buyer's. This method requires businesses to charge the tax rate applicable in the seller's state, impacting compliance and tax collection processes. Understanding origin-based sourcing is essential for companies operating across multiple states to navigate complex jurisdictional rules efficiently.

What is Destination-Based Sourcing?

Destination-based sourcing is a tax principle where sales tax is collected based on the location where the buyer receives the goods or services, rather than the seller's location. This method aligns tax revenue with the place of consumption, ensuring that local governments receive appropriate tax funds. It is commonly used in states with destination-based sales tax systems to simplify compliance and reflect consumer demand geography.

Key Differences Between Origin and Destination Sourcing

Origin-based sourcing determines sales tax liability based on the seller's location, making the tax rate of the seller's jurisdiction applicable to the transaction. Destination-based sourcing applies sales tax according to the buyer's location, requiring tax rates of the delivery destination to be used. Key differences include the locus of tax imposition, compliance complexity, and the impact on tax revenue distribution between jurisdictions.

State Tax Implications: Origin vs Destination

Origin-based sourcing determines state sales tax liability based on the seller's location, affecting tax rates and jurisdictions where the business is established. Destination-based sourcing assigns tax responsibilities according to the buyer's location, often resulting in varying tax obligations depending on where the product or service is delivered. Understanding these distinctions is crucial for businesses operating in multiple states to ensure compliance with state-specific tax laws and avoid penalties.

Impact on Interstate Commerce

Origin-based sourcing determines sales tax based on the seller's location, creating complexities in interstate commerce due to varying state tax rates and rules. Destination-based sourcing applies the tax rate of the buyer's location, simplifying compliance but potentially burdening sellers with multi-state tax collection responsibilities. This contrast significantly impacts businesses engaged in interstate sales by influencing tax administration, pricing strategies, and competitive positioning.

Business Compliance Requirements

Origin-based sourcing requires businesses to remit sales tax based on the location where the sale originates, impacting compliance by necessitating accurate tracking of seller locations and corresponding tax rates. Destination-based sourcing mandates tax collection according to the buyer's delivery address, increasing complexity in maintaining compliance across multiple jurisdictions with varying tax rules. Businesses must invest in sophisticated tax automation systems to ensure proper calculation, reporting, and remittance aligned with either sourcing method to avoid penalties.

Effects on Remote and Online Sales

Origin-based sourcing taxes sales based on the seller's location, often simplifying compliance for businesses with centralized operations but potentially disadvantaging remote buyers by imposing inconsistent tax rates. Destination-based sourcing taxes sales according to the buyer's location, ensuring state and local governments receive appropriate revenue and promoting tax fairness in remote and online sales. This approach aligns with the growing e-commerce trend, requiring sellers to navigate complex multi-jurisdictional tax rules and implement sophisticated systems for accurate tax calculation and remittance.

Examples of States Using Each Method

California exemplifies destination-based sourcing by taxing sales where goods or services are consumed, while Texas uses origin-based sourcing, applying taxes where sales originate. New York follows destination-based sourcing, focusing tax collection on the buyer's location, contrasting with Arizona's origin-based approach. These examples highlight how states adopt different sourcing methods to align taxing authority with either the seller's or buyer's location.

Challenges and Controversies

Origin-based sourcing faces challenges in accurately tracking the location of sales, leading to disputes over tax jurisdiction and potential double taxation. Destination-based sourcing complicates compliance due to varying tax rates and regulations across jurisdictions, increasing administrative burdens for businesses. Both methods spark controversies around fairness, economic impact, and the allocation of tax revenues between states.

Future Trends in Sales Tax Sourcing

Future trends in sales tax sourcing are shifting towards destination-based sourcing to align with the growing e-commerce market and changing regulatory frameworks. Origin-based sourcing, which taxes based on the seller's location, is increasingly challenged by the need for fair tax distribution and compliance across multiple jurisdictions. Advances in technology and real-time data analytics are driving more accurate destination-based tax calculations, enhancing transparency and reducing disputes between states and retailers.

Important Terms

Nexus

Nexus defines the connection between a business and a taxing jurisdiction, critically influencing tax obligations under origin-based sourcing, where sales are taxed at the seller's location, versus destination-based sourcing, which applies tax based on the buyer's location. Understanding nexus rules ensures compliance with state and local tax laws, as businesses engaged in destination-based sourcing must track and report sales according to their customers' jurisdictions.

Apportionment

Apportionment in tax law determines how income is allocated between jurisdictions using origin-based sourcing, which taxes income where it is produced, versus destination-based sourcing, which taxes income where the goods or services are consumed. The choice between origin and destination-based sourcing significantly impacts state and international tax liabilities, influencing businesses' reporting and compliance strategies.

Sales Tax Jurisdiction

Sales tax jurisdiction determines tax liability based on origin-based sourcing, where tax is applied according to the seller's location, or destination-based sourcing, taxing according to the buyer's location; understanding these rules is critical for compliance in multi-state transactions. Origin-based states include California and Texas, while destination-based sourcing is common in states like New York and Florida, impacting how businesses calculate and remit sales tax depending on shipment and delivery points.

Use Tax

Use tax ensures compliance by taxing purchases made out-of-state but used within a consumer's jurisdiction, complementing origin-based sourcing where tax is applied based on the seller's location. Destination-based sourcing, in contrast, applies sales tax according to the buyer's location, making use tax critical for capturing revenue when sellers do not collect tax at the destination point.

VAT Place of Supply

VAT Place of Supply rules determine whether tax is applied based on the origin of goods or services or their destination, affecting cross-border transaction taxation. Origin-based sourcing taxes supplies where they originate, while destination-based sourcing imposes VAT where the goods or services are consumed, optimizing tax revenue alignment with consumer location.

Cross-border Transactions

Cross-border transactions in origin-based sourcing assign tax liability according to the seller's location, whereas destination-based sourcing calculates tax based on the buyer's location. Understanding these sourcing rules is critical for compliance in international trade, affecting VAT, GST, and sales tax collection across jurisdictions.

Consumption Tax Principle

The Consumption Tax Principle mandates that sales tax collection aligns with the location where goods or services are ultimately consumed. Origin-based sourcing taxes transactions at the seller's location, while destination-based sourcing applies tax according to the buyer's location, ensuring tax revenue corresponds to the point of consumption.

Economic Presence

Economic presence in origin-based sourcing focuses on taxing goods or services where production occurs, prioritizing the location of creators and manufacturers. Destination-based sourcing shifts tax liability to the location where consumption happens, emphasizing the end-user's geographic market over the point of origin.

Source Principle

Source Principle in taxation refers to the method of determining the location where income is generated for tax purposes, contrasting with Origin-based sourcing that taxes income at the source location where the economic activity occurs, while Destination-based sourcing allocates tax based on where the goods or services are consumed. Understanding the distinction is crucial for multinational corporations managing cross-border transactions, as Source Principle influences transfer pricing, tax liabilities, and compliance with international tax treaties.

Digital Services Tax

Digital Services Tax (DST) targets revenues from digital activities, with origin-based sourcing taxing income where the service is created, while destination-based sourcing taxes where the user or consumer is located. Origin-based DST can advantage companies concentrating in high-tax jurisdictions, whereas destination-based DST aligns taxation with market consumption, ensuring fairer tax distribution globally.

Origin-based sourcing vs Destination-based sourcing Infographic

moneydif.com

moneydif.com